Introduction

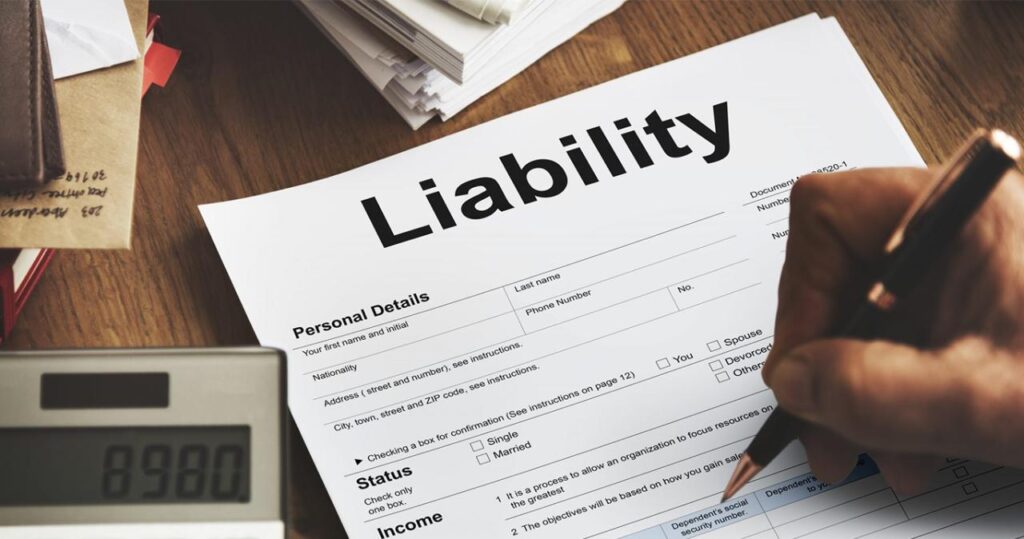

Liability insurance is a type of insurance that protects individuals or businesses from financial responsibility for injuries or damages caused to others. It is an essential form of protection for anyone who owns property, operates a business, or engages in activities that could potentially result in liability.

In Spanish-speaking communities, liability insurance is particularly important due to the prevalence of close-knit relationships and communal living. Many individuals in these communities share living spaces, participate in group activities, and engage in social interactions that could potentially lead to accidents or injuries. Liability insurance provides peace of mind by ensuring that individuals are financially protected in the event of such incidents.

Importance of Liability Insurance

Liability insurance is crucial for several reasons in Spanish-speaking communities:

- Protection from Financial Loss: Liability insurance safeguards individuals and businesses from the financial burden of legal expenses, settlements, and judgments that may arise from accidents or injuries caused to others.

- Peace of Mind: Liability insurance provides peace of mind by ensuring that individuals are protected from financial ruin in the event of a liability claim.

- Enhanced Credibility: For businesses, liability insurance enhances credibility and demonstrates a commitment to responsible operations.

Types of Liability Insurance

Liability insurance is a broad category of insurance that protects businesses and individuals from financial losses resulting from claims of negligence or wrongful acts. There are many different types of liability insurance available, each designed to cover specific risks.

Some of the most common types of liability insurance in Spanish-speaking countries include:

General Liability Insurance

General liability insurance provides basic protection against claims of bodily injury, property damage, and personal injury. This type of insurance is typically required by businesses and landlords.

Professional Liability Insurance

Professional liability insurance protects professionals, such as doctors, lawyers, and accountants, from claims of negligence or errors and omissions in their work.

Product Liability Insurance

Product liability insurance protects businesses from claims of bodily injury or property damage caused by their products.

Automobile Liability Insurance

Automobile liability insurance is required by law in most countries and provides coverage for bodily injury and property damage caused by the operation of a motor vehicle.

Homeowners Liability Insurance

Homeowners liability insurance provides coverage for bodily injury or property damage that occurs on the insured’s property.

Benefits of Liability Insurance

Liability insurance offers a wide range of advantages for individuals and businesses alike. It provides protection against financial losses resulting from legal claims alleging bodily injury, property damage, or personal injury caused by the insured’s negligence or wrongful acts.

One of the primary benefits of liability insurance is peace of mind. Knowing that you are protected from unexpected expenses and legal costs can provide significant reassurance. It allows individuals and businesses to operate with greater confidence, knowing that they have a safety net in place to cover potential liabilities.

Protection from Financial Losses

Liability insurance acts as a financial safety net, safeguarding individuals and businesses from the potentially devastating costs associated with legal claims. These costs can include:

- Legal fees

- Court costs

- Settlement or judgment payments

- Medical expenses

- Property repair or replacement costs

Without liability insurance, individuals and businesses would be responsible for paying these expenses out of pocket, which could lead to financial ruin. Liability insurance provides a buffer against these expenses, ensuring that the insured party can continue operating and avoid severe financial consequences.

Protection for Personal Assets

For individuals, liability insurance can protect personal assets, such as homes, vehicles, and savings, from being seized to satisfy legal judgments. Without liability insurance, an individual’s personal wealth could be at risk in the event of a successful legal claim.

Business Continuity

For businesses, liability insurance is crucial for business continuity. A lawsuit alleging negligence or wrongful acts can disrupt operations, damage reputation, and lead to significant financial losses. Liability insurance can help businesses weather these storms by providing coverage for legal expenses and potential settlements, allowing them to focus on maintaining operations and protecting their bottom line.

