Market Overview

The car insurance market in Waco, Texas, is characterized by a growing population and increasing vehicle ownership, leading to a surge in demand for insurance coverage. The market size is projected to reach $1.2 billion by 2025, with a steady growth rate of 3.5% annually.

The competitive landscape is fragmented, with several major players holding significant market shares. The top insurers include State Farm, Allstate, Geico, and Progressive. These companies offer a wide range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Major Players

- State Farm: 25% market share

- Allstate: 18% market share

- Geico: 15% market share

- Progressive: 12% market share

Industry Trends

The car insurance industry in Waco, TX, is influenced by several key trends, including:

- Increasing use of telematics devices for usage-based insurance

- Growing demand for personalized coverage options

- Emergence of new technologies, such as autonomous vehicles and ride-sharing services

Target Audience

Waco, TX, has a diverse population of car owners with varying demographics and characteristics. Understanding these segments and their specific needs is crucial for tailoring insurance products and marketing strategies.

The market can be segmented based on factors such as age, income, driving habits, and vehicle type. Each segment has unique risk profiles and insurance requirements.

Age

Younger drivers (under 25) typically have higher risk profiles due to limited driving experience and higher likelihood of accidents. They may require higher insurance premiums compared to older, more experienced drivers.

Older drivers (over 65) may also face increased risk due to age-related factors such as slower reaction times and declining physical abilities. However, they often have lower mileage and may qualify for discounts.

Income

Income levels influence car ownership and insurance needs. Higher-income individuals may own more expensive vehicles and have a greater need for comprehensive coverage.

Lower-income individuals may prioritize affordability and may opt for basic liability coverage. Understanding income distribution in Waco helps insurers tailor products to meet the financial constraints of different segments.

