Types of Dental Insurance Plans

Dental insurance plans can vary in their coverage and structure. The three main types of dental insurance plans are indemnity, PPO, and HMO plans. Each type offers different benefits and restrictions, so it’s important to understand the differences before choosing a plan.

Indemnity Plans

Indemnity plans provide the most flexibility in terms of choosing your dentist and the services you receive. With an indemnity plan, you can visit any dentist you want and are reimbursed for a percentage of the cost of your care, up to the plan’s maximum coverage. Indemnity plans typically have higher premiums than other types of plans, but they offer the most freedom in choosing your dental care.

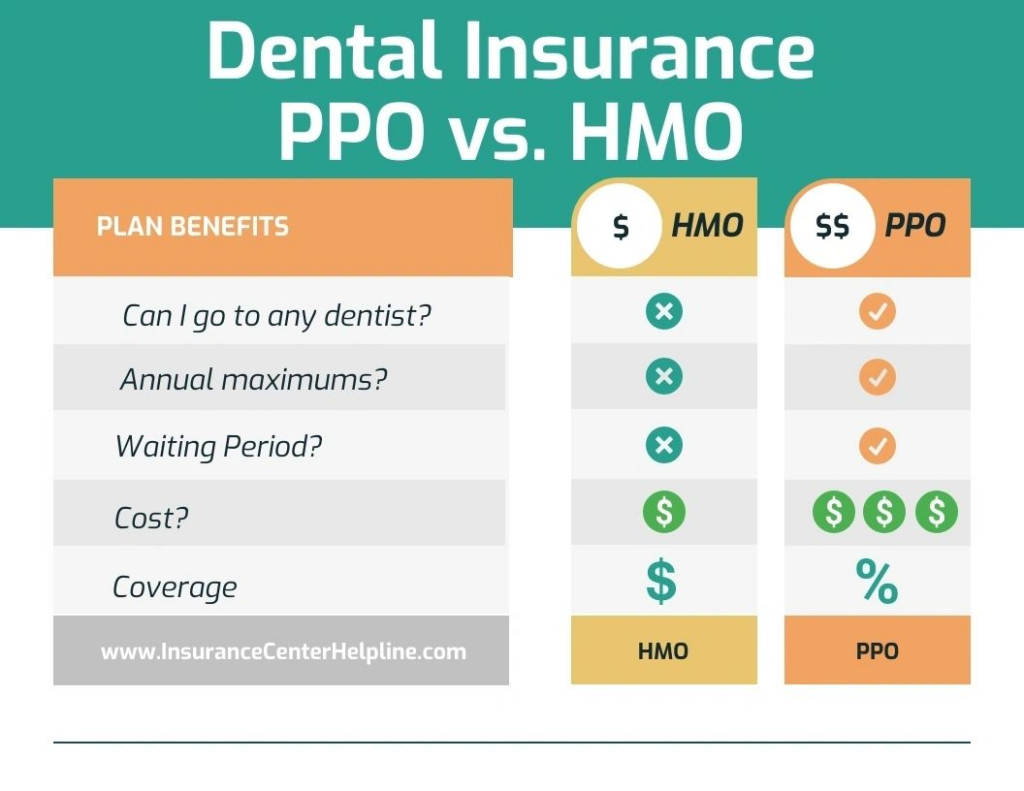

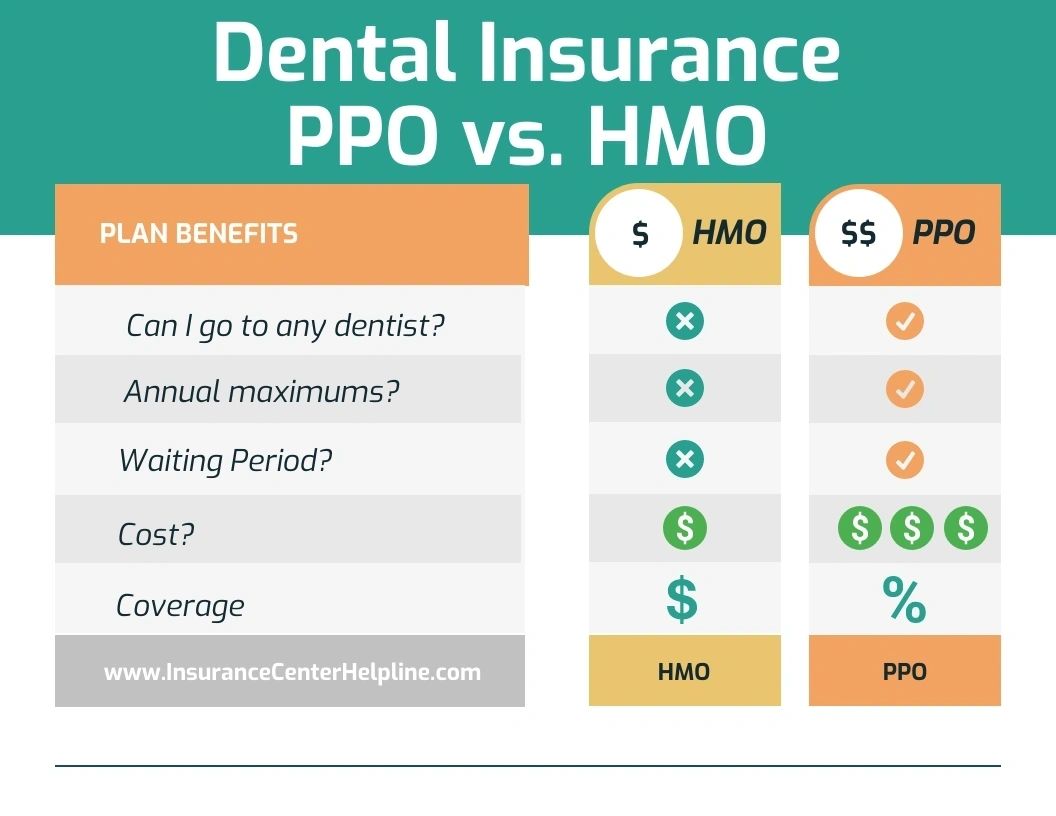

PPO Plans

PPO (Preferred Provider Organization) plans offer a network of dentists that you can choose from. If you see a dentist within the network, you will receive a higher level of coverage than if you see a dentist outside the network. PPO plans typically have lower premiums than indemnity plans, but they may have some restrictions on your choice of dentists.

HMO Plans

HMO (Health Maintenance Organization) plans are the most restrictive type of dental insurance plan. With an HMO plan, you must choose a primary care dentist from a network of dentists. You can only see other dentists within the network for covered services. HMO plans typically have the lowest premiums, but they offer the least flexibility in choosing your dental care.

Coordinating Benefits Between Two Dental Insurance Plans

Coordinating benefits between two dental insurance plans involves a process to determine which plan is primary and which is secondary. The primary plan pays first, up to the limits of its coverage. The secondary plan then pays for any remaining eligible expenses, up to its own coverage limits.

Determining Primary and Secondary Coverage

Typically, the plan provided by the employer is considered primary, while the plan provided by a spouse or other family member is secondary. If both plans are through the same employer, the plan with the lower deductible is usually considered primary.

Calculating Benefits

The amount paid by each plan is calculated based on the following formula:

Benefit = Eligible Expense x (Plan Coverage / Total Coverage)

For example, if the eligible expense is $1,000, the primary plan covers 80%, and the secondary plan covers 50%, the benefit from the primary plan would be $800, and the benefit from the secondary plan would be $100 (50% of the remaining $200).

