Overview of Auto Insurance in Tyler, TX

Auto insurance in Tyler, TX is essential for protecting yourself and your vehicle in the event of an accident. There are several types of auto insurance coverage available in Tyler, TX, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

The average cost of auto insurance in Tyler, TX varies depending on several factors, including your age, driving history, and the type of coverage you choose. According to the Texas Department of Insurance, the average annual cost of auto insurance in Tyler, TX is $1,234.

Factors Affecting Auto Insurance Rates in Tyler, TX

- Age: Younger drivers typically pay higher auto insurance rates than older drivers.

- Driving history: Drivers with clean driving records typically pay lower auto insurance rates than drivers with accidents or traffic violations on their records.

- Type of coverage: The type of auto insurance coverage you choose will affect your rates. Liability coverage is the minimum required coverage in Texas, but you may also want to consider collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower auto insurance rates.

- Credit score: In some states, your credit score can affect your auto insurance rates.

Top Auto Insurance Companies in Tyler, TX

When shopping for auto insurance in Tyler, TX, it’s essential to consider several factors, including coverage options, rates, and customer service. Here’s a table listing the top auto insurance companies in Tyler, TX, along with their strengths and weaknesses:

| Company | Coverage Options | Rates | Customer Service Ratings | Strengths | Weaknesses |

|---|---|---|---|---|---|

| State Farm | Comprehensive coverage options | Competitive rates | Excellent customer service | Strong financial stability, 24/7 claims service | Higher rates for some drivers |

| Progressive | Wide range of coverage options | Affordable rates | Good customer service | Discounts for safe drivers, online claims filing | Fewer local agents than some other companies |

| GEICO | Competitive rates | Good customer service | Easy-to-use website | Discounts for military members and government employees | Limited coverage options compared to some other companies |

| Allstate | Comprehensive coverage options | Competitive rates | Good customer service | Accident forgiveness program, roadside assistance | Higher rates for some drivers |

| Farmers | Wide range of coverage options | Competitive rates | Good customer service | Discounts for multiple vehicles and safe drivers | Fewer local agents than some other companies |

Finding the Right Auto Insurance Policy in Tyler, TX

Finding the right auto insurance policy in Tyler, TX, requires careful consideration of your specific needs and budget. Here are the key steps to follow:

1. Determine Your Coverage Needs: Assess your driving habits, vehicle value, and financial situation to determine the level of coverage you require. Consider factors such as liability coverage, collision and comprehensive coverage, and uninsured/underinsured motorist coverage.

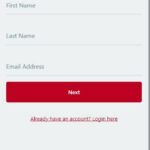

Compare Quotes from Multiple Insurance Companies

2. Comparison Shopping: Obtain quotes from several insurance companies to compare coverage options and rates. Utilize online comparison tools or contact insurance agents directly. Look for companies with a strong reputation, financial stability, and customer service.

Negotiate the Best Possible Rates

3. Negotiation: Discuss your quotes with each insurance company and inquire about discounts or rate adjustments. Be prepared to provide details about your driving history, vehicle safety features, and any other factors that may qualify you for lower premiums.

Filing an Auto Insurance Claim in Tyler, TX

Filing an auto insurance claim in Tyler, TX, involves several steps to ensure a smooth and successful process. Understanding these steps can help you navigate the process effectively and receive the compensation you deserve.

Step 1: Reporting the Accident

Immediately report the accident to your insurance company by phone or online. Provide details such as the date, time, location, and a brief description of the incident.

Step 2: Gathering Information

Collect as much information as possible at the accident scene. This includes:

– Contact information of all involved parties (drivers, passengers, witnesses)

– Vehicle details (make, model, license plate numbers)

– Photos of the damage and the accident scene

– Police report (if applicable)

Step 3: Submitting the Claim

Submit a formal claim to your insurance company, either online or by mail. Include all the information gathered in Step 2, along with a detailed account of the accident.

Step 4: Investigation and Settlement

The insurance company will investigate the claim and determine liability. They may contact you or the other parties involved for additional information. Once liability is established, the insurance company will offer a settlement amount based on the policy coverage and the extent of damages.

Step 5: Review and Acceptance

Review the settlement offer carefully. If you agree, sign the settlement agreement and return it to the insurance company. The payment will typically be processed within a few days.

Additional Considerations for Auto Insurance in Tyler, TX

Maintaining a clean driving record is crucial for affordable auto insurance. Violations, accidents, and DUIs increase your risk profile, resulting in higher premiums. Safe driving practices not only protect you but also save you money.

Qualifying for discounts can further reduce your insurance costs. Consider enrolling in defensive driving courses, maintaining a good credit score, and bundling multiple policies with the same insurer.

Additional coverage options provide peace of mind in various situations. Uninsured motorist coverage protects you if you’re hit by a driver without insurance. Rental car coverage reimburses expenses if your car is damaged or stolen while you’re renting.