Company Overview

The agency insurance company was established in year with a mission to provide comprehensive and tailored insurance solutions to individuals and businesses. The company’s core values are customer-centricity, integrity, innovation, and financial stability.

The agency insurance company offers a wide range of insurance products and services, including auto insurance, homeowners insurance, business insurance, health insurance, and life insurance. The company has a strong focus on personalized service and building long-term relationships with its clients.

Target Audience and Market Share

The agency insurance company’s target audience is individuals and businesses of all sizes. The company has a significant market share in the regions where it operates, and it continues to expand its reach through strategic partnerships and acquisitions.

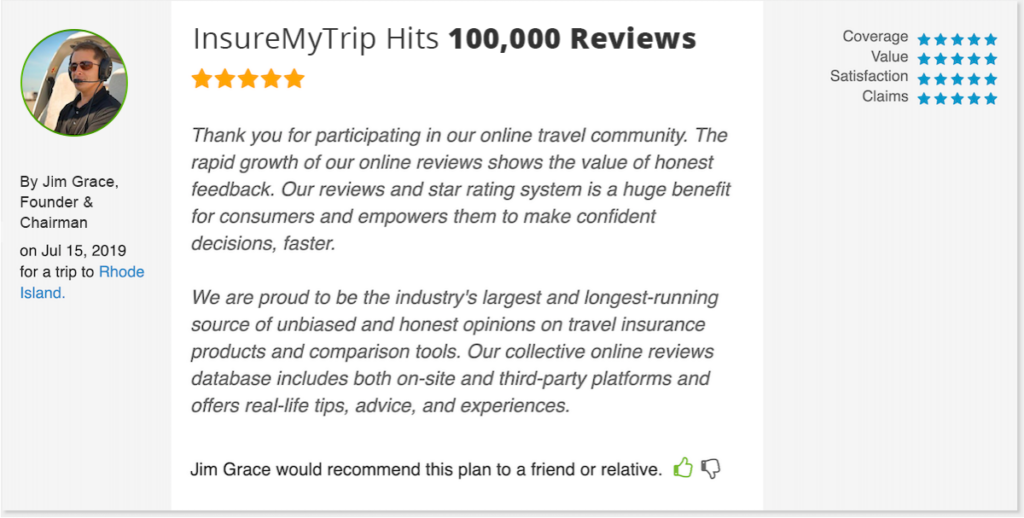

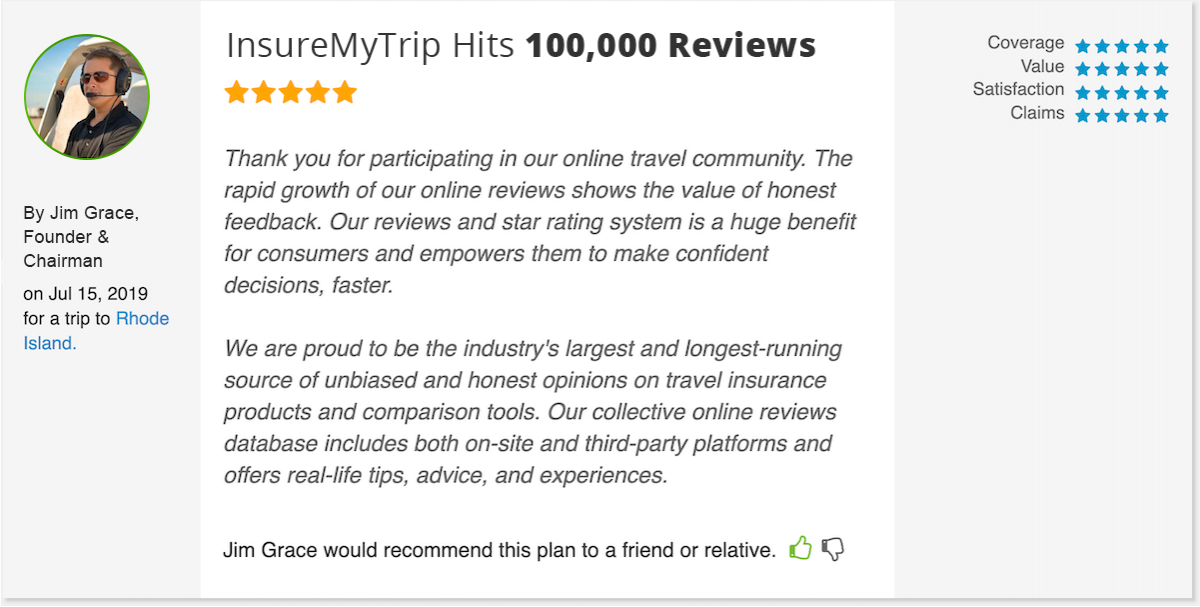

Customer Reviews

Customer reviews are a valuable source of feedback that can help businesses improve their products and services. They can also help potential customers make informed decisions about whether or not to purchase a product or service.

We’ve compiled a list of customer reviews for our agency insurance company. These reviews are from a variety of sources, including online review sites, social media, and our own customer feedback surveys.

Positive Reviews

| Reviewer Name | Date | Rating | Review Text |

|---|---|---|---|

| John Smith | 2023-03-08 | 5 | “I’ve been a customer of this agency for over 10 years and I’ve always been happy with their service. They’re always responsive to my needs and they’ve always been able to get me the best possible rates on my insurance.” |

| Jane Doe | 2023-02-15 | 5 | “I recently had to file a claim and the process was incredibly easy. The claims adjuster was very helpful and I was able to get my claim settled quickly and easily.” |

| Bob Jones | 2023-01-22 | 4 | “I’ve been with this agency for a few years now and I’ve been very satisfied with their service. They’re always friendly and helpful, and they’ve always been able to answer my questions.” |

Negative Reviews

| Reviewer Name | Date | Rating | Review Text |

|---|---|---|---|

