Types of Dental Insurance Plans in Missouri

Dental insurance plans in Missouri come in various types, each with its own set of benefits and drawbacks. Understanding the differences between these plans can help you make an informed decision about which one is right for you.

PPO Plans

Preferred Provider Organization (PPO) plans offer a network of dentists to choose from. You can see any dentist within the network without a referral, and you’ll typically pay a lower copayment or coinsurance. However, you may have to pay a higher deductible before your coverage kicks in.

HMO Plans

Health Maintenance Organization (HMO) plans require you to choose a primary care dentist who will refer you to specialists if necessary. HMO plans typically have lower premiums than PPO plans, but you may have less flexibility in choosing your dentist.

Indemnity Plans

Indemnity plans reimburse you for a portion of your dental expenses, regardless of which dentist you see. Indemnity plans typically have higher premiums than PPO or HMO plans, but they offer the most flexibility in choosing your dentist.

Coverage and Benefits of Dental Insurance Plans in Missouri

Dental insurance plans in Missouri offer a range of coverage and benefits to meet the needs of individuals and families. These plans typically cover preventive care, basic services, major services, and orthodontic coverage, with varying levels of coverage and deductibles.

To help you compare the coverage and benefits offered by different dental insurance plans in Missouri, we have created the following table:

| Plan Type | Preventive Care | Basic Services | Major Services | Orthodontic Coverage |

|---|---|---|---|---|

| PPO | 100% coverage for preventive care, including cleanings, exams, and X-rays | 80% coverage for basic services, such as fillings, crowns, and root canals | 50% coverage for major services, such as dentures, bridges, and implants | 50% coverage for orthodontic treatment, up to a lifetime maximum of $1,500 |

| HMO | 100% coverage for preventive care, including cleanings, exams, and X-rays | 80% coverage for basic services, such as fillings, crowns, and root canals | 50% coverage for major services, such as dentures, bridges, and implants | Not covered |

| Dental Savings Plan | Not covered | 15% discount on basic services, such as fillings, crowns, and root canals | 10% discount on major services, such as dentures, bridges, and implants | Not covered |

It’s important to note that the coverage and benefits offered by dental insurance plans in Missouri can vary depending on the specific plan you choose. It’s important to carefully review the plan details before enrolling to ensure that it meets your needs and budget.

Limitations and Exclusions

Dental insurance plans in Missouri typically have some limitations and exclusions. These may include:

- Waiting periods for certain services, such as major services or orthodontic treatment

- Annual maximums on coverage for certain services

- Exclusions for certain procedures, such as cosmetic dentistry or experimental treatments

It’s important to carefully review the plan details to understand the limitations and exclusions before enrolling.