Driving Habits

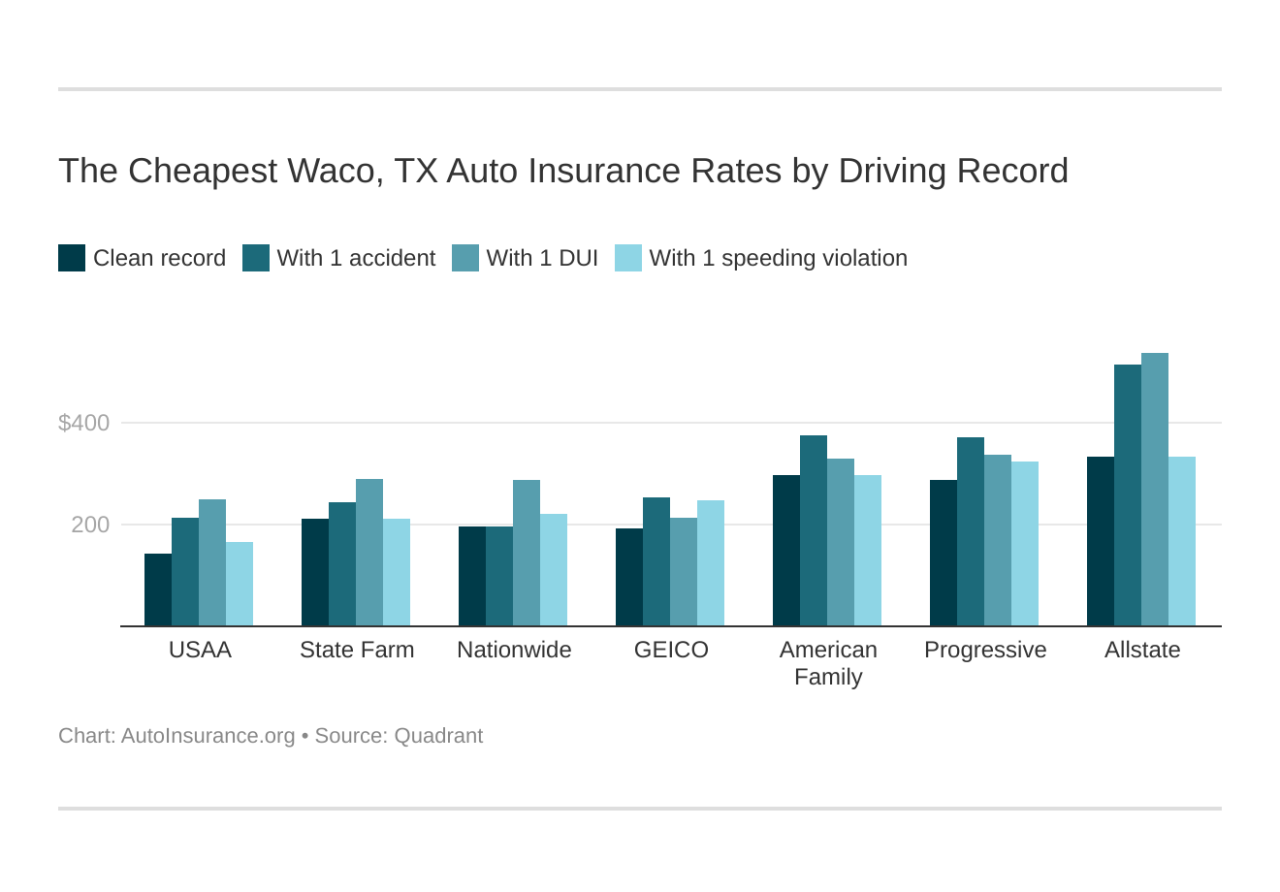

Driving habits significantly impact insurance premiums. Drivers with a history of accidents, traffic violations, or reckless driving may face higher rates.

Insurers may offer discounts to safe drivers with clean driving records, encouraging responsible driving behavior and reducing risk.

Vehicle Type

The type of vehicle owned also affects insurance premiums. Sports cars, luxury vehicles, and high-performance vehicles typically carry higher premiums due to their increased risk of accidents and repairs.

Insurers may offer lower rates for fuel-efficient vehicles, hybrid cars, or vehicles with safety features such as airbags and anti-lock brakes.

Product Offerings

In Waco, TX, various car insurance coverage options are available to meet the diverse needs of drivers. Understanding the different types of coverage, their benefits, and limitations is crucial for selecting the most suitable policy.

The cost of car insurance premiums is influenced by several factors, including the driver’s age, driving history, vehicle type, and coverage limits. It’s important to compare quotes from multiple insurance providers to find the best combination of coverage and affordability.

Liability Coverage

Liability coverage is required by law in most states, including Texas. It protects drivers against financial responsibility for injuries or property damage caused to others in an accident. There are two types of liability coverage:

- Bodily injury liability: Covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder.

- Property damage liability: Covers the cost of repairing or replacing property damaged in an accident caused by the policyholder.

Distribution Channels

Car insurance in Waco, TX, is distributed through various channels, each with its advantages and disadvantages.

Traditional Channels:

- Independent Insurance Agents: Offer policies from multiple insurance companies, providing personalized advice and competitive rates. However, they may charge higher commissions.

- Captive Agents: Represent a single insurance company, offering limited options but often providing lower premiums. However, they may be less flexible in meeting specific needs.

Online Channels:

- Direct Insurers: Sell policies directly to consumers through their websites, offering lower premiums by eliminating intermediaries. However, they may have limited customer service and policy options.

- Online Aggregators: Compare quotes from multiple insurance companies, providing convenience and transparency. However, they may not offer personalized advice or comprehensive coverage options.

Other Channels:

- Banks and Credit Unions: Offer car insurance as an additional product to their customers, providing convenience and cross-selling opportunities. However, they may have limited coverage options and higher premiums.

- Automobile Dealerships: May offer car insurance as part of the vehicle purchase process, providing convenience and potential discounts. However, they may have limited options and higher premiums.

Role of Technology

Technology plays a crucial role in the distribution of car insurance in Waco, TX:

- Online Quoting Tools: Allow consumers to compare quotes from multiple insurers quickly and easily, increasing transparency and competition.

- Telematics Devices: Monitor driving behavior and provide personalized premiums based on actual driving habits, promoting safer driving and reducing insurance costs.

