Industry Overview

Farmers insurance agency owners are a vital part of the insurance industry, providing a wide range of insurance products and services to individuals, families, and businesses. They work closely with clients to assess their needs and develop tailored insurance plans that meet their specific requirements.

As of 2023, there are approximately 10,000 farmers insurance agency owners operating in the United States. They are located in all 50 states and represent a significant portion of the insurance industry’s workforce. The growth potential for farmers insurance agency owners is expected to remain strong in the coming years, as the demand for insurance products and services continues to grow.

Growth Potential

The growth potential for farmers insurance agency owners is driven by a number of factors, including:

– The increasing population of the United States

– The growing number of businesses

– The rising cost of insurance premiums

– The increasing awareness of the importance of insurance

As a result of these factors, the demand for insurance products and services is expected to continue to grow in the coming years, which will create new opportunities for farmers insurance agency owners.

Salary Structure

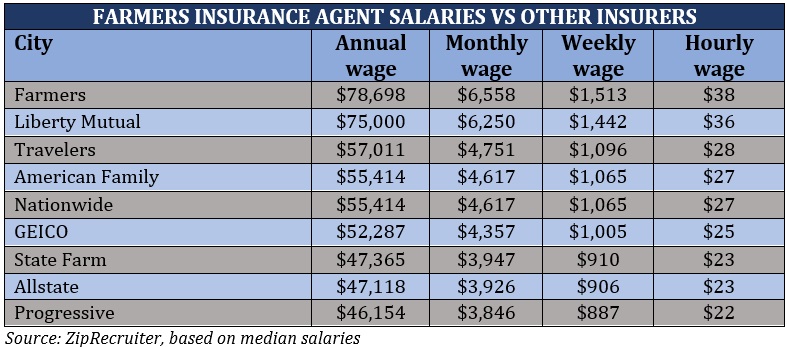

Farmers insurance agency owners’ salaries comprise a blend of base salary, commissions, and bonuses, with each component playing a crucial role in determining their overall compensation.

The base salary provides a steady foundation, while commissions offer the potential for significant earnings based on agency performance. Bonuses reward exceptional results and incentivize ongoing success.

Experience and Location

Experience is a key factor influencing salary levels. Agency owners with more experience typically command higher base salaries and have a proven track record of success, which translates into increased commission earnings.

Location also plays a role, with agency owners in larger metropolitan areas generally earning more than those in smaller towns or rural areas. This reflects the higher cost of living and increased competition in urban markets.

Agency Performance

Agency performance is a major determinant of commission earnings. Agencies that consistently meet or exceed sales targets and provide excellent customer service are rewarded with higher commissions.

Conversely, agencies that underperform may face reduced commissions, impacting the overall salary of the agency owner.

Salary Range

The salary range for farmers insurance agency owners varies widely depending on experience, location, and agency performance. Entry-level agency owners can expect to earn a base salary in the range of $50,000 to $70,000, with the potential to earn additional income through commissions and bonuses.

Experienced agency owners with a proven track record of success can earn base salaries exceeding $100,000, with the potential for total compensation well into the six figures.

Benefits and Perks

Farmers Insurance Agency owners enjoy a comprehensive benefits package that includes health insurance, retirement plans, and paid time off. These benefits and perks are designed to attract and retain top talent, and they compare favorably to those offered by other insurance companies.

Health Insurance

Farmers Insurance Agency owners are eligible for comprehensive health insurance coverage that includes medical, dental, and vision care. The plans offered by Farmers Insurance are competitive with those offered by other insurance companies, and they provide peace of mind for owners and their families.

Retirement Plans

Farmers Insurance Agency owners have access to a variety of retirement plans, including 401(k) plans and profit-sharing plans. These plans allow owners to save for their future and take advantage of tax-deferred growth. The retirement plans offered by Farmers Insurance are comparable to those offered by other insurance companies, and they provide a secure foundation for owners’ financial future.

Paid Time Off

Farmers Insurance Agency owners are eligible for paid time off, including vacation days, sick days, and personal days. The amount of paid time off varies depending on the owner’s years of service, but it is generally comparable to that offered by other insurance companies. Paid time off allows owners to take time off to rest and recharge, and it helps to prevent burnout.

Career Path

Farmers Insurance Agency owners typically begin their careers as agents. With experience and success, they may advance to management roles, such as agency manager or district manager. Some agency owners may even go on to become regional vice presidents or national sales directors.

To advance within the organization, Farmers Insurance Agency owners typically need to have strong sales and marketing skills, as well as a deep understanding of the insurance industry. They also need to be able to effectively manage a team of agents and provide excellent customer service.

Examples of Successful Career Paths

- John Smith started his career as an agent with Farmers Insurance in 2005. Within five years, he was promoted to agency manager. In 2015, he became a district manager. Today, John is a regional vice president for Farmers Insurance.

- Jane Doe began her career with Farmers Insurance in 2008 as an agent. In 2012, she was promoted to agency manager. In 2017, she became a national sales director for Farmers Insurance.

Market Trends

The insurance industry is constantly evolving, and these trends are having a significant impact on farmers insurance agency owners.

One of the most important trends is the rise of digital insurance. In the past, people had to go through an insurance agent to get coverage. However, today, there are a number of online insurance companies that allow people to get coverage directly. This has made it easier and more convenient for people to get the insurance they need.

Another trend that is impacting farmers insurance agency owners is the increasing demand for personalized insurance products. In the past, insurance companies offered a one-size-fits-all approach to insurance. However, today, people are looking for insurance products that are tailored to their specific needs. This has led to the development of a number of new insurance products that are designed to meet the needs of specific groups of people.

Adapting to the Changing Market

These trends are having a significant impact on the future of farmers insurance agency owners. In order to succeed in the future, farmers insurance agency owners will need to adapt to these changes.

One way that farmers insurance agency owners can adapt to the changing market is to embrace digital technology. By using digital tools, farmers insurance agency owners can make it easier for people to get coverage. They can also use digital tools to provide personalized insurance products that meet the needs of specific groups of people.

Another way that farmers insurance agency owners can adapt to the changing market is to focus on providing excellent customer service. By providing excellent customer service, farmers insurance agency owners can build relationships with their clients and earn their trust. This will help them to retain clients and grow their businesses.