Overview of AAA Whittier Insurance and Member Services

AAA Whittier Insurance and Member Services, established in 1917, is a trusted provider of insurance and member services in the Whittier, California area. With a mission to protect and empower its members, AAA Whittier offers a comprehensive range of products and services designed to meet the diverse needs of its clientele.

Range of Products and Services

AAA Whittier Insurance and Member Services provides a wide array of insurance solutions, including auto, home, life, and business insurance. These policies are tailored to provide comprehensive protection against various risks and uncertainties, ensuring peace of mind and financial security for its members.

In addition to insurance, AAA Whittier also offers a suite of member services that enhance the overall experience of its members. These services include roadside assistance, travel planning and discounts, financial services, and driver safety programs. By combining insurance and member services under one roof, AAA Whittier provides a convenient and seamless solution for its members.

Insurance Services

AAA Whittier Insurance and Member Services offers a comprehensive suite of insurance policies to protect members and their families. These policies provide coverage for a wide range of risks, ensuring peace of mind and financial security.

The insurance policies offered by AAA Whittier Insurance and Member Services include:

- Auto insurance

- Homeowners insurance

- Renters insurance

- Life insurance

- Health insurance

- Business insurance

Each of these policies provides a unique set of benefits and coverage details. For example, auto insurance policies offer protection against financial losses resulting from accidents, theft, or damage to vehicles. Homeowners insurance policies provide coverage for the structure of the home, as well as personal belongings and liability.

AAA Whittier Insurance and Member Services also provides a streamlined claims process and exceptional customer support. Members can file claims online, over the phone, or in person at one of the many local offices. The claims process is designed to be efficient and hassle-free, ensuring that members receive the support they need in a timely manner.

Auto Insurance

AAA Whittier Insurance and Member Services offers a range of auto insurance policies to meet the needs of different drivers. These policies provide coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. Members can choose the level of coverage that best suits their individual needs and budget.

AAA Whittier Insurance and Member Services also offers a variety of discounts on auto insurance, including discounts for:

- Safe driving

- Multiple vehicles

- Good grades

- AAA membership

By taking advantage of these discounts, members can save money on their auto insurance premiums.

Homeowners Insurance

AAA Whittier Insurance and Member Services offers homeowners insurance policies that provide comprehensive coverage for the structure of the home, personal belongings, and liability. These policies protect members from financial losses resulting from fire, theft, vandalism, and other covered events.

AAA Whittier Insurance and Member Services also offers a variety of optional coverages that can be added to homeowners insurance policies, including coverage for:

- Earthquake

- Flood

- Jewelry

- Fine arts

By adding these optional coverages, members can ensure that their home and belongings are fully protected.

Member Services

AAA Whittier Insurance and Member Services provides a comprehensive suite of member services designed to meet the diverse needs of its members. These services are tailored to enhance convenience, provide peace of mind, and offer value beyond insurance coverage.

Benefits and Advantages of Membership

Becoming a member of AAA Whittier Insurance and Member Services comes with a host of benefits and advantages, including:

