Understanding Gap Insurance

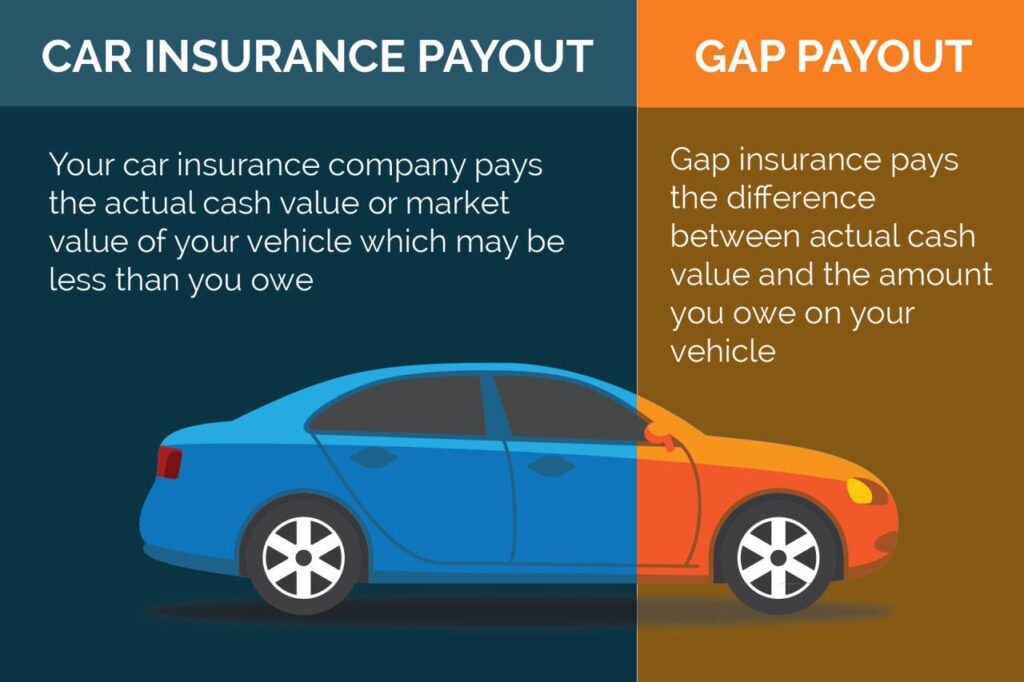

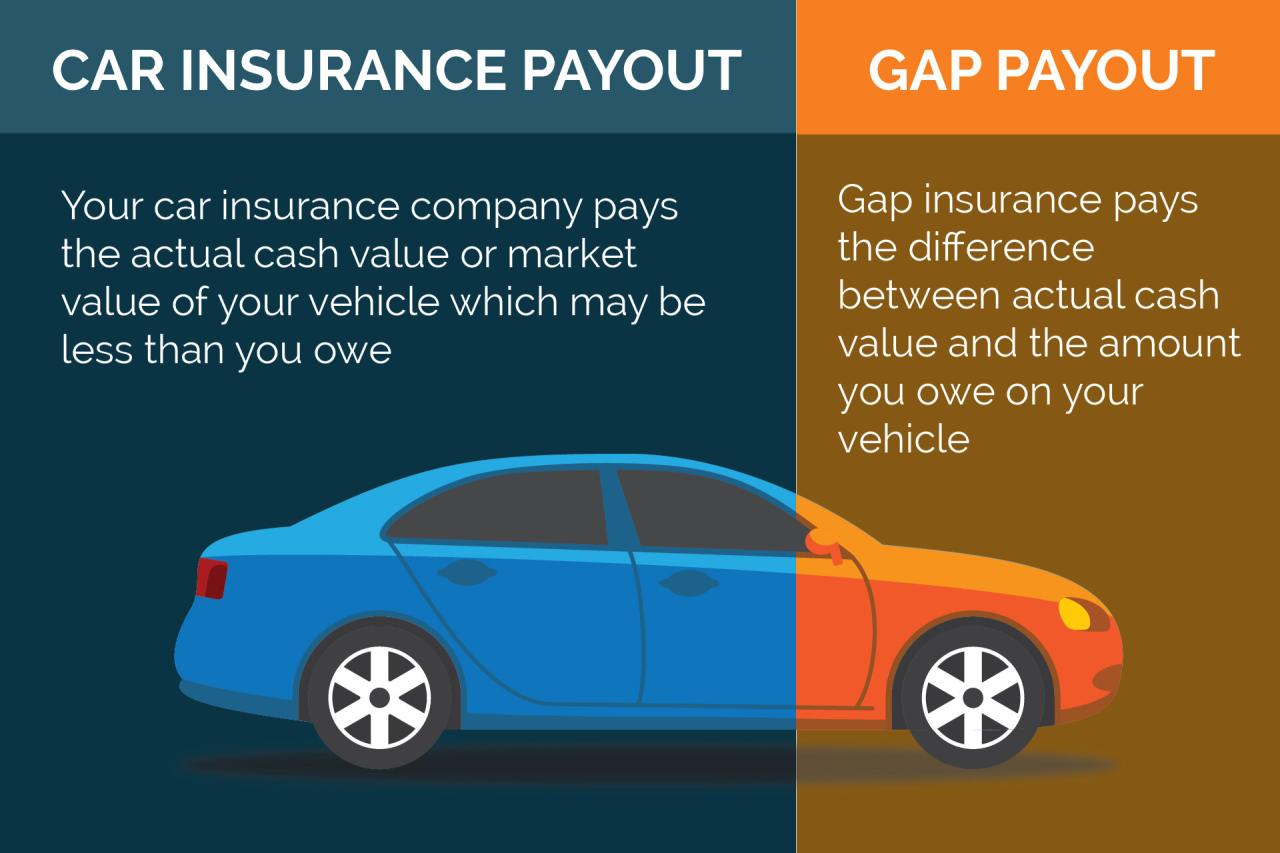

Gap insurance is an optional coverage that helps protect you from financial loss if your car is totaled or stolen. It covers the difference between the actual cash value of your car and the amount you owe on your loan or lease.

Gap insurance is especially beneficial if you have a new car or a car that is worth less than you owe on it. This is because the actual cash value of a car depreciates quickly over time. If your car is totaled or stolen, you could be left owing more on your loan than the insurance company will pay out.

The cost of gap insurance varies depending on the value of your car, the amount you owe on your loan, and the length of your loan term. Gap insurance is typically more expensive for new cars and cars that are worth less than you owe on them.

Factors that Affect Gap Insurance Premiums

The following factors can affect the cost of gap insurance:

- The value of your car

- The amount you owe on your loan

- The length of your loan term

- Your credit score

- Your driving record

Reasons for Cancelling Gap Insurance

Individuals may consider cancelling gap insurance for various reasons. One common reason is when they have paid off a significant portion of their car loan and the gap between the car’s value and the loan balance has narrowed.

Another reason for cancelling gap insurance is when the vehicle’s value has depreciated to a point where the gap coverage is no longer necessary. For example, if the car is several years old and has lost a substantial amount of its value, the gap coverage may not be worth the cost.

Financial Implications

Cancelling gap insurance can have financial implications. If the vehicle is totalled or stolen, the individual may be responsible for paying the difference between the car’s value and the loan balance. This can result in a significant financial loss, especially if the gap between the car’s value and the loan balance is substantial.

Risks Associated with Cancelling

Cancelling gap insurance can also carry risks. If the vehicle is totalled or stolen shortly after the gap insurance is cancelled, the individual may be left with a large financial burden. Additionally, if the individual refinances the car loan, they may not be able to obtain gap insurance coverage on the new loan.

