Definition of Renters Insurance

Renters insurance, also known as tenant’s insurance, is a type of insurance policy designed to protect renters and their personal belongings from financial losses caused by unexpected events or incidents.

Renters insurance typically covers a wide range of events and incidents, including but not limited to:

Covered Events

- Theft of personal property

- Damage to personal property caused by fire, smoke, or water

- Liability for injuries or damage to others caused by the renter or their guests

- Loss of use of the rental unit due to a covered event

- Additional living expenses incurred if the rental unit becomes uninhabitable due to a covered event

Common claims covered by renters insurance include:

Common Claims

- Theft of laptops, smartphones, and other electronics

- Damage to furniture and clothing caused by a fire

- Liability for injuries sustained by a guest who slips and falls on the rental property

- Loss of use of the rental unit due to a burst pipe

- Additional living expenses incurred while the rental unit is being repaired after a covered event

Coverage for Hotel Stays

Renters insurance policies typically provide coverage for temporary hotel stays in certain circumstances. These circumstances usually involve situations where the policyholder’s primary residence becomes uninhabitable due to a covered peril, such as a fire, flood, or other natural disaster.

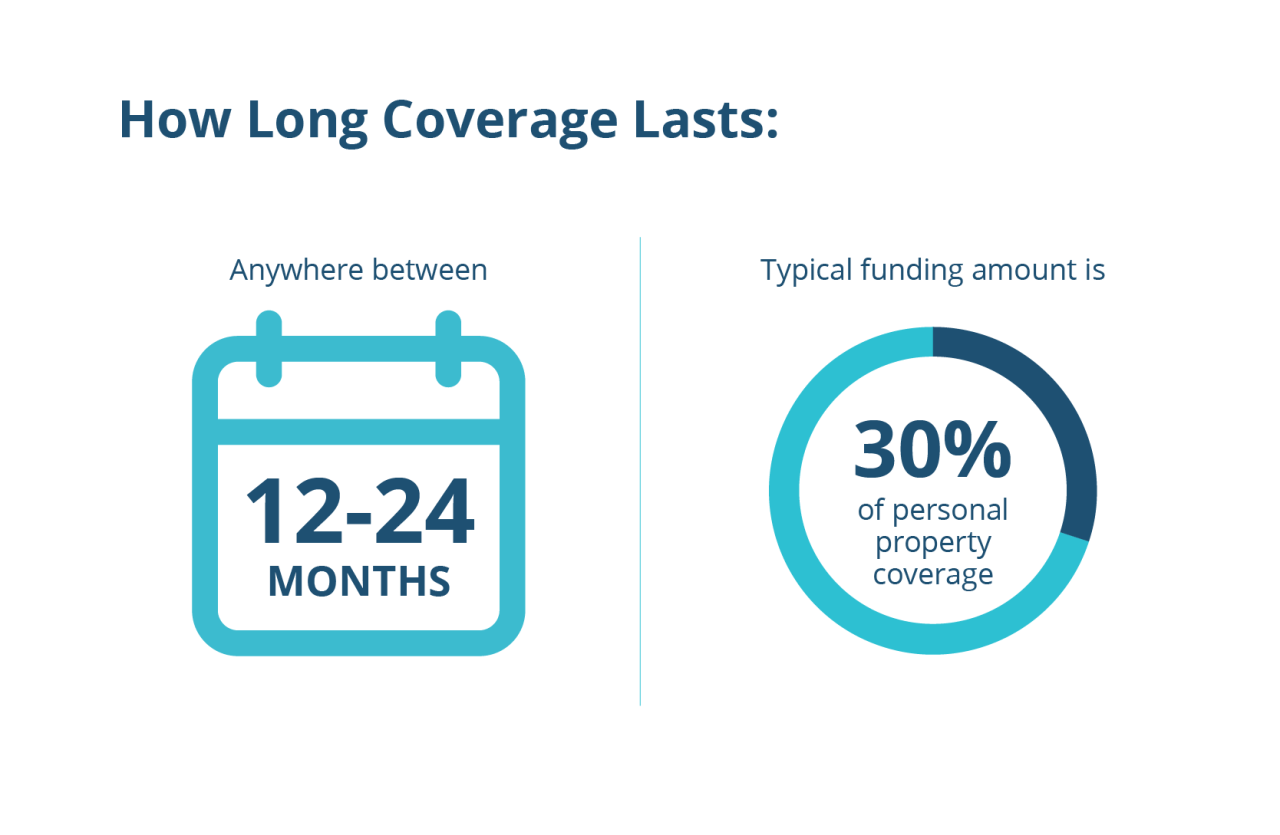

In such cases, renters insurance may cover the costs of a hotel stay for a limited period, typically up to a specific number of days or until the policyholder’s residence is habitable again. The coverage amount for hotel stays is usually subject to policy limits, and there may be specific exclusions or limitations that apply.

Reasons for Hotel Stay Coverage

Renters insurance coverage for hotel stays can provide financial relief in situations where renters are temporarily displaced from their homes. These situations may arise due to various reasons, such as uninhabitable living conditions or temporary relocation.

Uninhabitable Living Conditions

Unforeseen events, such as natural disasters, fires, or extensive repairs, can render a rental property uninhabitable. In such cases, renters may be forced to seek temporary accommodation in a hotel while their home is being repaired or restored. Renters insurance can cover these hotel expenses, providing financial assistance during an unexpected and stressful time.

Temporary Relocation

Temporary relocation for work or other reasons may also necessitate a hotel stay. For instance, a renter may need to relocate for a job assignment or to attend a training program in a different city. Renters insurance can provide coverage for hotel expenses incurred during these temporary relocations, helping to offset the additional costs associated with living away from home.

