Coverage and Eligibility

Insurance coverage for breast reduction and lift procedures varies depending on the specific plan and the individual’s eligibility.

Typically, these procedures are covered under insurance if they are deemed medically necessary. This means that the surgery must be performed to address a physical condition that is causing pain, discomfort, or other health problems.

Insurance Plans

Some examples of insurance plans that commonly cover breast reduction and lift procedures include:

- Blue Cross Blue Shield

- UnitedHealthcare

- Cigna

- Aetna

- Humana

Eligibility Requirements

To be eligible for insurance coverage, individuals may need to meet certain requirements, such as:

- Having a documented history of breast pain, discomfort, or other health problems caused by the size or shape of their breasts

- Being overweight or obese, which can contribute to breast pain and discomfort

- Having a family history of breast cancer, which can increase the risk of developing breast problems

Factors Influencing Cost

The cost of breast reduction and lift procedures can vary significantly, influenced by several key factors.

One of the primary factors is the surgeon’s fees. The surgeon’s experience, reputation, and location can impact the cost of the procedure. Facility charges, which include the use of the operating room, anesthesia, and other equipment, also contribute to the overall expense.

Geographic Location

The geographic location of the procedure can also affect the cost. Procedures performed in larger cities or areas with a higher cost of living tend to be more expensive than those performed in smaller towns or rural areas.

Insurance Coverage

Insurance coverage can play a significant role in the cost of breast reduction and lift procedures. Some insurance plans may cover a portion of the expenses, while others may not provide any coverage at all. It is important to check with your insurance provider to determine your coverage and out-of-pocket expenses before undergoing the procedure.

Payment Options

Understanding the available payment options for breast reduction and lift procedures is crucial. Each option has its advantages and disadvantages, so it’s essential to consider your financial situation and preferences.

The primary payment options include using insurance, financing, or making out-of-pocket payments. Let’s delve into each option and its implications.

Insurance

- Advantages: Insurance can significantly reduce the cost of the procedure, depending on your coverage and policy. It provides financial protection against unexpected medical expenses.

- Disadvantages: Coverage for breast reduction and lift varies widely. You may have to meet certain criteria, such as demonstrating medical necessity or a significant impact on your physical or emotional well-being. Additionally, insurance companies may require pre-authorization and have deductibles and co-pays.

Financing

- Advantages: Financing allows you to spread out the cost of the procedure over time, making it more manageable. It can be an option for those who don’t have insurance or sufficient funds upfront.

- Disadvantages: Financing typically involves interest charges, which can increase the overall cost of the procedure. It’s essential to carefully consider the interest rates and repayment terms to avoid financial strain.

Out-of-Pocket Payments

- Advantages: Paying out-of-pocket gives you complete control over the procedure and eliminates the need for insurance approvals or financing arrangements. It can also ensure privacy and confidentiality.

- Disadvantages: Out-of-pocket payments require you to have the full amount available upfront. This can be a substantial financial burden, especially for major procedures like breast reduction and lift.

Navigating Insurance Claims and Payment Processes:

- Confirm Coverage: Verify your insurance coverage for breast reduction and lift before proceeding with the procedure. Understand the terms and conditions, including any deductibles or co-pays.

- Obtain Pre-Authorization: Most insurance companies require pre-authorization for elective procedures. Submit the necessary documentation to your insurance provider for review and approval.

- Gather Documentation: Keep a record of all medical records, receipts, and correspondence related to the procedure. This documentation will be essential for submitting claims and resolving any disputes.

- Understand Payment Process: Familiarize yourself with the payment process and timelines. Contact your insurance provider or healthcare provider if you have any questions or concerns.

Insurance Coverage Comparison

The coverage and cost of breast reduction and lift procedures vary depending on the insurance plan you choose. It’s important to understand the differences between plans to make an informed decision that meets your financial and medical needs.

The following table provides a comparison of the coverage and cost of these procedures under different insurance plans:

Deductibles and Co-pays

| Insurance Plan | Deductible | Co-pay |

|---|---|---|

| Plan A | $1,000 | 20% |

| Plan B | $500 | 15% |

| Plan C | $2,000 | 10% |

Out-of-Pocket Expenses

Out-of-pocket expenses refer to the amount you pay for the procedure that is not covered by insurance. This can include the deductible, co-pay, and any additional charges that exceed your plan’s coverage limits.

The following table provides an example of how out-of-pocket expenses can vary depending on the insurance plan you choose:

| Insurance Plan | Total Cost of Procedure | Deductible | Co-pay | Out-of-Pocket Expenses |

|---|---|---|---|---|

| Plan A | $10,000 | $1,000 | 20% ($2,000) | $3,000 |

| Plan B | $10,000 | $500 | 15% ($1,500) | $2,000 |

| Plan C | $10,000 | $2,000 | 10% ($1,000) | $3,000 |

Implications of Choosing One Insurance Plan Over Another

The choice of insurance plan can have a significant impact on the cost of your breast reduction and lift procedure. Here are some factors to consider:

- Deductible: A higher deductible means you will pay more out-of-pocket before your insurance coverage begins. However, it can also lower your monthly premiums.

- Co-pay: A higher co-pay means you will pay a larger percentage of the cost of the procedure at the time of service. However, it can also lower your deductible and monthly premiums.

- Coverage limits: Some insurance plans may have coverage limits for certain procedures, such as breast reduction and lift. It’s important to check your plan’s coverage details to make sure the procedure is covered.

Ultimately, the best insurance plan for you will depend on your individual circumstances and financial situation. It’s important to carefully compare the coverage and costs of different plans before making a decision.

