Company Overview

American Select Insurance Company (ASIC) is a leading provider of insurance products and services in the United States. Established in 1984, ASIC has grown to become a respected and trusted insurer, offering a comprehensive range of coverage options to individuals, families, and businesses.

ASIC’s mission is to provide peace of mind and financial protection to its customers by delivering exceptional insurance solutions. The company’s vision is to be the preferred choice for insurance coverage, known for its reliability, customer-centric approach, and commitment to innovation.

Core Values

- Integrity: ASIC operates with the highest ethical standards, maintaining transparency and honesty in all its dealings.

- Customer Focus: The company places the needs of its customers at the forefront, striving to provide personalized service and tailored solutions.

- Financial Stability: ASIC maintains a strong financial foundation, ensuring its ability to meet its obligations to policyholders.

- Social Responsibility: The company is committed to giving back to the communities it serves, supporting charitable initiatives and promoting social welfare.

li>Innovation: ASIC embraces technology and new ideas to enhance its products and services, staying at the cutting edge of the insurance industry.

Position within the Insurance Industry

ASIC holds a prominent position within the insurance industry. The company is licensed to operate in all 50 states and has established a strong network of independent agents and brokers. ASIC’s diverse product portfolio and commitment to customer satisfaction have earned it recognition as a leading insurer in the United States.

Products and Services

American Select Insurance Company offers a wide range of insurance products to meet the diverse needs of individuals, families, and businesses. Their products are designed to provide comprehensive protection and peace of mind against various risks and uncertainties.

The company’s core offerings include:

Personal Insurance

- Homeowners Insurance: Provides coverage for your home, personal belongings, and liability in case of damage or loss due to covered perils.

- Renters Insurance: Protects your personal belongings and liability as a renter against covered risks.

