Cash Value Life Insurance

Cash value life insurance is a type of permanent life insurance that has a cash value component. The cash value grows over time, and you can borrow against it or withdraw it for any reason. Cash value life insurance can be a good way to save for retirement, pay for college, or cover unexpected expenses.

Benefits of Cash Value Life Insurance

There are many benefits to cash value life insurance, including:

- Tax-deferred growth: The cash value grows tax-deferred, which means you don’t have to pay taxes on the growth until you withdraw it.

- Loan provisions: You can borrow against the cash value of your policy without having to pay taxes on the loan.

- Death benefit: In addition to the cash value, cash value life insurance also provides a death benefit to your beneficiaries.

Uses of Cash Value Life Insurance

Cash value life insurance can be used for a variety of purposes, including:

- Retirement savings: Cash value life insurance can be a good way to save for retirement because the cash value grows tax-deferred.

- College savings: Cash value life insurance can also be used to save for college. You can borrow against the cash value to pay for tuition, fees, and other expenses.

- Unexpected expenses: Cash value life insurance can also be used to cover unexpected expenses, such as medical bills or home repairs.

Face Value Life Insurance

Face value life insurance is a type of life insurance that pays out a predetermined amount, or face value, to the beneficiary upon the death of the insured person. The face value is typically set when the policy is purchased and remains the same throughout the life of the policy.

Face value life insurance provides several benefits, including:

- Guaranteed payout: The face value is guaranteed to be paid out to the beneficiary, regardless of the circumstances of the insured person’s death.

- Death benefit: The face value provides a death benefit to the beneficiary, which can be used to cover expenses such as funeral costs, outstanding debts, or lost income.

- Simple and straightforward: Face value life insurance is simple and straightforward to understand, making it a good option for people who want a basic life insurance policy.

Face value life insurance can be used in a variety of ways, including:

- To provide financial security for loved ones: The death benefit can provide financial security for loved ones, ensuring that they have the resources they need to cover expenses and maintain their lifestyle.

- To pay for final expenses: The death benefit can be used to pay for final expenses, such as funeral costs, burial expenses, and outstanding debts.

- To replace lost income: The death benefit can be used to replace lost income, providing financial support for the family of the deceased.

Comparison of Cash Value and Face Value Life Insurance

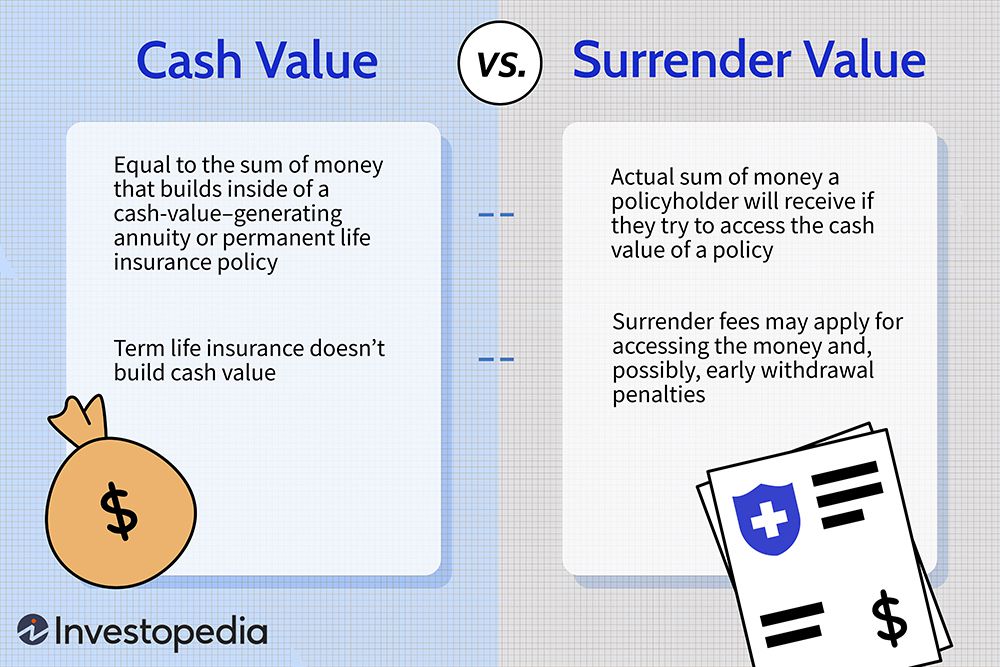

Cash value and face value life insurance are two main types of life insurance policies that provide different benefits and features. Understanding the differences between these two types of policies can help you make an informed decision about which one is right for you.

Features Comparison

The following table compares the key features of cash value and face value life insurance:

| Feature | Cash Value Life Insurance | Face Value Life Insurance |

|—|—|—|

| Premium | Higher premiums | Lower premiums |

| Cash Value | Builds cash value over time | No cash value |

| Death Benefit | Death benefit plus cash value | Death benefit only |

| Loans | Can borrow against cash value | No loans |

| Surrender Value | Cash value minus surrender charge | No surrender value |

Advantages and Disadvantages

Cash Value Life Insurance

* Advantages:

* Builds cash value that can be borrowed against or withdrawn

* Death benefit is increased by the cash value

* Can provide a source of retirement income

* Disadvantages:

* Higher premiums

* Cash value growth is subject to market fluctuations

* Surrender charges may apply if you withdraw cash value early

Face Value Life Insurance

* Advantages:

* Lower premiums

* Guaranteed death benefit

* No cash value to manage

* Disadvantages:

* No cash value

* Death benefit is fixed and cannot be increased

* No potential for additional income

Recommendation

The best type of life insurance for you depends on your individual needs and financial situation. If you need a policy that provides both a death benefit and a cash value that can be used for other purposes, then cash value life insurance may be a good option. If you are looking for a policy with lower premiums and a guaranteed death benefit, then face value life insurance may be a better choice.

How to Choose the Right Life Insurance Policy

When choosing a life insurance policy, it’s crucial to consider several factors to ensure it meets your specific needs and financial goals.

Factors to Consider:

- Age and Health: Your age and overall health will significantly impact your life insurance premiums.

- Income and Expenses: Determine how much coverage you need to protect your family’s financial well-being in case of your untimely demise.

- Debts and Assets: Consider any outstanding debts or mortgages that your policy should cover. Also, account for any assets or investments that may offset your insurance needs.

- Family Situation: If you have dependents, it’s essential to ensure your policy provides adequate financial support for their future.

- Occupation and Lifestyle: Certain occupations or risky hobbies may affect your insurance premiums.

Step-by-Step Guide:

- Assess Your Needs: Determine the coverage amount and policy term that aligns with your financial situation and goals.

- Research and Compare: Explore different insurance companies and compare their policies, premiums, and customer service ratings.

- Get Quotes: Obtain quotes from multiple insurers to find the most competitive rates and coverage options.

- Consider Riders: Optional riders, such as accidental death or dismemberment coverage, can enhance your policy’s protection.

- Choose a Policy: Carefully review the policy details and ensure it meets your needs and budget before signing up.

Tips for Getting the Best Deal:

- Shop Around: Comparing quotes from different insurers can help you secure the most affordable policy.

- Maintain a Healthy Lifestyle: Non-smokers and individuals in good health typically qualify for lower premiums.

- Consider Term Life Insurance: Term life insurance offers temporary coverage at lower premiums than whole life insurance.

- Negotiate: If possible, negotiate with your insurance provider to obtain a more favorable premium rate.