Does Renters Insurance Cover Hotel Expenses?

Renters insurance is a type of insurance that helps protect your personal belongings in the event of theft, damage, or loss. It can also provide coverage for additional living expenses, such as hotel expenses, if your home becomes uninhabitable due to a covered event.

Renters insurance typically covers hotel expenses if your home is damaged or destroyed by a covered peril, such as a fire, flood, or natural disaster. The coverage will typically pay for the cost of a hotel room, meals, and other necessary expenses while your home is being repaired or rebuilt.

When Renters Insurance Covers Hotel Expenses

Renters insurance will cover hotel expenses if:

– Your home is damaged or destroyed by a covered peril.

– You are unable to live in your home while it is being repaired or rebuilt.

– The hotel expenses are reasonable and necessary.

The amount of coverage for hotel expenses will vary depending on your policy. Be sure to check your policy to see how much coverage you have and what the deductible is.

Coverage for Temporary Housing

Renters insurance typically covers temporary housing expenses if your rental unit becomes uninhabitable due to a covered peril, such as fire, theft, or natural disaster. This coverage helps you pay for the cost of staying in a hotel or other temporary accommodation while your unit is being repaired or rebuilt.

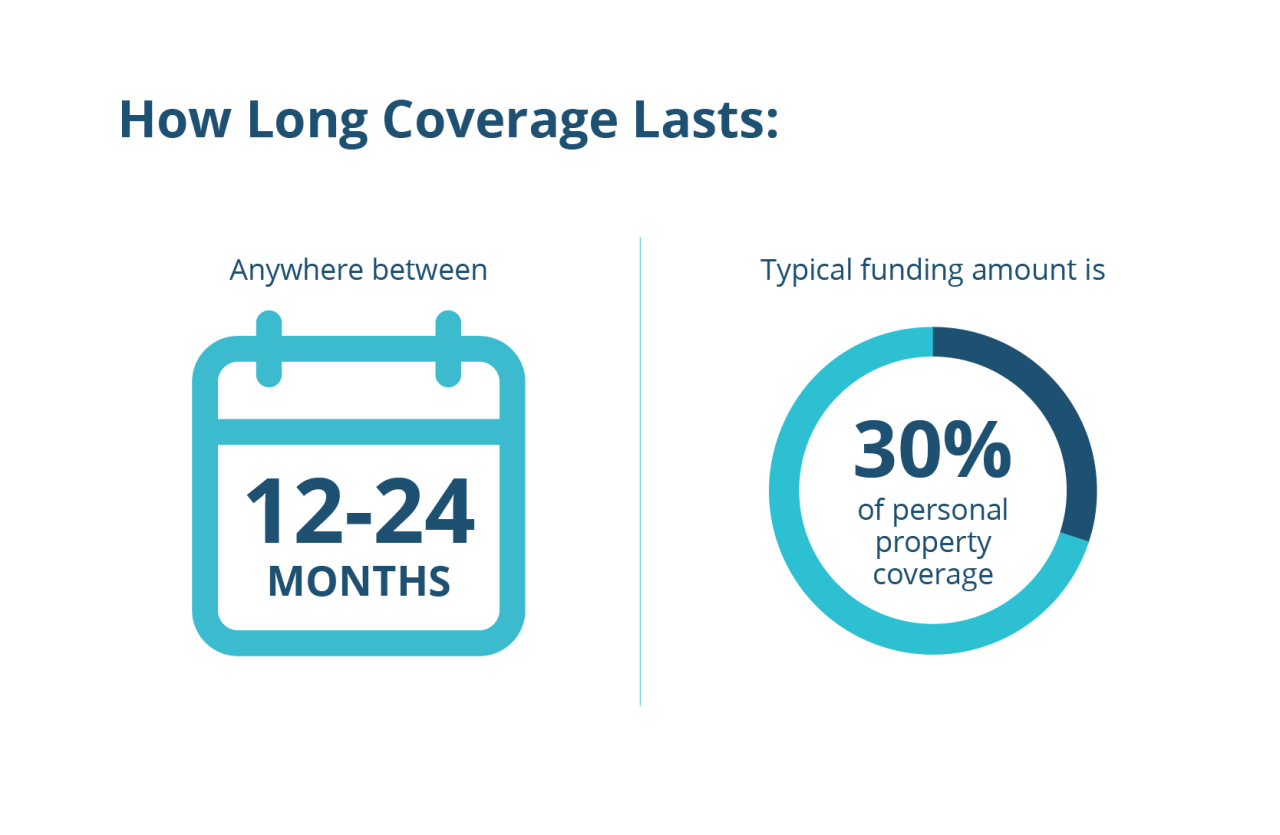

The duration of coverage for temporary housing varies depending on your policy. Some policies provide coverage for up to 30 days, while others may offer coverage for up to 12 months. There may also be a limit on the amount of money that your policy will pay for temporary housing expenses.

