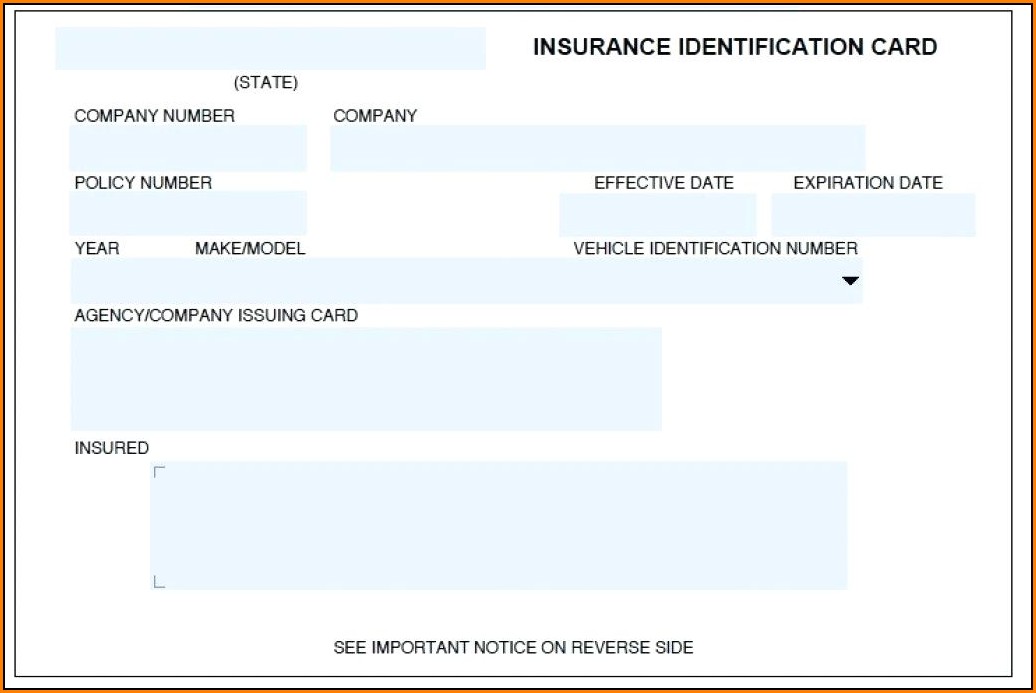

Definition and Purpose of Fake Car Insurance Cards

Fake car insurance cards are fraudulent documents that mimic the appearance of legitimate insurance cards, providing false proof of insurance coverage for vehicles. Their use is strictly prohibited by law and constitutes a serious offense.

Individuals may resort to using fake insurance cards for various reasons, such as avoiding the financial burden of purchasing genuine insurance, concealing their lack of coverage to evade legal repercussions, or perpetrating insurance fraud.

Methods of Obtaining and Using Fake Insurance Cards

Fake insurance cards can be acquired through various illicit channels, including online marketplaces, fraudulent brokers, or unscrupulous individuals. They are often designed to resemble authentic cards, featuring forged signatures, company logos, and policy numbers.

Once obtained, fake insurance cards are used to deceive law enforcement, insurance companies, and other parties by falsely representing that a vehicle is insured. This can have serious consequences, as it not only violates the law but also leaves individuals financially vulnerable in the event of an accident.

Consequences of Using Fake Car Insurance Cards

Using fake car insurance cards is a serious offense that can have severe consequences. The legal penalties and financial risks associated with this practice can be significant.

Legal Penalties

In most jurisdictions, using a fake insurance card is a criminal offense that can result in fines, jail time, and loss of driving privileges. The severity of the penalties will vary depending on the specific laws in your area, but even a first-time offense can have serious consequences.

Financial Risks

In addition to the legal penalties, using a fake insurance card can also have significant financial risks. If you are involved in an accident while driving with a fake insurance card, you will be personally liable for all damages caused to other vehicles and property. This can include:

- Medical expenses

- Property damage

- Lost wages

- Pain and suffering

Your own insurance company will not cover any of these costs, and you may be sued by the victims of the accident.

Personal Safety and Liability

Using a fake insurance card also puts your personal safety and liability at risk. If you are involved in an accident while driving with a fake insurance card, you may not have access to medical care or legal representation. This can leave you vulnerable to serious financial and legal consequences.

Methods of Detecting Fake Car Insurance Cards

Identifying fake car insurance cards is crucial for ensuring road safety and preventing fraud. Several methods can be employed to detect such cards, including examining the card’s physical characteristics, verifying information with insurance companies, and leveraging law enforcement resources.

Common Signs of Fake Car Insurance Cards

* Poor printing quality: Fake cards often have blurry or pixelated printing, uneven edges, or misaligned text.

* Typos and grammatical errors: Genuine insurance cards typically have error-free text. Errors may indicate a fake card.

* Missing security features: Holograms, watermarks, and raised lettering are common security features on authentic cards.

* Unfamiliar insurance company: If the insurance company named on the card is not recognized or has a questionable reputation, it could be a sign of a fake card.

Role of Insurance Companies and Law Enforcement

* Insurance company verification: Individuals can contact the insurance company listed on the card to verify the policy’s existence and validity.

* Law enforcement investigation: Police officers have access to databases that can quickly identify fake insurance cards and initiate legal action against offenders.

