Auto Insurance Market in Albany, GA

The auto insurance market in Albany, GA, is a significant segment of the city’s insurance industry, providing coverage to a large number of vehicle owners.

The market has experienced steady growth in recent years, driven by factors such as increasing vehicle ownership and rising insurance premiums. In 2022, the market was valued at approximately $120 million, with an annual growth rate of 2.5%.

Competitive Landscape

The auto insurance market in Albany, GA, is highly competitive, with several major insurance companies vying for market share.

- State Farm

- Geico

- Progressive

- Allstate

- Farmers

These companies offer a wide range of coverage options and discounts to attract customers.

Consumer Trends and Preferences

Consumers in Albany, GA, are increasingly looking for auto insurance policies that provide comprehensive coverage at affordable rates.

- Many consumers are opting for higher deductibles to reduce their premiums.

- Consumers are also increasingly using online comparison tools to find the best rates.

Types of Auto Insurance Coverage Available

Choosing the right auto insurance coverage can be overwhelming. Understanding the different types of coverage available can help you make an informed decision to protect yourself and your vehicle.

Liability Coverage

Liability coverage is required by law in most states and protects you if you cause an accident that injures another person or damages their property. It covers the costs of medical expenses, lost wages, and property damage.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if you are involved in an accident with another vehicle or object, regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related events, such as theft, vandalism, fire, and natural disasters. It also covers damage caused by animals.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

| Coverage | Description | Premium |

|---|---|---|

| Liability | Protects you if you cause an accident | Varies based on risk factors |

| Collision | Pays for repairs or replacement of your vehicle in an accident | Typically higher than liability coverage |

| Comprehensive | Protects your vehicle from non-collision-related events | Usually lower than collision coverage |

| Uninsured/Underinsured Motorist | Protects you from drivers without or with insufficient insurance | Relatively low premium |

Factors Influencing Auto Insurance Premiums

Auto insurance premiums are not fixed and vary depending on several factors. Understanding these factors can help you make informed decisions to lower your premiums and secure affordable coverage.

Key factors that impact premium rates include:

Driving History

- A clean driving record with no accidents or traffic violations typically leads to lower premiums.

- Driving history is a significant factor in determining premiums, as it reflects your risk level.

Vehicle Type

- Premiums for sports cars and luxury vehicles are generally higher than for standard sedans or family cars.

- The cost to repair and replace certain vehicles influences the premium rates.

Age

- Young drivers, especially those under 25, often pay higher premiums due to their perceived higher risk of accidents.

- As you age and gain experience, your premiums may decrease.

Location

- Premiums vary based on the location you live in, as accident rates and insurance claims differ by region.

- Urban areas typically have higher premiums than rural areas.

Other Factors

- Annual mileage driven can impact premiums, as more miles driven increase the likelihood of accidents.

- Insurance companies may offer discounts for good students, defensive driving courses, and other factors.

Finding the Best Auto Insurance Providers in Albany, GA

Finding the right auto insurance provider can be a daunting task, but it’s crucial to protect yourself financially in case of an accident. Here are some tips to help you compare and select the best insurance providers in Albany, GA:

– Get quotes from multiple companies: Don’t just go with the first company you find. Compare quotes from several different providers to get the best rates.

– Consider your coverage needs: Make sure you understand what types of coverage you need and how much coverage you want. This will help you narrow down your choices.

– Read reviews and check ratings: See what other customers have to say about different insurance companies. This can give you valuable insights into their customer service and claims handling.

– Talk to an insurance agent: An insurance agent can help you compare policies and find the best coverage for your needs.

Here is a list of reputable insurance companies in Albany, GA, along with their contact information:

– Allstate Insurance: 229-439-8900

– Farmers Insurance: 229-439-9200

– Geico Insurance: 229-439-8700

– Progressive Insurance: 229-439-8600

– State Farm Insurance: 229-439-8500

When choosing an insurance provider, there are several key considerations to keep in mind:

– Financial strength: Make sure the company you choose is financially sound. This will ensure that they can pay your claims if you need them.

– Customer service: You want to choose a company that provides excellent customer service. This means they should be easy to reach, responsive to your questions, and helpful in resolving any issues you may have.

– Price: Of course, you want to find an insurance policy that is affordable. However, don’t just go with the cheapest policy. Make sure you understand what’s covered and what’s not before you make a decision.

By following these tips, you can find the best auto insurance provider in Albany, GA, to protect yourself and your vehicle.

Filing and Managing Auto Insurance Claims

Filing an auto insurance claim can be a stressful process, but understanding the process can help you navigate it more smoothly.

The first step is to report the accident to your insurance company as soon as possible. You can do this by phone, online, or through the insurance company’s mobile app. Be prepared to provide the following information:

- Your name, address, and contact information

- Your policy number

- The date, time, and location of the accident

- The names and contact information of the other drivers involved

- The make, model, and year of all vehicles involved

- A description of the accident

Once you have reported the accident, the insurance company will assign you a claims adjuster. The claims adjuster will investigate the accident and determine whether your claim is covered. If your claim is covered, the claims adjuster will work with you to determine the amount of your settlement.

