Understanding Certificate of Insurance (COI) for Vendors

A Certificate of Insurance (COI) is a crucial document that demonstrates a vendor’s compliance with insurance requirements. It provides assurance that the vendor has adequate insurance coverage to protect both parties in case of an incident or accident.

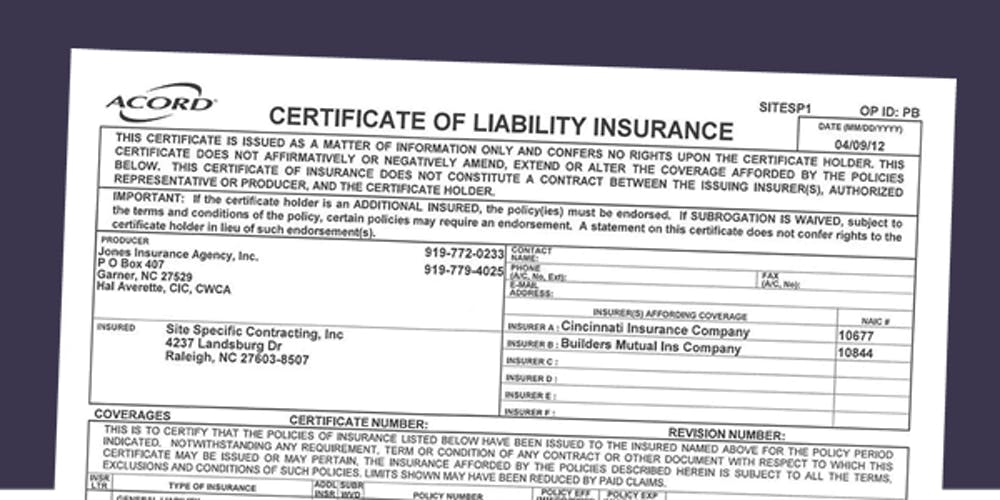

A COI typically includes essential components such as the named insured (the vendor), the coverage details (types of insurance coverage), and the limits of liability (maximum amount the insurer will pay for a claim).

Key Components of a COI

The named insured is the individual or business that is covered by the insurance policy. The coverage details specify the types of insurance coverage included, such as general liability, property damage, and workers’ compensation.

The limits of liability indicate the maximum amount the insurer will pay for each type of coverage. These limits are crucial in determining the extent of financial protection provided by the insurance policy.

Legal Requirements for COIs

Businesses may have legal obligations to request Certificates of Insurance (COIs) from vendors to protect themselves against potential risks and liabilities.

In certain industries or jurisdictions, COIs are commonly required as part of contractual agreements or regulatory compliance. Failure to obtain COIs can expose businesses to significant financial and legal consequences.

Industries and Jurisdictions

- Construction: COIs are often required to ensure that contractors and subcontractors have adequate liability and workers’ compensation coverage.

- Healthcare: Healthcare providers may request COIs from vendors to verify coverage for medical malpractice and other professional liability.

- Government Contracts: Many government agencies require vendors to provide COIs as a condition of doing business.

- Insurance Regulations: In some jurisdictions, insurance regulations may mandate that businesses obtain COIs from vendors who perform certain types of work.

Risks and Liabilities

- Liability for Vendor Negligence: Without a COI, businesses may be held liable for injuries or damages caused by a vendor’s negligence, even if the vendor is at fault.

- Breach of Contract: Failure to obtain a COI may constitute a breach of contract, leading to legal penalties and financial damages.

- Regulatory Non-Compliance: Businesses that fail to comply with regulations requiring COIs may face fines, penalties, or license suspensions.

Evaluating COIs

Evaluating a Certificate of Insurance (COI) is crucial to ensure the validity and adequacy of the coverage it provides. By carefully reviewing the document, you can verify that the insurance meets your specific requirements and protects your business in the event of a claim.

To evaluate a COI effectively, consider the following steps:

Verifying Coverage Details

Examine the COI to ensure that the coverage limits and types align with your business needs. Check for:

- Liability limits: The maximum amount the insurer will pay for covered claims.

- Coverage types: General liability, professional liability, workers’ compensation, etc.

- Named insured: The business or individual covered by the policy.

- Policy period: The dates during which the policy is active.

Reviewing Endorsements and Exclusions

Endorsements modify or extend the coverage provided by the policy. Exclusions limit or eliminate coverage for certain events or situations. Carefully review these sections to ensure they do not conflict with your business needs.

Ensuring Compliance

Compare the COI to your business’s insurance requirements. Ensure that the coverage provided meets or exceeds the minimum standards set by your contracts, industry regulations, or other legal obligations.

Managing COIs

Effective COI management ensures you have the necessary insurance coverage in place and helps you mitigate risks associated with third-party vendors. Here’s how you can establish a robust COI management process:

Design a Process for Collecting, Storing, and Tracking COIs

- Establish clear guidelines for vendors to submit COIs upon contract initiation and renewal.

- Create a centralized repository for COIs, such as a shared drive or cloud-based platform.

- Implement a system for tracking COI expiration dates and notifying vendors of upcoming renewals.

Benefits of Using COI Management Software or Systems

- Automated COI collection and tracking reduces manual effort and minimizes errors.

- Real-time monitoring of COI status allows for prompt action in case of coverage lapses.

- Integration with vendor management systems provides a comprehensive view of vendor compliance.

Best Practices for Maintaining Up-to-Date COIs and Monitoring for Coverage Changes

- Regularly review COIs for accuracy and completeness.

- Monitor for coverage changes, such as increases in coverage limits or changes in policy terms.

- Communicate with vendors to resolve any coverage gaps or discrepancies promptly.

COIs in Vendor Contracts

Incorporating COI requirements into vendor contracts is crucial to ensure that vendors maintain adequate insurance coverage, protecting both parties in the event of a claim. This safeguards the interests of the organization, vendors, and any affected individuals.

When drafting COI clauses, clarity and specificity are essential. Clearly Artikel the types and amounts of insurance coverage required, including general liability, property damage, and professional liability. Specify the minimum coverage limits, deductibles, and policy terms. Additionally, consider including provisions for additional insured status, endorsements, and certificates of excess insurance if necessary.

Potential Consequences of Not Including COI Requirements in Vendor Contracts

- Lack of insurance coverage in the event of an incident, leaving the organization financially liable.

- Delayed or denied claims due to insufficient or invalid insurance coverage.

- Reputational damage to the organization associated with uninsured or underinsured vendors.

- Increased insurance premiums for the organization due to higher risk exposure.