Understanding Cheap Non-Owners Insurance in North Carolina

Non-owners insurance is a type of auto insurance designed for individuals who do not own a vehicle but occasionally drive other people’s cars. It provides liability coverage in case of an accident while driving a non-owned vehicle.

In North Carolina, non-owners insurance is not legally required. However, it is highly recommended for those who frequently drive other people’s vehicles, as it can protect them from financial liability in the event of an accident.

Factors Determining Insurance Premiums

- Driving history

- Age

- Location

- Amount of coverage

By understanding these factors, individuals can make informed decisions about their non-owners insurance coverage and find the most affordable options.

Comparing Different Providers and Coverage Options

When selecting cheap non-owners insurance in North Carolina, it is crucial to compare the offerings of various insurance companies. Different providers may offer varying coverage options and premiums, so it is essential to understand the distinctions to make an informed decision.

Coverage Options

Insurance companies typically provide two main coverage options for non-owners insurance:

- Bodily Injury Liability: Covers medical expenses and lost wages for injuries you cause to others while driving someone else’s car.

- Property Damage Liability: Covers damages to property caused by your negligence while operating a vehicle you do not own.

Some insurers may also offer additional coverage options, such as:

- Uninsured/Underinsured Motorist Coverage: Protects you if you are injured by a driver who does not have insurance or has insufficient coverage.

- Collision Coverage: Covers damages to your vehicle if you are involved in an accident while driving someone else’s car.

- Comprehensive Coverage: Covers damages to your vehicle from events other than collisions, such as theft or vandalism.