Process for Cancelling Gap Insurance

Cancelling gap insurance typically involves the following steps:

- Contact your insurance provider. You can usually do this by phone, email, or mail.

- Provide your policy number and the reason for cancellation.

- Submit the required documentation, such as a copy of your loan statement or a letter from your lender.

- Pay any applicable cancellation fees.

Alternatives to Gap Insurance

While gap insurance provides a valuable layer of protection, it may not be the most suitable option for everyone. Consider the following alternatives to gap insurance, each with its unique benefits and drawbacks:

Extended Warranties

Extended warranties offer coverage beyond the manufacturer’s original warranty, typically extending the coverage period and including additional components. These warranties can provide peace of mind by covering unexpected repairs or replacements. However, they can be expensive and may not cover all potential losses.

Savings Plans

Establishing a savings plan specifically for unexpected car expenses can provide a more flexible and cost-effective alternative to gap insurance. By regularly setting aside a certain amount, you can accumulate funds to cover potential losses or unexpected repairs. However, this requires discipline and consistency in saving, and it may not provide immediate coverage.

Choosing the Most Suitable Option

The best alternative to gap insurance depends on your individual circumstances and financial situation. Consider the following factors when making your decision:

- Financial situation: Can you afford the upfront cost of an extended warranty or the regular contributions to a savings plan?

- Driving habits: Are you likely to have a car accident or experience significant mechanical issues?

- Car value: Is your car worth more than you owe on it?

- Personal preferences: Do you prefer the peace of mind of an extended warranty or the flexibility of a savings plan?

By carefully evaluating these factors, you can choose the alternative to gap insurance that best meets your needs and provides the appropriate level of protection.