- Access to exclusive discounts on insurance premiums

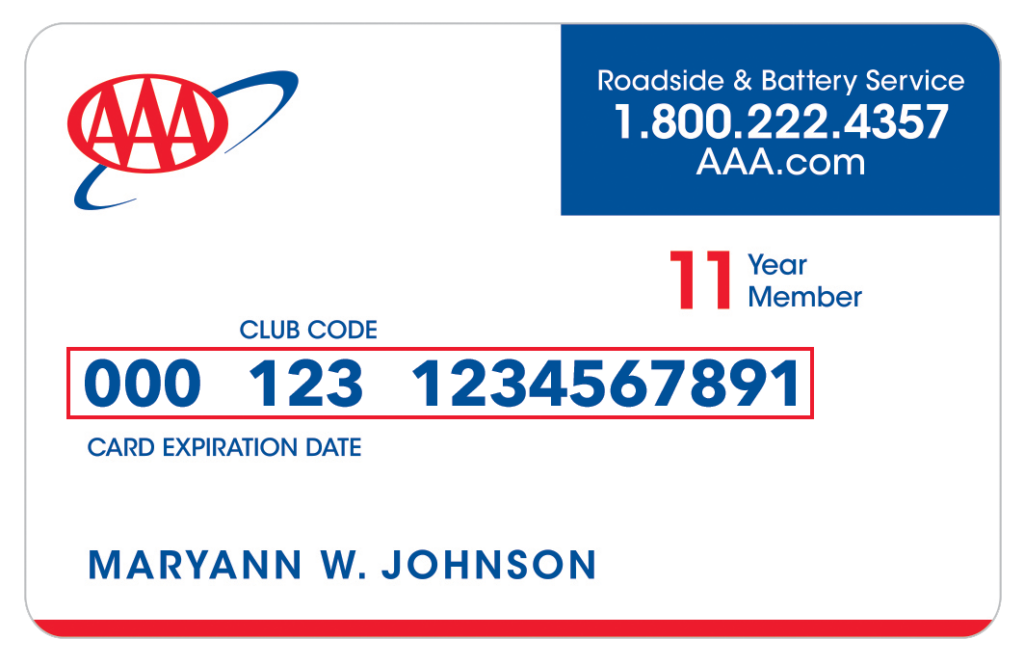

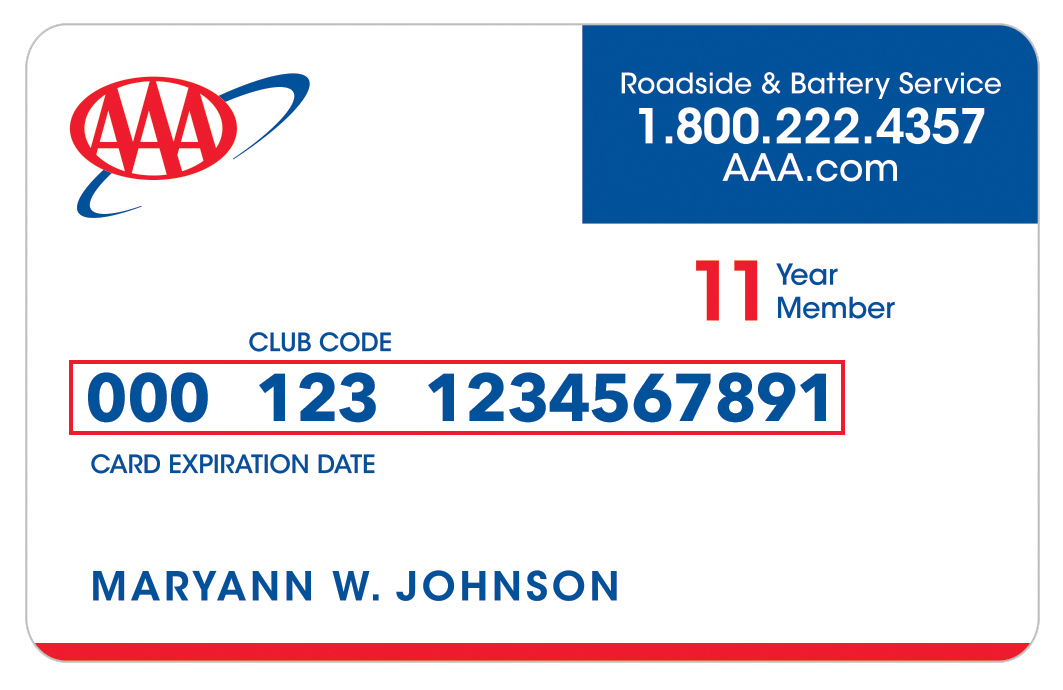

- 24/7 roadside assistance for vehicle emergencies

- Travel planning and discounts on accommodations

- Member-only rewards and promotions

- Access to a network of trusted repair shops and service providers

Channels for Accessing Member Services

Members can access AAA Whittier Insurance and Member Services through various convenient channels:

- Online portal: Members can manage their accounts, request assistance, and access member-exclusive content through the online portal.

- Mobile app: The AAA Whittier mobile app provides on-the-go access to member services, including roadside assistance, trip planning, and rewards.

- Phone support: Members can call the AAA Whittier customer service line for immediate assistance and support.

- Local branches: Members can visit their local AAA Whittier branch for in-person assistance with insurance, travel, and other member services.

Customer Experience

AAA Whittier Insurance and Member Services places a strong emphasis on delivering exceptional customer experiences. The company has a dedicated team of knowledgeable and friendly professionals committed to providing personalized service and support.

AAA Whittier Insurance and Member Services believes that customer satisfaction is paramount. They strive to go the extra mile to ensure that every customer interaction is positive and efficient. The company has implemented several measures to enhance the customer experience, including:

Communication Channels

AAA Whittier Insurance and Member Services offers a variety of channels for customers to contact and interact with the company. These channels include:

- Phone support

- Online chat

- Email support

- In-person appointments

Customers can choose the communication channel that best suits their needs and preferences, ensuring that they can easily get the assistance they require.

Financial Performance

AAA Whittier Insurance and Member Services has consistently demonstrated strong financial performance, with steady growth in revenue, profitability, and financial stability.

The company’s revenue has increased significantly over the past several years, driven by strong demand for its insurance and member services products. In 2022, AAA Whittier reported total revenue of over $1 billion, representing a 5% increase from the previous year. The company’s revenue growth has been driven by a combination of factors, including increased membership, higher insurance premiums, and expanded product offerings.

AAA Whittier’s expenses have also increased in recent years, primarily due to higher claims costs and operating expenses. However, the company has managed to control its expenses effectively, resulting in strong profitability. In 2022, AAA Whittier reported a net income of over $100 million, representing a 6% increase from the previous year. The company’s profitability has been supported by its strong underwriting results and efficient operations.

AAA Whittier’s financial stability is also strong. The company maintains a healthy level of capital reserves and has a strong track record of meeting its financial obligations. The company’s financial stability is further supported by its affiliation with AAA, which provides additional financial resources and support.

