Company Overview

ACE Property and Casualty Insurance Company, a subsidiary of Chubb, is a leading global insurance provider offering a broad range of property and casualty insurance products and services to businesses and individuals around the world.

Established in 1985, ACE has grown to become one of the largest and most respected insurance companies in the world, with operations in over 50 countries and territories. The company’s mission is to provide its customers with innovative, tailored insurance solutions that meet their unique needs and help them manage risk effectively.

Mission, Vision, and Values

ACE’s mission, vision, and values are the foundation of its business operations and guide its decision-making processes. The company’s mission is to:

- Provide innovative, tailored insurance solutions that meet the unique needs of its customers.

- Help customers manage risk effectively and achieve their financial goals.

- Build lasting relationships with customers based on trust and integrity.

ACE’s vision is to be the world’s leading insurance company, renowned for its financial strength, underwriting expertise, and exceptional customer service.

The company’s values are:

- Customer focus: ACE is committed to providing its customers with the highest level of service and support.

- Integrity: ACE operates with honesty, transparency, and fairness in all its dealings.

- Innovation: ACE is constantly innovating to develop new products and services that meet the evolving needs of its customers.

- Teamwork: ACE values teamwork and collaboration, recognizing that its success is the result of the collective efforts of its employees.

Financial Performance and Key Metrics

ACE has a strong financial performance, with consistently high ratings from independent rating agencies. The company’s financial performance is driven by its diversified business model, strong underwriting discipline, and prudent risk management practices.

Key financial metrics include:

- Gross written premiums: $14.5 billion in 2021

- Net income: $2.2 billion in 2021

- Return on equity: 12.5% in 2021

- Combined ratio: 94.5% in 2021

These metrics indicate that ACE is a financially sound company with a strong track record of profitability and growth.

Products and Services

ACE Property and Casualty Insurance Company offers a comprehensive range of insurance products designed to protect individuals, businesses, and organizations from a wide range of risks.

These products include:

Personal Insurance

- Homeowners insurance: Protects homeowners from financial losses due to damage or destruction of their property, as well as liability for injuries or accidents on their property.

- Renters insurance: Provides coverage for renters’ personal belongings and liability for injuries or accidents in their rented space.

