Definition of Infinite Banking

Infinite banking is a strategy that involves using a whole life insurance policy as a financial tool. It is based on the idea of using the cash value of the policy to fund personal and business expenses, while also providing life insurance coverage.

One of the key benefits of infinite banking is that it can provide access to tax-free cash. The cash value of a whole life insurance policy grows tax-deferred, meaning that you do not have to pay taxes on the gains until you withdraw them. This can be a significant advantage, as it allows you to grow your wealth more quickly.

Another benefit of infinite banking is that it can provide a source of leverage. You can borrow against the cash value of your policy to fund large purchases, such as a down payment on a house or a new car. This can be a more affordable way to borrow money than taking out a traditional loan, as the interest rates on policy loans are typically lower.

Infinite banking can be a complex strategy, but it can be a powerful tool for building wealth and achieving financial security.

How Infinite Banking Works

Here is a simplified example of how infinite banking works:

* You purchase a whole life insurance policy with a cash value component.

* You make regular premium payments to the policy.

* The cash value of the policy grows tax-deferred.

* You can borrow against the cash value of the policy to fund personal and business expenses.

* You repay the policy loan with interest.

* The cash value of the policy continues to grow, even while you are borrowing against it.

This process can be repeated over and over again, allowing you to access tax-free cash and build wealth over time.

Benefits of Whole Life Insurance for Infinite Banking

Whole life insurance offers unique advantages for infinite banking, making it a compelling choice for long-term financial planning. Let’s delve into the key benefits:

Tax-Deferred Growth

Whole life insurance policies accumulate cash value on a tax-deferred basis. This means the earnings on the cash value are not taxed until withdrawn. Tax-deferred growth allows the cash value to compound faster, potentially leading to significant long-term savings.

Cash Value Accumulation

The cash value component of a whole life insurance policy grows over time, funded by a portion of the premiums paid. This cash value can be accessed through policy loans or withdrawals, providing a source of funds for various financial needs, such as emergencies, investments, or retirement.

