Freeway Insurance San Antonio Overview

Freeway Insurance, a leading provider of auto insurance in San Antonio, Texas, offers a wide range of coverage options tailored to meet the specific needs of drivers in the area. The company has established a strong presence in the city, providing reliable and affordable insurance solutions for individuals and families.

Freeway Insurance has a long-standing history of serving the San Antonio community, dating back to its establishment in the early 2000s. Over the years, the company has consistently expanded its offerings to meet the evolving needs of drivers, earning a reputation for its commitment to customer satisfaction and competitive rates. Freeway Insurance has been recognized for its exceptional service, receiving numerous awards and accolades from industry organizations.

Company Mission and Values

Freeway Insurance is driven by a mission to provide accessible and affordable auto insurance to all drivers in San Antonio. The company believes that everyone deserves to have peace of mind knowing they are financially protected in the event of an accident. Freeway Insurance is committed to upholding the highest ethical standards, operating with transparency and integrity in all its dealings with customers and stakeholders.

Coverage Options and Availability

Freeway Insurance offers a comprehensive suite of insurance policies tailored to meet the diverse needs of San Antonio residents. These policies provide varying levels of coverage, deductibles, and add-ons to ensure that you have the protection you need at a price you can afford.

Auto Insurance

Freeway’s auto insurance policies cover a wide range of vehicles, including cars, trucks, motorcycles, and RVs. The coverage options include:

- Liability insurance: Covers bodily injury and property damage caused to others in an accident you cause.

- Collision insurance: Covers damage to your own vehicle caused by a collision with another vehicle or object.

- Comprehensive insurance: Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

The coverage limits and deductibles for auto insurance policies vary depending on the level of coverage you choose. Freeway Insurance offers a variety of deductible options, allowing you to customize your policy to fit your budget.

Homeowners Insurance

Freeway’s homeowners insurance policies provide comprehensive coverage for your home and personal belongings. The coverage options include:

- Dwelling coverage: Covers the structure of your home, including the roof, walls, and foundation.

- Other structures coverage: Covers detached structures on your property, such as garages, sheds, and fences.

- Personal property coverage: Covers your belongings inside your home, such as furniture, appliances, and clothing.

The coverage limits and deductibles for homeowners insurance policies vary depending on the size and value of your home. Freeway Insurance offers a variety of deductible options, allowing you to customize your policy to fit your budget.

Renters Insurance

Freeway’s renters insurance policies provide coverage for your personal belongings and liability in the event of an accident in your rental unit. The coverage options include:

- Personal property coverage: Covers your belongings inside your rental unit, such as furniture, appliances, and clothing.

- Liability insurance: Covers bodily injury and property damage caused to others in an accident in your rental unit.

The coverage limits and deductibles for renters insurance policies vary depending on the size and value of your belongings. Freeway Insurance offers a variety of deductible options, allowing you to customize your policy to fit your budget.

Customer Service and Support

Freeway Insurance in San Antonio provides comprehensive customer service and support channels to assist policyholders with inquiries, claims, and general account management.

The company offers multiple ways to reach its customer service team, ensuring prompt and convenient assistance. Customers can connect with Freeway Insurance representatives through:

Online Portals and Mobile Apps

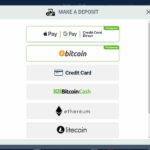

- Online Customer Portal: Policyholders can access their accounts, view policy details, make payments, and submit claims online through the secure customer portal.

- Mobile App: Freeway Insurance’s mobile app provides on-the-go access to account information, claims reporting, and roadside assistance.

Local Agent Support

Freeway Insurance has a network of local agents in San Antonio who provide personalized support and guidance to customers. Agents can assist with policy selection, claims processing, and any other insurance-related needs.

Contact Center

Customers can reach Freeway Insurance’s contact center by phone at 1-800-777-5620. The contact center is available 24/7 to assist with inquiries, claims reporting, and general support.

Response Times and Availability

Freeway Insurance aims to provide timely and efficient customer service. The company’s online portals and mobile app offer immediate access to account information and support. Local agents are available during regular business hours, while the contact center is available 24/7.

