Types of Farmers Life Insurance Rates

Farmers life insurance rates can vary depending on several factors, including the type of policy, the age of the farmer, and the size of the farm. There are two main types of farmers life insurance rates: term life insurance and whole life insurance.

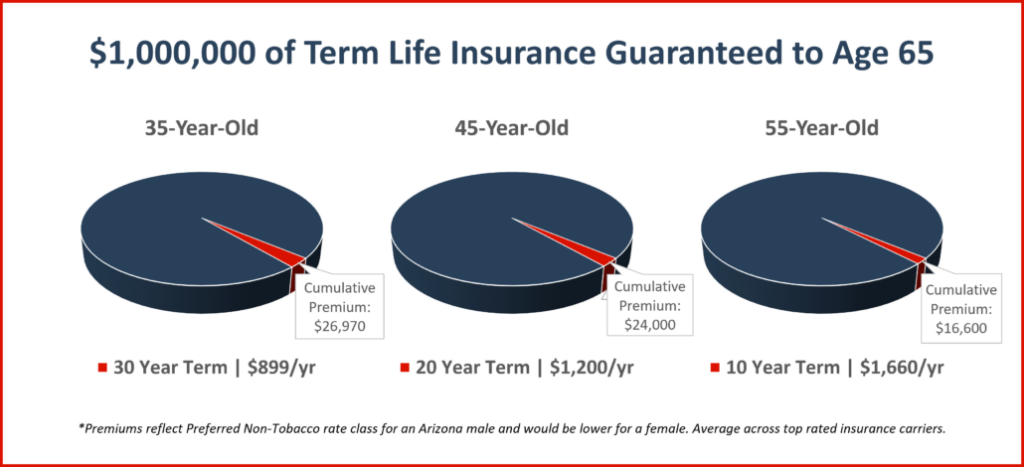

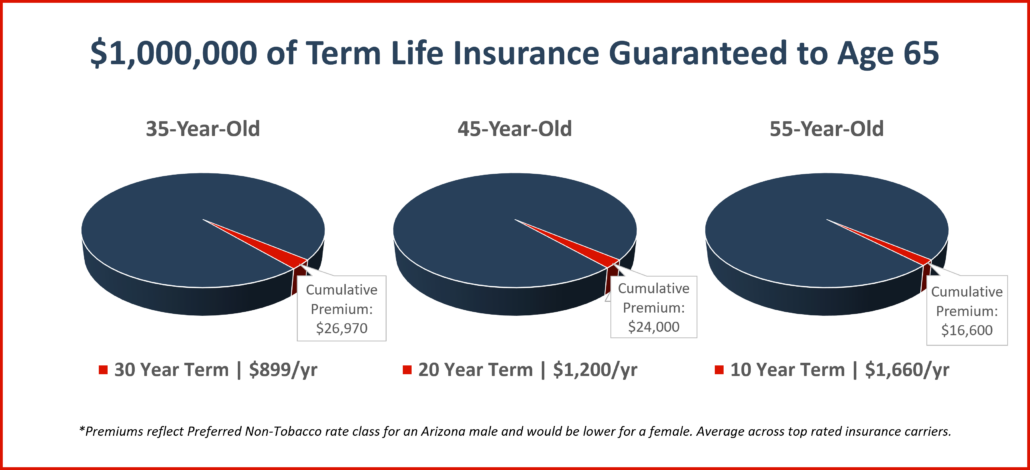

Term life insurance is a temporary policy that provides coverage for a specific period of time, such as 10, 20, or 30 years. If the farmer dies during the term of the policy, the beneficiaries will receive the death benefit. However, if the farmer outlives the term of the policy, the policy will expire and there will be no payout.

Whole life insurance is a permanent policy that provides coverage for the entire life of the farmer. The premiums for whole life insurance are typically higher than the premiums for term life insurance, but the policy will never expire and the beneficiaries will always receive the death benefit.

Factors Affecting Farmers Life Insurance Rates

In addition to the type of policy, there are several other factors that can affect farmers life insurance rates, including:

- The age of the farmer

- The size of the farm

- The health of the farmer

- The occupation of the farmer

- The location of the farm

Factors Affecting Farmers Life Insurance Rates

Farmers life insurance rates are influenced by a multitude of factors, ranging from the individual’s age and health to the type of farming operation and location. Understanding these factors can help farmers make informed decisions about their coverage and ensure they have adequate protection in place.

Age and Health

Age and health play a significant role in determining life insurance premiums. Younger and healthier individuals generally qualify for lower rates, as they pose a lower risk to the insurer. As individuals age or develop health conditions, their premiums may increase to reflect the increased risk of mortality.

