Introduction

A pet insurance waiting period refers to a specified time frame during which coverage for certain conditions or treatments is not available after the policy’s effective date. This period allows insurers to assess the pet’s health before providing coverage for pre-existing conditions or illnesses that may have been present before the policy was purchased.

Waiting periods serve several important purposes:

- Prevent fraud: Waiting periods help prevent individuals from taking out pet insurance policies only when their pet is sick or injured, which could lead to higher premiums for all policyholders.

- Control costs: By excluding coverage for pre-existing conditions during the waiting period, insurers can manage their financial risk and keep premiums affordable for all policyholders.

- Promote responsible pet ownership: Waiting periods encourage pet owners to seek veterinary care promptly for any signs of illness or injury, rather than waiting until the condition becomes more severe or expensive to treat.

Types of Waiting Periods

Waiting periods are a common feature of pet insurance policies. They are designed to give the insurance company time to assess the risk of insuring your pet before coverage begins. There are several different types of waiting periods, each with its own specific purpose.

The most common type of waiting period is the pre-existing conditions waiting period. This waiting period applies to any conditions that your pet has been diagnosed with or treated for before the policy goes into effect. The length of the pre-existing conditions waiting period varies from policy to policy, but it is typically 30 to 90 days.

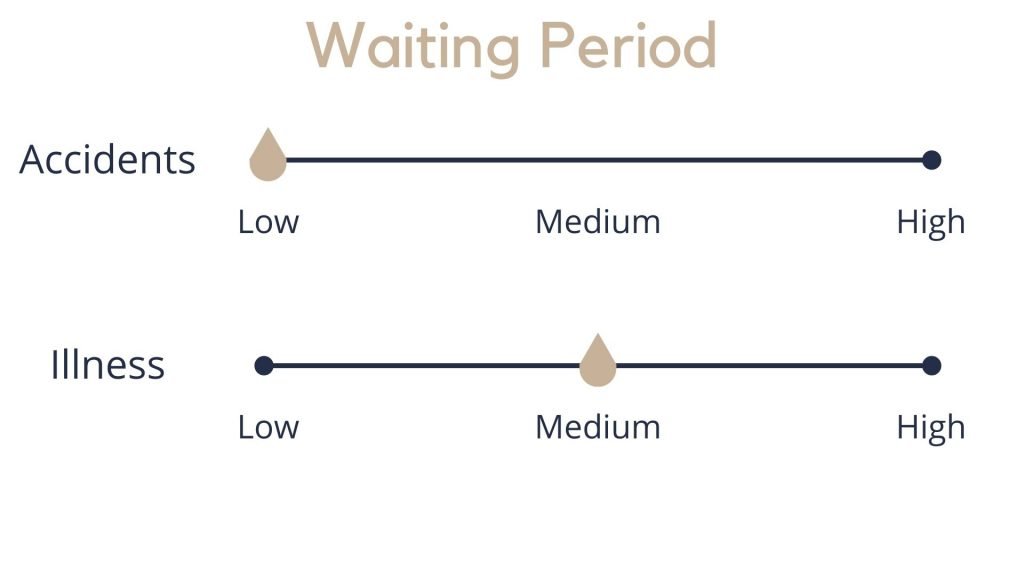

Another common type of waiting period is the accident-only waiting period. This waiting period applies to any injuries that your pet sustains after the policy goes into effect, but before the accident-only waiting period has expired. The length of the accident-only waiting period is typically 14 days.

The illness-only waiting period is similar to the accident-only waiting period, but it applies to any illnesses that your pet develops after the policy goes into effect, but before the illness-only waiting period has expired. The length of the illness-only waiting period is typically 30 days.

Finally, some pet insurance policies also have a routine care waiting period. This waiting period applies to any routine care that your pet receives, such as vaccinations, spaying or neutering, and dental cleanings. The length of the routine care waiting period is typically 30 days.

Benefits of Embracing Pet Insurance Waiting Periods

Pet insurance waiting periods provide several benefits that contribute to a more robust and sustainable insurance system.

These benefits include:

Protection from Fraudulent Claims

Waiting periods help prevent individuals from taking advantage of insurance by purchasing coverage only after their pet becomes ill or injured. This discourages fraudulent claims, ensuring that premiums remain affordable for all policyholders.

Pet Health Assessment

Waiting periods allow insurers to assess the pet’s overall health before providing coverage. This assessment helps determine the appropriate level of coverage and ensures that premiums accurately reflect the pet’s risk profile.

Reduced Insurance Costs

By deterring fraudulent claims and allowing for accurate health assessments, waiting periods help reduce overall insurance costs. This, in turn, translates into lower premiums for policyholders, making pet insurance more accessible and affordable for all.

Drawbacks of Embracing Pet Insurance Waiting Periods

While pet insurance waiting periods can provide some benefits, it’s essential to be aware of their potential drawbacks.

One significant disadvantage is the potential delay in accessing necessary veterinary care. During the waiting period, pet owners may be responsible for covering the costs of unexpected medical expenses, which can be a financial burden.

Unexpected Out-of-Pocket Expenses

Waiting periods can result in unexpected out-of-pocket expenses for pet owners. If a pet experiences a medical emergency or illness during the waiting period, the owner may be required to pay for the treatment out of their own pocket.

Discouragement of Pet Insurance Purchase

Waiting periods can also discourage pet owners from purchasing insurance in the first place. Some pet owners may be hesitant to invest in insurance if they know they will have to wait a certain amount of time before coverage takes effect.

Best Practices for Navigating Waiting Periods

Understanding and navigating pet insurance waiting periods is crucial to ensure your furry friend receives the coverage they need without unexpected financial burdens. Here are some best practices to help you navigate these periods effectively:

Understand the Waiting Period Before Purchasing Insurance

Before purchasing a pet insurance policy, thoroughly review the waiting periods associated with different coverages. Waiting periods vary depending on the insurance provider and the type of coverage, so it’s essential to understand the specific terms and conditions of the policy you’re considering.

Consider Purchasing a Policy with a Shorter Waiting Period

If you anticipate needing coverage for your pet soon, consider purchasing a policy with a shorter waiting period. This will ensure your pet is covered sooner rather than later, reducing the risk of out-of-pocket expenses during the waiting period.

Be Prepared for Out-of-Pocket Expenses During the Waiting Period

Even with a shorter waiting period, there may be some expenses you’ll need to cover out of pocket during the waiting period. This is why it’s important to budget accordingly and be prepared for these costs.