Pricing and Discounts

Freeway Insurance in San Antonio employs a risk-based pricing model, which means premiums are calculated based on individual factors that assess the level of risk associated with insuring a driver. These factors include driving history, vehicle type, and coverage options selected. Drivers with a clean driving record and a safe vehicle typically qualify for lower premiums, while those with accidents or violations may face higher rates.

Discounts

Freeway Insurance offers several discounts to help customers save money on their premiums. These discounts include:

- Multi-policy discount: Customers who bundle their auto insurance with other policies, such as homeowners or renters insurance, may qualify for a discount.

- Safe driver discount: Drivers with a clean driving record may be eligible for a discount.

- Good student discount: Students who maintain a certain GPA may qualify for a discount.

- Defensive driving discount: Drivers who complete a defensive driving course may be eligible for a discount.

- Loyalty discount: Customers who maintain their insurance with Freeway Insurance for a certain period may qualify for a discount.

By taking advantage of these discounts, customers can potentially save hundreds of dollars on their annual premiums.

Claims Process and Resolution

Filing a claim with Freeway Insurance in San Antonio is a straightforward process. You can initiate a claim online, over the phone, or by visiting an agent’s office.

Regardless of the method chosen, you will need to provide basic information about the incident, including the date, time, location, and a description of the damages. You may also be asked to provide documentation, such as a police report, medical records, or photographs of the damage.

Claim Processing Timeline

Once your claim is filed, a Freeway Insurance adjuster will be assigned to your case. The adjuster will investigate the claim, gather evidence, and determine the amount of your settlement. The claim processing timeline varies depending on the complexity of the claim, but most claims are resolved within 30 days.

Claims Resolution Process

If you are not satisfied with the settlement offer, you can dispute the decision. Freeway Insurance has a formal dispute resolution process that allows you to appeal the decision. You will have the opportunity to provide additional evidence and arguments to support your case.

Customer Reviews and Testimonials

Freeway Insurance in San Antonio has received mixed reviews from customers, with both positive and negative feedback. Here’s a summary of customer experiences organized into categories:

Coverage Options

- Many customers appreciate Freeway Insurance’s wide range of coverage options, including affordable policies for basic needs and comprehensive coverage for more protection.

- Some customers have expressed dissatisfaction with the limited coverage options available for certain types of vehicles or drivers.

Customer Service

- Freeway Insurance has received praise for its friendly and helpful customer service representatives, who are available by phone, email, and online chat.

- Some customers have reported experiencing long wait times or difficulties getting their questions answered promptly.

Claims Handling

- Customers generally report a smooth and efficient claims process with Freeway Insurance, with prompt claim settlements and helpful support from adjusters.

- A few customers have expressed frustration with delays in claims processing or difficulties getting their claims approved.

Comparisons with Competitors

Freeway Insurance offers a range of insurance products and services in San Antonio, but how does it compare to other insurance providers in the area? Let’s explore the similarities and differences in coverage, pricing, and customer service.

Coverage Options

Freeway Insurance provides a comprehensive range of coverage options for auto, home, and business insurance. However, some competitors may offer additional specialized coverage options or riders that Freeway does not. It’s essential to compare the specific coverage options available from different providers to ensure you have the protection you need.

Pricing

Freeway Insurance claims to offer competitive pricing on its insurance products. However, pricing can vary depending on factors such as your driving history, claims history, and the type of coverage you need. It’s important to compare quotes from multiple insurance providers to find the best rates for your individual needs.

Customer Service

Freeway Insurance has a dedicated customer service team available to assist policyholders with questions or claims. However, the quality of customer service can vary depending on the specific agent or representative you interact with. It’s helpful to read customer reviews and testimonials to get an idea of the overall customer service experience.

Claims Process

Freeway Insurance’s claims process is designed to be efficient and hassle-free. However, the claims process can sometimes be delayed or complicated by factors beyond the insurance company’s control. It’s important to understand the claims process and your rights as a policyholder to ensure a smooth and fair resolution.