Benefits of Having Two Dental Insurance Plans

Having two dental insurance plans can provide several advantages, including increased coverage and reduced out-of-pocket expenses. By combining the benefits of multiple plans, individuals can access a wider range of dental services and potentially save money on their dental care.

Increased Coverage

With two dental insurance plans, individuals can often increase their overall coverage limits. This means that they may be able to receive more extensive dental care without having to pay additional out-of-pocket costs. For example, if one plan has a maximum coverage of $1,000 per year and the other plan has a maximum coverage of $1,500 per year, the individual would have a combined coverage limit of $2,500. This increased coverage can be particularly beneficial for individuals who require major dental work, such as crowns, bridges, or implants.

Reduced Out-of-Pocket Expenses

Having two dental insurance plans can also help individuals reduce their out-of-pocket expenses. This is because each plan may cover different portions of the cost of dental services. For example, one plan may cover 80% of the cost of fillings, while the other plan may cover 50% of the cost of crowns. By combining the coverage from both plans, individuals can potentially reduce their out-of-pocket costs for these services.

Additional Benefits

In addition to increased coverage and reduced out-of-pocket expenses, having two dental insurance plans can also provide access to additional benefits. For example, one plan may offer orthodontic coverage, while the other plan may offer vision coverage. By combining the benefits of multiple plans, individuals can access a wider range of dental and health care services.

Examples of Situations Where Having Two Plans Is Beneficial

There are several situations where having two dental insurance plans can be beneficial. For example, individuals who are employed by two different employers may be eligible for dental insurance coverage through both employers. Individuals who are married may also be able to combine their dental insurance coverage if their spouses have different plans. Additionally, individuals who are self-employed or who do not have access to employer-sponsored dental insurance may choose to purchase two individual plans to ensure adequate coverage.

Considerations When Having Two Dental Insurance Plans

While having two dental insurance plans may seem beneficial, it is crucial to consider potential drawbacks and challenges.

Premium Costs

Maintaining two dental insurance plans can result in higher monthly premiums, increasing the financial burden. Consider the combined cost and assess whether it aligns with your budget and financial goals.

Administrative Hassles

Managing multiple dental insurance plans involves additional paperwork, coordination, and communication with both insurance providers. This can be time-consuming and administratively burdensome, especially when submitting claims or resolving coverage issues.

Coverage Limitations

Having two dental insurance plans does not necessarily guarantee comprehensive coverage. Each plan may have its own limitations, exclusions, and annual maximums. Understanding these limitations and coordinating benefits between the plans is essential to avoid gaps in coverage.

Tips for Managing Multiple Dental Insurance Plans Effectively

To mitigate the challenges associated with having two dental insurance plans, consider the following tips:

- Choose complementary plans: Opt for plans that complement each other’s coverage, such as one plan covering preventive care and the other covering major procedures.

- Coordinate benefits: Inform both insurance providers about your multiple coverage and work with them to coordinate benefits to maximize coverage.

- Keep records organized: Maintain a clear record of all insurance cards, policy details, and communication with both providers.

- Communicate proactively: Stay in regular contact with both insurance providers to avoid any misunderstandings or delays in claim processing.

Special Cases and Exceptions

Having two dental insurance plans may not always be advisable in certain situations. It’s crucial to be aware of these exceptions to make informed decisions about your dental coverage.

Medicare or Medicaid Coverage

Individuals enrolled in Medicare or Medicaid may not benefit from having a second dental insurance plan. These government-sponsored programs often provide comprehensive dental coverage, making additional insurance redundant.

Employer-Sponsored Plans

If you have dental coverage through your employer, it may not be necessary to purchase a second plan. Employer-sponsored plans typically offer adequate coverage, and having two plans could lead to unnecessary duplication and higher premiums.

Preexisting Conditions

Some dental insurance plans may have exclusions for preexisting conditions. If you have a known dental condition, it’s essential to carefully review the terms of both plans to ensure that your condition is covered. If not, having two plans may not provide additional benefits.