Eligibility Requirements

Eligibility for Blue Cross Medical insurance coverage of dental implants varies depending on the specific policy and the group or individual it covers.

Generally, coverage is available to policyholders who meet the following criteria:

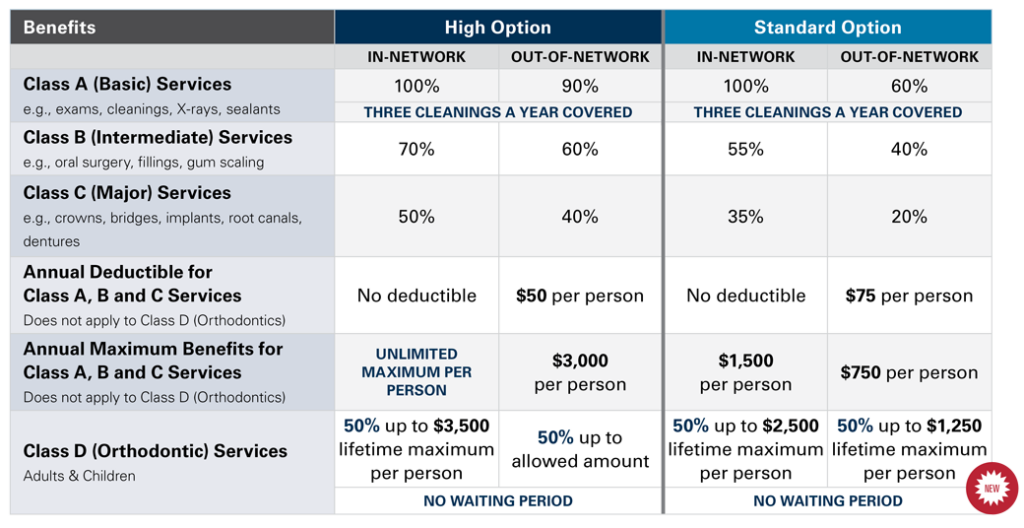

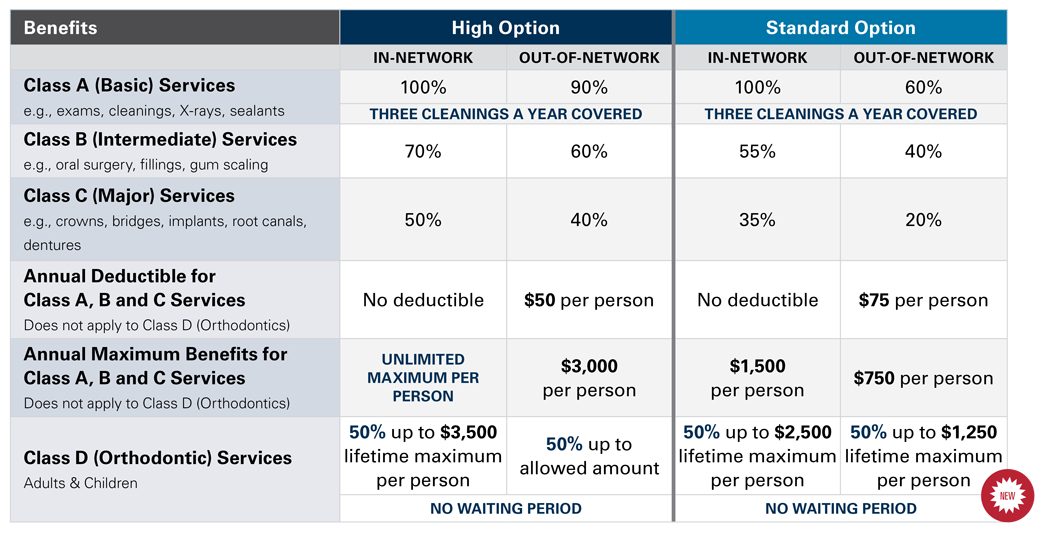

Policy Type

- Coverage is typically included in comprehensive dental insurance plans, which may be offered as an add-on to medical insurance or as a standalone policy.

- Basic medical insurance plans do not typically cover dental implants.

Group Coverage

- For group policies, coverage may be available to employees of specific companies or organizations.

- Eligibility may be limited to certain employee groups, such as full-time employees or those enrolled in specific benefit plans.

Individual Coverage

- Individuals can purchase dental insurance plans that include coverage for dental implants.

- Eligibility requirements may vary depending on the insurance provider and the specific plan selected.