Tips for Verifying Authenticity

* Check the card thoroughly: Examine the card for signs of tampering or forgery. Look for high-quality printing, correct spelling, and security features.

* Contact the insurance company: Call the insurance company directly to confirm the policy’s validity and the cardholder’s information.

* Use online resources: Some insurance companies provide online tools for verifying insurance cards. These tools can quickly identify fake cards.

* Report suspicious cards: If you suspect a fake insurance card, report it to the insurance company and local law enforcement.

Prevention and Countermeasures

Preventing the use of fake insurance cards requires a multifaceted approach involving law enforcement, insurance companies, and the public.

- Stricter Penalties: Enacting stricter penalties for individuals caught using fake insurance cards can deter potential offenders.

- Public Awareness Campaigns: Educating the public about the consequences of using fake insurance cards and providing resources to verify legitimate cards can help reduce their use.

Importance of Purchasing Insurance from Reputable Sources

To ensure the authenticity of insurance cards, it is crucial to purchase insurance from reputable and licensed insurance companies. Avoid purchasing insurance from unknown or unlicensed sources, as these may be fronts for fraudulent activities.

Combating Fake Insurance Cards

Various initiatives are underway to combat fake insurance cards:

- Insurance Verification Databases: Centralized databases allow law enforcement and insurance companies to verify the authenticity of insurance cards.

- Technology Solutions: Advancements in technology, such as mobile apps and electronic verification systems, can help detect and prevent the use of fake insurance cards.

5. Case Studies and Examples

Fake car insurance cards are a significant issue that affects individuals, insurance companies, and the legal system. Here are some real-world examples of fake insurance card cases and their outcomes:

Individual Cases

- In 2021, a driver in California was arrested for driving with a fake insurance card. The driver had been involved in an accident and could not provide proof of insurance to the police officer. The driver was charged with a misdemeanor and had their license suspended.

- In 2022, a woman in Florida was convicted of fraud for using a fake insurance card to obtain a car loan. The woman had purchased a car from a dealership and used a fake insurance card to prove that she had coverage. The woman was sentenced to probation and ordered to pay restitution to the dealership.

Insurance Company Cases

- In 2020, an insurance company in Texas filed a lawsuit against a driver who used a fake insurance card to file a claim. The driver had been involved in an accident and submitted a claim to the insurance company using a fake insurance card. The insurance company investigated the claim and discovered that the insurance card was fake. The insurance company denied the claim and filed a lawsuit against the driver.

- In 2021, an insurance company in California settled a class-action lawsuit with a group of drivers who had been issued fake insurance cards. The drivers had purchased insurance from a company that was selling fake insurance cards. The insurance company settled the lawsuit for $10 million.

Legal System Cases

- In 2019, a federal grand jury indicted a group of individuals for conspiracy to commit mail fraud and wire fraud in connection with a scheme to sell fake insurance cards. The individuals were accused of selling fake insurance cards to drivers in multiple states. The individuals were convicted and sentenced to prison.

- In 2020, a state court in Florida convicted a man of forgery for creating and selling fake insurance cards. The man was sentenced to probation and ordered to pay restitution to the victims of his scheme.

Legal and Ethical Considerations

The use of fake car insurance cards has significant legal and ethical implications. It is crucial to understand these implications and take appropriate measures to prevent and address this issue.

Legally, using a fake insurance card is a serious offense. It is a form of fraud and can result in criminal charges. The consequences can vary depending on the jurisdiction and the specific circumstances, but they can include fines, jail time, and the loss of driving privileges.

Ethical Concerns

Beyond the legal implications, there are also ethical concerns surrounding the use of fake insurance cards. It is a dishonest and irresponsible act that can have far-reaching consequences.

Fake insurance cards undermine the integrity of the insurance system. They create a false sense of security for drivers who believe they are insured but are not. This can lead to accidents and injuries that go uncompensated, leaving victims with financial and emotional hardship.

Reporting and Prosecution

If you suspect someone is using a fake insurance card, it is important to report it to the authorities. You can do this by contacting your local police department or the insurance company. Providing as much information as possible, such as the vehicle description, license plate number, and the suspected driver’s information, can help law enforcement investigate and prosecute these cases.

Technological Advancements in Detection

In the battle against fake car insurance cards, technology is emerging as a powerful ally. Cutting-edge advancements are empowering insurers and law enforcement agencies with sophisticated tools to identify fraudulent documents with greater accuracy and efficiency.

Artificial intelligence (AI) and data analytics are transforming the detection process. AI algorithms can analyze vast datasets, identifying patterns and anomalies that indicate fraudulent activity. Machine learning models can be trained to recognize subtle differences between genuine and fake insurance cards, flagging suspicious documents for further investigation.

Blockchain and Digital Verification

Blockchain technology offers another promising solution to combat fake insurance cards. Its decentralized and immutable nature makes it an ideal platform for storing and verifying insurance information. By recording insurance data on a blockchain, insurers can create a secure and tamper-proof record that can be easily verified by law enforcement and other stakeholders.

Digital verification systems are also gaining traction as a means to authenticate insurance cards. These systems use mobile apps or online portals to allow policyholders to instantly verify the validity of their insurance cards. This provides a convenient and reliable way to combat fraud and protect consumers.