Insurance Companies in Spartanburg, SC

Spartanburg, South Carolina, is home to several insurance companies that offer auto insurance coverage. These companies provide a range of options to meet the needs of drivers in the area.

Here is a list of some of the insurance companies that offer auto insurance in Spartanburg, SC:

Allstate Insurance Company

- Address: 100 E Main St, Spartanburg, SC 29302

- Phone: (864) 582-2100

- Website: https://www.allstate.com/

American Family Insurance

- Address: 200 W Main St, Spartanburg, SC 29301

- Phone: (864) 583-2200

- Website: https://www.amfam.com/

Farmers Insurance

- Address: 300 N Church St, Spartanburg, SC 29303

- Phone: (864) 584-2300

- Website: https://www.farmers.com/

Geico Insurance

- Address: 400 S Church St, Spartanburg, SC 29304

- Phone: (864) 585-2400

- Website: https://www.geico.com/

Progressive Insurance

- Address: 500 E Main St, Spartanburg, SC 29305

- Phone: (864) 586-2500

- Website: https://www.progressive.com/

State Farm Insurance

- Address: 600 N Church St, Spartanburg, SC 29306

- Phone: (864) 587-2600

- Website: https://www.statefarm.com/

Types of Auto Insurance Coverage Available

Spartanburg, South Carolina, offers various types of auto insurance coverage to meet the diverse needs of drivers. Each coverage type has its own set of benefits and drawbacks, so it’s essential to understand them before making a decision.

Liability Coverage

Liability coverage is required by law in South Carolina and protects you financially if you cause an accident that results in injuries or property damage to others. There are two types of liability coverage:

- Bodily injury liability coverage: Covers the medical expenses and lost wages of people you injure in an accident.

- Property damage liability coverage: Covers the cost of repairing or replacing property you damage in an accident.

Collision Coverage

Collision coverage protects your own vehicle from damage caused by a collision with another vehicle or object. It’s not required by law but is highly recommended, especially if you have a newer or expensive vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, hail, and fire. Like collision coverage, it’s not required by law but is a good idea if you want to ensure your vehicle is fully protected.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage is optional but highly recommended, as it provides peace of mind in case of an accident with an uninsured driver.

Personal Injury Protection (PIP)

PIP coverage provides medical expenses and lost wages to you and your passengers, regardless of who is at fault for an accident. It’s required by law in South Carolina and can be a valuable source of financial protection.

Factors that Affect Auto Insurance Rates

Auto insurance rates in Spartanburg, SC, are determined by several factors that insurance companies consider when calculating premiums. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your insurance costs.

Age and Gender

Younger drivers, particularly those under the age of 25, typically pay higher insurance rates due to their higher risk of accidents. Similarly, male drivers tend to pay more than female drivers, as statistics show they are more likely to be involved in accidents and file claims.

Driving History

Your driving history is a major factor in determining your insurance rates. Drivers with a clean driving record, free of accidents and traffic violations, are rewarded with lower premiums. Conversely, drivers with multiple accidents or violations will face higher insurance costs.

Vehicle Type

The type of vehicle you drive also affects your insurance rates. Sports cars, luxury vehicles, and high-performance cars are typically more expensive to insure than sedans, hatchbacks, and other standard vehicles.

Coverage Level

The level of coverage you choose will directly impact your insurance rates. Higher coverage limits and additional coverages, such as collision and comprehensive, will result in higher premiums. However, it’s important to find a balance between affordability and adequate protection.

Location

Your location within Spartanburg, SC, can also affect your insurance rates. Areas with higher rates of accidents and crime tend to have higher insurance premiums. Additionally, urban areas typically have higher insurance costs than rural areas.

Credit Score

In some states, insurance companies may consider your credit score when calculating your insurance rates. Drivers with lower credit scores may be seen as higher risks and therefore pay more for insurance.

Tips to Reduce Auto Insurance Rates

- Maintain a clean driving record by avoiding accidents and traffic violations.

- Consider taking a defensive driving course to improve your driving skills and potentially lower your rates.

- Choose a vehicle with a good safety rating and lower repair costs.

- Increase your deductible to reduce your premiums, but make sure you can afford the higher out-of-pocket expenses in the event of an accident.

- Shop around and compare quotes from multiple insurance companies to find the best rates.

- Bundle your auto insurance with other policies, such as homeowners or renters insurance, to potentially qualify for discounts.

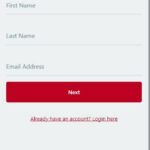

How to Get Auto Insurance Quotes

Obtaining auto insurance quotes in Spartanburg, SC, is a crucial step in securing affordable and adequate coverage for your vehicle. Here are the different ways to acquire quotes:

- Online: Numerous insurance companies offer online quoting tools that allow you to input your information and receive instant quotes.

- Phone: Contacting insurance companies directly via phone is another option to obtain quotes. You can speak with an agent who can provide personalized guidance and assist you with the process.

- In-person: Visiting local insurance agencies in Spartanburg, SC, allows you to meet with an agent in person. They can assess your needs and provide tailored quotes.

Comparing Quotes

Once you have obtained multiple quotes, it’s essential to compare them thoroughly. Consider the following factors:

- Coverage: Ensure that the quotes provide the level of coverage you require, including liability, collision, and comprehensive.

- Deductible: The deductible is the amount you pay out-of-pocket before the insurance coverage kicks in. Compare deductibles to find a balance between affordability and coverage.

- Premium: The premium is the monthly or annual cost of the insurance policy. Consider your budget and compare premiums to find the most cost-effective option.

- Company reputation: Research the reputation and financial stability of the insurance companies you’re considering.

Importance of Multiple Quotes

Getting multiple quotes is crucial because it allows you to:

- Identify the best coverage for your needs: Different insurance companies offer varying coverage options. Comparing quotes helps you determine the most suitable coverage for your vehicle and driving habits.

- Save money: Premiums can vary significantly between insurance companies. By comparing quotes, you can potentially find significant savings.

- Negotiate better terms: When you have multiple quotes, you can use them to negotiate with insurance companies for more favorable terms, such as lower premiums or higher coverage limits.

Filing an Auto Insurance Claim

Filing an auto insurance claim in Spartanburg, SC, is a relatively straightforward process. By following the steps Artikeld below and providing the necessary documentation, you can ensure that your claim is processed efficiently.

Step-by-Step Guide to Filing a Claim

1. Report the accident to your insurance company promptly. You can do this by calling your agent or visiting their website.

2. Gather the necessary documentation. This includes your insurance policy number, the police report (if applicable), and any photos or videos of the damage.

3. File a claim form. Your insurance company will provide you with a claim form to complete. Be sure to provide all of the requested information accurately.

4. Submit your claim. You can submit your claim form by mail, fax, or email.

5. Cooperate with the claims adjuster. The claims adjuster will contact you to investigate your claim and assess the damage. Be sure to provide them with all of the requested information and documentation.

Documentation Required to File a Claim

* Insurance policy number

* Police report (if applicable)

* Photos or videos of the damage

* Proof of ownership (e.g., vehicle registration)

* Proof of identity (e.g., driver’s license)

* Contact information for witnesses (if applicable)