Insurance Coverage in High Fire Risk Areas

Homeowners in high fire risk areas face unique challenges when it comes to insurance coverage. Standard homeowners insurance policies may not provide adequate protection against fire-related losses.

Insurance companies offer specific coverages and endorsements to address the risks associated with living in a fire-prone area. These include:

Extended Replacement Cost Coverage

This coverage provides additional protection beyond the standard replacement cost coverage. It ensures that the homeowner is reimbursed for the full cost of rebuilding their home, even if the cost exceeds the policy limits.

Fire Sprinkler Credit

Insurance companies may offer a discount on premiums for homes equipped with fire sprinklers. Fire sprinklers can significantly reduce the risk of damage in the event of a fire.

Fire-Resistant Building Materials Credit

Homes constructed with fire-resistant building materials may qualify for a premium discount. These materials can help to slow the spread of fire and reduce the severity of damage.

Risk Assessment and Mitigation

Insurance companies assess fire risk for a property based on various factors, including:

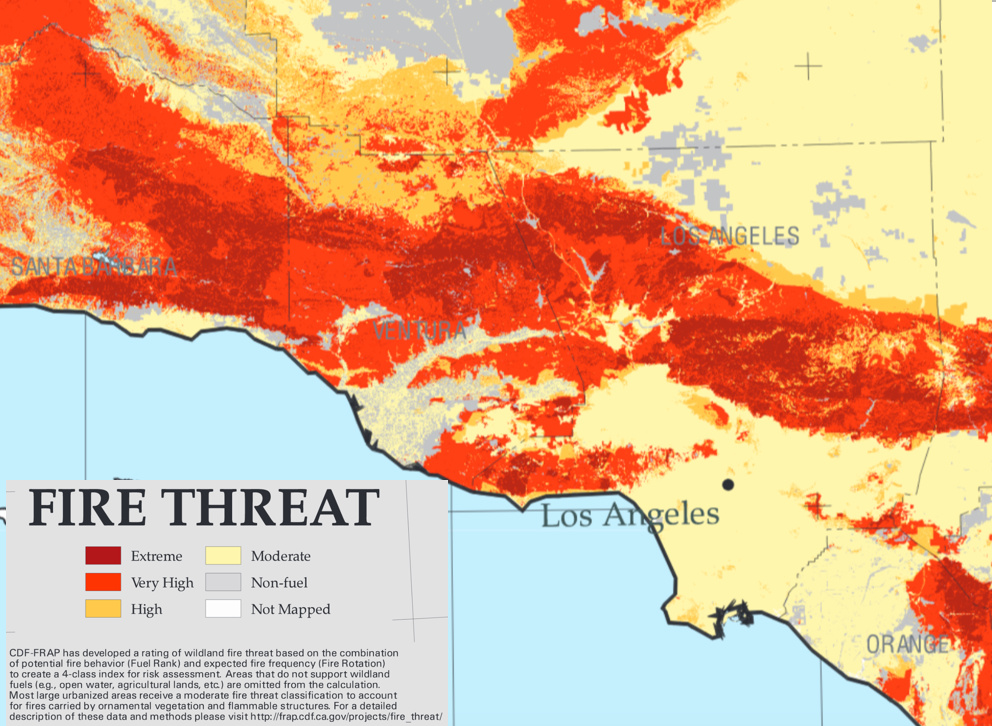

* Location: Properties in areas with a history of wildfires or in close proximity to potential ignition sources, such as power lines or flammable vegetation, face higher risks.

* Construction and building materials: Homes built with fire-resistant materials, such as stucco or metal roofing, are less likely to ignite or spread flames.

* Landscaping: Properties surrounded by dense vegetation or combustible materials, such as dry brush or woodpiles, create a fuel source for wildfires.

* Defensible space: Creating a buffer zone around a home by clearing flammable materials and maintaining a well-maintained yard can help prevent fire from spreading to the structure.

