Concealed Carry Insurance Types

Concealed carry insurance protects individuals who carry concealed weapons from potential legal and financial liabilities arising from self-defense shootings. Various types of concealed carry insurance offer different coverage options, premiums, and deductibles.

There are three main types of concealed carry insurance:

Occurrence-Based Coverage

Occurrence-based coverage provides protection for incidents that occur during the policy period, regardless of when the claim is filed. This type of coverage is typically more comprehensive and offers higher limits of liability.

Claims-Made Coverage

Claims-made coverage only provides protection for incidents that are reported to the insurance company during the policy period. This type of coverage is typically less expensive than occurrence-based coverage, but it can be more restrictive.

Combination Coverage

Combination coverage provides a combination of occurrence-based and claims-made coverage. This type of coverage offers the best of both worlds, but it can also be more expensive than either type of coverage on its own.

The following table compares the coverage, premiums, and deductibles of different types of concealed carry insurance:

| Type of Coverage | Coverage | Premiums | Deductibles |

|---|---|---|---|

| Occurrence-Based | Incidents that occur during the policy period | Higher | Higher |

| Claims-Made | Incidents that are reported during the policy period | Lower | Lower |

| Combination | Combination of occurrence-based and claims-made coverage | Higher | Higher |

Factors to Consider When Choosing Concealed Carry Insurance

Choosing concealed carry insurance is crucial for protecting yourself and your firearm. Here are the key factors to consider:

Coverage Limits

Determine the maximum amount the policy will pay for legal expenses, medical bills, and other covered costs. Higher limits provide more comprehensive protection.

Deductibles

A deductible is the amount you must pay out-of-pocket before the insurance kicks in. Lower deductibles offer quicker access to coverage, but higher deductibles can reduce your premium.

Exclusions

Review the policy carefully to identify any exclusions or limitations that may apply to your specific circumstances. Common exclusions include intentional acts, criminal activity, and certain types of weapons.

Company Reputation and Financial Stability

Research the insurance company’s reputation and financial stability. Choose a company with a strong track record of paying claims and providing reliable customer service.

Additional Features

Some policies offer additional features such as training reimbursement, coverage for borrowed firearms, or accidental discharge protection. Consider your specific needs and preferences when evaluating these features.

Concealed Carry Insurance Coverage

Concealed carry insurance provides financial protection for individuals who carry concealed weapons. It typically covers expenses related to legal defense, medical treatment, and property damage in the event of a self-defense shooting.

Covered Expenses

- Legal defense costs: This includes expenses for attorneys, court fees, and expert witnesses in criminal or civil lawsuits related to the use of a concealed weapon in self-defense.

- Medical expenses: Insurance may cover medical costs for the policyholder, any innocent bystanders injured, and even the person who was shot in self-defense.

- Property damage: Coverage may extend to damage to property caused by the use of a concealed weapon in self-defense, such as damage to the policyholder’s firearm or the property of others.

Limitations and Exclusions

While concealed carry insurance provides valuable protection, it is important to be aware of potential limitations and exclusions. Some policies may not cover:

- Intentional acts or criminal conduct

- Self-defense shootings outside the policyholder’s state of residence

- Injuries or damages resulting from negligent or reckless use of a firearm

- Punitive damages

It is crucial to carefully review the policy terms and conditions to understand the specific coverage and limitations of your insurance policy.

Comparison of Coverage

The following table summarizes the coverage offered by different concealed carry insurance policies:

| Policy | Legal Defense | Medical Expenses | Property Damage |

|---|---|---|---|

| Policy A | $250,000 | $50,000 | $10,000 |

| Policy B | $500,000 | $100,000 | $25,000 |

| Policy C | $1,000,000 | $250,000 | $50,000 |

Choosing the right concealed carry insurance policy depends on your individual needs and risk tolerance. It is advisable to compare coverage, limitations, and premiums before making a decision.

Concealed Carry Insurance Costs

Concealed carry insurance (CCI) costs vary based on several factors, including the insured’s age, experience, and location. Generally, younger and less experienced shooters pay higher premiums than older and more experienced individuals. Additionally, residents of states with stricter gun laws often pay higher premiums than those in states with more lenient laws.

Tips for Finding Affordable Concealed Carry Insurance

* Shop around and compare quotes from multiple insurance companies.

* Consider increasing your deductible to lower your premiums.

* Take a concealed carry training course to demonstrate your proficiency and potentially qualify for discounts.

* Bundle your CCI policy with other insurance policies, such as homeowners or renters insurance, to save money.

