What is Gap Insurance?

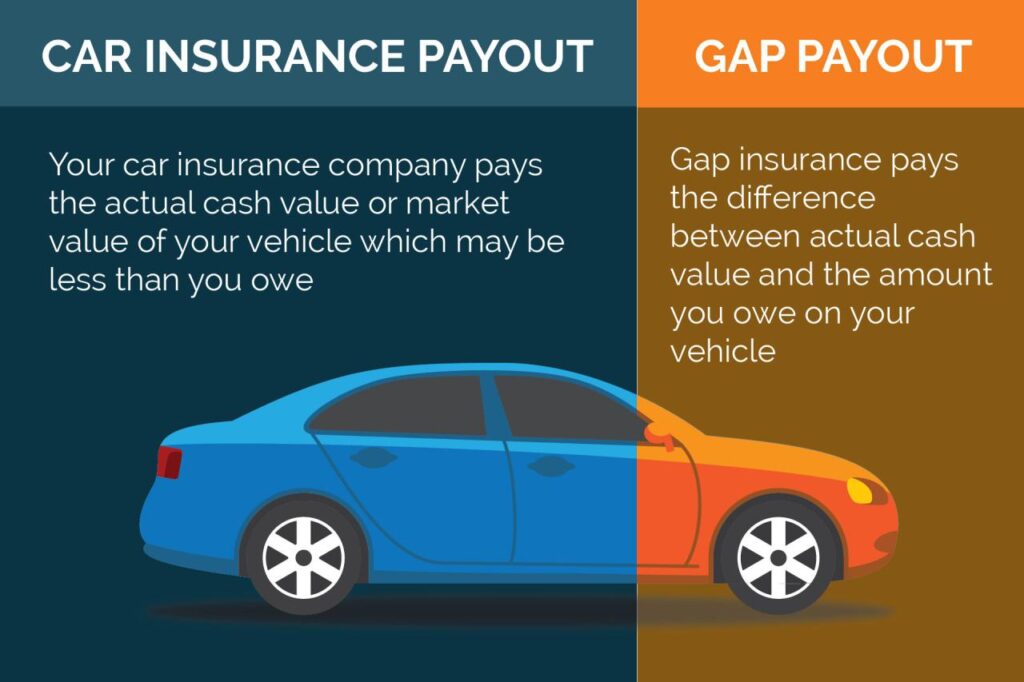

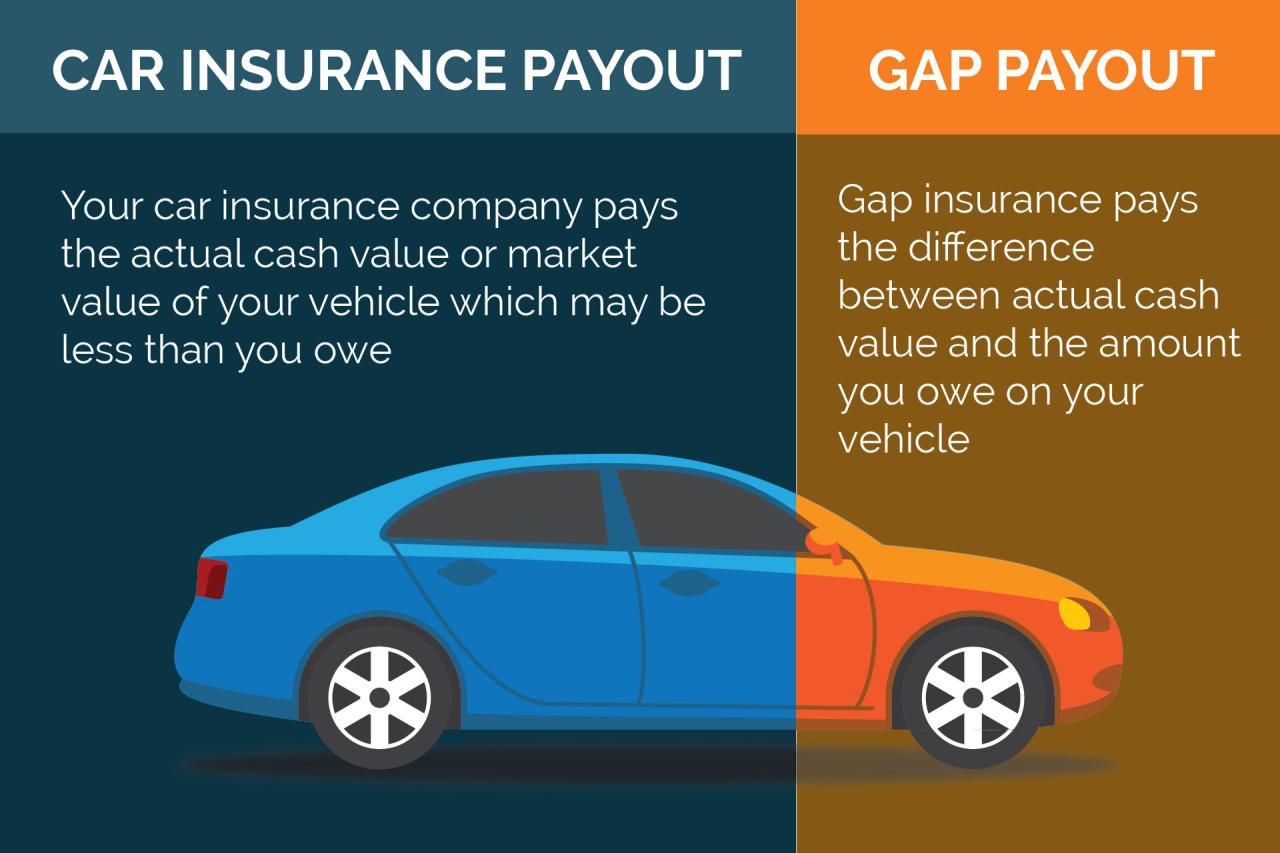

Gap insurance, also known as guaranteed auto protection (GAP), is an optional type of auto insurance that helps cover the difference between the actual cash value (ACV) of your vehicle and the amount you owe on your loan or lease.

Gap insurance can be a valuable option if you have a new or leased vehicle that is worth less than you owe on it. This is because the ACV of your vehicle will typically depreciate quickly, while the amount you owe on your loan or lease will not.

Coverage and Limitations

Gap insurance coverage typically begins when you purchase a new or leased vehicle and ends when the loan or lease is paid off. The amount of coverage you have will vary depending on the policy you purchase, but it will typically cover the difference between the ACV of your vehicle and the amount you owe on your loan or lease, up to the policy limit.

There are some limitations to gap insurance coverage. For example, gap insurance will not cover the following:

- Damage to your vehicle that is caused by an accident

- Theft of your vehicle

- Wear and tear on your vehicle

- Mechanical breakdowns

Purchasing Gap Insurance Independently

If your lender does not offer gap insurance, you may consider purchasing it separately. This can provide you with flexibility and control over the coverage you choose.

Identifying Potential Providers

Several insurance companies offer standalone gap insurance policies. Some of the notable providers include:

- Progressive

- Geico

- USAA

- Liberty Mutual

- MetLife

Factors to Consider

Purchasing gap insurance independently offers both advantages and disadvantages. One key advantage is the potential cost savings compared to purchasing it through a dealership. However, it’s important to consider the following factors before making a decision:

Vehicle Value