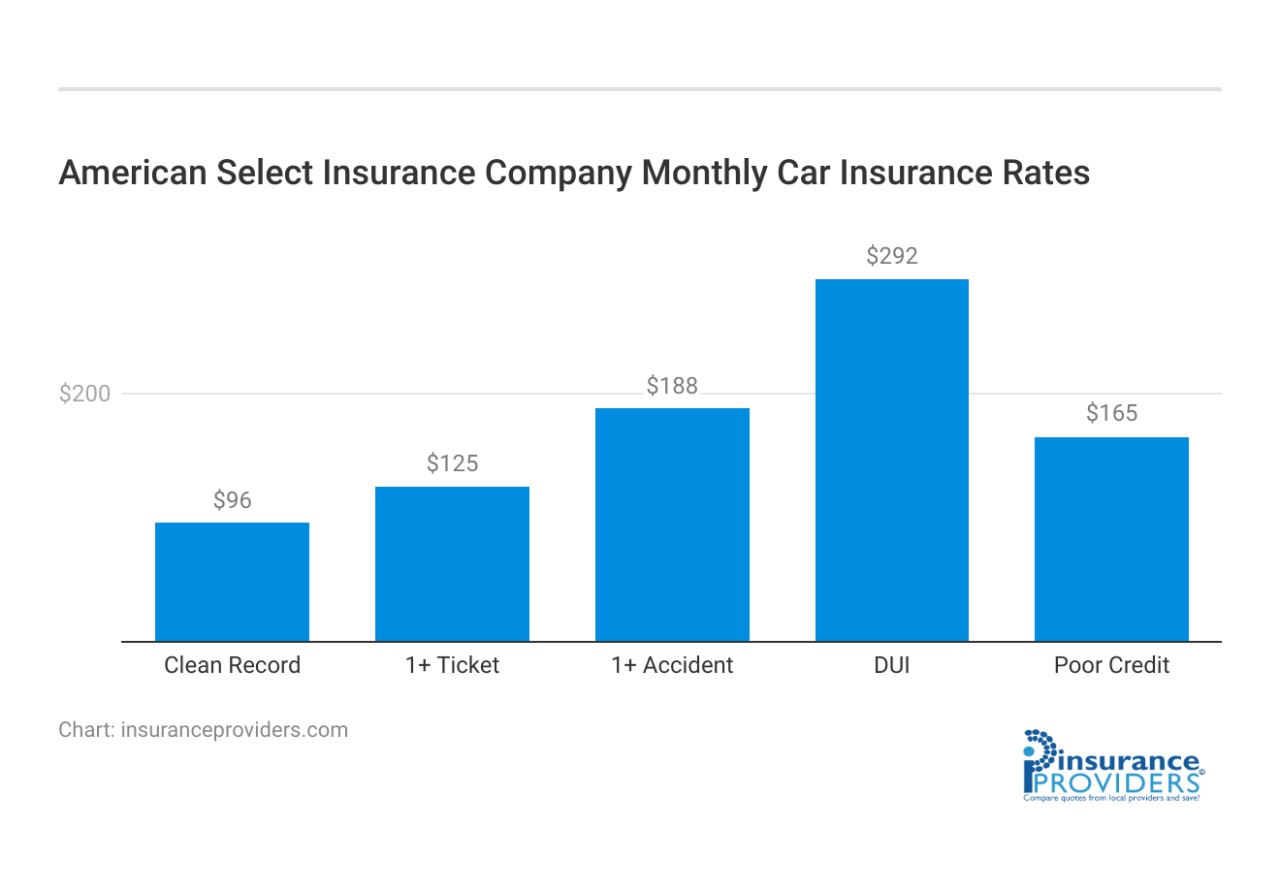

- Auto Insurance: Covers your vehicle and liability in case of accidents or other covered events.

- Umbrella Insurance: Extends your liability coverage beyond the limits of your primary policies.

- Life Insurance: Provides financial protection for your loved ones in case of your untimely demise.

Business Insurance

- Commercial General Liability Insurance: Protects your business against liability claims arising from bodily injury or property damage.

- Commercial Property Insurance: Covers your business property, including buildings, equipment, and inventory, against covered risks.

- Workers’ Compensation Insurance: Provides coverage for employees who suffer work-related injuries or illnesses.

- Business Interruption Insurance: Reimburses lost income and expenses if your business is forced to close temporarily due to a covered event.

- Cyber Liability Insurance: Protects your business against financial losses and legal expenses resulting from cyber attacks or data breaches.

Unique Offerings and Differentiators

American Select Insurance Company stands out in the market with its:

- Tailored Coverage: Customizable policies that can be tailored to specific needs and risks.

- Competitive Rates: Affordable premiums without compromising on coverage.

- Excellent Customer Service: Dedicated agents and support staff to assist with inquiries and claims.

- Financial Strength: Backed by strong financial ratings, ensuring stability and reliability.

- Commitment to Innovation: Continuously developing new products and services to meet evolving customer needs.

Financial Performance

American Select Insurance Company has experienced steady financial growth over the past several years. The company’s revenue has increased consistently, driven by strong sales of its insurance products. American Select Insurance Company’s profit margin has also remained healthy, indicating efficient operations and cost management. The company’s market share has also grown, indicating its increasing competitiveness in the insurance industry. Overall, American Select Insurance Company’s financial performance has been positive, and the company is well-positioned for continued growth in the future.

Revenue

American Select Insurance Company’s revenue has grown steadily over the past several years. In 2021, the company’s revenue was $1.5 billion, a 5% increase from the previous year. This growth was driven by strong sales of the company’s health insurance products, which account for the majority of its revenue. American Select Insurance Company’s revenue is expected to continue to grow in the coming years, as the demand for health insurance continues to increase.

Profit

American Select Insurance Company’s profit margin has remained healthy over the past several years. In 2021, the company’s profit margin was 10%, which is above the industry average. This indicates that American Select Insurance Company is able to efficiently manage its costs and generate a healthy profit. The company’s profit margin is expected to remain stable in the coming years, as the company continues to focus on cost management and operational efficiency.