Patient Responsibilities

Undergoing breast reduction and lift procedures requires significant patient involvement and responsibility. Patients play a crucial role in ensuring a successful outcome by adhering to pre-operative instructions, following post-operative care guidelines, and maintaining regular follow-up appointments.

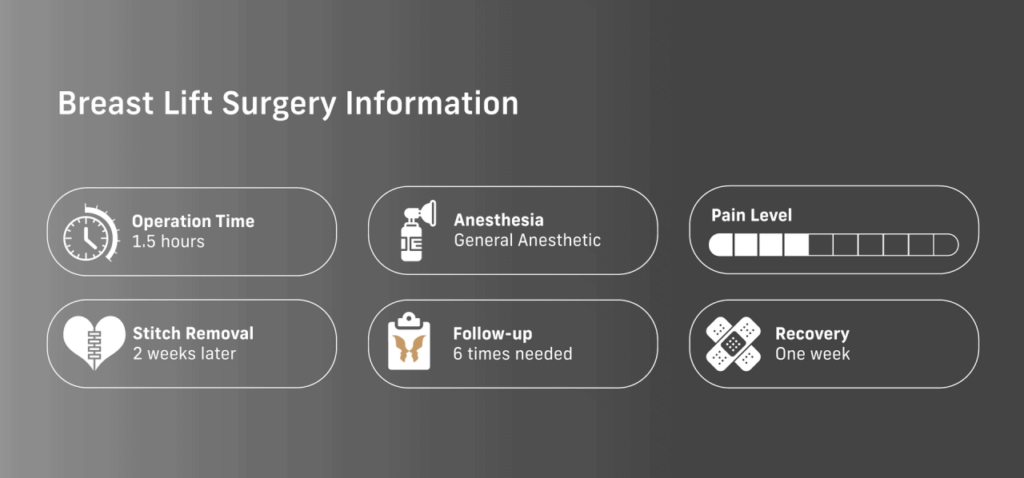

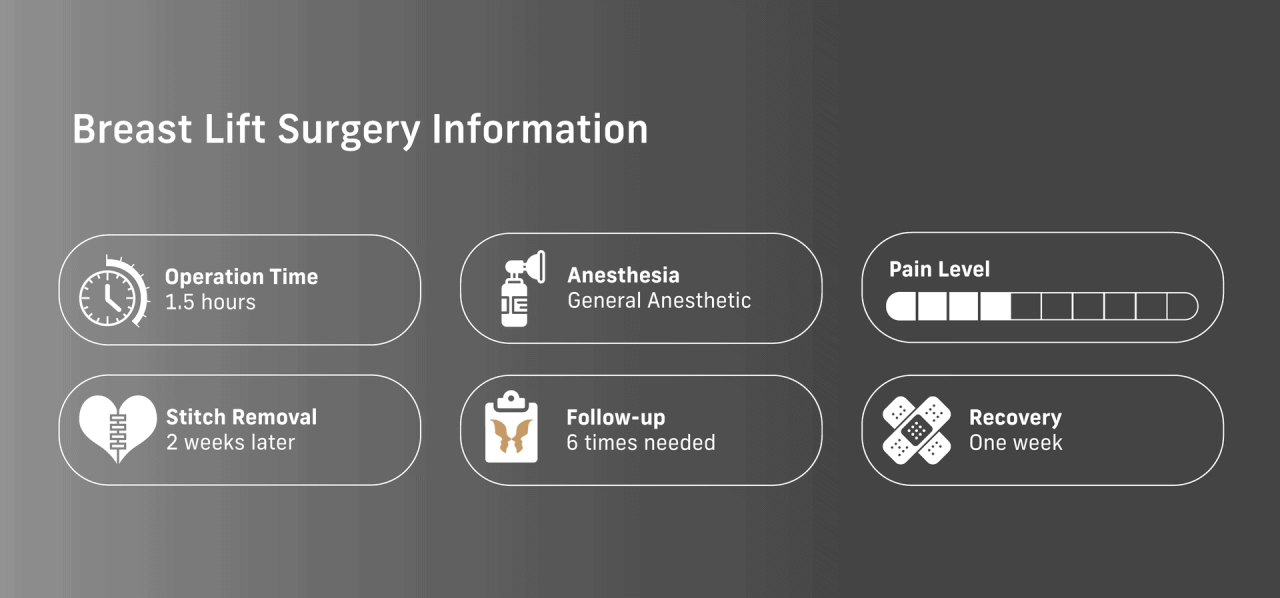

The timeline of events typically includes pre-operative appointments, surgery, and post-operative care. During pre-operative appointments, patients undergo a thorough medical evaluation, discuss their goals and expectations with the surgeon, and receive detailed instructions on preparing for surgery.

Pre-operative Preparation

- Follow surgeon’s instructions regarding diet, exercise, and medication.

- Arrange for transportation to and from surgery and post-operative appointments.

- Secure a comfortable and supportive environment for recovery.

Post-operative Care

- Adhere to pain management and wound care instructions.

- Wear a compression garment as directed.

- Avoid strenuous activities and heavy lifting.

- Attend all follow-up appointments to monitor progress and ensure proper healing.

Importance of Following Instructions and Attending Appointments

Following the surgeon’s instructions and attending follow-up appointments are essential for several reasons. Adhering to post-operative care guidelines helps minimize complications, promote healing, and achieve optimal results. Regular follow-up appointments allow the surgeon to assess progress, make any necessary adjustments to the treatment plan, and provide ongoing support.