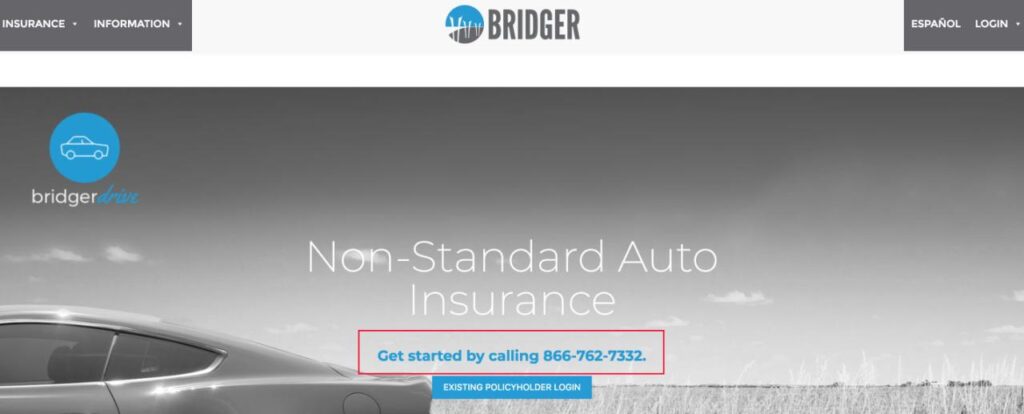

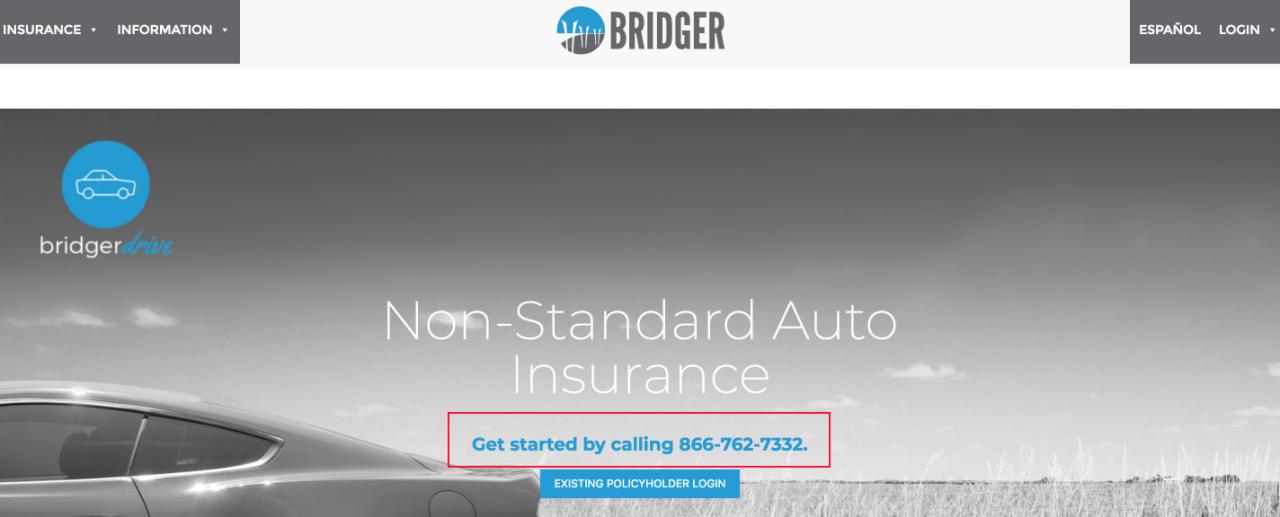

Phone Number Identification

Insurance claims can be a stressful and confusing process, especially when you’re trying to figure out who to contact. That’s why it’s important to have a dedicated phone number for insurance claims.

Most insurance companies have a separate phone number for claims reporting. This number is typically listed on the company’s website, insurance card, and other policy documents. Having a dedicated claims phone number makes it easy to get in touch with the right person quickly and efficiently.

Phone Number Display

The way that insurance companies display their claims phone numbers varies. Some companies use a toll-free number, while others use a local number. There are pros and cons to both options.

- Toll-free numbers are easy to remember and can be called from anywhere in the country. However, they can also be more expensive for insurance companies to maintain.

- Local numbers are typically less expensive for insurance companies to maintain, but they can be more difficult to remember and may require you to pay long-distance charges if you’re calling from out of the area.

