Excess Insurance

Excess insurance, also known as umbrella insurance, provides an extra layer of protection beyond the limits of underlying insurance policies. It acts as a safety net, covering expenses that exceed the coverage provided by primary policies.

Excess insurance policies typically have high deductibles, which are the amounts that policyholders must pay out-of-pocket before the excess coverage takes effect. The premiums for excess insurance are typically lower than those for primary insurance, making it a cost-effective way to increase coverage.

Types of Excess Insurance Policies

There are several types of excess insurance policies available, including:

- Commercial excess liability insurance: Provides additional coverage for businesses that face potential liability claims beyond the limits of their primary general liability insurance policy.

- Personal excess liability insurance: Extends coverage for individuals beyond the limits of their homeowners or auto insurance policies.

- Professional liability excess insurance: Protects professionals, such as doctors and lawyers, against claims that exceed the coverage provided by their primary malpractice insurance.

Examples of Excess Insurance in Real-World Scenarios

Excess insurance can be used in a variety of real-world scenarios, including:

- A business with a general liability insurance policy of $1 million may purchase excess liability insurance to provide an additional $5 million of coverage.

- A homeowner with a homeowners insurance policy of $500,000 may purchase excess liability insurance to increase their coverage to $1 million.

- A doctor with a malpractice insurance policy of $2 million may purchase excess liability insurance to provide an additional $5 million of protection.

Surplus Insurance

Surplus insurance, also known as excess insurance, is a type of insurance that provides coverage beyond the limits of primary insurance policies. It is designed to protect businesses and individuals from catastrophic losses that exceed the capacity of their primary insurance policies. Surplus insurance plays a crucial role in the insurance market by providing additional protection for high-risk or specialized exposures that may not be adequately covered by standard insurance policies.

Benefits of Surplus Insurance

* Expanded coverage: Surplus insurance extends the limits of primary insurance policies, providing coverage for losses that exceed the primary policy’s limits.

* Tailored protection: Surplus insurance can be customized to meet specific needs and exposures, ensuring that businesses and individuals have adequate coverage for their unique risks.

* Risk mitigation: By providing additional coverage, surplus insurance helps businesses and individuals mitigate the financial impact of catastrophic losses, protecting their assets and financial stability.

Limitations of Surplus Insurance

* Higher premiums: Surplus insurance premiums are typically higher than primary insurance premiums due to the increased coverage and risk assumed by the insurer.

* Limited availability: Surplus insurance may not be available for all types of risks or in all geographic areas.

* Coverage exclusions: Surplus insurance policies may have exclusions or limitations that may not be present in primary insurance policies, so it is important to carefully review the policy before purchasing.

Case Studies of Surplus Insurance Applications

* Construction: Surplus insurance is often used in construction projects to provide coverage for large-scale projects with potential for significant losses due to accidents, weather events, or other unforeseen circumstances.

* Healthcare: Surplus insurance can provide additional coverage for hospitals and healthcare providers against medical malpractice claims or catastrophic events that may exceed the limits of their primary insurance policies.

* Manufacturing: Surplus insurance can protect manufacturing companies against product liability claims or equipment breakdowns that may result in substantial financial losses.

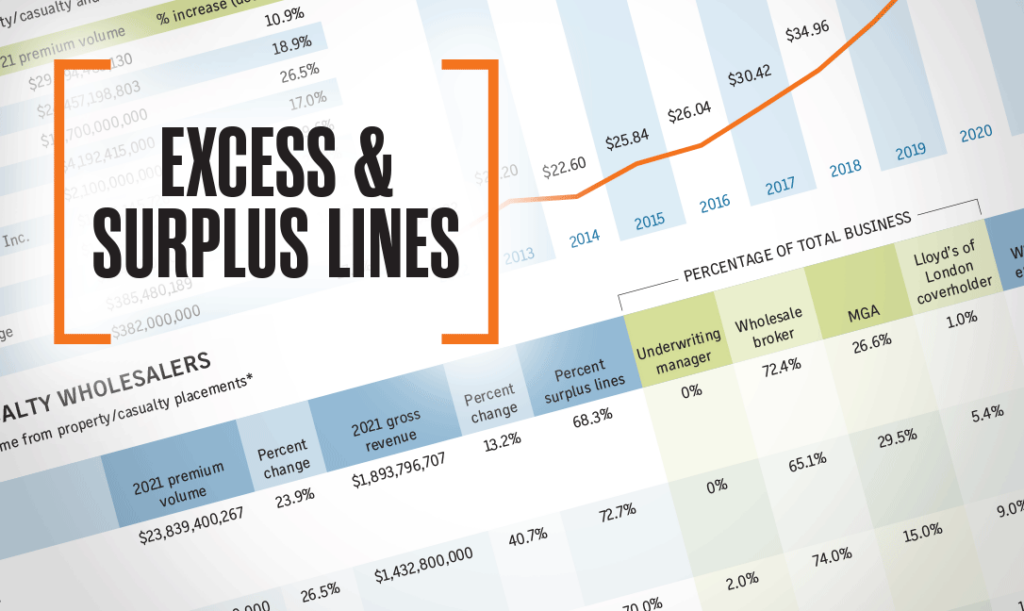

Differences between Excess and Surplus Insurance

Excess and surplus insurance are both types of insurance that provide coverage beyond the limits of a primary insurance policy. However, there are some key differences between the two types of insurance.