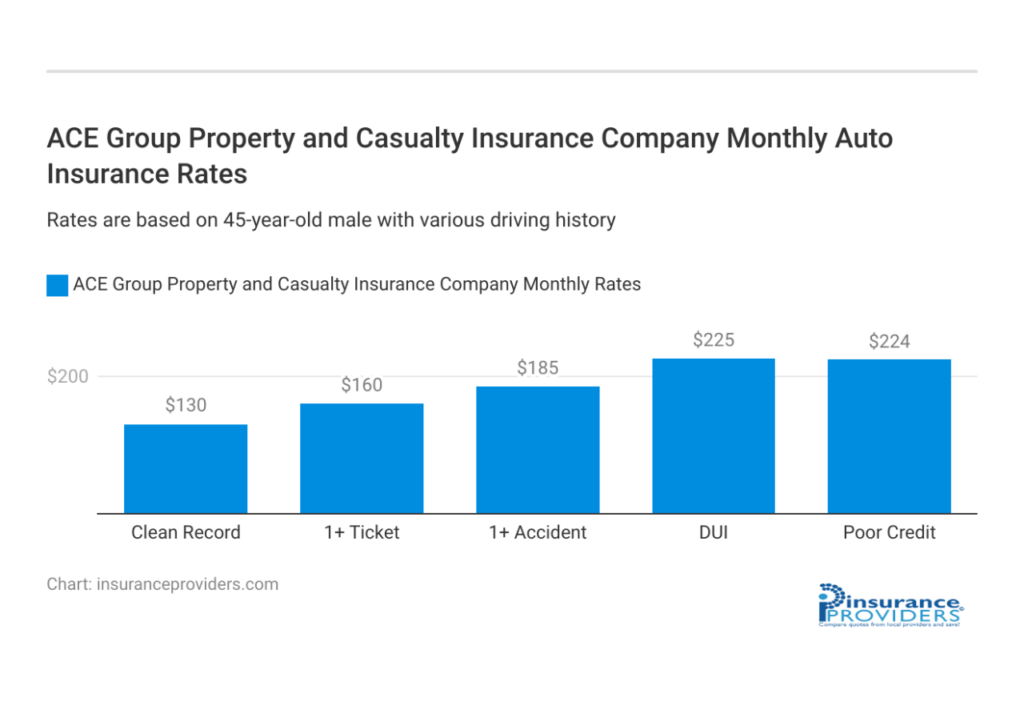

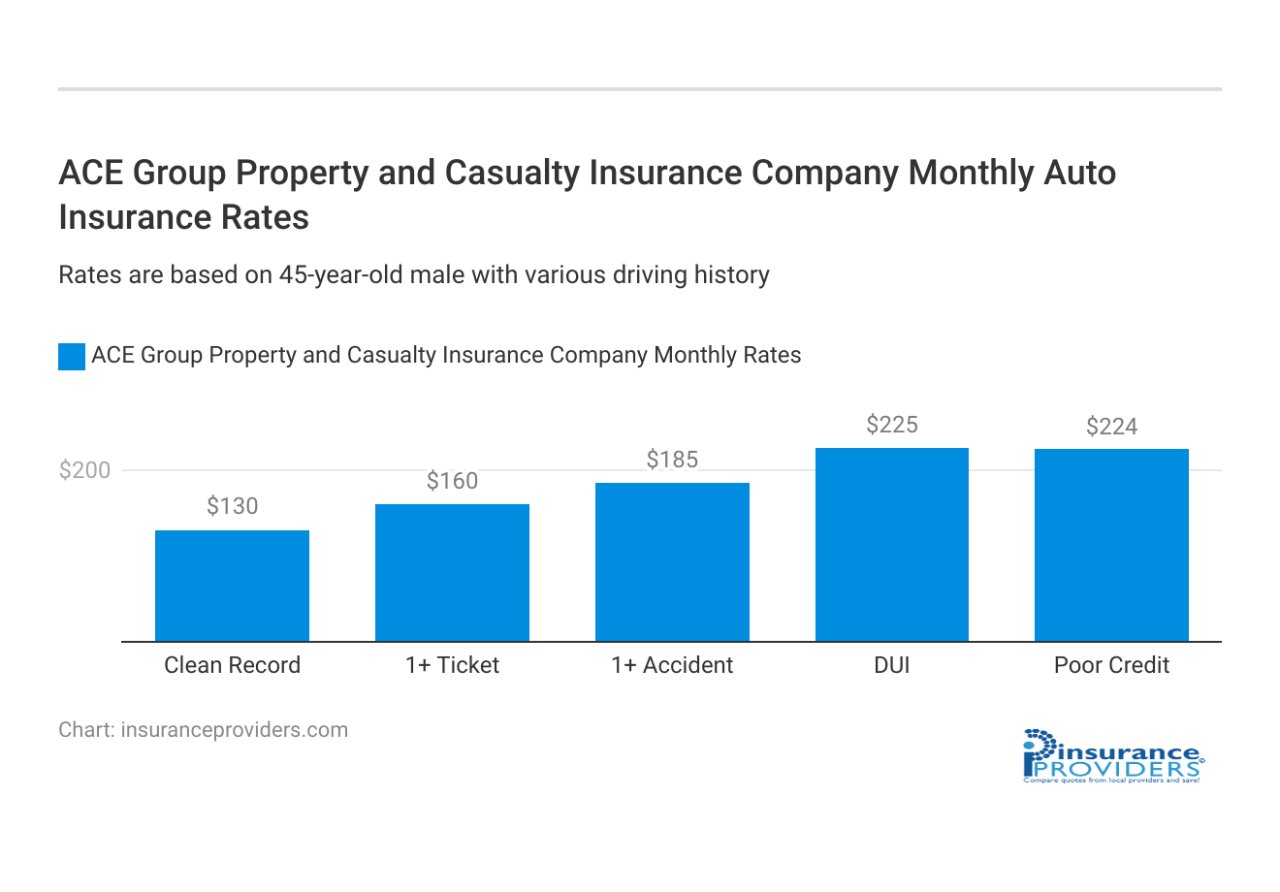

- Auto insurance: Covers vehicles and drivers from financial losses due to accidents, theft, or other covered events.

- Umbrella insurance: Provides additional liability coverage beyond the limits of other personal insurance policies.

Commercial Insurance

- Commercial property insurance: Protects businesses from financial losses due to damage or destruction of their property, including buildings, equipment, and inventory.

- Commercial liability insurance: Provides coverage for businesses against claims of negligence or liability for injuries or accidents caused by their products, services, or operations.

- Business interruption insurance: Reimburses businesses for lost income and expenses if their operations are interrupted due to a covered event, such as a fire or natural disaster.