Claim Process

Filing a renters insurance claim for hotel stay expenses typically involves the following steps:

- Contact your insurance provider promptly: Report the incident and request a claim form within the specified time frame.

- Provide documentation: Gather evidence supporting your claim, such as receipts for hotel expenses, proof of displacement, and a police report if applicable.

- Complete the claim form: Accurately fill out the claim form, providing detailed information about the incident, expenses, and any other relevant factors.

- Submit the claim: Submit the completed claim form along with supporting documentation to your insurance provider.

Time Limits

It’s crucial to file your claim within the time limits specified in your renters insurance policy. Failure to do so may result in a denied claim. Time limits vary between insurance companies, but typically range from 30 to 60 days after the incident.

Policy Comparison

Choosing the right renters insurance policy is essential for ensuring adequate coverage in case of a hotel stay. Different policies offer varying levels of coverage, so it’s crucial to compare them carefully.

Coverage Limits and Deductibles

Coverage limits determine the maximum amount your insurance will cover for hotel expenses. Deductibles are the amount you pay out-of-pocket before insurance coverage kicks in. Consider your budget and risk tolerance when choosing these parameters.

Policy Comparison Table

The following table summarizes the coverage and costs of different renters insurance policies:

| Policy | Coverage Limit | Deductible | Annual Premium |

|—|—|—|—|

| Policy A | $5,000 | $250 | $150 |

| Policy B | $10,000 | $500 | $200 |

| Policy C | $15,000 | $1,000 | $250 |

Policy A offers a lower coverage limit but a lower deductible and premium. Policy B provides higher coverage but a higher deductible and premium. Policy C offers the highest coverage but also the highest deductible and premium.

Additional Considerations

Understanding additional factors that may impact coverage for hotel stays under renters insurance is crucial. These considerations include the location of the hotel and the duration of the stay.

Communicating clearly with your insurance provider is essential. Explain your situation and the reason for your hotel stay to ensure a thorough understanding of your coverage.

Policy Comparison

Comparing different renters insurance policies can help you maximize coverage and avoid potential disputes. Look for policies that provide comprehensive coverage for hotel stays, including reimbursement for expenses and protection against theft or damage.