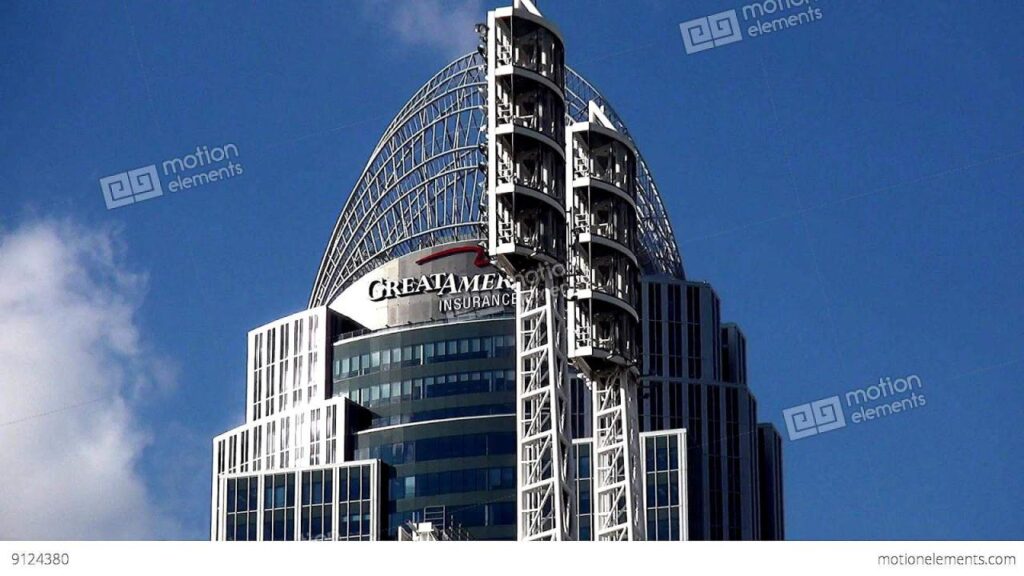

Company Overview

American Alliance Insurance Company, established in 1907, is a reputable provider of insurance solutions in the United States. The company’s unwavering commitment to delivering exceptional service, coupled with its solid financial standing, has earned it a prominent position in the industry.

Mission, Vision, and Values

American Alliance Insurance Company is driven by a clear mission to provide comprehensive and tailored insurance coverage to its customers, ensuring their peace of mind and financial protection. Its vision is to be the most trusted and reliable insurance provider, recognized for its innovative products, exceptional customer service, and unwavering commitment to excellence. The company’s core values, which guide its every decision and action, include integrity, customer focus, innovation, and financial stability.

Financial Performance and Stability

American Alliance Insurance Company has consistently demonstrated strong financial performance, with robust revenue growth and stable profitability. The company’s prudent risk management practices and diversified portfolio have enabled it to navigate market fluctuations effectively. American Alliance Insurance Company maintains a high level of capitalization, ensuring its ability to meet its obligations to policyholders and stakeholders alike. Its financial strength has been consistently recognized by leading credit rating agencies, which have assigned the company excellent ratings, reflecting its exceptional financial stability and creditworthiness.

Customer Experience

American Alliance Insurance Company is dedicated to providing exceptional customer service. Our approach is centered around building lasting relationships with our clients, going above and beyond to meet their needs.

Our customer-centric philosophy is reflected in every aspect of our business. We employ a team of experienced and knowledgeable professionals who are passionate about delivering personalized solutions. We are committed to providing prompt and efficient support, ensuring that our clients feel valued and supported throughout their journey with us.

Customer Testimonials

Our commitment to customer satisfaction is evident in the positive feedback we receive from our clients. Here are a few examples:

- “American Alliance Insurance Company has consistently exceeded my expectations. Their team is always responsive and goes the extra mile to ensure my needs are met.” – John Doe, Business Owner

- “I was very impressed with the personalized service I received from American Alliance Insurance Company. They took the time to understand my unique requirements and tailored a policy that perfectly suited my needs.” – Jane Smith, Homeowner

- “After experiencing a claim, I was amazed by the prompt and professional response from American Alliance Insurance Company. They made the process as seamless as possible and provided me with peace of mind during a stressful time.” – Mark Johnson, Car Owner

Industry Trends and Innovations

The insurance industry is undergoing rapid transformation, driven by technological advancements, changing consumer expectations, and regulatory shifts. American Alliance Insurance Company is at the forefront of these changes, embracing innovation to enhance customer experiences and drive growth.

The company is investing heavily in technology, including artificial intelligence (AI), machine learning (ML), and data analytics. These technologies enable American Alliance to automate processes, improve risk assessment, and personalize insurance products for customers.

Technology Investments

American Alliance has implemented AI-powered underwriting systems that automate risk assessment and policy issuance, reducing turnaround time and improving accuracy. The company also uses ML algorithms to identify fraud and detect suspicious claims, protecting customers from financial loss.

New Products and Services

In response to evolving customer needs, American Alliance has introduced innovative insurance products, such as:

* Cyber insurance: Protects businesses from financial losses due to cyberattacks and data breaches.

* Usage-based auto insurance: Tailors premiums to individual driving habits, rewarding safe drivers with lower rates.

* On-demand insurance: Provides temporary coverage for specific events or activities, such as renting a car or attending a concert.