- Workers’ compensation insurance: Provides coverage for employees who are injured or become ill on the job.

Specialty Insurance

- Professional liability insurance: Protects professionals, such as doctors, lawyers, and accountants, from claims of negligence or errors in their work.

- Directors and officers insurance: Provides coverage for directors and officers of companies against claims of mismanagement or breach of fiduciary duty.

- Cyber insurance: Protects businesses from financial losses due to cyberattacks, data breaches, or other technology-related events.

- Marine insurance: Provides coverage for ships, cargo, and other marine-related risks.

Claims Process

Filing a claim with ACE Property and Casualty Insurance Company is a straightforward process designed to assist you promptly and efficiently. Our claims handling team is committed to providing exceptional customer service and support throughout the claims process.

To initiate a claim, you can contact our 24/7 claims hotline or file a claim online through our secure customer portal. Our experienced claims representatives will guide you through the process, gather necessary information, and assign a dedicated claims adjuster to your case.

Claims Handling Process

- Report the Claim: Contact our claims hotline or file a claim online. Provide details of the incident, including the date, time, and location.

- Gather Evidence: Collect documentation and evidence related to the claim, such as photos, invoices, or medical records.

- Assign Claims Adjuster: A dedicated claims adjuster will be assigned to your case and will be your primary contact throughout the process.

- Investigate the Claim: The claims adjuster will review the evidence, contact witnesses, and determine the extent of the damage or loss.

- Settlement Offer: Based on the investigation, the claims adjuster will make a settlement offer that covers the covered damages or losses.

- Payment: Once the settlement is accepted, payment will be processed promptly.

Customer Service and Support

ACE Property and Casualty Insurance Company prioritizes customer satisfaction. Our claims team is available 24/7 to assist you with any questions or concerns. You can reach our claims hotline at [phone number] or email us at [email address].

We understand that filing a claim can be stressful, and we are committed to making the process as smooth and hassle-free as possible. Our claims representatives are trained to provide empathetic and personalized support to guide you through every step of the process.

Industry Trends and Competitive Landscape

The property and casualty insurance industry is constantly evolving, with new challenges and opportunities emerging all the time. Some of the key trends that are currently shaping the industry include:

- The increasing frequency and severity of natural disasters.

- The rise of new technologies, such as telematics and artificial intelligence.

- The changing demographics of the population.

ACE Property and Casualty Insurance Company is well-positioned to meet these challenges and capitalize on these opportunities. The company has a strong track record of innovation, and it is constantly investing in new technologies and products. ACE also has a deep understanding of the needs of its customers, and it is committed to providing them with the best possible service.

Major Competitors

ACE Property and Casualty Insurance Company’s major competitors include:

- Allstate Insurance Company

- American International Group, Inc. (AIG)

- Chubb Limited

- The Hartford Financial Services Group, Inc.

- Liberty Mutual Insurance Group

ACE Property and Casualty Insurance Company compares favorably to its competitors in terms of its financial strength, product offerings, and customer service. The company has a strong track record of profitability, and it has consistently received high ratings from independent rating agencies. ACE also offers a wide range of products and services to meet the needs of its customers, and it is committed to providing excellent customer service.

Marketing and Distribution

ACE Property and Casualty Insurance Company leverages a multi-channel distribution strategy to reach its target audience and promote its products and services. The company has established strong relationships with independent agents and brokers, who play a crucial role in distributing its insurance solutions to businesses and individuals. Additionally, ACE utilizes direct marketing channels, such as its website, social media platforms, and email campaigns, to connect with potential customers.

Target Audience

ACE Property and Casualty Insurance Company primarily targets small to medium-sized businesses, as well as high-net-worth individuals and families. The company offers a range of insurance products tailored to the specific needs of these customer segments, including commercial property and casualty insurance, personal lines insurance, and specialty insurance solutions.

Marketing Channels

ACE Property and Casualty Insurance Company employs a diverse mix of marketing channels to reach its target audience. The company invests in traditional advertising, such as print and television ads, to build brand awareness and generate leads. Additionally, ACE leverages digital marketing channels, such as search engine optimization (), social media marketing, and content marketing, to engage with potential customers online. The company also participates in industry events and conferences to showcase its products and services and connect with potential clients.