The value of your vehicle plays a crucial role in determining the necessity of gap insurance. If your vehicle is relatively new or expensive, gap insurance can provide peace of mind in the event of a total loss. However, if your vehicle is older or less valuable, the cost of gap insurance may outweigh its benefits.

Loan Terms

The length and terms of your auto loan also impact the need for gap insurance. If you have a long-term loan or a high-interest rate, gap insurance can help protect you from being upside down on your loan in case of a total loss.

Insurance Premiums

The cost of gap insurance premiums should be factored into your decision. While independent gap insurance may be cheaper than dealership-purchased insurance, it’s important to compare quotes from multiple providers to find the best deal.

Alternative Options

In addition to gap insurance, consider exploring other financial protection options that can cover the gap between a vehicle’s value and loan balance.

Compare the costs and benefits of these alternatives to determine the best fit for your specific financial situation and vehicle ownership goals.

Vehicle Service Contracts

Vehicle service contracts, also known as extended warranties, provide coverage for repairs and replacements beyond the manufacturer’s warranty. While they don’t directly cover the gap between a vehicle’s value and loan balance, they can help reduce unexpected repair costs, potentially freeing up funds that could be used to pay down the loan balance.

Legal and Regulatory Considerations

Purchasing gap insurance independently is generally not subject to specific legal or regulatory restrictions. However, it’s essential to be aware of the following considerations:

Reviewing Insurance Contracts Carefully

When purchasing gap insurance independently, carefully review the insurance contract to ensure you understand the terms and conditions, including:

– The coverage limits and exclusions

– The deductible amount

– The length of the coverage period

– The claims process

– Any additional fees or charges

Understanding the contract will help you make informed decisions and avoid potential disputes or misunderstandings.