Homeowners can mitigate fire risks and potentially lower their premiums by:

* Creating defensible space: Clear brush, dead leaves, and other flammable materials within 100 feet of the home. Trim tree branches that overhang the roof and keep firewood stacks at least 30 feet away from the house.

* Using fire-resistant materials: Install fire-resistant roofing, siding, and windows. Consider using non-combustible materials for decks, fences, and outdoor furniture.

* Maintaining landscaping: Keep grass and shrubs trimmed and watered, and remove any dead or dying vegetation. Create a firebreak by planting fire-resistant plants or using gravel or stone.

* Inspecting and maintaining electrical and mechanical systems: Ensure electrical wiring and appliances are in good condition and up to code. Inspect chimneys and fireplaces regularly for any cracks or blockages.

Fire Prevention Measures

* Landscaping: Plant fire-resistant species, such as succulents, aloe vera, and native wildflowers. Create a fuel break by using gravel or stone to separate flammable vegetation from the home.

* Roofing materials: Choose fire-resistant roofing materials, such as metal, tile, or Class A-rated asphalt shingles. Avoid using wood shakes or other combustible materials.

* Defensible space: Clear brush, dead leaves, and other flammable materials within 100 feet of the home. Trim tree branches that overhang the roof and keep firewood stacks at least 30 feet away from the house.

Claims Process and Coverage Limits

Filing a claim for fire damage in high-risk areas involves specific procedures and considerations. Understanding the claims process and coverage limitations is crucial for homeowners to ensure timely and adequate compensation.

In the event of a fire, homeowners should immediately contact their insurance provider to report the damage and initiate the claims process. The insurance company will typically dispatch an adjuster to assess the extent of the damage and determine the coverage available under the policy. The adjuster will inspect the property, review the policy, and gather documentation to support the claim.

Coverage Limitations

Certain types of fire damage may be subject to limitations or exclusions in coverage. For instance, some policies may exclude coverage for damage caused by wildfires or arson. It is important for homeowners to carefully review their policies and understand any potential exclusions or limitations that may apply to fire damage.

Coverage Limits

Coverage limits for fire damage vary depending on the policy and the insurance provider. Homeowners should ensure they have adequate coverage to cover the potential costs of rebuilding or repairing their property in the event of a fire. Insufficient coverage can result in financial hardship and out-of-pocket expenses. It is recommended to consult with an insurance professional to determine the appropriate coverage limits based on the value of the property and its location in a high-fire risk area.

Market Trends and Availability

The insurance market for homes in high fire risk areas is constantly evolving, influenced by various factors. Understanding these trends can help homeowners navigate the challenges and identify opportunities for securing coverage.

One notable trend is the increasing demand for home insurance in high fire risk areas. As more people relocate to these regions, the demand for insurance coverage has surged. However, this increased demand has also led to challenges, such as rising insurance premiums and limited availability of coverage.

Government Programs and Initiatives

Recognizing the importance of insurance availability in high fire risk areas, governments have implemented various programs and initiatives to address this issue.

- Fair Access to Insurance Requirements (FAIR) Plans: These state-run programs provide insurance coverage to homeowners in high fire risk areas who have been unable to obtain coverage through traditional insurance companies.

- Catastrophic Insurance Coverage: Some states offer catastrophic insurance coverage, which provides limited coverage for homes destroyed or severely damaged by wildfires.

- Wildfire Risk Mitigation Grants: Governments provide grants to homeowners and communities to implement wildfire risk mitigation measures, such as fire-resistant building materials and defensible space.

Homeowner Resources and Support

Homeowners in high fire risk areas face unique challenges in securing and maintaining adequate insurance coverage. To navigate these challenges, several resources and support systems are available.

Insurance Agents and Brokers

Insurance agents and brokers play a crucial role in helping homeowners understand their insurance options and securing the coverage they need. They can provide expert advice on policy details, risk assessment, and claims filing.

Community Assistance and Financial Aid Programs

In the aftermath of a fire, homeowners may qualify for various community assistance programs and financial aid. These programs can provide temporary housing, financial assistance for rebuilding, and other essential support services.