Definition and Overview

Beauty and bodywork insurance is a type of insurance that provides coverage for beauty and bodywork professionals, such as hair stylists, makeup artists, and massage therapists. This insurance can help protect professionals from financial losses due to claims of negligence, errors, or omissions in their work.

Some of the types of treatments and services that beauty and bodywork insurance may cover include:

- Hair styling and cutting

- Makeup application

- Massage therapy

- Body treatments

- Nail care

Benefits and Coverage

Acquiring beauty and bodywork insurance offers numerous advantages to protect your business and provide peace of mind. This insurance shields you from financial liabilities and ensures the well-being of your clients.

Various policies offer a wide range of treatments and procedures, including:

Professional Liability Coverage

- Protects against claims of negligence, errors, or omissions that result in injuries or damages to clients during treatments.

- Covers legal expenses, settlements, and judgments in case of lawsuits.

Product Liability Coverage

- Provides protection against claims arising from adverse reactions or injuries caused by the use of products used in treatments.

- Covers costs associated with product recalls, replacements, and settlements.

Premises Liability Coverage

- Protects against claims related to injuries or accidents that occur on your business premises.

- Covers medical expenses, legal fees, and damages awarded to injured parties.

Equipment Breakdown Coverage

- Insures against losses resulting from the breakdown or damage of essential equipment used in treatments.

- Provides coverage for repairs, replacements, and business interruption expenses.

Eligibility and Requirements

Obtaining beauty and bodywork insurance is subject to specific eligibility criteria and requirements. These may vary depending on the insurance provider and the type of coverage sought.

Generally, eligibility is determined based on factors such as:

Age Restrictions

Most insurance providers have age restrictions for beauty and bodywork professionals. Typically, individuals must be at least 18 years of age to obtain coverage.

Medical Conditions and Pre-Existing Injuries

Insurance providers may consider an individual’s medical history when assessing eligibility. Pre-existing medical conditions or injuries that could potentially affect the ability to perform beauty or bodywork services may impact coverage availability or premium rates.

Cost and Premiums

The cost of beauty and bodywork insurance premiums is influenced by several factors, including the type of coverage you need, the size of your business, the location of your business, and your claims history. Some insurers may also offer discounts for businesses that have implemented safety measures or have a good safety record.

Premiums can be paid monthly, quarterly, or annually. Some insurers may offer a discount for paying your premium in full upfront. There are also a variety of premium structures available, such as guaranteed cost, retrospective rating, and pay-as-you-go. Your insurance agent can help you choose the premium structure that is right for your business.

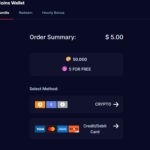

Payment Options

There are several different payment options available for beauty and bodywork insurance premiums. You can pay your premium monthly, quarterly, or annually. Some insurers may offer a discount for paying your premium in full upfront.

Premium Structures

There are also a variety of premium structures available, such as guaranteed cost, retrospective rating, and pay-as-you-go. Your insurance agent can help you choose the premium structure that is right for your business.

- Guaranteed cost: With a guaranteed cost policy, you pay a fixed premium for the entire policy period. This type of policy is typically more expensive than other types of policies, but it can provide you with peace of mind knowing that your premium will not increase during the policy period.

- Retrospective rating: With a retrospective rating policy, you pay a provisional premium at the beginning of the policy period. At the end of the policy period, your premium is adjusted based on your actual claims experience. This type of policy can be less expensive than a guaranteed cost policy, but it can also be more risky if you have a high number of claims.

- Pay-as-you-go: With a pay-as-you-go policy, you only pay for the coverage you use. This type of policy can be a good option for businesses that have a low volume of claims.

Comparison with Other Insurance Types

Beauty and bodywork insurance differs from other insurance types in its specific coverage for aesthetic treatments and procedures.

Compared to health insurance, which covers medical expenses for illnesses and injuries, beauty and bodywork insurance focuses on elective procedures that enhance appearance. Medical malpractice insurance, on the other hand, protects healthcare professionals against claims of negligence or errors in medical treatment, while beauty and bodywork insurance protects providers who perform cosmetic procedures.

Unique Features of Beauty and Bodywork Insurance

- Covers a wide range of cosmetic procedures, including injectables, laser treatments, and body contouring.

- Provides liability protection against claims of complications or adverse effects from treatments.

- Offers coverage for both medical and non-medical providers, such as aestheticians and cosmetologists.

li>May include coverage for business interruption, loss of income, and equipment damage.

Market Trends and Industry Analysis

The beauty and bodywork insurance industry is experiencing dynamic changes driven by advancements in technology, evolving consumer preferences, and regulatory shifts. Here are the key trends and developments shaping the industry:

One notable trend is the growing adoption of digital tools and telemedicine in the delivery of beauty and bodywork services. This allows for greater convenience and accessibility for clients, while enabling providers to expand their reach and streamline operations.

Growth Potential

- Increasing demand for non-invasive and minimally invasive procedures.

- Growing awareness of the importance of self-care and well-being.

- Rising disposable income and consumer spending on personal care.

Challenges

- Competition from unlicensed and uninsured providers.

- Strict regulatory requirements and compliance costs.

- Fluctuating insurance rates and coverage limitations.

Tips for Choosing the Right Policy

Choosing the right beauty and bodywork insurance policy is crucial to ensure adequate protection for your business. Consider the following tips:

Compare coverage: Evaluate the coverage limits and exclusions of different policies to ensure they align with your specific needs. Consider the types of treatments, equipment, and premises you require coverage for.

Assess premiums: Compare the premiums offered by different insurers to find the most cost-effective option that meets your coverage requirements. Consider both the monthly or annual premiums and any potential deductibles or co-pays.

Consider customer service: Look for insurers with a strong reputation for responsive and reliable customer service. This is important for prompt claims handling and assistance with policy-related inquiries.