Spokane, Washington Car Insurance Market Overview

Spokane, Washington is the second-largest city in the state and has a thriving car insurance market. The market is expected to continue to grow in the coming years, driven by the city’s growing population and increasing number of vehicles on the road.

There are a number of major players in the Spokane car insurance market, including Allstate, Geico, Progressive, and State Farm. These companies offer a variety of coverage options and discounts to meet the needs of drivers in the area.

Spokane Car Insurance Rates

The average cost of car insurance in Spokane is $1,023 per year, which is slightly higher than the national average of $983. However, rates can vary depending on a number of factors, including the driver’s age, driving history, and type of vehicle.

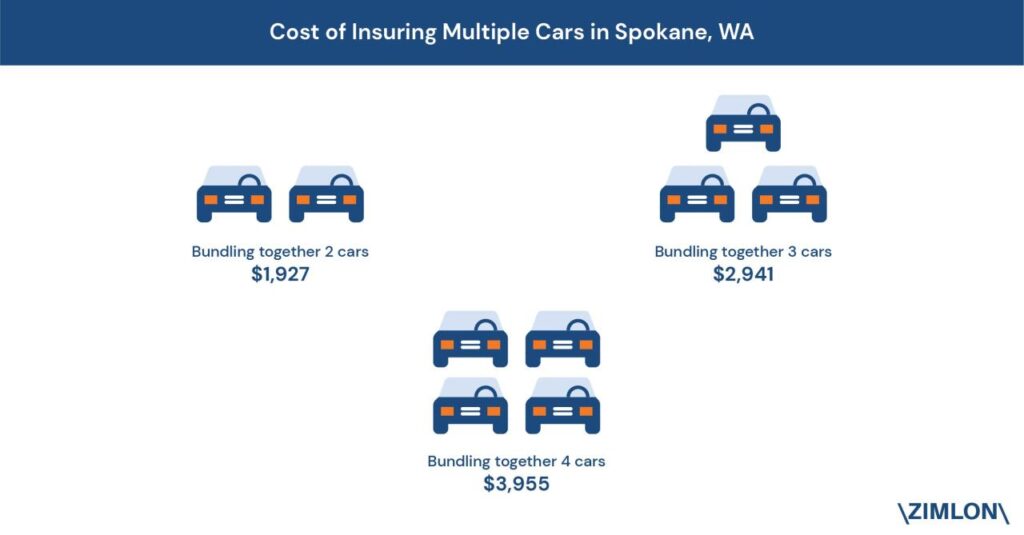

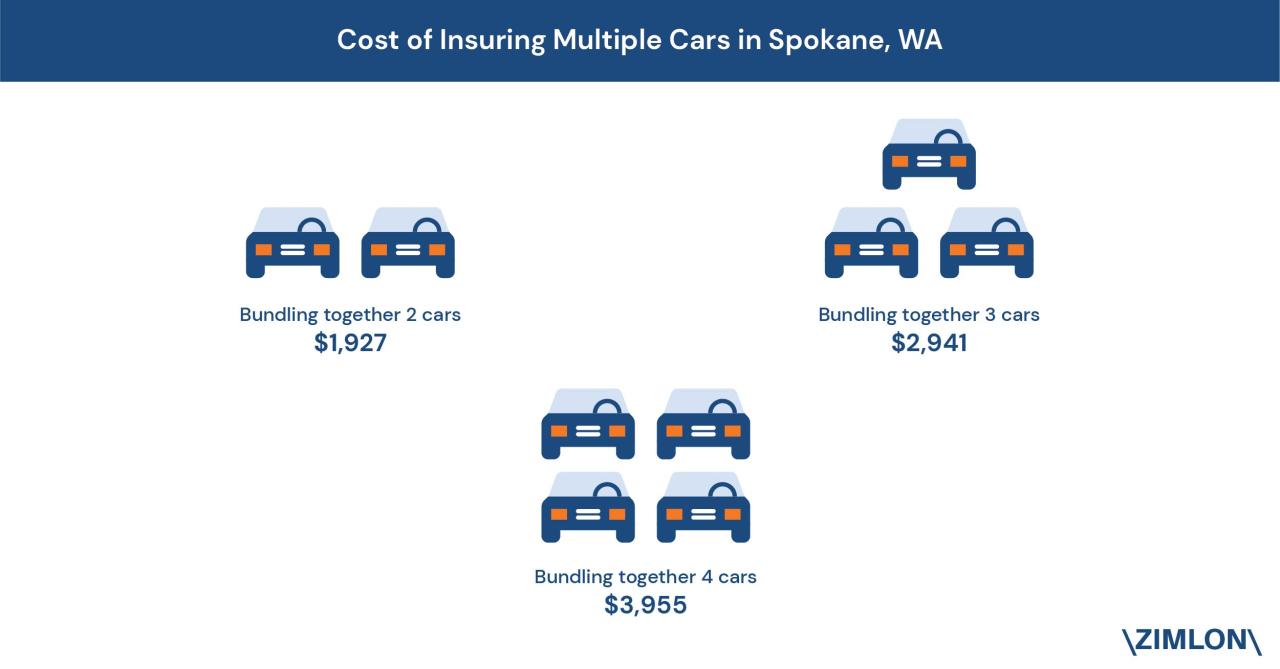

Drivers in Spokane can save money on their car insurance by shopping around and comparing quotes from different companies. They can also take advantage of discounts for things like good driving records, multiple vehicles, and homeowners insurance.

