Overview of SR22 Insurance in Illinois

SR22 insurance is a type of car insurance required by the Illinois Secretary of State (SOS) for drivers who have been convicted of certain traffic violations, such as driving under the influence (DUI) or driving without insurance.

SR22 insurance is not a separate insurance policy, but rather an endorsement that is added to an existing auto insurance policy. It certifies that the driver has met the minimum liability insurance requirements set by the state of Illinois and that they will maintain continuous coverage for a specified period of time, typically three years.

Requirements for Obtaining an SR22 Insurance Policy in Illinois

To obtain an SR22 insurance policy in Illinois, drivers must first file an SR22 form with the SOS. This form can be obtained from the SOS website or from an insurance company. Once the form has been filed, the driver must then purchase an auto insurance policy that meets the state’s minimum liability insurance requirements. The insurance company will then file an SR22 endorsement with the SOS, which will remain on the driver’s record for the specified period of time.

Number of Drivers Who Need SR22 Insurance in Illinois

According to the Illinois SOS, there are approximately 300,000 drivers in Illinois who have an SR22 insurance policy. This number has been increasing in recent years, due to the state’s crackdown on DUI and other traffic violations.

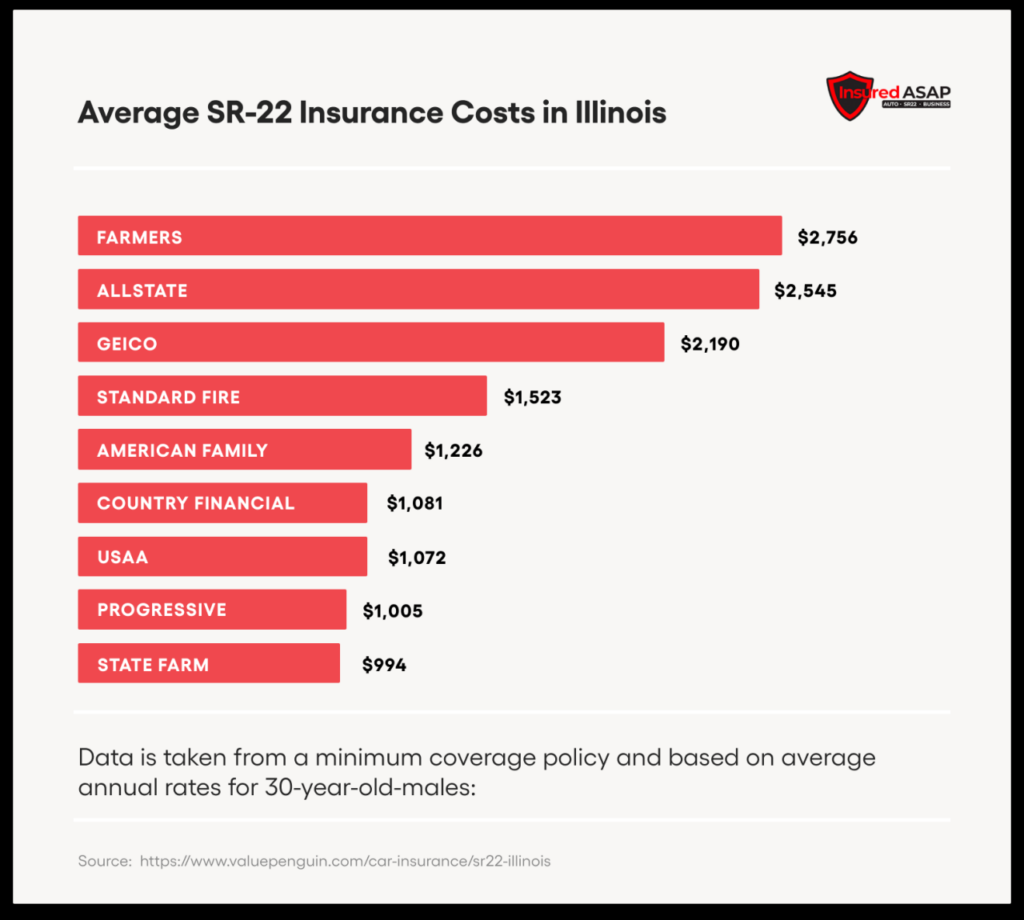

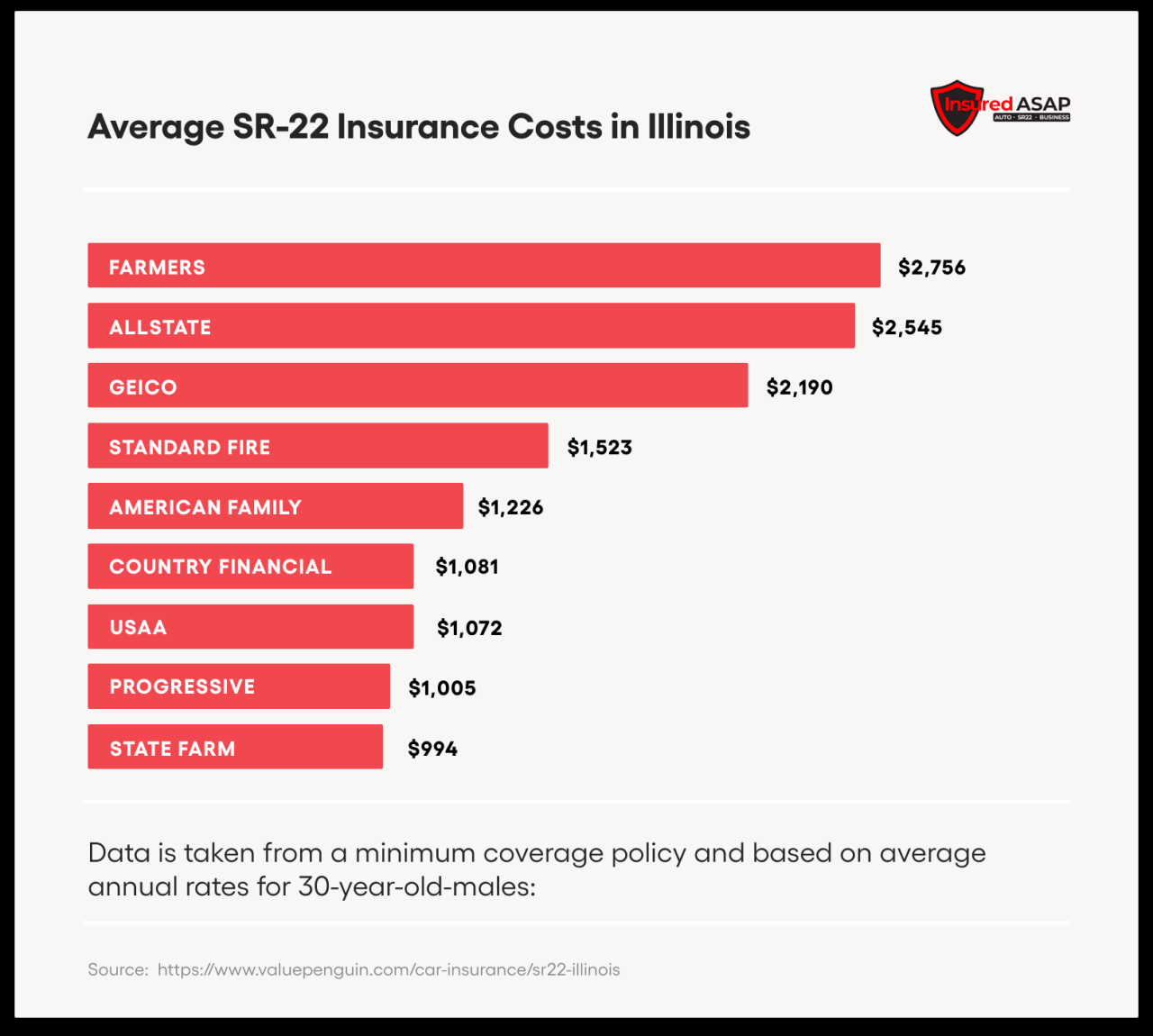

Factors Affecting SR22 Insurance Costs

SR22 insurance costs in Illinois are determined by several factors, including driving history, violations, age, credit scores, and the insurance company you choose.