Type of Farming Operation

The type of farming operation also affects insurance rates. Farmers involved in high-risk activities, such as operating heavy machinery or handling livestock, may face higher premiums than those engaged in less hazardous tasks. Insurers consider the potential for accidents and injuries when setting rates.

Location

The location of the farming operation can also influence rates. Farmers operating in areas with higher crime rates or natural disaster risks may pay higher premiums to account for the increased potential for loss. Insurers assess the environmental and socioeconomic factors of the area to determine the appropriate risk profile.

Coverage Amount

The amount of coverage purchased also affects the premium. Higher coverage amounts result in higher premiums, as they represent a greater financial risk to the insurer. Farmers should carefully consider their coverage needs and balance them against the cost of insurance.

Deductibles and Riders

Deductibles and riders can also impact insurance rates. Higher deductibles, which represent the amount the farmer pays out of pocket before insurance coverage begins, can lower premiums. Riders, which provide additional coverage for specific events or circumstances, can increase premiums. Farmers should carefully consider the benefits and costs of these options.

Comparison of Farmers Life Insurance Rates

Comparing life insurance rates offered by different insurance companies is crucial to find the best coverage at an affordable price. The premiums vary depending on factors like age, health, coverage amount, and policy type. It’s important to compare quotes from multiple insurers to make an informed decision.

Here are some key considerations when comparing rates:

- Coverage amount: The amount of life insurance coverage you need will impact the premium you pay.

- Policy type: Term life insurance, whole life insurance, and universal life insurance have different premium structures.

- Age and health: Younger and healthier individuals typically pay lower premiums than older or less healthy individuals.

- Occupation: Certain high-risk occupations may result in higher premiums.

- Insurance company: Different insurance companies have their own underwriting criteria and pricing models.

To compare rates effectively, you can use online quote comparison tools or consult with an insurance agent. By providing information about your specific needs and circumstances, you can get personalized quotes and compare them side-by-side.

Coverage Options for Farmers Life Insurance

Farmers life insurance policies offer a range of coverage options to meet the unique needs of agricultural professionals. These options include:

Term Life Insurance:

– Provides coverage for a specific period, such as 10, 20, or 30 years.

– Premiums are typically lower than other options, making it a cost-effective choice for younger farmers.

– However, there is no cash value accumulation or death benefit beyond the term period.

Whole Life Insurance:

– Provides coverage for the entire life of the insured.

– Premiums are higher than term life insurance, but build cash value over time.

– The cash value can be borrowed against or withdrawn, providing financial flexibility.

Universal Life Insurance:

– Offers a flexible premium structure, allowing policyholders to adjust their premiums and coverage amounts as their needs change.

– Premiums are typically higher than term life insurance but lower than whole life insurance.

– Cash value accumulation is based on the policy’s performance and interest rates.

Variable Life Insurance:

– Similar to universal life insurance, but the cash value is invested in mutual funds or other investment options.

– Premiums and death benefits fluctuate based on the performance of the investments.

– Potential for higher returns but also carries higher risk.

Each coverage option has its own benefits and limitations, so it’s important for farmers to carefully consider their individual needs and financial situation before selecting a policy.

Tips for Finding Affordable Farmers Life Insurance

Finding affordable life insurance as a farmer can be challenging, but it’s crucial to protect your family’s financial future. Here are some tips to help you find the best coverage at a price you can afford:

Compare Quotes from Multiple Insurers

Don’t settle for the first quote you receive. Get quotes from several different insurers to compare rates and coverage options. Online comparison tools can simplify this process.

Increase Your Deductible

Similar to health insurance, raising your life insurance deductible can lower your premiums. Consider a higher deductible if you’re comfortable with the financial risk.

Maintain a Healthy Lifestyle

Insurers offer lower rates to individuals who maintain a healthy lifestyle. This includes avoiding tobacco use, eating a balanced diet, and exercising regularly.

Negotiate with Your Insurer

Don’t be afraid to negotiate with your insurer. If you have a good driving record or a history of good health, you may be eligible for discounts or lower premiums.

Consider Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10 or 20 years. It’s generally more affordable than permanent life insurance, which covers you for your entire life.

Importance of Farmers Life Insurance

Farmers life insurance is crucial for protecting the financial well-being of farmers and their families. In the event of an untimely demise, it ensures that the farm and family are financially secure.

Farmers often face unique risks and challenges, such as natural disasters, accidents, and health issues. Life insurance provides a safety net, ensuring that the family can maintain their livelihood and pay off any outstanding debts or expenses. It also helps cover funeral costs, which can be a significant financial burden.