Age and Health Restrictions

- Some policies may have age restrictions, with coverage limited to individuals within a certain age range.

- Pre-existing dental conditions may affect coverage, and implants may not be covered if they are deemed medically unnecessary.

Pre-Approval Process

Blue Cross Medical insurance coverage for dental implants typically requires pre-approval. This process ensures that the treatment is medically necessary and meets the insurance plan’s coverage criteria.

To obtain pre-approval, you must submit a detailed treatment plan from your dentist to Blue Cross. The plan should include a description of the proposed treatment, the estimated cost, and any supporting documentation, such as X-rays or dental records.

Once submitted, Blue Cross will review the treatment plan and determine if it meets their coverage criteria. If pre-approval is granted, you will receive a letter outlining the approved treatment and any applicable coverage limits.

Potential Delays or Obstacles

The pre-approval process can sometimes experience delays or obstacles. These may include:

* Incomplete or inaccurate treatment plans

* Missing or delayed documentation

* Denial of coverage due to treatment not meeting coverage criteria

* Appeal process, if coverage is initially denied

To minimize delays, ensure that your treatment plan is complete and accurate, and submit all necessary documentation promptly. If coverage is denied, you may have the option to appeal the decision.

Cost and Payment Options

The cost of dental implants covered by Blue Cross Medical insurance varies depending on factors such as the number of implants needed, the complexity of the procedure, and the geographic location of the dental provider. On average, the cost of a single dental implant, including the implant, abutment, and crown, ranges from $3,000 to $6,000.

Payment options available for dental implants covered by Blue Cross Medical insurance include co-pays, deductibles, and out-of-pocket expenses. A co-pay is a fixed amount that you pay for a covered service, such as a dental implant. A deductible is the amount you must pay out-of-pocket before your insurance coverage begins. Out-of-pocket expenses are any costs that are not covered by your insurance, such as the cost of the implant surgery itself.

Blue Cross Medical insurance may offer financing options or payment plans to help you spread the cost of dental implants over time. These options can vary depending on your specific plan and the dental provider you choose. It is important to contact your insurance provider to discuss the specific costs and payment options available for dental implants.

Blue Cross Medical insurance typically covers a portion of the cost of dental implants, but the exact amount of coverage varies depending on your specific plan. Most plans cover between 50% and 80% of the cost of the implant, abutment, and crown. Some plans may also cover the cost of the implant surgery itself.

Provider Network

Blue Cross Medical insurance has partnered with a network of dental providers who offer dental implant procedures. Utilizing in-network providers offers advantages such as potentially lower out-of-pocket expenses and streamlined billing processes.

Locating an In-Network Provider

To locate an in-network provider, you can:

– Visit the Blue Cross Medical insurance website and use their provider search tool.

– Call the Blue Cross Medical insurance customer service number and request a list of in-network providers in your area.

– Ask your dentist for recommendations for in-network providers.

Claims Process

Filing a claim for dental implants covered by Blue Cross Medical insurance involves several steps. To ensure a smooth and timely process, it’s essential to follow the necessary procedures and submit the required documentation.

To initiate a claim, you’ll need to obtain a claim form from Blue Cross Medical insurance. This form can be downloaded from their website or obtained by contacting their customer service department. Once you have the form, carefully fill out all the necessary information, including your personal details, policy number, and details of the dental implant procedure.

Required Documentation

Along with the claim form, you’ll need to submit supporting documentation to substantiate your claim. This typically includes:

- A detailed invoice from the dental provider outlining the costs of the implant procedure.

- A pre-approval letter from Blue Cross Medical insurance, if required for your specific plan.

- Dental X-rays or other relevant medical records that support the need for the implant procedure.

Timelines

Blue Cross Medical insurance typically has specific timelines for submitting claims. It’s important to adhere to these deadlines to avoid any delays in processing your claim. The timelines may vary depending on your plan, so it’s best to refer to your policy documents or contact the insurance company directly for specific information.

Potential Delays or Issues

While Blue Cross Medical insurance aims to process claims efficiently, there may be potential delays or issues that can arise during the claims process. Some common reasons for delays include:

- Incomplete or inaccurate claim forms.

- Missing or insufficient supporting documentation.

- Medical necessity reviews that require additional information or clarification.

- Coordination of benefits with other insurance policies.

If you encounter any delays or issues with your claim, it’s important to contact Blue Cross Medical insurance promptly to resolve the matter and ensure a timely resolution.