Driving History and Violations

Your driving history is a major factor in determining your SR22 insurance rates. Insurers will consider the number of accidents and traffic violations you have had in the past few years. The more serious the violations, the higher your rates will be.

Age

Younger drivers typically pay higher SR22 insurance rates than older drivers. This is because they are considered to be a higher risk.

Credit Scores

In Illinois, insurance companies can use your credit score to determine your SR22 insurance rates. A good credit score can lead to lower rates, while a poor credit score can lead to higher rates.

Insurance Companies

Different insurance companies have different rates for SR22 insurance. It is important to compare quotes from several different companies before choosing one.

Finding Cheap SR22 Insurance in Illinois

Finding affordable SR22 insurance in Illinois requires a strategic approach. By comparing quotes from multiple insurance companies, you can identify the most competitive rates. Additionally, taking advantage of discounts and special programs designed for low-income drivers can further reduce your insurance costs.

Tips for Finding Affordable SR22 Insurance

- Shop around and compare quotes: Obtain quotes from several insurance companies to find the best rates. Consider factors like coverage limits, deductibles, and discounts.

- Ask about discounts: Inquire about discounts offered by insurance companies, such as safe driving discounts, multi-policy discounts, and low-mileage discounts.

- Consider high-risk insurance pools: If you have a poor driving record, you may qualify for high-risk insurance pools, which provide coverage for drivers who cannot obtain insurance through traditional channels.

- Explore state assistance programs: Illinois offers financial assistance programs for low-income drivers, including the Illinois Low-Cost Auto Insurance Program (ILCAIP).

Choosing the Right SR22 Insurance Company

Selecting the right SR22 insurance company is crucial for securing affordable coverage and peace of mind. Consider the following factors:

Top SR22 Insurance Providers in Illinois

Identify the leading SR22 insurance providers in Illinois based on their competitive premiums, comprehensive coverage options, and exceptional customer service. Research and compare their offerings to find the best fit for your needs.

Financial Stability and Reputation

The financial stability and reputation of an insurance company are essential indicators of their ability to fulfill their obligations and provide reliable coverage. Look for companies with strong financial ratings and positive customer reviews.

Evaluating and Selecting an Insurance Company

Thoroughly evaluate each insurance company’s offerings, including their coverage limits, deductibles, and discounts. Read reviews and consult with an insurance agent to gather insights and make an informed decision. Consider your budget, driving history, and coverage requirements to select the insurance company that best meets your needs.

Maintaining SR22 Insurance in Illinois

Maintaining SR22 insurance in Illinois is crucial to avoid legal penalties and ensure financial responsibility after a traffic violation. Here are the requirements, consequences, and guidance for maintaining an SR22 insurance policy:

Requirements for Maintaining SR22 Insurance

To maintain SR22 insurance in Illinois, you must meet the following requirements:

– Obtain an SR22 certificate from your insurance company and file it with the Illinois Secretary of State (SOS).

– Keep your SR22 insurance policy active for the duration required by the SOS, typically three years.

– Notify the SOS within 30 days of any changes to your insurance policy, such as a cancellation or lapse in coverage.

Consequences of Failing to Maintain SR22 Insurance

Failure to maintain SR22 insurance can result in severe consequences, including:

– Suspension of your driver’s license

– Reinstatement fees

– Additional penalties imposed by the court

Renewing or Canceling an SR22 Insurance Policy

To renew your SR22 insurance policy, contact your insurance company before the expiration date. They will provide you with a new SR22 certificate to file with the SOS.

To cancel your SR22 insurance policy, you must first contact the SOS to verify that you are no longer required to maintain SR22 insurance. Once you have received confirmation, you can notify your insurance company and cancel your policy.