Coverage

Excess insurance provides coverage for losses that exceed the limits of a primary insurance policy. Surplus insurance provides coverage for losses that are not covered by a primary insurance policy. For example, excess insurance might provide coverage for a loss that exceeds the $1 million limit of a commercial general liability policy. Surplus insurance might provide coverage for a loss that is not covered by a standard homeowners insurance policy, such as a loss caused by an earthquake.

Underwriting

Excess insurance is typically underwritten by the same insurance company that provides the primary insurance policy. Surplus insurance is typically underwritten by a different insurance company, known as a surplus lines insurer. Surplus lines insurers are not subject to the same regulations as standard insurance companies, which means that they can offer coverage for risks that are not covered by standard insurance policies.

Pricing

Excess insurance is typically more expensive than surplus insurance. This is because excess insurance provides coverage for losses that are more likely to occur. Surplus insurance provides coverage for losses that are less likely to occur, so it is less expensive.

Table of Differences

The following table summarizes the main differences between excess and surplus insurance:

| Feature | Excess Insurance | Surplus Insurance |

|—|—|—|

| Coverage | Losses that exceed the limits of a primary insurance policy | Losses that are not covered by a primary insurance policy |

| Underwriting | Typically underwritten by the same insurance company that provides the primary insurance policy | Typically underwritten by a different insurance company, known as a surplus lines insurer |

| Pricing | Typically more expensive than surplus insurance | Typically less expensive than excess insurance |

Applications of Excess and Surplus Insurance

Excess and surplus insurance plays a crucial role in risk management for various industries and sectors. These insurance policies provide additional coverage beyond the limits of primary insurance policies, allowing businesses and individuals to protect themselves against catastrophic losses.

One common application of excess insurance is in the property and casualty sector. Businesses and property owners often purchase excess insurance to cover potential losses that exceed the limits of their primary property and liability policies. This can be especially important for businesses operating in high-risk industries, such as construction, manufacturing, or transportation.

Case Study: Excess Insurance for a Construction Company

A construction company was working on a major project when a fire broke out at the construction site, causing extensive damage to the property and equipment. The company’s primary property insurance policy had a limit of $5 million, but the total loss amounted to $7 million. The excess insurance policy covered the remaining $2 million, ensuring that the company could continue operations and meet its financial obligations.

Surplus insurance, on the other hand, is often used to cover risks that are not covered by standard insurance policies. For example, businesses may purchase surplus insurance to cover environmental liabilities, professional liability, or cyber risks. Surplus insurance can also be used to provide additional coverage for risks that are considered to be too risky or unpredictable for primary insurance carriers.

Case Study: Surplus Insurance for a Technology Company

A technology company was facing a lawsuit alleging that its software product had caused financial losses to customers. The company’s primary liability insurance policy did not cover this type of loss, as it was considered to be a professional liability risk. The company purchased surplus insurance to cover the potential costs of the lawsuit, which ultimately resulted in a favorable settlement for the company.

Excess and surplus insurance provide businesses and individuals with the flexibility and protection they need to manage complex and catastrophic risks. By carefully evaluating their risk exposures and purchasing appropriate excess and surplus insurance policies, businesses can ensure their financial stability and protect their assets.

Regulation and Oversight of Excess and Surplus Insurance

Excess and surplus insurance, due to its specialized nature and potential for high-risk exposure, is subject to specific regulatory frameworks and oversight mechanisms. These measures aim to ensure the stability, solvency, and ethical conduct of the excess and surplus insurance market.

Role of State Insurance Departments

State insurance departments play a crucial role in regulating excess and surplus insurance. They have the authority to license and monitor insurance companies, review and approve policy forms, and enforce compliance with applicable laws and regulations. These departments work to protect consumers by ensuring that excess and surplus insurance policies are fairly priced, clearly written, and financially sound.

Other Regulatory Bodies

In addition to state insurance departments, other regulatory bodies may also have oversight responsibilities over excess and surplus insurance. These include the National Association of Insurance Commissioners (NAIC), which develops model laws and regulations for the insurance industry, and the Federal Insurance Office (FIO), which monitors the overall health of the insurance sector and advises Congress on insurance-related matters.

Importance of Compliance and Ethical Practices

Compliance with regulatory requirements and adherence to ethical practices are essential for maintaining the integrity and stability of the excess and surplus insurance market. Insurance companies must accurately disclose policy terms and conditions, maintain adequate reserves, and avoid conflicts of interest. Ethical practices, such as fair dealing and transparency, help to foster trust between insurers and policyholders.