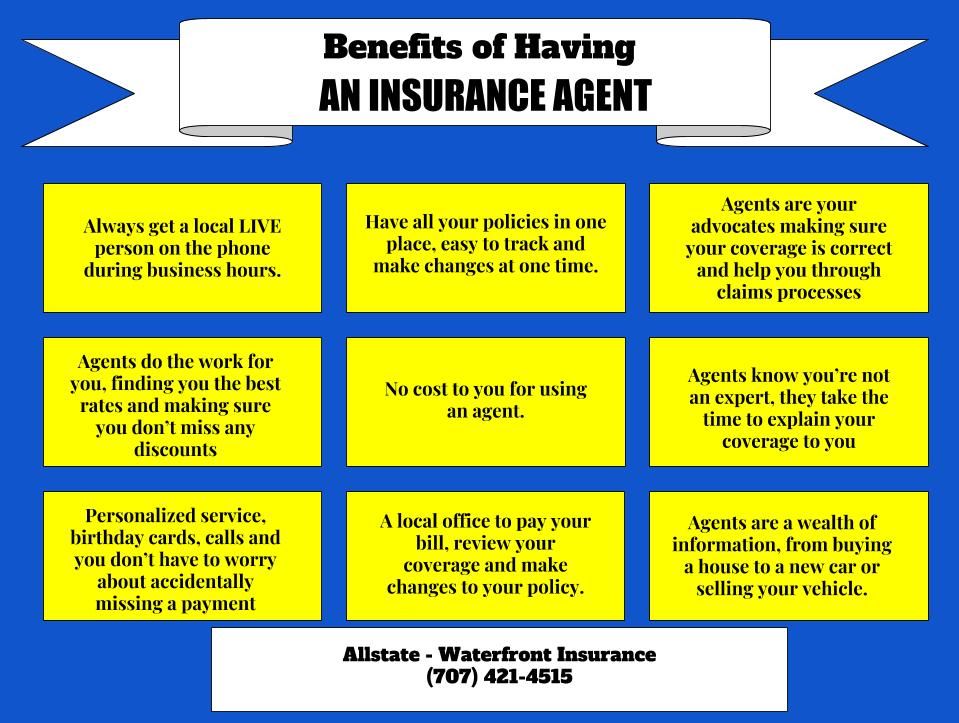

Understanding the Benefits of Insurance Agents

Navigating the complex world of insurance can be daunting. Insurance agents serve as invaluable guides, offering personalized advice and support tailored to your unique needs. By working with an agent, you gain access to a wealth of benefits that can enhance your insurance experience.

Personalized Guidance and Support

Insurance agents are knowledgeable professionals who understand the intricacies of various insurance policies. They take the time to assess your individual circumstances, risk tolerance, and financial goals. Based on this comprehensive analysis, they recommend customized insurance solutions that align with your specific requirements.

Comprehensive Insurance Coverage and Options

Insurance agents are invaluable resources when it comes to obtaining comprehensive insurance coverage that meets your specific needs. They offer a wide range of insurance products, from auto and homeowners insurance to health and life insurance, ensuring you have the protection you require.

Agents play a crucial role in helping clients navigate complex insurance policies. They decipher the jargon, explain the terms and conditions, and guide you through the selection process. By understanding your risk profile and financial situation, they can tailor an insurance plan that provides optimal coverage without over- or under-insuring you.

Benefits of a Tailored Insurance Plan

- Customized Coverage: A tailored insurance plan ensures your coverage aligns precisely with your needs and risks.

- Optimized Premiums: Agents can help you find the right balance between coverage and affordability, optimizing your premiums.

- Peace of Mind: Knowing you have the right insurance coverage can provide immense peace of mind.

Access to Expert Advice and Guidance

Insurance agents possess extensive knowledge and expertise in the intricate world of insurance policies and products. They undergo rigorous training and stay abreast of industry developments to provide informed advice to their clients. Agents can help you understand complex insurance concepts, assess your risks, and identify the coverage options that best suit your unique needs and financial situation.

Tailored Recommendations

Unlike online insurance platforms or direct insurers, insurance agents take a personalized approach to insurance planning. They engage in detailed conversations with you to understand your specific requirements, risk tolerance, and financial goals. Based on this assessment, they provide tailored recommendations that align with your individual circumstances, ensuring you have the right coverage at the right price.

Ongoing Support and Advice

Insurance agents offer ongoing support and advice throughout your insurance journey. They are available to answer your questions, clarify policy details, and assist you in filing claims. As your life and financial situation evolve, your insurance needs may also change. Agents can proactively review your coverage periodically and recommend adjustments to ensure your insurance plan remains aligned with your evolving needs.

Streamlined Claims Process

Filing and managing insurance claims can be a daunting task, especially during stressful situations. This is where insurance agents step in to provide invaluable assistance. They act as intermediaries between clients and insurance companies, ensuring that claims are processed smoothly and efficiently.

Agents guide clients through the entire claims process, from initial reporting to settlement. They help gather necessary documentation, review coverage details, and prepare claim forms. Their expertise ensures that clients submit complete and accurate claims, maximizing the chances of a favorable outcome.

Advocacy and Support

Insurance agents are not just claims processors; they are advocates for their clients’ interests. They represent clients in negotiations with insurance companies, ensuring that they receive fair and equitable settlements. Agents have a deep understanding of insurance policies and industry practices, which allows them to effectively argue on behalf of their clients.

Convenience and Peace of Mind

Having an insurance agent handle the claims process provides immense convenience and peace of mind. Clients can focus on recovering from their losses or dealing with other pressing matters while their agent takes care of the insurance-related complexities. Agents provide regular updates on the status of claims, keeping clients informed and reducing their anxiety.

Cost Savings and Value

Insurance agents play a crucial role in helping clients secure the most cost-effective insurance coverage. They possess the knowledge and expertise to navigate the complex insurance landscape, ensuring clients receive the optimal combination of coverage and affordability.

Working with an agent can lead to significant cost savings in several ways:

Customized Coverage

- Agents tailor insurance policies to clients’ specific needs, eliminating unnecessary coverage and minimizing premiums.

- They identify coverage gaps and recommend additional policies or riders to ensure comprehensive protection without overpaying.

Access to Discounts and Incentives

- Agents have access to exclusive discounts and promotions that are not available to the general public.

- They negotiate with insurance carriers on behalf of clients, securing the most favorable rates and terms.

Claims Assistance

- Agents provide invaluable assistance during the claims process, ensuring clients receive fair and timely settlements.

- They negotiate with insurance companies on behalf of clients, maximizing payouts and minimizing out-of-pocket expenses.

Convenience and Time Savings

In today’s fast-paced world, convenience and time efficiency are highly valued. Working with an insurance agent offers significant benefits in these aspects.

Insurance agents take the hassle out of managing your insurance policies. They handle all aspects of the process, from researching and comparing options to purchasing and renewing policies. This frees up your time and allows you to focus on more important matters.

Single Point of Contact

Having a single point of contact for all your insurance needs is incredibly convenient. Instead of dealing with multiple insurance companies and agents, you can rely on your agent to manage everything on your behalf. This streamlined approach saves you time and ensures that all your insurance matters are handled efficiently.