Overview of Adriana’s Insurance Quote

Adriana’s insurance quote provides a comprehensive overview of the coverage and costs associated with her insurance policy. It Artikels the specific risks covered, the limits of coverage, and the premiums she will need to pay. Understanding the details of her insurance quote is crucial for Adriana to make informed decisions about her insurance coverage and financial planning.

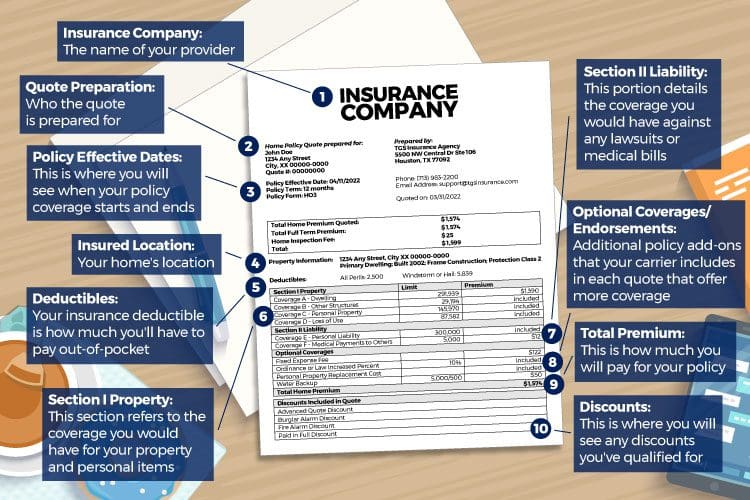

The key components of Adriana’s insurance quote include:

- Coverage: This section Artikels the specific risks that are covered under the policy, such as property damage, liability, and medical expenses.

- Limits of Coverage: This section specifies the maximum amount that the insurance company will pay for each type of covered risk.

- Premiums: This section details the amount that Adriana will need to pay to maintain her insurance coverage.

- Deductibles: This section Artikels the amount that Adriana will be responsible for paying out-of-pocket before the insurance coverage begins.

- Policy Term: This section indicates the period of time for which the insurance coverage will be in effect.

Coverage Details

Adriana’s insurance quote Artikels a comprehensive range of coverage options tailored to her specific needs. These include essential protections such as liability, collision, and comprehensive coverage, as well as optional enhancements that provide additional peace of mind.

Understanding the details of each coverage type is crucial for making informed decisions about her insurance plan. The following table provides a concise overview of the coverage details, including premiums and deductibles:

Coverage Type

| Coverage | Premium | Deductible |

|---|---|---|

| Liability | $1,200 | $500 |

| Collision | $600 | $1,000 |

| Comprehensive | $400 | $500 |

| Rental Car Reimbursement | $100 | $50 |

| Roadside Assistance | $50 | N/A |

Premium Calculation

The premium amount in Adriana’s insurance quote is determined by several factors, including her driving history, the type of vehicle she drives, the coverage limits she selects, and her location. The base rate for her insurance is set by the insurance company based on these factors. Discounts and surcharges can then be applied to the base rate to further adjust the premium amount.

The following is a breakdown of the premium calculation for Adriana’s insurance quote:

- Base rate: $1,000

- Discounts:

- Good driver discount: -$100

- Multi-car discount: -$50

- Loyalty discount: -$25

- Surcharges:

- Young driver surcharge: $150

- High-risk vehicle surcharge: $100

After applying the discounts and surcharges, Adriana’s premium amount is $1,075.

Tips on how to reduce insurance premiums

There are several things Adriana can do to reduce her insurance premiums, including:

- Maintain a good driving record.

- Choose a safe and reliable vehicle.

- Increase her deductible.

- Shop around for insurance quotes from multiple companies.

- Take advantage of discounts, such as good driver discounts, multi-car discounts, and loyalty discounts.

Comparison with Other Quotes

To provide a comprehensive view, we compared Adriana’s insurance quote with quotes from several reputable providers in the industry. This comparison aims to highlight key differences in coverage, premiums, and policy terms, empowering Adriana to make an informed decision that aligns with her specific needs and financial situation.