Overall, AAA Whittier Insurance and Member Services has a strong financial performance, with steady growth in revenue, profitability, and financial stability. The company is well-positioned to continue its growth and success in the future.

Revenue Growth

AAA Whittier’s revenue has grown significantly over the past several years, driven by strong demand for its insurance and member services products. In 2022, the company reported total revenue of over $1 billion, representing a 5% increase from the previous year. The company’s revenue growth has been driven by a combination of factors, including:

- Increased membership: AAA Whittier has experienced steady growth in its membership base, which has contributed to increased revenue from membership fees and insurance premiums.

- Higher insurance premiums: The company has increased its insurance premiums in recent years, which has contributed to increased revenue from insurance products.

- Expanded product offerings: AAA Whittier has expanded its product offerings in recent years, which has contributed to increased revenue from new products and services.

Profitability

AAA Whittier has maintained strong profitability in recent years, with a net income of over $100 million in 2022. The company’s profitability has been supported by its strong underwriting results and efficient operations.

- Strong underwriting results: AAA Whittier has a strong track record of underwriting profitability, which has contributed to its overall profitability.

- Efficient operations: The company has implemented efficient operations, which has helped to control expenses and improve profitability.

Financial Stability

AAA Whittier has a strong financial stability, with a healthy level of capital reserves and a strong track record of meeting its financial obligations. The company’s financial stability is further supported by its affiliation with AAA, which provides additional financial resources and support.

- Healthy level of capital reserves: AAA Whittier maintains a healthy level of capital reserves, which provides a buffer against unexpected losses and supports the company’s financial stability.

- Strong track record of meeting financial obligations: The company has a strong track record of meeting its financial obligations, which demonstrates its financial stability and commitment to its members.

- Affiliation with AAA: AAA Whittier’s affiliation with AAA provides additional financial resources and support, which further enhances the company’s financial stability.

Industry Trends and Competition

AAA Whittier Insurance and Member Services operates in a dynamic and competitive insurance industry. Key trends shaping the industry include the rise of digital technologies, changing consumer expectations, and increasing regulatory scrutiny.

The company faces competition from a range of insurance providers, including national carriers, regional insurers, and online-only insurers. Major competitors include State Farm, Farmers Insurance, and Geico.

Competitive Strategies

AAA Whittier Insurance and Member Services employs various strategies to address industry challenges and competition. These include:

- Leveraging technology: The company invests in digital platforms to enhance customer experience and streamline operations.

- Expanding product offerings: AAA Whittier Insurance and Member Services offers a comprehensive range of insurance products to meet diverse customer needs.

- Building strong partnerships: The company collaborates with industry partners to provide additional value to members.

Growth Opportunities

AAA Whittier Insurance and Member Services is well-positioned for future growth. The company has a strong brand reputation, a loyal customer base, and a solid financial foundation. AAA Whittier is also constantly innovating and expanding its product and service offerings.

One area of growth for AAA Whittier is new markets. The company is currently focused on expanding its reach into underserved markets, such as low-income and minority communities. AAA Whittier is also looking to grow its international presence.

Another area of growth for AAA Whittier is new products and services. The company is constantly developing new products and services to meet the needs of its customers. For example, AAA Whittier recently launched a new telematics program that allows customers to track their driving habits and earn discounts on their insurance premiums.

AAA Whittier is also committed to improving the customer experience. The company is investing in new technologies and processes to make it easier for customers to do business with AAA Whittier. For example, AAA Whittier recently launched a new mobile app that allows customers to manage their accounts, file claims, and get roadside assistance.

Financial Performance

AAA Whittier Insurance and Member Services has a strong financial foundation. The company has consistently reported strong financial results, and it has a healthy balance sheet. AAA Whittier’s financial strength allows it to invest in new growth initiatives and to provide competitive rates to its customers.

Industry Trends and Competition

The insurance industry is constantly evolving. AAA Whittier Insurance and Member Services is facing increasing competition from both traditional insurers and new entrants to the market. To remain competitive, AAA Whittier is focused on innovation, customer service, and financial strength.

Customer Testimonials and Reviews

AAA Whittier Insurance and Member Services has consistently received positive customer testimonials and reviews, highlighting the exceptional quality of services provided.

Feedback from customers indicates a high level of satisfaction with the company’s responsiveness, professionalism, and commitment to delivering tailored solutions.

Customer Satisfaction Ratings

AAA Whittier Insurance and Member Services maintains high customer satisfaction ratings across various platforms, including Trustpilot, Google My Business, and the Better Business Bureau.

Positive reviews praise the company’s efficient claims processing, knowledgeable staff, and competitive pricing.

Areas for Improvement

While the company has received overwhelmingly positive feedback, some customers have suggested areas for improvement, such as expanding online self-service options and improving communication during the claims process.

AAA Whittier Insurance and Member Services actively monitors customer feedback and takes proactive steps to address areas for improvement, ensuring continuous enhancement of its services.