To support your claim, you will need to provide the insurance company with the following documentation:

- A copy of the police report

- Medical records

- Estimates for repairs or replacement of your vehicle

- Photographs of the damage

The claims process can take several weeks or even months to complete. Be patient and cooperative with the insurance company throughout the process.

Flowchart of the Auto Insurance Claims Process

- Report the accident to your insurance company.

- The insurance company will assign you a claims adjuster.

- The claims adjuster will investigate the accident.

- If your claim is covered, the claims adjuster will determine the amount of your settlement.

- You will need to provide the insurance company with documentation to support your claim.

- The insurance company will process your claim and issue payment.

Auto Insurance Laws and Regulations in Georgia

Georgia, like other states, has specific laws and regulations in place to ensure that drivers have adequate auto insurance coverage. Understanding these laws is crucial for Albany, GA residents to avoid legal consequences and protect themselves financially.

Minimum Coverage Requirements

Georgia law mandates that all drivers carry a minimum level of auto insurance, including:

* Bodily injury liability: $25,000 per person and $50,000 per accident

* Property damage liability: $25,000 per accident

* Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident

Drivers who fail to maintain the required coverage may face penalties, including fines, license suspension, and impounding of vehicles.

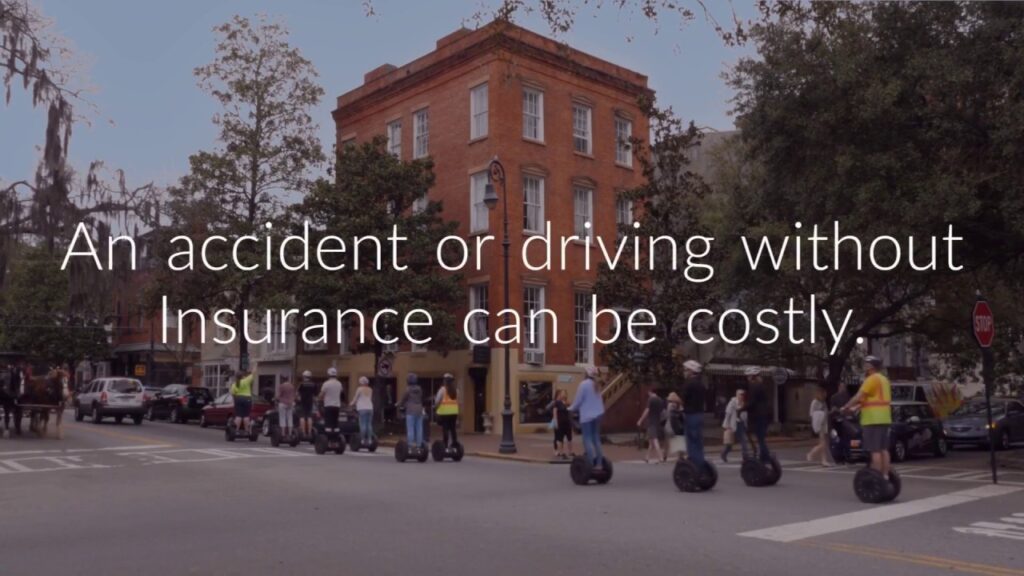

Penalties for Driving Without Insurance

Driving without insurance in Georgia is a serious offense that can result in severe consequences:

* Fines of up to $1,000

* License suspension for up to 12 months

* Vehicle impoundment

* Criminal charges for repeat offenses

These penalties serve as a deterrent to uninsured driving and encourage responsible behavior on the road.

Impact on Albany, GA Drivers

The auto insurance laws in Georgia directly impact Albany drivers by:

* Ensuring that they have financial protection in case of an accident

* Reducing the risk of uninsured motorists on the road

* Promoting responsible driving practices and compliance with the law

By adhering to these laws, Albany drivers can safeguard themselves and others while navigating the roads.

Infographic

[Insert an infographic summarizing the key auto insurance laws and regulations in Georgia, including minimum coverage requirements, penalties for driving without insurance, and the impact on Albany drivers.]

Discounts and Savings on Auto Insurance

Auto insurance premiums can vary significantly depending on a range of factors. However, there are numerous discounts and savings opportunities available to help you reduce your insurance costs.

To qualify for these discounts, it’s important to maintain a good driving record, bundle your policies, and inquire about loyalty programs offered by your insurance provider.

Available Discounts

| Discount | Eligibility Criteria |

|---|---|

| Safe Driver Discount | Maintained a clean driving record, free of accidents and traffic violations for a specified period |

| Bundling Discount | Purchasing multiple policies, such as auto and home insurance, from the same provider |

| Loyalty Discount | Remaining with the same insurance company for a specified period |

| Good Student Discount | Maintaining a high GPA (typically 3.0 or above) for students under 25 |

| Defensive Driving Course Discount | Completing an approved defensive driving course |

| Low Mileage Discount | Driving less than a specified number of miles per year |

| Multi-Car Discount | Insuring multiple vehicles under the same policy |