Sioux Falls Auto Insurance Market Overview

Sioux Falls, South Dakota, is a thriving city with a population of over 180,000 residents. The city has a robust economy and a diverse population, which has led to a competitive auto insurance market.

There are over 20 auto insurance providers in Sioux Falls, offering a wide range of coverage options and prices. The average cost of auto insurance in Sioux Falls is $1,200 per year, which is slightly higher than the state average of $1,100. However, rates can vary significantly depending on a number of factors, including age, driving history, and vehicle type.

Factors Influencing Auto Insurance Rates in Sioux Falls

The following factors can influence auto insurance rates in Sioux Falls:

- Age: Younger drivers are typically charged higher rates than older drivers, as they are considered to be higher risk.

- Driving history: Drivers with clean driving records will typically pay lower rates than drivers with accidents or traffic violations on their record.

- Vehicle type: Sports cars and luxury vehicles are typically more expensive to insure than sedans and economy cars.

Types of Auto Insurance Coverage Available in Sioux Falls

In Sioux Falls, South Dakota, various types of auto insurance coverage are available to protect drivers and their vehicles. Understanding the different coverage options can help you make informed decisions to ensure adequate protection on the road.

Liability Coverage

Liability coverage is legally required in South Dakota and provides financial protection if you cause an accident resulting in injuries or property damage to others. It covers:

- Bodily injury liability: Covers medical expenses, lost wages, and pain and suffering for injured parties.

- Property damage liability: Covers damages to property, such as other vehicles, structures, or objects.

Collision Coverage

Collision coverage protects your own vehicle from damages sustained in an accident, regardless of who is at fault. It is optional but highly recommended, especially if you have a financed or leased vehicle.

Comprehensive Coverage

Comprehensive coverage provides protection for your vehicle against non-collision-related damages, such as:

- Theft

- Vandalism

- Natural disasters (e.g., hail, flooding)

- Animal collisions

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you are involved in an accident with a driver who does not have sufficient insurance or is uninsured. It covers:

- Bodily injury

- Property damage

- Lost wages

- Medical expenses

How to Find the Best Auto Insurance Company in Sioux Falls

When searching for the best auto insurance company in Sioux Falls, consider the following factors:

* Customer service: Look for companies with a reputation for responsive and helpful customer service.

* Financial stability: Choose a company with a strong financial rating, ensuring it can pay claims and provide ongoing coverage.

* Coverage options: Compare the range of coverage options available to find a company that meets your specific needs and budget.

Tips for Comparing Quotes

* Obtain quotes from multiple insurance companies to compare rates and coverage.

* Provide accurate information about your driving history, vehicle, and coverage needs.

* Consider discounts and promotions offered by different companies.

Importance of Reading the Policy Carefully

Before purchasing auto insurance, thoroughly read the policy to understand the following:

* Coverage details: Verify the types of coverage included and the limits of each.

* Exclusions: Identify any situations or events that are not covered by the policy.

* Deductibles: Determine the amount you will be responsible for paying out of pocket in the event of a claim.

Discounts and Savings on Auto Insurance in Sioux Falls

In Sioux Falls, there are various ways to save money on auto insurance. Insurance companies offer discounts to reward responsible driving habits, multiple vehicle ownership, and bundling home and auto insurance.

To qualify for these discounts, drivers must meet certain criteria set by the insurance company. For example, safe driver discounts may require a clean driving record for a specified period, while multi-vehicle discounts are available to those who insure multiple vehicles with the same company.

Safe Driver Discounts

- Defensive driving course completion

- Accident-free driving record

- Low annual mileage

Safe driver discounts can reduce premiums by up to 20% or more.

Multi-Vehicle Discounts

Insuring multiple vehicles with the same company can save drivers up to 15% on each vehicle.

Bundling Home and Auto Insurance

Bundling home and auto insurance with the same company can save drivers up to 25% on both policies.

Filing an Auto Insurance Claim in Sioux Falls

If you’re involved in an auto accident in Sioux Falls, it’s important to know how to file an insurance claim. Here are the steps you need to take:

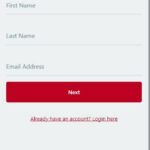

1. Contact your insurance company as soon as possible after the accident. You can do this by phone, email, or through their website.

2. Gather evidence of the accident. This includes photos of the damage to your vehicle, a copy of the police report, and contact information for any witnesses.

3. Submit a claim form to your insurance company. This form will ask for information about the accident, your vehicle, and your injuries.

4. Cooperate with the insurance company during the claims process. This means providing them with any information they request and attending any appointments they schedule.

Tips for maximizing the chances of a successful claim:

- Be honest and accurate when reporting the accident to your insurance company.

- Gather as much evidence as possible, including photos, a police report, and witness statements.

- Cooperate with the insurance company during the claims process.

- Keep track of all expenses related to the accident, such as medical bills and lost wages.

- Be patient. The claims process can take time.