Table of Concealed Carry Insurance Premiums

The following table compares the annual premiums for different concealed carry insurance policies:

| Insurance Company | Premium Range |

|—|—|

| USCCA | $120-$250 |

| NRA | $90-$200 |

| NSSF | $100-$225 |

| Lockton | $110-$240 |

| CCW Safe | $125-$260 |

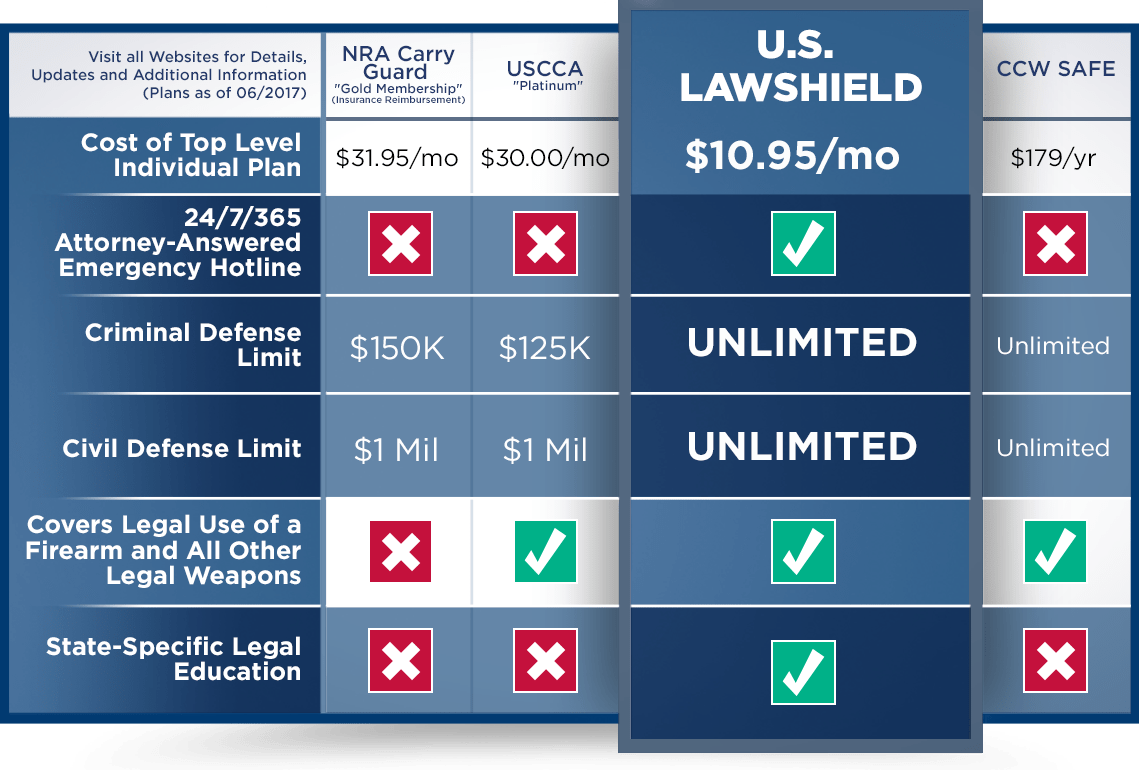

Concealed Carry Insurance Companies

Identifying the right concealed carry insurance provider is crucial. Different companies offer varying coverage, premiums, and customer service levels. Understanding the leading providers and their offerings can help you make an informed decision.

Top Concealed Carry Insurance Companies

- USCCA (United States Concealed Carry Association): USCCA offers comprehensive coverage with various plans and benefits, including legal defense, medical expenses, and bail bonds.

- CCW Safe (Concealed Carry Weapon Safe): CCW Safe provides a range of coverage options, including legal defense, bail bonds, and firearms coverage. It also offers discounts for multiple policies and membership in the National Rifle Association (NRA).

- NRA Carry Guard: NRA Carry Guard is offered through the National Rifle Association. It provides legal defense, firearms coverage, and discounts on firearms-related products and services.

- Armed Citizens Legal Defense Network (ACLDN): ACLDN offers legal defense coverage for self-defense shootings. It also provides training and educational resources for concealed carry permit holders.

- CarryGuard: CarryGuard provides legal defense, firearms coverage, and medical expenses coverage. It offers a variety of plans with different coverage limits and premiums.

Comparison of Coverage, Premiums, and Customer Service

| Company | Coverage | Premiums | Customer Service |

|---|---|---|---|

| USCCA | Comprehensive coverage | Higher premiums | Excellent customer service |

| CCW Safe | Various coverage options | Competitive premiums | Good customer service |

| NRA Carry Guard | Legal defense, firearms coverage | Moderate premiums | Average customer service |

| ACLDN | Legal defense coverage | Lower premiums | Limited customer service |

| CarryGuard | Legal defense, firearms coverage, medical expenses | Competitive premiums | Good customer service |

Ultimately, the best concealed carry insurance company for you will depend on your specific needs and budget. It’s recommended to compare different providers, read reviews, and consult with a licensed insurance agent to find the right policy for you.