Insurance Coverage for Physical Therapy

Physical therapy is a valuable healthcare service that can help individuals recover from injuries, manage chronic conditions, and improve overall physical function. Many insurance plans cover physical therapy, but the extent of coverage can vary depending on the type of insurance and the specific policy.

There are several types of insurance that may cover physical therapy, including:

- Health insurance

- Workers’ compensation insurance

- Automobile insurance

- Disability insurance

Most health insurance policies include some coverage for physical therapy. However, the amount of coverage and the specific services that are covered can vary depending on the policy. Some policies may only cover physical therapy for certain conditions, such as injuries or surgeries. Others may cover a limited number of physical therapy sessions per year.

Workers’ compensation insurance typically covers physical therapy for injuries that occur on the job. This coverage is designed to help injured workers recover from their injuries and return to work as soon as possible.

Automobile insurance may also cover physical therapy for injuries that occur in car accidents. This coverage is typically part of the personal injury protection (PIP) coverage that is required in most states.

Disability insurance may cover physical therapy for individuals who are unable to work due to a disability. This coverage can help individuals pay for the cost of physical therapy and other medical expenses.

It is important to note that there may be some exclusions or limitations to physical therapy coverage under different insurance plans. For example, some policies may not cover physical therapy for cosmetic purposes or for conditions that are not considered medically necessary.

If you are considering physical therapy, it is important to check with your insurance provider to determine what coverage is available. You should also be aware of any exclusions or limitations that may apply to your policy.

Eligibility for Physical Therapy Coverage

To be eligible for physical therapy coverage under insurance, individuals typically need to meet certain criteria, such as:

- Having a qualifying medical condition that requires physical therapy.

- Receiving a referral from a physician or other qualified healthcare provider.

- Obtaining pre-authorization or approval from the insurance company.

The process for obtaining pre-authorization or approval for physical therapy services may vary depending on the insurance provider. In general, individuals will need to provide documentation supporting the medical necessity of the physical therapy, such as:

- A diagnosis from a physician.

- A treatment plan developed by a physical therapist.

- A description of the expected benefits of physical therapy.

Costs Associated with Physical Therapy

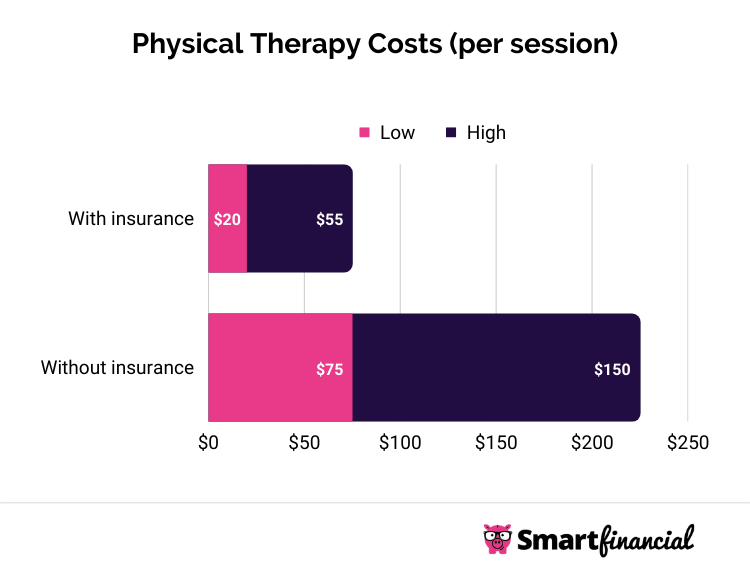

Physical therapy can be a costly endeavor, with expenses varying depending on factors such as the type of treatment, the provider, and the location. Understanding the typical costs associated with physical therapy, including co-pays, deductibles, and out-of-pocket expenses, is essential for budgeting and planning.

Co-pays

A co-pay is a fixed amount that you pay for a specific healthcare service, such as a physical therapy session. Co-pays typically range from $10 to $50 per session, depending on your insurance plan.

Deductibles

A deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Deductibles for physical therapy can vary widely, ranging from $0 to thousands of dollars. Once you meet your deductible, your insurance will begin to cover a portion of your physical therapy costs.

Out-of-Pocket Expenses

Out-of-pocket expenses refer to any costs that are not covered by your insurance. These expenses can include co-pays, deductibles, and any additional charges for services not covered by your plan.

Factors Affecting Cost

Several factors can affect the cost of physical therapy, including:

– Type of Treatment: The cost of physical therapy can vary depending on the type of treatment you receive. For example, manual therapy or specialized techniques may be more expensive than basic exercises.

– Provider: The experience and reputation of the physical therapist can also impact the cost of treatment. Physical therapists with specialized training or advanced certifications may charge higher fees.

– Location: The cost of physical therapy can vary depending on the geographic location. Physical therapy services tend to be more expensive in urban areas compared to rural areas.

Financial Assistance

If you are concerned about the cost of physical therapy, there are several financial assistance programs and payment plans available. These programs can help reduce the financial burden of physical therapy, making it more accessible for those who need it.

Maximizing Insurance Coverage for Physical Therapy

Negotiating with insurance companies to obtain coverage for necessary physical therapy services is a critical aspect of maximizing coverage. By understanding the insurance policy and communicating effectively, individuals can increase the likelihood of obtaining the coverage they need.

Tips for Negotiating with Insurance Companies

- Understand the Policy: Carefully review the insurance policy to identify the specific coverage for physical therapy, including any limitations or exclusions.

- Document Medical Necessity: Obtain a detailed prescription or referral from a qualified healthcare provider that clearly Artikels the medical necessity of physical therapy.

- Appeal Denied Claims: If a claim is denied, file an appeal with the insurance company, providing additional documentation and supporting evidence to justify the need for coverage.

- Consider Independent Review: If the appeal is unsuccessful, consider seeking an independent review from an external organization to assess the medical necessity of the physical therapy.

- Communicate Effectively: Maintain open communication with the insurance company, providing clear and concise information to support the request for coverage.