Definition and Purpose of Fillable Certificate of Insurance

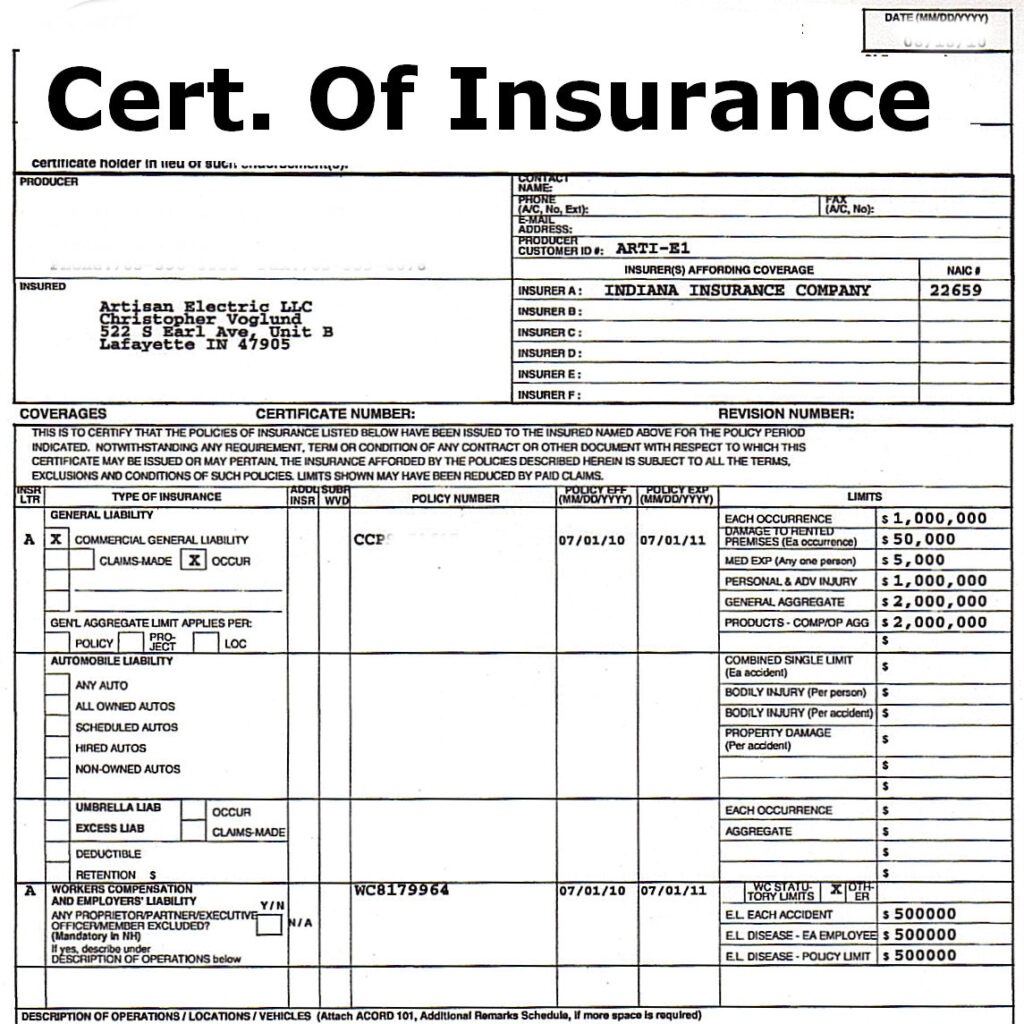

A fillable certificate of insurance is a digital or physical document that allows policyholders to easily update and share their insurance information. Unlike a standard certificate of insurance, which is typically issued by the insurance company and contains static data, a fillable certificate is designed to be customized and completed by the policyholder as needed.

The primary purpose of a fillable certificate of insurance is to provide proof of insurance to third parties, such as contractors, clients, or lenders. It is commonly used in situations where the policyholder needs to demonstrate their insurance coverage quickly and conveniently. For example, a contractor may need to provide a fillable certificate of insurance to a potential client as part of the bidding process.

Benefits of Using Fillable Certificates of Insurance

- Convenience: Fillable certificates can be completed and shared electronically, eliminating the need for physical copies or manual data entry.

- Accuracy: Policyholders can ensure that the information on the certificate is up-to-date and accurate.

- Flexibility: Fillable certificates can be customized to include additional information, such as specific coverage limits or endorsements.

- Time-saving: Fillable certificates can significantly reduce the time it takes to provide proof of insurance.

Common Uses of Fillable Certificates of Insurance

- Bidding on contracts

- Securing financing

- Providing proof of insurance to vendors or clients

- Meeting regulatory requirements

- Enrolling in insurance programs or groups

Benefits of Using Fillable Certificates of Insurance

Fillable certificates of insurance offer numerous advantages over traditional methods. They streamline insurance processes, saving time and effort while providing greater flexibility and customization options.

Convenience and Time-Saving:

- Fillable certificates can be completed online or downloaded and filled out offline, eliminating the need for manual entry and reducing the risk of errors.