Technology and Innovation

ACE Property and Casualty Insurance Company embraces technology and innovation to enhance its marketing and distribution efforts. The company utilizes data analytics to gain insights into customer behavior and preferences, enabling it to tailor its marketing campaigns more effectively. ACE also leverages insurtech solutions to streamline its distribution processes and provide a seamless customer experience. For example, the company offers online quoting and policy management tools that allow customers to easily access and manage their insurance coverage.

Financial Analysis

ACE Property and Casualty Insurance Company’s financial performance has been strong in recent years. The company has consistently reported positive net income, and its profitability ratios have been above industry average. ACE Property and Casualty Insurance Company’s solvency ratios are also strong, indicating that the company is well-positioned to meet its obligations to policyholders. The company’s liquidity ratios are also healthy, indicating that it has sufficient cash and other liquid assets to meet its short-term obligations.

Profitability

ACE Property and Casualty Insurance Company’s profitability has been driven by a number of factors, including strong underwriting results, investment income, and expense management. The company’s combined ratio, which measures underwriting profitability, has been below 100% in recent years, indicating that the company has been able to generate underwriting profits. ACE Property and Casualty Insurance Company has also benefited from strong investment income, which has helped to offset underwriting losses in some years. The company’s expense ratio, which measures the cost of doing business, has also been well-managed.

Solvency

ACE Property and Casualty Insurance Company’s solvency ratios are strong, indicating that the company is well-positioned to meet its obligations to policyholders. The company’s total capital ratio, which measures the amount of capital relative to total liabilities, has been well above the regulatory minimum in recent years. ACE Property and Casualty Insurance Company’s surplus, which measures the amount of capital available to cover losses, has also been strong.

Liquidity

ACE Property and Casualty Insurance Company’s liquidity ratios are also healthy, indicating that the company has sufficient cash and other liquid assets to meet its short-term obligations. The company’s current ratio, which measures the amount of current assets relative to current liabilities, has been well above 100% in recent years. ACE Property and Casualty Insurance Company’s quick ratio, which measures the amount of liquid assets relative to current liabilities, has also been strong.

Comparison to Peers

ACE Property and Casualty Insurance Company’s financial performance compares favorably to that of its peers. The company’s profitability ratios, solvency ratios, and liquidity ratios are all above industry average. This indicates that ACE Property and Casualty Insurance Company is a well-managed company that is well-positioned to meet its obligations to policyholders.

Technology and Innovation

ACE Property and Casualty Insurance Company is committed to leveraging technology to enhance its operations and customer service. The company has invested heavily in innovation and research and development to stay at the forefront of the industry.

ACE’s technology initiatives are focused on improving the customer experience, streamlining operations, and reducing costs. The company has implemented a number of digital tools to make it easier for customers to do business with ACE, including online quoting, policy management, and claims filing. ACE has also invested in data analytics to improve its underwriting and risk management capabilities.

Innovation and Research and Development

ACE is actively involved in innovation and research and development. The company has a dedicated team of engineers and scientists who are constantly exploring new ways to use technology to improve the insurance experience. ACE has partnered with a number of leading technology companies to develop new products and services.

Future Technology Initiatives

ACE has a number of exciting technology initiatives planned for the future. The company is exploring the use of artificial intelligence (AI) to improve its underwriting and claims processing. ACE is also looking into the use of blockchain technology to create a more secure and efficient insurance ecosystem.

Corporate Social Responsibility

ACE Property and Casualty Insurance Company is committed to being a responsible corporate citizen. The company believes that its success is inextricably linked to the well-being of the communities it serves. ACE’s corporate social responsibility (CSR) initiatives are focused on three key areas: environmental sustainability, social responsibility, and governance.

Environmental Sustainability

ACE is committed to reducing its environmental impact. The company has set a goal of reducing its greenhouse gas emissions by 25% by 2025. ACE is also working to reduce its water consumption and waste production. The company has invested in energy-efficient technologies and renewable energy sources. ACE is also working with its suppliers to reduce the environmental impact of its supply chain.

Social Responsibility

ACE is committed to giving back to the communities it serves. The company supports a variety of programs that focus on education, health, and community development. ACE also encourages its employees to volunteer their time to charitable organizations. ACE has a long history of supporting disaster relief efforts. The company has provided financial assistance and volunteer support to communities affected by natural disasters.

Governance

ACE is committed to the highest standards of corporate governance. The company has a strong board of directors that is independent of management. ACE also has a comprehensive code of conduct that all employees are required to follow. The company is committed to transparency and disclosure. ACE publishes an annual sustainability report that provides detailed information about its CSR initiatives.