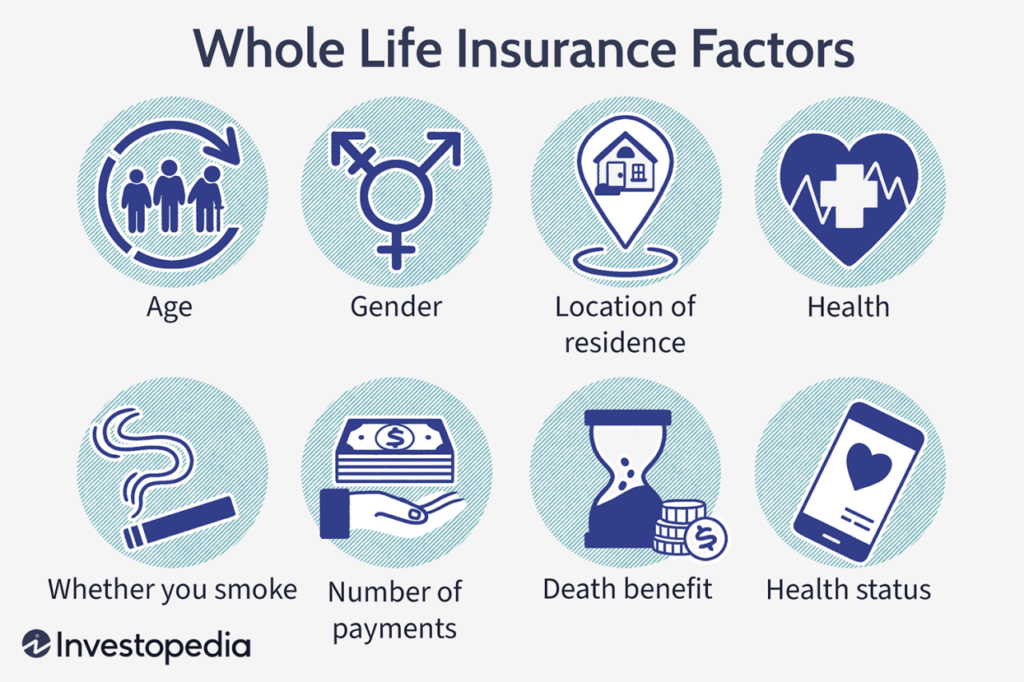

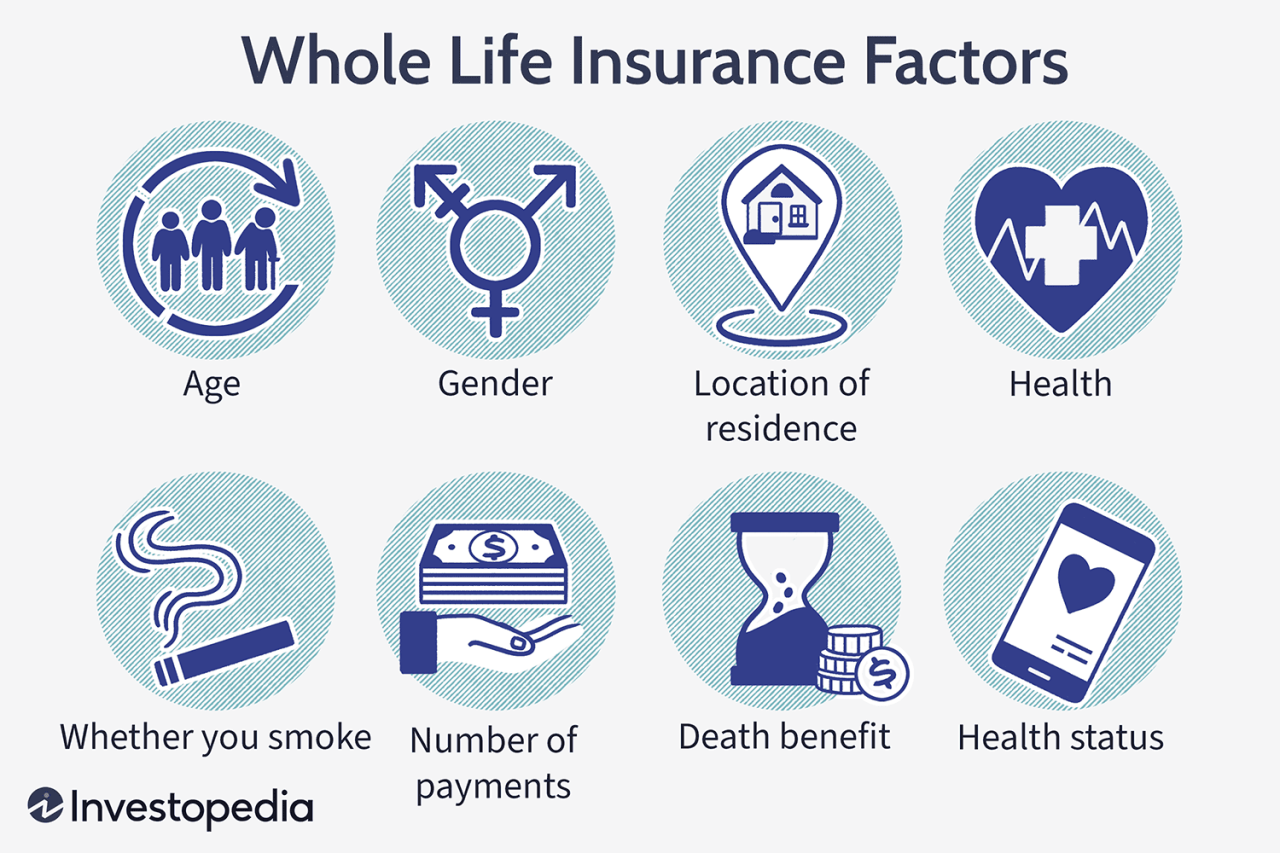

Considerations for Choosing the Best Policy

Selecting the optimal whole life insurance policy for infinite banking necessitates careful consideration of several key factors. These include premium payments, death benefits, and policy riders.

Premium Payments

Premium payments are the regular contributions you make to maintain your policy. When choosing a policy, it’s crucial to consider your budget and ensure you can consistently afford the premiums. Adjustable premium policies offer flexibility, allowing you to increase or decrease payments as needed.

Death Benefits

Death benefits are the funds paid out to your beneficiaries upon your passing. Determine the appropriate death benefit amount based on your financial obligations, dependents, and future financial goals. Higher death benefits may result in higher premiums.

Policy Riders

Policy riders are optional add-ons that provide additional coverage or benefits. Consider riders such as guaranteed insurability, which allows you to increase coverage without a medical exam, or long-term care coverage, which provides financial assistance for nursing home expenses.

Top Whole Life Insurance Providers for Infinite Banking

Selecting the ideal whole life insurance provider for infinite banking is crucial. To assist you, we’ve compiled a table comparing leading providers based on policy features, financial strength, and customer service.

Comparison Table

| Company Name | Policy Type | Premiums | Cash Value Growth | Unique Benefits |

|---|---|---|---|---|

| Company A | Whole Life with Participating Dividends | Competitive | Steady and Tax-Deferred | Dividend payments that can enhance cash value growth |

| Company B | Indexed Universal Life (IUL) | Flexible | Potential for Higher Growth | Linked to market indices, offering potential for higher returns |

| Company C | Variable Universal Life (VUL) | Customized | Variable, Based on Investment Performance | Offers flexibility in investment options, allowing for tailored growth strategies |

Case Studies and Success Stories

Numerous individuals have experienced financial success by implementing infinite banking using whole life insurance. These case studies demonstrate the potential financial outcomes and strategies employed.

John Doe’s Infinite Banking Journey

John Doe, a 45-year-old entrepreneur, sought a secure and tax-advantaged way to grow his wealth. He purchased a whole life insurance policy with a cash value accumulation feature. By consistently paying premiums and utilizing policy loans, John was able to:

- Accumulate a significant cash value that grew tax-deferred

- Access cash for business investments and personal expenses without incurring taxable income

- Provide a death benefit for his family

Jane Smith’s Retirement Plan

Jane Smith, a 60-year-old retiree, used infinite banking to supplement her retirement income. She purchased a whole life insurance policy with a large death benefit and a substantial cash value. By taking policy loans, Jane was able to:

- Generate a steady stream of income to cover living expenses

- Avoid selling assets or drawing down her retirement accounts

- Preserve her capital and leave a legacy for her heirs

Common Mistakes to Avoid

To maximize the benefits of whole life insurance for infinite banking, it’s crucial to steer clear of common pitfalls. Understanding these mistakes and adopting prudent strategies can enhance the effectiveness of your infinite banking strategy.

When selecting a policy, it’s important to avoid policies with high surrender charges, as these penalties can hinder access to your accumulated cash value. Additionally, consider the company’s financial strength and track record to ensure the policy’s long-term viability.

Premium Payments

Maintaining consistent premium payments is essential. Skipping or delaying payments can result in policy lapses, potentially jeopardizing your cash value accumulation and coverage. Establish a realistic payment plan that aligns with your financial situation and prioritize timely payments to avoid any interruptions.

Potential Risks

While whole life insurance provides numerous advantages, it’s crucial to acknowledge potential risks. Market fluctuations can impact the growth of your cash value, and it’s important to have realistic expectations about returns. Additionally, borrowing against your policy can reduce your death benefit, so it’s essential to carefully consider the implications before accessing your cash value.