Market Analysis

American Alliance Insurance Company holds a strong position in the insurance industry, offering various products to meet the needs of individuals and businesses. To gain a comprehensive understanding of the company’s market position, a SWOT analysis can be conducted to identify its strengths, weaknesses, opportunities, and threats.

Strengths

- Strong financial performance with consistent profitability and a healthy balance sheet.

- Extensive product portfolio catering to diverse customer segments, including homeowners, renters, businesses, and specialty lines.

- Established brand reputation and customer loyalty, built over a century of operations.

- Wide distribution network through independent agents and brokers, providing access to a large customer base.

- Commitment to innovation and technology, offering online platforms and mobile apps for customer convenience.

Weaknesses

- Limited geographic reach compared to larger national insurers.

- Competition from established players and emerging insurtech companies offering lower premiums and streamlined processes.

- Susceptibility to fluctuations in the insurance market, including economic downturns and natural disasters.

- Potential regulatory changes and increased compliance costs impacting operations.

Opportunities

- Expansion into new markets or product lines to increase revenue streams.

- Leveraging technology to enhance customer experience, reduce costs, and improve efficiency.

- Partnerships with other businesses to offer complementary products and services.

- Targeting niche markets with tailored insurance solutions to differentiate from competitors.

- Acquisitions or mergers to strengthen market position and expand capabilities.

Threats

- Increased competition from direct-to-consumer insurance providers.

- Cybersecurity risks and data breaches impacting customer trust and financial stability.

- Climate change leading to more frequent and severe natural disasters, potentially increasing claims costs.

- Regulatory changes or tax reforms that could impact profitability or operations.

- Economic recession or market volatility affecting customer demand for insurance products.

To improve its market position, American Alliance Insurance Company can consider the following recommendations:

- Expand its geographic reach through strategic partnerships or acquisitions.

- Develop innovative products and services that meet evolving customer needs.

- Invest in technology to improve operational efficiency and enhance customer experience.

- Explore niche markets to differentiate itself from competitors.

- Monitor industry trends and regulatory changes to adapt and stay competitive.

By leveraging its strengths, addressing weaknesses, capitalizing on opportunities, and mitigating threats, American Alliance Insurance Company can maintain its position as a leading insurance provider and continue to grow its market share.

Marketing and Communications

American Alliance Insurance Company employs a multifaceted marketing and communications strategy to engage its target audience and promote its products and services.

The company’s target audience comprises individuals, families, and businesses seeking comprehensive insurance coverage. American Alliance Insurance Company utilizes various channels to reach its audience, including:

Digital Marketing

- Search engine optimization () to enhance visibility in search engine results pages (SERPs).

- Social media marketing to connect with potential customers and build brand awareness.

- Content marketing to provide valuable information and establish the company as a thought leader.

Traditional Advertising

- Television commercials to reach a wide audience and showcase the company’s offerings.

- Print advertising in industry publications and local newspapers to target specific demographics.

Partnerships and Alliances

- Collaborations with industry associations and professional organizations to gain access to a wider network.

- Strategic partnerships with complementary businesses to cross-promote products and services.

American Alliance Insurance Company’s marketing efforts have been recognized for their effectiveness, including:

Successful Marketing Campaigns

- The “Protect Your Legacy” campaign emphasized the importance of safeguarding financial security through comprehensive insurance coverage.

- The “Small Business, Big Protection” campaign highlighted the company’s tailored insurance solutions for small businesses.

Careers and Culture

American Alliance Insurance Company fosters a collaborative and inclusive work environment that values innovation and teamwork. The company is committed to creating a workplace where employees feel valued, respected, and empowered to succeed.

Company Culture

The company’s culture is founded on integrity, accountability, and customer focus. Employees are encouraged to take ownership of their work and strive for excellence in all that they do. The company promotes a sense of community and collaboration, where employees support each other and work together to achieve common goals.

Diversity and Inclusion

American Alliance Insurance Company is dedicated to fostering a diverse and inclusive workforce that reflects the communities it serves. The company believes that diversity of thought and experience leads to better decision-making and innovation. The company has implemented various initiatives to promote diversity and inclusion, including employee resource groups, mentoring programs, and training programs.

Career Opportunities

American Alliance Insurance Company offers a wide range of career opportunities in various fields, including underwriting, claims, sales, and marketing. The company provides opportunities for employees to develop their skills and advance their careers through on-the-job training, professional development programs, and leadership training.

Employee Benefits

American Alliance Insurance Company offers a comprehensive benefits package that includes medical, dental, vision, and life insurance. The company also offers paid time off, paid holidays, and a 401(k) plan with company matching. The company is committed to providing a work-life balance for its employees and offers flexible work arrangements and employee assistance programs.

Sustainability and Social Responsibility

American Alliance Insurance Company is committed to being a responsible corporate citizen and has a long-standing tradition of giving back to the communities it serves. The company’s sustainability efforts are focused on three key areas: environmental stewardship, social responsibility, and economic development.

Environmental Stewardship

American Alliance is committed to reducing its environmental impact and has implemented a number of initiatives to achieve this goal. The company has reduced its energy consumption by 20% since 2010, and it has also reduced its water usage by 15%. American Alliance is also committed to recycling and waste reduction, and it has diverted over 90% of its waste from landfills.