Spokane Car Insurance Laws

Washington state requires all drivers to have liability insurance. The minimum liability limits are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

Drivers in Spokane can also choose to purchase additional coverage, such as collision, comprehensive, and uninsured/underinsured motorist coverage.

Factors Affecting Car Insurance Rates in Spokane, WA

Car insurance rates in Spokane, WA, are influenced by a multitude of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

One of the most significant factors that affect car insurance rates is your driving history. Drivers with a clean driving record, free of accidents or traffic violations, typically qualify for lower rates. Conversely, drivers with a history of accidents or traffic violations will likely pay higher premiums.

Vehicle Type

The type of vehicle you drive also plays a role in determining your car insurance rates. Generally, vehicles that are more expensive to repair or replace, such as luxury cars or sports cars, will have higher insurance premiums. Additionally, vehicles with poor safety ratings or high theft rates may also result in higher insurance costs.

Age

Age is another factor that insurance companies consider when setting rates. Younger drivers, typically those under the age of 25, are statistically more likely to be involved in accidents and therefore pay higher insurance premiums. As drivers age and gain experience, their insurance rates typically decrease.

Location

The location where you live can also impact your car insurance rates. Drivers who live in areas with high crime rates or frequent accidents tend to pay higher premiums. This is because insurance companies view these areas as being riskier and therefore charge higher rates to offset the potential costs of claims.

Types of Car Insurance Coverage Available in Spokane, WA

Car insurance policies in Spokane, WA offer a range of coverage options to protect drivers against various financial risks associated with owning and operating a vehicle. Understanding the different types of coverage available is crucial for making informed decisions and tailoring a policy that meets your specific needs.

The following are the primary types of car insurance coverage available in Spokane, WA:

Liability Coverage

- Bodily Injury Liability: Covers expenses related to injuries or death caused to others in an accident you are at fault for.

- Property Damage Liability: Covers damages to property belonging to others, such as vehicles or structures, in an accident you are at fault for.

Collision Coverage

Provides coverage for damages to your own vehicle in an accident, regardless of who is at fault.

Comprehensive Coverage

Covers damages to your vehicle caused by non-collision events, such as theft, vandalism, fire, or weather-related incidents.

Uninsured/Underinsured Motorist Coverage

- Uninsured Motorist Coverage: Provides coverage if you are involved in an accident with a driver who does not have insurance.

- Underinsured Motorist Coverage: Provides coverage if you are involved in an accident with a driver who has insufficient insurance to cover your damages.

Medical Payments Coverage

Covers medical expenses for you and your passengers, regardless of who is at fault for the accident.

Personal Injury Protection (PIP)

Provides coverage for medical expenses, lost wages, and other costs associated with injuries sustained in an accident, regardless of who is at fault.

Finding the Best Car Insurance Policy in Spokane, WA

Finding the best car insurance policy in Spokane, WA, requires research and comparison. Follow these steps to secure the optimal coverage at a competitive price:

Compare Quotes from Multiple Insurers

Obtain quotes from several insurance companies to compare premiums and coverage options. Use online comparison tools or contact agents directly. Consider factors like deductibles, coverage limits, and discounts.

Negotiate with Insurers

Once you have a few quotes, negotiate with insurers to lower your premium. Inquire about discounts for good driving history, multiple policies, and safety features in your vehicle. Be prepared to provide supporting documentation to qualify for discounts.

Special Considerations for Car Insurance in Spokane, WA

Spokane, Washington, presents unique factors that can influence car insurance rates. Understanding these considerations is crucial for securing the right coverage at the most competitive price.

Weather Conditions

Spokane experiences extreme weather conditions, including heavy snowfall, icy roads, and windstorms. These conditions can increase the risk of accidents, leading to higher insurance premiums. Drivers should consider comprehensive coverage to protect their vehicles from weather-related damage.

State-Specific Laws and Regulations

Washington State has specific laws and regulations that impact car insurance. These include:

- Fault-based system: Washington follows a fault-based system, where the at-fault driver is responsible for damages.

- Minimum coverage requirements: Washington requires all drivers to carry liability insurance, covering bodily injury and property damage.

- Uninsured motorist coverage: Uninsured motorist coverage is mandatory in Washington, protecting drivers from accidents caused by uninsured or underinsured motorists.