- Automated processes, such as pre-populated fields and drop-down menus, accelerate the completion process.

Customization:

- Fillable certificates allow for easy customization to meet specific insurance requirements.

- Users can add or remove fields as needed, ensuring the certificate accurately reflects the coverage provided.

Streamlined Processes:

- Fillable certificates facilitate the exchange of insurance information between parties.

- They can be easily shared electronically, eliminating the need for physical delivery or mailing.

Features and Functionality of Fillable Certificates of Insurance

Fillable certificates of insurance offer a seamless and convenient way to manage your insurance documentation. They provide an intuitive platform for easily filling out, editing, and sharing your insurance information electronically.

These fillable certificates are designed with user-friendly interfaces, making it effortless to enter and update your insurance details. The editable fields allow you to customize the certificate to reflect your specific coverage and requirements.

Security Measures

To ensure the security and confidentiality of your sensitive insurance information, fillable certificates employ robust security measures. They utilize encryption technologies and secure data storage protocols to safeguard your data from unauthorized access and breaches.

How to Fill Out and Use Fillable Certificates of Insurance

Filling out and using fillable certificates of insurance is a straightforward process that can be completed in a few simple steps. By following these steps and best practices, you can ensure that your certificate is accurate, valid, and meets the requirements of the requesting party.

Step 1: Download and Open the Fillable Certificate

To begin, download the fillable certificate of insurance template from the insurance provider’s website or through an online service. Once downloaded, open the certificate using a PDF reader or editor that supports fillable forms.

Step 2: Enter Data and Customize Fields

The fillable certificate will typically include fields for you to enter information such as the policyholder’s name, address, policy number, coverage details, and additional insured parties. Carefully review the certificate and fill in all required fields accurately.

Some fillable certificates may also allow you to customize certain fields, such as the certificate holder’s name or the effective and expiration dates. Make any necessary customizations to ensure the certificate meets your specific needs.

Step 3: Attach Supporting Documents

If required, you may need to attach supporting documents to the fillable certificate. These documents could include a copy of the insurance policy, a schedule of values, or a loss run. To attach a document, simply click on the designated field in the certificate and select the file from your computer.

Step 4: Review and Sign

Once you have completed filling out the fillable certificate, carefully review all the information to ensure it is accurate and complete. If you notice any errors, correct them before signing the certificate.

Once you are satisfied with the certificate, sign it electronically or physically, depending on the requirements of the requesting party.

Best Practices

- Use a PDF reader or editor that supports fillable forms.

- Enter data accurately and completely.

- Customize fields as needed to meet your specific requirements.

- Attach supporting documents if required.

- Review the certificate carefully before signing.

- Keep a copy of the signed certificate for your records.

Integration with Insurance Management Systems

Fillable certificates of insurance can be seamlessly integrated with insurance management systems (IMSs), providing a range of benefits that enhance efficiency and accuracy in insurance operations.

Integration with IMSs enables automated data entry, eliminating manual processes and reducing the risk of errors. The data from fillable certificates can be automatically imported into the IMS, saving time and resources while ensuring that the information is accurate and up-to-date.

Benefits of Integration

- Automated data entry reduces manual effort and minimizes errors.

- Improved efficiency frees up staff for more strategic tasks.

- Enhanced accuracy ensures that insurance information is always current and reliable.

Software Solutions

Several software solutions offer integration capabilities for fillable certificates of insurance. These solutions provide a seamless connection between the fillable certificates and the IMS, ensuring that data flows effortlessly between the two systems.

Legal Considerations and Compliance

Fillable certificates of insurance have significant legal implications and compliance requirements. It’s crucial to understand these aspects to ensure accuracy, authenticity, and compliance with industry regulations.

Importance of Accuracy and Authenticity

Fillable certificates of insurance are legally binding documents that provide proof of insurance coverage. The information provided on these certificates must be accurate and authentic to avoid potential disputes or legal liabilities. Inaccurate or fraudulent information can lead to insurance coverage denial, financial penalties, and even criminal charges.

Compliance with Industry Regulations

Insurance companies and regulatory bodies have established specific regulations and guidelines for fillable certificates of insurance. These regulations may vary depending on the jurisdiction and industry. It’s essential to be aware of these regulations and ensure that the certificates comply with them to avoid legal issues and maintain insurance coverage.

Examples and Case Studies

Fillable certificates of insurance have gained widespread adoption across various industries, demonstrating their versatility and effectiveness in streamlining insurance management processes. Here are some real-world examples and case studies that illustrate the benefits and challenges encountered:

In the construction industry, a leading general contractor implemented fillable certificates of insurance to streamline the collection and verification of insurance coverage from subcontractors. This resulted in significant time savings, reduced errors, and improved compliance with insurance requirements.

Challenges and Lessons Learned

- One challenge was ensuring that all subcontractors had access to the fillable forms and understood how to complete them accurately.

- Another challenge was integrating the fillable certificates with the contractor’s existing insurance management system to automate the process further.

- However, by working closely with subcontractors and leveraging technology, the contractor successfully overcame these challenges and realized substantial benefits.