Examples of Events That Qualify for Coverage

Some examples of events that may qualify for coverage under your renters insurance policy include:

- Fire

- Theft

- Natural disaster (e.g., hurricane, earthquake, flood)

- Water damage

- Mold

- Structural damage

Filing a Claim for Hotel Expenses

To file a claim for hotel expenses covered by renters insurance, follow these steps:

Documentation Required

- Proof of loss, such as a police report or fire department report.

- Receipts for hotel expenses.

- Documentation of the cause of the loss, such as a letter from your landlord.

Filing Process

- Contact your insurance company as soon as possible to report the loss.

- Provide the insurance company with the required documentation.

- Cooperate with the insurance company’s investigation.

Timeframe for Claim Processing

The timeframe for claim processing varies depending on the insurance company and the complexity of the claim. However, most claims are processed within 30 days.

Exclusions and Limitations

Renters insurance typically excludes coverage for hotel expenses in certain circumstances. It’s crucial to understand these exclusions and limitations to avoid unexpected out-of-pocket expenses.

Common Exclusions

Renters insurance generally excludes coverage for hotel expenses resulting from:

- Acts of God: Natural disasters like hurricanes, earthquakes, and floods are often excluded from coverage.

- War and Terrorism: Hotel expenses related to war, terrorism, or civil unrest are typically not covered.

- Intentional Acts: Damages caused by intentional acts, such as arson or vandalism, are not covered.

- Wear and Tear: Gradual deterioration or damage due to normal use is not covered.

Limitations on Coverage

Even when hotel expenses are covered, there may be limitations on the amount of coverage provided.

- Time Limits: Coverage for hotel expenses is often limited to a specific number of days or weeks.

- Expense Limits: There may be a daily or overall limit on the amount of hotel expenses that are covered.

- Deductibles: A deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Deductibles can apply to hotel expenses.

Examples

Here are some examples of how exclusions and limitations can impact hotel coverage:

- If your apartment is damaged by a hurricane, your renters insurance may not cover hotel expenses because hurricanes are typically excluded from coverage.

- If your apartment is burglarized and you have to stay in a hotel for a week, your renters insurance may only cover up to $1,000 in hotel expenses.

- If you accidentally leave a candle burning and it causes a fire that damages your apartment, your renters insurance may not cover hotel expenses because the damage was caused by your own negligence.

It’s important to carefully review your renters insurance policy to understand the exclusions and limitations that apply to hotel coverage. By doing so, you can avoid unexpected expenses and ensure that you have adequate protection in the event of a covered loss.

Comparing Renters Insurance Policies

When comparing renters insurance policies that cover hotel expenses, consider factors like coverage limits, deductibles, and premiums. Different policies offer varying levels of coverage, so it’s important to assess your needs and budget to choose the best fit.

Coverage Limits

Coverage limits determine the maximum amount your insurance will pay for hotel expenses. Higher coverage limits provide greater financial protection, but also typically come with higher premiums.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Lower deductibles mean you pay less upfront in the event of a claim, but may result in higher premiums. Choose a deductible that balances your financial situation with the level of coverage you need.

Premiums

Premiums are the regular payments you make to maintain your insurance coverage. Premiums vary based on factors like coverage limits, deductibles, and your personal risk profile. Compare premiums from different insurers to find the best value for your needs.

| Policy | Coverage Limit | Deductible | Premium |

|---|---|---|---|

| Policy A | $5,000 | $500 | $150/year |

| Policy B | $10,000 | $250 | $200/year |

| Policy C | $15,000 | $100 | $250/year |

Policy A offers the lowest coverage limit but also the lowest premium. Policy B provides a higher coverage limit and a lower deductible, but comes with a higher premium. Policy C has the highest coverage limit and the lowest deductible, but also the highest premium. Choose the policy that aligns with your risk tolerance and financial situation.

Additional Tips and Considerations

Maximizing coverage for hotel expenses and selecting a suitable insurance policy are crucial for renters. Here are some additional tips to consider:

Review the Policy Carefully

Before purchasing renters insurance, it’s essential to thoroughly review the policy. Pay close attention to the terms and conditions, including the coverage limits for hotel expenses and any exclusions or limitations. This will help ensure that you have the necessary coverage in place.

Choose a Reputable Insurance Company

Choosing a reputable insurance company is equally important. Look for companies with a strong financial rating, positive customer reviews, and a history of providing reliable service. Research and compare different insurers to find the one that best meets your needs and offers competitive rates.