Entities Ineligible for Group Life Insurance Ownership

Group life insurance is an employer-sponsored insurance plan that provides coverage to employees and their dependents. However, individuals cannot own group life insurance due to legal and regulatory restrictions.

Legal and Regulatory Restrictions

The Employee Retirement Income Security Act (ERISA) governs group life insurance plans. ERISA defines a group life insurance plan as “a plan of insurance under which life insurance is provided to a group of employees, members, or their dependents.” This definition excludes individuals who are not part of a group.

Ineligible Individuals

Individuals who are not eligible to own group life insurance include:

- Individuals who are not employed by a company that offers group life insurance.

- Individuals who are not members of a group, such as an association or union.

- Individuals who are not dependents of an employee or member of a group.

Group Life Insurance Eligibility Criteria

Group life insurance eligibility is determined by specific criteria that ensure the fairness and appropriateness of coverage within a group.

One of the key factors in determining eligibility is the employer-employee relationship. Typically, group life insurance is offered as a benefit to employees of a company or organization. Employees who meet certain criteria, such as being full-time or part-time employees with a minimum number of hours worked, are eligible for coverage.

Group Size and Membership Requirements

The size of the group and the membership requirements also play a role in eligibility. In general, a group must have a minimum number of members to qualify for group life insurance coverage. This number varies depending on the insurance carrier and the specific plan design. Additionally, some plans may have specific membership requirements, such as requiring members to be members of a particular union or association.

Exclusions and Limitations in Group Life Insurance Coverage

Group life insurance policies often include exclusions and limitations that restrict coverage in certain situations. Understanding these exclusions and limitations is crucial for policyholders to ensure they have adequate protection.

Exclusions refer to specific events or conditions that are not covered by the policy. For instance, many group life insurance policies exclude coverage for pre-existing conditions, meaning any medical conditions that existed before the policy was issued. Hazardous activities, such as skydiving or rock climbing, may also be excluded from coverage.

Limitations, on the other hand, refer to restrictions on the amount of coverage or the duration of coverage. For example, some group life insurance policies may have a maximum benefit amount, limiting the payout to a specific dollar amount. Others may have a time limit on coverage, such as a policy that only provides coverage for a specific number of years.

It’s important to carefully review the group life insurance policy to understand the exclusions and limitations that apply. This information can help policyholders make informed decisions about the coverage they need and ensure they have adequate protection in the event of a covered loss.

Legal and Regulatory Framework for Group Life Insurance

Group life insurance is subject to various legal and regulatory provisions that shape its ownership, coverage, and administration. These provisions aim to ensure fairness, protect policyholders, and maintain the financial soundness of insurers.

State insurance laws play a significant role in regulating group life insurance. These laws typically define the eligibility criteria for group life insurance, specify the minimum and maximum coverage amounts, and establish rules for premium payments and policy administration.

ERISA (Employee Retirement Income Security Act)

ERISA is a federal law that governs employee benefit plans, including group life insurance. ERISA sets minimum standards for plan participation, vesting, funding, and reporting. It also provides protections for plan participants and beneficiaries, such as the right to appeal denied claims.

Alternative Insurance Options for Individuals

Individuals who are not eligible for group life insurance can explore alternative insurance products that provide similar coverage and benefits. These products offer a range of options tailored to individual needs, including coverage amounts, premium rates, and additional benefits.

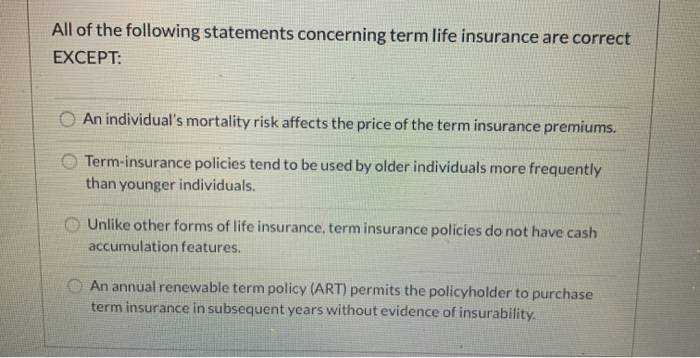

Individual Term Life Insurance

- Provides coverage for a specific period, typically 10, 20, or 30 years.

- Offers flexible coverage amounts and premium rates.

- May include additional riders for benefits such as accidental death or dismemberment.

Whole Life Insurance

- Provides coverage for the entire life of the insured.

- Accumulates cash value over time, which can be borrowed against or withdrawn.

- Offers higher premium rates compared to term life insurance.

Universal Life Insurance

- Provides flexible coverage amounts and premium rates.

- Accumulates cash value that can be used to pay premiums or increase coverage.

- Offers investment options within the policy.

Variable Life Insurance

- Provides coverage that varies based on the performance of an underlying investment portfolio.

- Offers the potential for higher returns, but also carries investment risk.

- May have higher premium rates than other life insurance options.

Selection Considerations

When selecting an alternative insurance option, individuals should consider their age, health, financial situation, and specific insurance needs. It is recommended to consult with an insurance professional to determine the most appropriate product and coverage amount.