- Mobile Apps: Provide convenient access to policy information, claims reporting, and roadside assistance, enhancing customer experience and engagement.

Marketing Strategies

Car insurance providers in Waco, TX employ a range of marketing strategies to attract and retain customers. These strategies aim to increase brand visibility, generate leads, and drive sales.

One effective strategy is leveraging local partnerships. Collaborating with local businesses, such as auto repair shops or car dealerships, allows insurance providers to tap into established customer bases and cross-promote their services.

Online Marketing

Online marketing has become increasingly important for car insurance providers. Search engine optimization () and pay-per-click (PPC) advertising are commonly used to enhance website visibility and attract potential customers searching for insurance-related queries.

Social media marketing is also effective in reaching a wide audience. Insurance providers create engaging content, such as informative articles or videos, to educate and connect with potential customers.

Innovative Marketing Approaches

To stay ahead in the competitive insurance market, innovative marketing approaches can be explored. One such approach is personalized marketing. By leveraging data analytics, insurance providers can tailor marketing messages and product offerings to individual customer needs.

Another innovative approach is influencer marketing. Partnering with local influencers who have a strong following in the automotive or insurance industry can help reach a targeted audience and build credibility.

Customer Service

Customer service plays a pivotal role in the car insurance industry, influencing customer satisfaction, loyalty, and overall brand reputation. Excellent customer service is essential for building strong relationships with policyholders, ensuring their needs are met, and fostering a positive experience throughout their insurance journey.

To provide exceptional customer service, insurance providers should adopt best practices such as:

- Personalized communication: Tailoring interactions to each customer’s unique needs and preferences.

- Timely and responsive support: Providing prompt and efficient assistance through multiple channels.

- Empathy and understanding: Demonstrating genuine care and understanding for customers’ situations.

- Empowering employees: Giving customer service representatives the authority to resolve issues effectively.

Role of Technology

Technology has become an indispensable tool in enhancing customer service within the car insurance industry. By leveraging advanced technologies, insurers can:

- Automate processes: Streamlining tasks such as policy issuance, claims processing, and billing to improve efficiency.

- Provide self-service options: Empowering customers with online portals and mobile apps for convenient access to account information and policy management.

- Personalize experiences: Utilizing data analytics to tailor recommendations, offers, and support based on individual customer profiles.

- Enable real-time communication: Facilitating instant responses through live chat, virtual assistants, and social media platforms.

Legal and Regulatory Environment

The car insurance industry in Waco, TX is subject to a comprehensive set of legal and regulatory requirements. These regulations aim to protect consumers, ensure fair competition, and maintain the stability of the insurance market.

The Texas Department of Insurance (TDI) is the primary regulatory body responsible for overseeing the car insurance industry in the state. The TDI has established a framework of laws and regulations that govern the operations of insurance companies, including licensing requirements, solvency standards, and policyholder protections.

Impact of Recent Regulatory Changes

In recent years, the car insurance industry in Waco, TX has been impacted by several significant regulatory changes. One notable change was the implementation of the Affordable Care Act (ACA), which expanded health insurance coverage to millions of Americans. This led to a decrease in the number of uninsured drivers, which in turn reduced the overall cost of car insurance for many consumers.

Another recent regulatory change that has affected the car insurance industry in Waco, TX is the implementation of the Texas Rate Review Law. This law requires insurance companies to file their proposed rate increases with the TDI for review and approval. The TDI has the authority to reject rate increases that are deemed to be excessive or unreasonable.

Potential Legal and Regulatory Challenges

The car insurance industry in Waco, TX is likely to face several legal and regulatory challenges in the future. One potential challenge is the increasing frequency and severity of natural disasters. These events can lead to a significant increase in insurance claims, which can put a strain on the financial resources of insurance companies.

Another potential legal and regulatory challenge is the rise of autonomous vehicles. As autonomous vehicles become more common, the traditional model of car insurance may need to be revised. This could lead to new legal and regulatory issues, such as who is liable in the event of an accident involving an autonomous vehicle.