Overview of Auto Insurance in Waco, TX

Auto insurance plays a crucial role in Waco, TX, where it is mandatory to have auto insurance to operate a vehicle legally. This coverage protects drivers financially in case of accidents, offering peace of mind and safeguarding them from potential liabilities.

Texas law requires all drivers to carry minimum levels of liability insurance, including bodily injury liability coverage of $30,000 per person and $60,000 per accident, as well as property damage liability coverage of $25,000 per accident. These minimum requirements provide basic protection in the event of an accident.

Factors Influencing Auto Insurance Premiums

Determining the cost of auto insurance in Waco, TX, involves considering several key factors. Understanding these factors can help you make informed decisions and potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your auto insurance premiums. Insurers assess your risk level based on factors such as:

- Number of accidents and traffic violations

- Severity of past accidents

- Length of time since your last accident or violation

A clean driving record typically results in lower premiums, while a history of accidents and violations can lead to higher costs.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums. Insurers consider factors such as:

- Vehicle’s make and model

- Vehicle’s safety features

- Vehicle’s value

Vehicles with higher safety ratings, lower theft rates, and lower repair costs tend to have lower premiums.

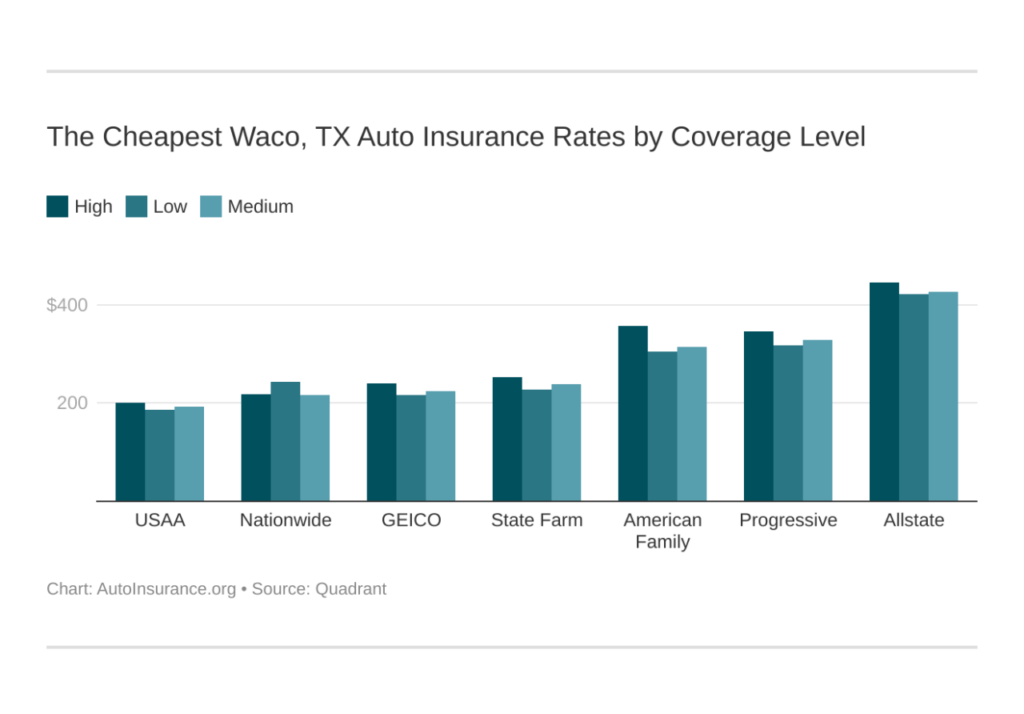

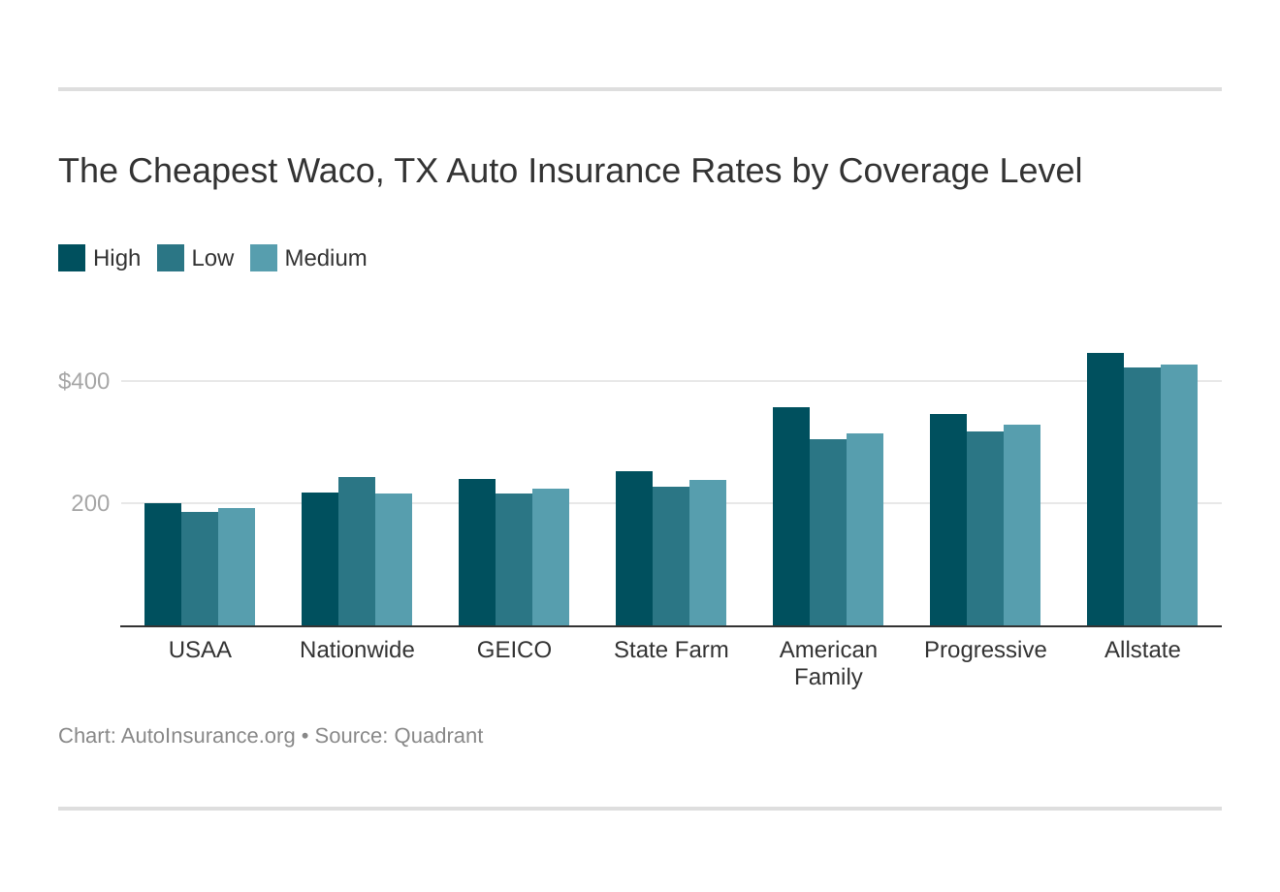

Coverage Levels

The amount of coverage you choose also affects your premiums. Insurers offer various coverage levels, including:

- Liability coverage: Protects you from financial responsibility if you cause an accident

- Collision coverage: Covers damage to your own vehicle in an accident

- Comprehensive coverage: Covers damage to your vehicle from non-collision events, such as theft or vandalism

Choosing higher coverage levels will generally result in higher premiums, but it provides more financial protection in the event of an accident or other covered incident.

Types of Auto Insurance Coverage Available

Understanding the different types of auto insurance coverage is essential for drivers in Waco, TX. It allows you to tailor your policy to meet your specific needs and financial situation.

Auto insurance policies in Waco, TX typically include the following coverage types:

Liability Coverage

- Protects you from financial responsibility if you cause an accident resulting in bodily injury or property damage to others.

- Mandatory in Texas, with minimum coverage limits of $30,000 per person/$60,000 per accident for bodily injury and $25,000 for property damage.