Premium Costs

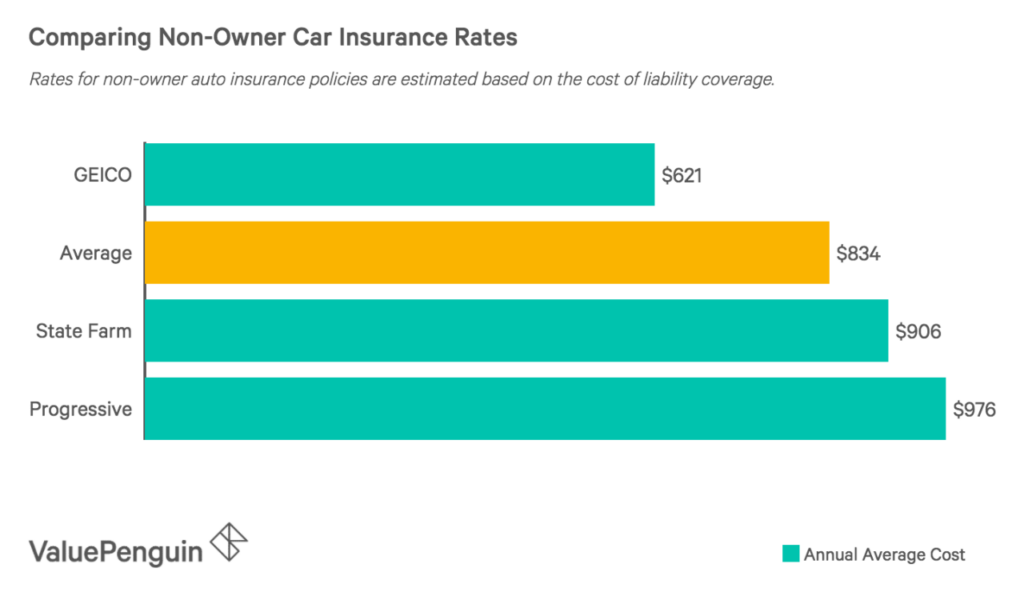

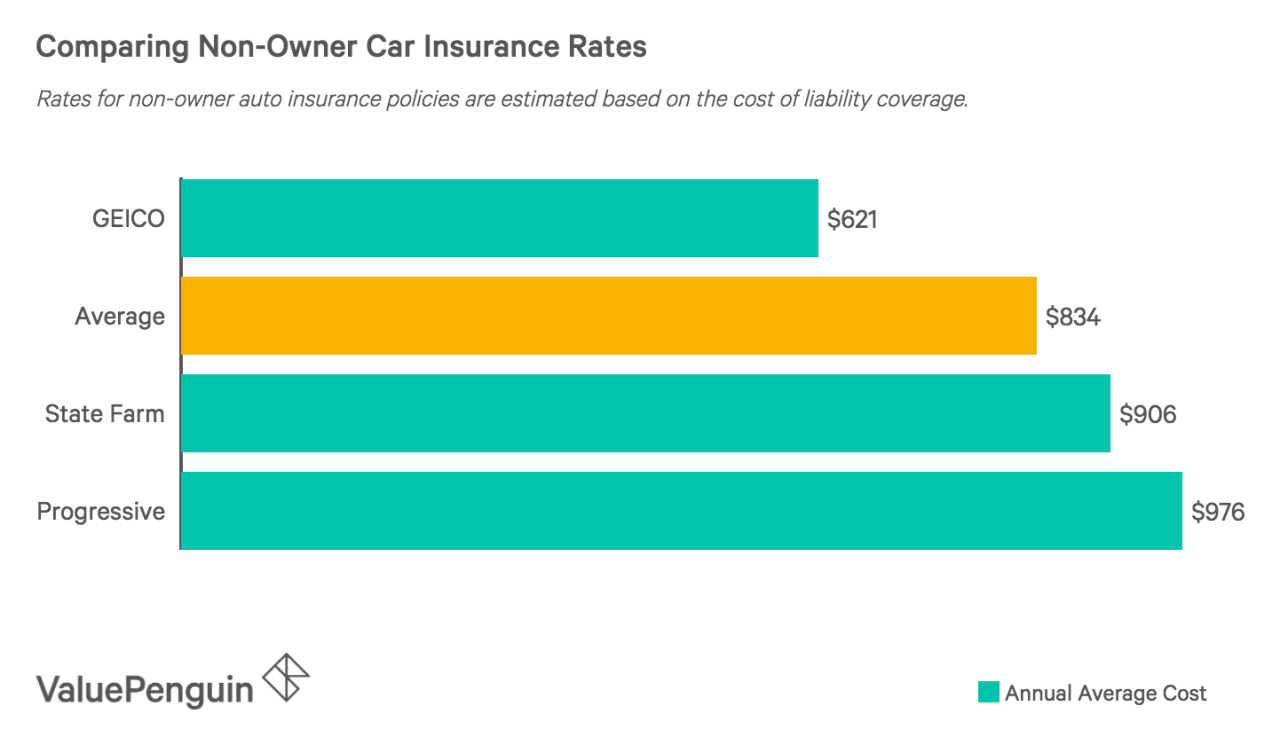

The cost of non-owners insurance varies depending on several factors, including your age, driving history, and coverage options selected. It is important to obtain quotes from multiple providers to compare premiums and find the most affordable option.

Reading the Policy

Before purchasing non-owners insurance, it is crucial to read and understand the policy carefully. Pay attention to the coverage limits, deductibles, and exclusions. Ensure that the policy meets your specific needs and provides adequate protection in case of an accident.

Eligibility and Application Process

Obtaining non-owners insurance in North Carolina is accessible to individuals who meet certain eligibility criteria. The process involves submitting an application and providing necessary documentation to verify your identity and circumstances.

To be eligible for non-owners insurance in North Carolina, you must:

- Be a resident of the state

- Hold a valid driver’s license

- Not own or lease a vehicle

Applying for non-owners insurance is straightforward:

- Choose an insurance provider: Research and compare different providers to find one that meets your needs and budget.

- Contact the provider: You can apply online, over the phone, or in person at an insurance agency.

- Provide personal information: This includes your name, address, date of birth, and driver’s license number.

- Answer questions about your driving history: Be prepared to provide details about any accidents or violations.

- Submit documentation: You may need to provide proof of residency, such as a utility bill or lease agreement.

Once your application is processed, the insurance company will determine your eligibility and provide you with a policy that meets your coverage needs.

Benefits and Drawbacks of Non-Owners Insurance

Non-owners insurance provides financial protection and peace of mind for drivers who don’t own a car but occasionally operate vehicles. It offers coverage for liability and medical expenses in the event of an accident while driving a borrowed or rented car.

Benefits

* Financial Protection: Non-owners insurance covers liability costs, including property damage and bodily injury, if you cause an accident while driving someone else’s car. This can protect your personal assets from legal claims.

* Peace of Mind: Having non-owners insurance gives you peace of mind knowing that you are financially covered in case of an accident. It reduces the stress and worry associated with driving without insurance.

Drawbacks

* Coverage Limitations: Non-owners insurance typically has lower coverage limits compared to traditional auto insurance. It may not provide comprehensive or collision coverage, which can leave you responsible for the cost of damage to the vehicle you’re driving.

* Premium Costs: Non-owners insurance premiums can be higher than standard auto insurance, especially for drivers with poor driving records or who frequently drive borrowed or rented vehicles.

Real-Life Examples

* Benefit: A driver without a car borrows their friend’s vehicle and causes an accident. Non-owners insurance covers the liability costs, preventing the driver from facing financial ruin.

* Drawback: A driver with a history of accidents purchases non-owners insurance. Their premiums are significantly higher than if they had traditional auto insurance.

Additional Tips for Saving Money on Non-Owners Insurance

Finding affordable non-owners insurance is possible with a few smart strategies. Here are some tips to help you save money on your premiums:

By following these tips, you can reduce your non-owners insurance costs without sacrificing coverage. Remember to shop around and compare quotes from multiple providers to find the best deal.

Maintain a Good Driving Record

Your driving history is a major factor in determining your insurance premiums. If you have a clean driving record, you can expect to pay lower rates. Conversely, if you have traffic violations or accidents on your record, your premiums will be higher.

Take Defensive Driving Courses

Defensive driving courses can help you improve your driving skills and reduce your risk of accidents. Some insurance companies offer discounts to drivers who complete these courses.

Ask About Discounts and Loyalty Programs

Many insurance companies offer discounts for things like bundling your insurance policies, paying your premiums in full, or having a good credit score. Be sure to ask your insurance agent about any discounts you may be eligible for.

Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premiums. However, it’s important to make sure you choose a deductible that you can afford to pay in the event of an accident.

Consider Usage-Based Insurance

Usage-based insurance programs track your driving habits and adjust your premiums based on how you drive. If you are a safe driver, you may be eligible for lower rates.