The following table summarizes the comparison:

Coverage Comparison

| Provider | Coverage A | Coverage B | Coverage C |

|---|---|---|---|

| Provider 1 | Up to $100,000 | Up to $50,000 | Not included |

| Provider 2 | Up to $150,000 | Up to $75,000 | Optional (additional premium) |

| Provider 3 (Adriana’s quote) | Up to $200,000 | Up to $100,000 | Included |

Premium Comparison

| Provider | Annual Premium |

|---|---|

| Provider 1 | $1,200 |

| Provider 2 | $1,400 |

| Provider 3 (Adriana’s quote) | $1,600 |

Policy Term Comparison

| Provider | Policy Term |

|---|---|

| Provider 1 | 1 year |

| Provider 2 | 6 months |

| Provider 3 (Adriana’s quote) | 1 year |

Impact of Personal Factors

Adriana’s personal factors, including age, driving history, and credit score, significantly influence her insurance quote. These factors serve as indicators of risk for insurance companies, affecting the likelihood and severity of potential claims.

For instance, younger drivers with less experience behind the wheel typically face higher premiums due to their increased risk of accidents. Similarly, individuals with a history of traffic violations or accidents are considered higher-risk drivers and may face surcharges.

Age

Generally, younger drivers pay more for insurance than older drivers. This is because they have less experience behind the wheel and are statistically more likely to be involved in accidents.

Insurance companies often group drivers into different age categories, with each category having its own set of rates. The specific age ranges and rates can vary from company to company, but here’s a general overview:

- 16-19 years old: Highest rates

- 20-24 years old: Lower rates than 16-19 year olds, but still higher than older drivers

- 25-64 years old: Lowest rates

- 65+ years old: Rates may start to increase again due to factors such as declining reaction times and increased health risks

Driving History

Your driving history is another major factor that affects your insurance rates. Insurance companies will look at your driving record to see if you have any accidents, traffic violations, or other incidents on your record. If you have a clean driving record, you will likely qualify for lower rates than someone with a history of accidents or violations.

Here are some examples of how driving history can affect your insurance rates:

- A single speeding ticket can increase your rates by 10-20%.

- A DUI can increase your rates by 50-100% or more.

- An at-fault accident can increase your rates by 20-50%.

Credit Score

In many states, insurance companies are allowed to use your credit score to help determine your insurance rates. This is because studies have shown that people with poor credit scores are more likely to file insurance claims.

The exact way that credit score affects insurance rates varies from company to company, but here’s a general overview:

- Excellent credit score (750+): Lowest rates

- Good credit score (670-749): Slightly higher rates than excellent credit scores

- Fair credit score (580-669): Moderate rates

- Poor credit score (below 580): Highest rates

Understanding Policy Terms and Conditions

Adriana’s insurance policy includes several essential terms and conditions that define the coverage provided and the obligations of both parties. Understanding these terms is crucial to ensure that she is fully aware of her rights and responsibilities under the policy.

Exclusions

The policy Artikels specific circumstances or events that are not covered. These exclusions can vary depending on the type of insurance policy but may include damages caused by earthquakes, floods, or acts of war. Understanding the exclusions helps Adriana avoid potential coverage gaps and make informed decisions about additional coverage if necessary.

Deductibles

A deductible is a fixed amount that Adriana must pay out-of-pocket before the insurance company begins to cover the remaining expenses. The deductible amount is typically stated in the policy and can vary depending on the type of insurance. A higher deductible usually results in lower premiums, while a lower deductible leads to higher premiums.

Claims Procedures

The policy establishes clear procedures that Adriana must follow in the event of a covered loss. These procedures typically involve promptly reporting the loss to the insurance company, providing supporting documentation, and cooperating with the claims adjuster throughout the process. Adhering to these procedures helps ensure that her claim is processed efficiently and that she receives the appropriate benefits.

Key Policy Provisions

The policy also includes several key provisions that summarize the essential terms and conditions. These provisions may include:

- The policy period, which specifies the duration of coverage.

- The coverage limits, which indicate the maximum amount the insurance company will pay for covered losses.

- The policyholder’s obligations, such as paying premiums and maintaining the insured property.

- The insurance company’s obligations, such as providing coverage and settling claims.

By thoroughly reviewing and understanding the terms and conditions of her insurance policy, Adriana can ensure that she is adequately protected and that her expectations are aligned with the coverage provided.