Call Center Operations

Insurance claims call centers typically operate with a structured system to manage the high volume of incoming calls. They often employ a multi-tiered approach to ensure efficient and effective handling of policyholder inquiries and claims.

Automated Systems

Automated systems play a significant role in handling incoming calls. Interactive voice response (IVR) systems are commonly used to greet callers, gather basic information, and direct them to the appropriate department or agent. These systems can also provide self-service options for common tasks, such as checking claim status or making payments.

Agent Training

Call center agents are trained to assist policyholders with a wide range of inquiries and claims. They undergo comprehensive training programs that cover various aspects of insurance policies, claims procedures, and customer service skills. Agents are also trained to handle sensitive information and provide empathetic support to policyholders during stressful situations.

Claim Reporting Process

Filing a claim over the phone involves several steps to ensure the process is smooth and efficient. Understanding these steps and the information required will facilitate a faster and more accurate claim resolution.

Steps Involved in Phone Claim Reporting

- Contact your insurance company’s dedicated claims hotline.

- Provide your policy number and personal details to verify your identity.

- Clearly state the nature of the claim, including the incident date and time.

- Describe the circumstances surrounding the claim in detail.

- Answer any questions the claims representative may have.

Required Information

Claims representatives typically require the following information when reporting a claim:

- Policy number

- Personal details (name, address, contact information)

- Incident date and time

- Location of the incident

- Description of the incident

- Details of any witnesses or involved parties

- Police report number (if applicable)

- Medical records or estimates (for health-related claims)

- Photographs or videos of the damage (if applicable)

Importance of Accuracy and Detail

Providing accurate and detailed information during claim reporting is crucial. This ensures that the claims representative has a clear understanding of the incident and can process the claim efficiently. Incomplete or inaccurate information may lead to delays, incorrect assessments, or even claim denials. It is advisable to gather all relevant documentation and prepare a brief account of the incident before contacting the insurance company.

Customer Experience

Ensuring a positive customer experience during the claims reporting process is paramount for fostering customer loyalty and trust. Several key factors contribute to a seamless and satisfying experience, including:

- Empathy and understanding: Claims representatives should demonstrate empathy and understanding towards customers who are often facing stressful situations. Active listening, validation of emotions, and reassurance can significantly enhance the customer’s experience.

- Clear communication: Claims representatives should provide clear and concise information about the claims process, timelines, and expectations. Avoiding jargon and technical terms, using plain language, and confirming understanding helps customers feel informed and engaged.

- Efficient and timely response: Prompt and efficient handling of claims is crucial for customer satisfaction. Establishing clear timelines, providing regular updates, and resolving claims in a timely manner demonstrates respect for customers’ time and needs.

Best Practices for Handling Claims Calls Effectively

Best practices for handling claims calls effectively include:

- Answer calls promptly and courteously.

- Identify the customer and their policy details accurately.

- Listen attentively to the customer’s claim and ask clarifying questions.

- Explain the claims process clearly and provide realistic timelines.

- Document the claim details accurately and thoroughly.

- Follow up with the customer regularly to provide updates and answer questions.

Role of Technology in Enhancing Customer Experience

Technology plays a vital role in enhancing the customer experience during the claims reporting process:

- Online claims reporting: Customers can conveniently report claims online, providing flexibility and 24/7 accessibility.

- Mobile apps: Mobile apps allow customers to track the status of their claims, submit documentation, and communicate with claims representatives.

- Artificial intelligence (AI): AI-powered chatbots and virtual assistants can provide immediate assistance to customers, answering basic questions and guiding them through the claims process.

- Data analytics: Data analytics can help insurers identify trends, improve processes, and personalize the customer experience.

By embracing these key factors, best practices, and leveraging technology, insurers can significantly enhance the customer experience during the claims reporting process, building stronger customer relationships and fostering long-term loyalty.

Additional Services

In addition to reporting claims, the claims phone number often provides access to a range of additional services that can benefit policyholders. These services may include roadside assistance, medical advice, and more.

Roadside assistance can provide policyholders with help in the event of a breakdown or other roadside emergency. This can include towing, jump-starting, and tire changes. Medical advice can provide policyholders with access to a nurse or doctor who can provide medical advice and assistance.

Clear Communication

It is important for insurance companies to clearly communicate the scope of these additional services to policyholders. This will help policyholders understand what services are available to them and how to access them.