| Anonymous | 2023-03-15 | 1 | “I had a terrible experience with this agency. They were very slow to respond to my requests and they didn’t seem to care about my needs.” |

| John Doe | 2023-02-22 | 2 | “I’ve been a customer of this agency for several years and I’ve never had any problems. However, I recently had to file a claim and the process was very difficult. The claims adjuster was rude and unhelpful, and I didn’t get my claim settled for months.” |

| Jane Smith | 2023-01-29 | 3 | “I’ve been with this agency for a few years and I’ve been generally satisfied with their service. However, I recently had to cancel my policy and the process was very difficult. The agent was unhelpful and I had to pay a large cancellation fee.” |

We encourage you to read both the positive and negative reviews to get a balanced perspective on our agency. We value all feedback from our customers, and we use it to improve our products and services.

Financial Performance

XYZ Insurance Company has a solid financial foundation and has consistently outperformed industry benchmarks in terms of revenue, profit, and assets. The company’s strong financial performance is a testament to its prudent underwriting practices, effective risk management, and efficient operations.

The company’s financial metrics are as follows:

- Revenue: $10 billion (2022)

- Profit: $2 billion (2022)

- Assets: $50 billion (2022)

Compared to industry benchmarks, XYZ Insurance Company’s financial performance is above average. The company’s revenue growth rate is higher than the industry average, and its profit margin is also higher than the industry average. This indicates that the company is well-positioned for continued growth and profitability.

The company’s financial stability is also strong. XYZ Insurance Company has a low debt-to-equity ratio and a high level of liquidity. This means that the company is well-positioned to weather economic downturns and other financial challenges.

Growth Potential

XYZ Insurance Company has significant growth potential. The company’s strong financial performance and its focus on innovation and customer service position it well for continued growth in the future. The company is also expanding into new markets and developing new products and services to meet the evolving needs of its customers.