Collision Coverage

- Covers damage to your own vehicle if you collide with another vehicle or object.

- Optional coverage, but recommended if you have a newer or expensive vehicle.

Comprehensive Coverage

- Protects your vehicle from damage or loss due to events other than collisions, such as theft, vandalism, hail, and flooding.

- Optional coverage, but may be required by lenders if you have a financed vehicle.

Finding Affordable Auto Insurance in Waco, TX

Securing affordable auto insurance in Waco, TX, requires a strategic approach. By exploring various options and utilizing available resources, you can find a policy that meets your coverage needs without breaking the bank.

Compare Quotes from Multiple Insurance Companies

Obtaining quotes from different insurance providers is crucial. Each company uses its own set of rating factors, so comparing quotes can reveal significant variations in premiums. Utilize online quote comparison tools or contact insurance agents to gather quotes and identify the most competitive options.

Discounts and Loyalty Programs

Many insurance companies offer discounts for various factors, such as maintaining a good driving record, completing defensive driving courses, and bundling multiple policies. Loyalty programs can also provide discounts for renewing your policy with the same company over time. Explore these options to reduce your premiums.

Local Insurance Companies in Waco, TX

Waco, TX, is home to several local insurance companies that offer a range of auto insurance options. These companies provide personalized coverage tailored to the specific needs of Waco residents.

Below is a table listing some of the most reputable local insurance companies in Waco, along with their contact information, websites, and a brief description of their services:

| Company Name | Contact Information | Website | Services |

|---|---|---|---|

| Texas Farm Bureau Insurance Company | (254) 753-3611 | https://www.texasfarmbureau.com/ | Auto insurance, home insurance, life insurance, health insurance |

| American National Insurance Company | (254) 753-2311 | https://www.americannational.com/ | Auto insurance, home insurance, life insurance, annuities |

| AAA Texas | (254) 753-4444 | https://www.aaatexas.com/ | Auto insurance, home insurance, travel insurance, roadside assistance |

| Allstate Insurance Company | (254) 753-5555 | https://www.allstate.com/ | Auto insurance, home insurance, life insurance, retirement planning |

| Farmers Insurance Company | (254) 753-6666 | https://www.farmers.com/ | Auto insurance, home insurance, life insurance, business insurance |

Tips for Filing an Auto Insurance Claim in Waco, TX

Filing an auto insurance claim in Waco, TX, can be a daunting task, but by following these tips, you can make the process smoother and ensure that you receive the compensation you deserve.

Steps for Filing a Claim

1. Report the accident to your insurance company immediately. You can do this by phone, online, or through the company’s mobile app.

2. Gather documentation. This includes the police report, medical records, and any other relevant documents that support your claim.

3. Submit your claim. You can submit your claim online, by mail, or by fax.

4. Cooperate with the insurance company. This includes providing them with all the information they request and attending any scheduled appointments.

Importance of Timely Reporting and Cooperation

It is important to report your accident to your insurance company as soon as possible. This will help to ensure that your claim is processed quickly and efficiently. Additionally, cooperating with the insurance company will help to build a strong case for your claim.

Additional Resources for Auto Insurance in Waco, TX

To assist you further, here are additional resources that provide valuable information and support regarding auto insurance in Waco, TX:

Government Websites

- Texas Department of Motor Vehicles (TxDMV): Provides comprehensive information on insurance requirements, regulations, and consumer protection laws.

- Texas Department of Insurance (TDI): Regulates the insurance industry in Texas, offering resources on insurance policies, filing claims, and resolving disputes.

Consumer Protection Agencies

- Consumer Financial Protection Bureau (CFPB): Provides guidance on understanding and managing insurance policies, including auto insurance.

- National Association of Insurance Commissioners (NAIC): Represents state insurance regulators and provides resources on insurance regulations, consumer rights, and complaint handling.

Insurance Industry Associations

- Insurance Information Institute (III): Provides research, statistics, and educational materials on auto insurance and other insurance-related topics.

- National Insurance Association of America (NIAA): Represents insurance professionals and advocates for consumer protection and access to affordable insurance.