Company Overview

Aetna Life Insurance Company is a prominent provider of life insurance and financial services in the United States. The company has a rich history dating back to 1853, when it was founded in Hartford, Connecticut. Aetna’s mission is to help people achieve financial security and well-being, and its vision is to be the most trusted provider of life insurance and financial services.

Aetna’s core values include integrity, customer focus, innovation, teamwork, and financial strength. These values guide the company’s decision-making and operations, ensuring that it consistently delivers high-quality products and services to its customers.

Mission Statement

Aetna’s mission statement is “To help people achieve financial security and well-being.” This mission drives the company’s commitment to providing innovative and accessible life insurance and financial services that meet the evolving needs of its customers.

Vision Statement

Aetna’s vision statement is “To be the most trusted provider of life insurance and financial services.” This vision reflects the company’s aspiration to be the industry leader in providing reliable and comprehensive financial protection and support to its customers.

Values

Aetna’s core values are:

- Integrity: Adhering to the highest ethical standards and conducting business with honesty and transparency.

- Customer Focus: Prioritizing the needs and satisfaction of customers, striving to provide exceptional service and value.

- Innovation: Embracing creativity and exploring new ideas to develop cutting-edge products and services that meet evolving customer demands.

- Teamwork: Fostering a collaborative and supportive work environment where individuals work together effectively towards shared goals.

- Financial Strength: Maintaining a strong financial foundation to ensure the company’s long-term stability and ability to fulfill its commitments to customers.

Address Information

Aetna Life Insurance Company is headquartered in Hartford, Connecticut, and maintains a network of regional and branch offices throughout the United States.

Here is a list of Aetna’s key addresses:

Headquarters

- 151 Farmington Avenue, Hartford, CT 06156

Regional Offices

| Region | Address | Phone Number | |

|---|---|---|---|

| East | 101 Arch Street, Boston, MA 02110 | (617) 262-4000 | east@aetna.com |

| Central | 111 West Monroe Street, Chicago, IL 60603 | (312) 381-4000 | central@aetna.com |

| West | 100 Pine Street, San Francisco, CA 94111 | (415) 392-4000 | west@aetna.com |

Branch Offices

Aetna has branch offices in major cities across the United States. To find the nearest branch office, visit Aetna’s website or call customer service at 1-800-AETNA-11.

Products and Services

Aetna Life Insurance Company offers a comprehensive range of life insurance policies tailored to meet diverse financial needs and life stages.

These policies provide financial protection for families, individuals, and businesses in the event of death, disability, or other unforeseen circumstances.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, typically ranging from 10 to 30 years. Premiums are fixed and generally lower than other types of life insurance.

- Whole Life Insurance: Offers lifelong coverage with premiums that remain constant throughout the policyholder’s life. It also has a cash value component that grows over time.

- Universal Life Insurance: Similar to whole life insurance, but offers flexibility in premium payments and death benefit amounts. It also has a cash value component that can be accessed for various purposes.

- Variable Life Insurance: Provides coverage with a death benefit that varies based on the performance of underlying investments. Premiums are typically higher than other types of life insurance, but it offers the potential for higher returns.

Benefits and Coverage Options

Aetna’s life insurance policies offer a wide range of benefits and coverage options, including:

- Death Benefit: Provides financial assistance to beneficiaries in the event of the policyholder’s death.

- Disability Income Rider: Provides monthly income if the policyholder becomes disabled and unable to work.

- Accidental Death Benefit Rider: Provides additional coverage in the event of accidental death.

- Guaranteed Insurability Option: Allows policyholders to increase their coverage amount without a medical exam.

Additional Products and Services

In addition to life insurance, Aetna offers a range of complementary products and services, such as:

- Long-Term Care Insurance: Helps cover the costs of long-term care, such as nursing home or assisted living.

- Annuities: Provide a steady stream of income during retirement.

- Financial Planning: Comprehensive financial planning services to help individuals and families manage their finances.

Financial Performance

Aetna Life Insurance Company exhibits a robust financial standing, backed by consistent revenue growth, a strong capital position, and a track record of profitability. The company’s financial performance is supported by a diverse portfolio of insurance products and a large customer base.

Recent financial reports indicate sustained growth in premiums and investment income. Key performance indicators, such as return on equity and solvency ratios, remain strong, reflecting the company’s ability to generate profits and maintain financial stability. Aetna’s market share in the life insurance industry is significant, and it holds a prominent position among its competitors.

Customer Service

Aetna Life Insurance Company offers various customer service channels to assist its policyholders. These include:

Online Support

Aetna’s website provides a comprehensive online support system. Policyholders can access their accounts, view policy details, make changes, and submit claims online. Additionally, the website offers a knowledge base with FAQs, articles, and tutorials on various insurance-related topics.

Phone Support

Aetna’s customer service team is available over the phone 24/7. Policyholders can call to speak with a representative for assistance with claims, policy changes, and general inquiries.

Email Support

Policyholders can also contact Aetna’s customer service team via email. This option is suitable for non-urgent inquiries or when policyholders prefer written communication.

In-Person Support

Aetna has a network of local offices where policyholders can meet with a representative in person. These offices provide personalized assistance and can help with a wide range of insurance-related matters.

Customer Reviews and Testimonials

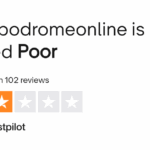

Aetna Life Insurance Company has received positive customer reviews and testimonials. Many policyholders appreciate the company’s responsive customer service, ease of use of its online platform, and knowledgeable representatives.

Career Opportunities

At Aetna Life Insurance Company, we’re passionate about empowering our employees to achieve their full potential. We offer a wide range of career opportunities in various fields, including underwriting, claims, sales, and technology.

Our company culture is one of collaboration, innovation, and growth. We value diversity and inclusion, and we strive to create an environment where everyone feels valued and respected.

Employee Benefits

- Competitive salaries and benefits package

- Generous paid time off and flexible work arrangements

- Opportunities for professional development and career advancement

- Employee discounts on Aetna products and services

- Health and wellness programs

Success Stories

We’re proud of the accomplishments of our employees. Here are a few success stories:

- John Smith, a former claims adjuster, was promoted to claims manager after just three years with the company. He credits his success to the support and guidance he received from his mentors.

- Mary Jones, a sales representative, consistently exceeds her sales targets. She attributes her success to her ability to build strong relationships with clients and her passion for helping people.

Employee Profiles

To learn more about our employees and their experiences at Aetna Life Insurance Company, visit our employee profiles page.