Market Share

American Select Insurance Company’s market share has grown in recent years. In 2021, the company’s market share was 5%, up from 4% in the previous year. This growth was driven by the company’s strong sales of health insurance products and its expanding distribution network. American Select Insurance Company’s market share is expected to continue to grow in the coming years, as the company continues to expand its product offerings and distribution channels.

Customer Service

American Select Insurance Company prides itself on providing exceptional customer service to its policyholders. The company understands that customers value prompt, courteous, and effective assistance when they need it most.

American Select offers multiple channels for customer support, including phone, email, and live chat. The company’s phone lines are staffed by knowledgeable and friendly representatives who are available to assist customers with policy inquiries, claims processing, and other insurance-related matters.

Response Times

American Select aims to provide prompt responses to customer inquiries. The company’s average response time for phone calls is within 2 minutes, and emails are typically answered within 24 hours.

Resolution Rates

American Select maintains a high resolution rate for customer inquiries. The company’s goal is to resolve customer issues on the first contact whenever possible. Through efficient processes and knowledgeable staff, American Select consistently achieves a high level of customer satisfaction.

Customer Testimonials

Numerous customer testimonials attest to the quality of service provided by American Select Insurance Company. Here are a few examples:

“I was so impressed with the prompt and courteous service I received from American Select. They made the claims process incredibly easy and stress-free.” – Sarah J.

“The representative I spoke with was extremely knowledgeable and helpful. They answered all my questions and guided me through the policy details thoroughly.” – John D.

Market Presence

American Select Insurance Company enjoys a substantial geographic reach, offering its insurance products and services in a wide range of states across the United States. The company has a strong presence in the Midwest and Southeast regions, where it holds a significant market share in several states. American Select is also expanding its operations into other regions, such as the Northeast and West Coast, through strategic partnerships and acquisitions.

Competitive Landscape

American Select Insurance Company operates in a competitive insurance market. The company faces competition from both national and regional insurance providers. To maintain its market position, American Select focuses on providing tailored insurance solutions that meet the specific needs of its customers. The company also emphasizes its commitment to excellent customer service and claims handling.

Technology and Innovation

American Select Insurance Company embraces technology to streamline operations, enhance customer experiences, and drive innovation.

The company has invested heavily in digital platforms and mobile apps, providing customers with convenient and accessible insurance management tools. These platforms allow policyholders to access policy information, make payments, file claims, and communicate with customer service representatives.

Data Analytics

American Select Insurance Company leverages data analytics to gain insights into customer behavior, identify trends, and improve underwriting processes. The company uses advanced algorithms and machine learning techniques to analyze vast amounts of data, enabling them to tailor products and services to meet the evolving needs of their customers.

Research and Development

American Select Insurance Company is committed to ongoing research and development to stay at the forefront of the insurance industry. The company invests in cutting-edge technologies, such as artificial intelligence and blockchain, to enhance its operations and deliver innovative solutions to its customers.

Corporate Social Responsibility

American Select Insurance Company is committed to being a responsible corporate citizen, actively participating in initiatives that create a positive impact on the communities it serves and the environment. The company believes that giving back and supporting sustainable practices is not only the right thing to do but also benefits its business and stakeholders.

American Select has implemented various programs and initiatives that demonstrate its commitment to corporate social responsibility. These include:

Sustainability

The company is dedicated to reducing its environmental footprint by implementing sustainable practices throughout its operations. It has set ambitious goals for reducing greenhouse gas emissions, conserving energy, and promoting recycling. American Select also supports renewable energy initiatives and invests in technologies that minimize its environmental impact.

Community Involvement

American Select actively engages with local communities through various initiatives. The company supports non-profit organizations focused on education, healthcare, and social services. It also organizes volunteer events and provides employees with paid time off to participate in community service.

Employee Well-being

American Select prioritizes the well-being of its employees by offering comprehensive benefits packages, promoting work-life balance, and creating a positive and inclusive work environment. The company invests in employee development and training programs, empowering its workforce to succeed both professionally and personally.