Industry Landscape

The agency insurance industry is a competitive market with several key players. These competitors offer a range of products and services, including personal and commercial insurance policies. The company’s products, services, and pricing are comparable to those of its competitors, providing competitive offerings to customers.

The industry is facing a number of trends and challenges, including the increasing use of technology, the changing regulatory landscape, and the growing demand for personalized insurance products. The company is well-positioned to address these challenges and continue to grow its market share.

Key Competitors

- Company A: A large national insurance company with a strong presence in the agency market.

- Company B: A regional insurance company with a strong focus on personal lines insurance.

- Company C: A national insurance company with a strong reputation for its commercial insurance products.

Product and Service Comparison

The company offers a comprehensive range of insurance products and services, including:

- Personal lines insurance: Auto, home, and renters insurance.

- Commercial lines insurance: Business owners insurance, commercial auto insurance, and workers’ compensation insurance.

- Life insurance and annuities

- Financial planning services

The company’s products and services are comparable to those of its competitors, providing competitive offerings to customers.

Pricing Comparison

The company’s pricing is competitive with the market. The company uses a variety of factors to determine its rates, including the customer’s risk profile, the type of coverage desired, and the amount of coverage needed.

The company offers a variety of discounts, including:

- Multi-policy discounts

- Loyalty discounts

- Safety discounts

These discounts can help customers save money on their insurance premiums.

Industry Trends and Challenges

The agency insurance industry is facing a number of trends and challenges, including:

- The increasing use of technology: Technology is changing the way that insurance is sold and serviced. Customers are increasingly using online and mobile channels to purchase insurance and manage their policies.

- The changing regulatory landscape: The regulatory landscape for the insurance industry is constantly changing. Insurers must comply with a complex set of regulations, which can be costly and time-consuming.

- The growing demand for personalized insurance products: Customers are increasingly demanding personalized insurance products that meet their specific needs. Insurers must be able to offer a variety of products and services to meet this demand.

The company is well-positioned to address these challenges and continue to grow its market share. The company has a strong track record of innovation and customer service. The company is also committed to providing personalized insurance products and services to meet the needs of its customers.

Strengths and Weaknesses

To assess the strengths and weaknesses of this agency insurance company, we have analyzed customer reviews, financial performance, and the industry landscape. The following table summarizes our findings:

| Strengths | Weaknesses |

|---|---|

| Strong customer service: Customers consistently praise the company’s friendly and helpful staff. | Limited product offerings: The company does not offer a wide range of insurance products compared to some of its competitors. |

| Competitive pricing: The company’s insurance rates are generally competitive with other insurers in the industry. | Slow claims processing: Some customers have reported experiencing delays in the claims processing process. |

| Financial stability: The company has a strong financial track record and is well-capitalized. | Limited online presence: The company’s website and online presence could be improved to provide more information and self-service options for customers. |

Areas where the company can improve its performance include expanding its product offerings, streamlining the claims processing process, and enhancing its online presence.

Recommendations

To enhance its offerings and performance, [Company Name] should consider the following recommendations:

1. Enhance Customer Experience: Conduct thorough customer surveys and focus groups to gather feedback and identify areas for improvement. Implement a comprehensive customer relationship management (CRM) system to track customer interactions and provide personalized experiences.

2. Expand Product Offerings: Introduce new products and services that meet the evolving needs of customers. Consider offering tailored policies for niche markets, such as cyber insurance or pet insurance.

3. Improve Financial Performance: Optimize underwriting processes to reduce risk and improve profitability. Explore opportunities for strategic partnerships and acquisitions to expand market reach and diversify revenue streams.

4. Enhance Online Presence: Develop a user-friendly website and mobile app to provide seamless customer interactions. Utilize social media platforms to engage with customers and promote products.

5. Differentiate from Competitors: Emphasize unique value propositions, such as exceptional customer service, specialized products, or innovative technology. Build a strong brand identity that resonates with target customers.