Choosing the Right Liability Insurance Policy

Choosing the right liability insurance policy is crucial to ensure adequate protection against potential financial losses. Here’s a guide to help you make an informed decision:

Factors to Consider:

- Type of Coverage: Identify the specific risks you need to cover, such as general liability, product liability, or professional liability.

- Limits of Liability: Determine the maximum amount of coverage you require to protect your assets.

- Deductible: The amount you agree to pay out-of-pocket before the insurance policy takes effect.

- Exclusions: Understand the specific situations or activities that are not covered by the policy.

- Endorsements: Additional coverage options that can enhance your protection.

- Insurance Carrier: Choose a reputable and financially stable insurance company with a proven track record.

- Premiums: Compare quotes from multiple insurers to find the most competitive rates while ensuring adequate coverage.

Filing a Liability Insurance Claim

Filing a liability insurance claim involves reporting an incident to your insurance provider and providing supporting documentation to prove your liability and the damages incurred. The process typically includes the following steps:

Contact Your Insurance Company

As soon as possible after the incident, contact your insurance company to report the claim. You will need to provide basic information, such as your policy number, the date and location of the incident, and a brief description of what happened.

Gather Documentation

To support your claim, you will need to gather documentation, such as:

– Police report or accident report

– Medical records or bills

– Photographs or videos of the damage

– Witness statements

– Proof of income or lost wages

Submit Your Claim

Once you have gathered the necessary documentation, submit your claim to your insurance company. You can do this online, by mail, or over the phone.

Insurance Company Investigation

Your insurance company will investigate the claim to determine if you are liable for the damages and if the claim is covered under your policy. This may involve contacting witnesses, reviewing medical records, and inspecting the damage.

Settlement

If your insurance company determines that you are liable and the claim is covered, they will offer you a settlement. This is a lump sum payment that compensates you for the damages you have incurred. You may have the option to accept or reject the settlement offer.

Common Exclusions in Liability Insurance Policies

Liability insurance policies often contain exclusions that limit the coverage provided. Understanding these exclusions is crucial to avoid gaps in protection and unexpected financial liability.

Common exclusions include:

Intentional Acts

- Liability policies generally exclude coverage for injuries or damages caused by intentional acts or criminal behavior.

Expected or Intended Harm

- Coverage is not provided for harm that was reasonably expected or intended by the insured.

Breach of Contract

- Liability policies do not cover claims arising from breach of contract, unless specifically endorsed.

Pollution

- Most liability policies exclude coverage for pollution-related damages, unless specifically endorsed.

War and Terrorism

- Coverage for damages caused by war, terrorism, or nuclear events is typically excluded.

Professional Negligence

- Liability policies may exclude coverage for professional negligence, unless specifically endorsed for professionals.

Employee Dishonesty

- Coverage for losses caused by employee dishonesty is typically excluded unless specifically endorsed.

Tips for Managing Liability Risk

Managing liability risk is crucial for individuals and businesses to protect themselves from financial losses and legal consequences. Here are some effective tips to help you reduce the likelihood of liability claims:

Assess and Identify Potential Risks

Start by thoroughly assessing your activities, operations, and potential exposures to liability. Identify areas where there is a higher risk of accidents, injuries, or property damage.

Implement Risk Control Measures

Once you have identified potential risks, implement appropriate risk control measures to minimize the likelihood of their occurrence. This may involve improving safety protocols, providing proper training to employees, and maintaining equipment regularly.

Obtain Adequate Liability Insurance

Liability insurance provides financial protection in the event of a covered liability claim. Ensure you have adequate coverage to protect your assets and liabilities.

Maintain Accurate Records

Keep detailed records of all relevant activities, incidents, and risk control measures. This documentation can be invaluable in defending against liability claims or demonstrating compliance with safety regulations.

Educate Employees and Others

Provide regular training and education to employees, contractors, and others involved in your operations on liability risks and risk management practices.

Regularly Review and Update

Continuously monitor your liability risk exposure and make necessary adjustments to your risk management strategies. Regularly review and update your insurance coverage to ensure it remains adequate.

Consider Risk Transfer Techniques

Explore risk transfer techniques such as contracts, waivers, or indemnities to shift or share liability with other parties. However, carefully evaluate the potential implications and limitations of these techniques.

Resources for Spanish-Speaking Individuals

Liability insurance is essential for protecting individuals and businesses from financial risks associated with legal claims. Spanish-speaking individuals may face language barriers when seeking liability insurance. To address this, various resources are available to assist them in understanding and obtaining the coverage they need.

Organizations and agencies provide support and guidance to Spanish-speaking individuals in navigating the liability insurance landscape. These resources include:

Spanish-Language Insurance Brokers

- Spanish-speaking insurance brokers specialize in assisting Spanish-speaking individuals in finding and understanding liability insurance policies.

- They can provide guidance on policy terms, coverage options, and the claims process in Spanish.

Community-Based Organizations

- Community-based organizations often offer assistance to Spanish-speaking individuals, including information and resources on liability insurance.

- They may host workshops, provide educational materials, and connect individuals with Spanish-speaking insurance professionals.

Government Agencies

- Government agencies, such as the National Association of Insurance Commissioners (NAIC), provide resources and information on liability insurance in Spanish.

- They can assist with understanding insurance regulations, filing complaints, and finding reputable insurance companies.

Online Resources

- Several online resources provide information on liability insurance in Spanish.

- These resources include articles, videos, and interactive tools that can help Spanish-speaking individuals learn about liability insurance and make informed decisions.