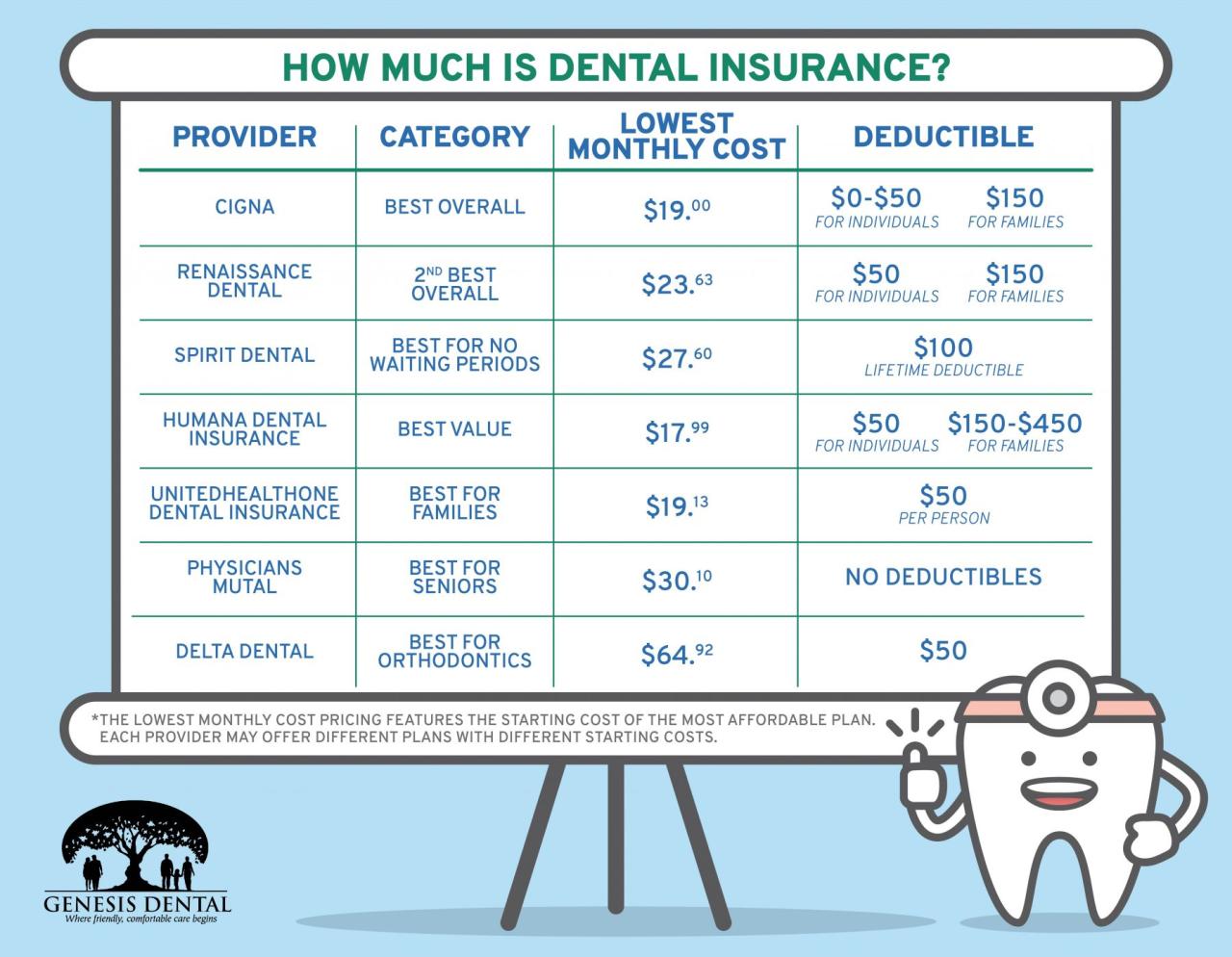

Costs and Premiums of Dental Insurance Plans in Missouri

Dental insurance plans in Missouri vary in costs and premiums. Understanding these costs is crucial for selecting the plan that best meets your needs and budget.

Deductibles

Deductibles are the initial amount you pay out-of-pocket before your insurance coverage begins. Dental insurance plans in Missouri typically have deductibles ranging from $50 to $200. Higher deductibles generally result in lower premiums.

Copays

Copays are fixed amounts you pay for specific dental services, such as cleanings, fillings, or extractions. Copays are typically lower for preventive services and higher for major procedures.

Coinsurance

Coinsurance is the percentage of the cost of a dental procedure that you are responsible for after meeting your deductible. Dental insurance plans in Missouri typically have coinsurance rates ranging from 10% to 50%.

Factors Affecting Premiums

Premiums for dental insurance plans in Missouri are influenced by several factors, including:

- Type of plan: HMOs and PPOs have different premium structures.

- Coverage level: Plans with more comprehensive coverage generally have higher premiums.

- Age: Premiums tend to increase with age.

- Location: Premiums can vary depending on the region within Missouri.

Comparing the costs of different dental insurance plans is essential to find the best value. Consider your expected dental expenses, risk tolerance, and budget when evaluating premiums and coverage options.

Finding a Dentist Who Accepts Dental Insurance Plans in Missouri

Finding a dentist who accepts your dental insurance plan in Missouri is crucial to maximizing your coverage benefits. Here are some resources to assist you:

Online Directories

- Missouri Dental Association: https://www.modental.org/find-a-dentist

- American Dental Association: https://findadentist.ada.org/

Insurance Company Websites

Most insurance companies provide online tools to locate dentists within their network. Visit your insurer’s website and search for “find a dentist” or “provider directory.”

Local Dental Societies

Local dental societies can provide you with a list of dentists in your area who accept your insurance. Contact your county or city dental society for assistance.

Importance of Verifying Coverage

Before scheduling an appointment, it’s essential to verify that the dentist accepts your specific insurance plan and coverage. Contact the dentist’s office directly to confirm their participation in your network and the services covered under your plan.