Overview of Extended Term Life Insurance

Extended term life insurance is a type of life insurance that provides coverage for a specific period of time, typically 10, 20, or 30 years. After the initial term expires, the policyholder can choose to renew the policy for an additional period of time or let it lapse.

One of the key features of extended term life insurance is its affordability. The premiums are typically lower than those for other types of life insurance, such as whole life or universal life insurance. This makes it a good option for people who are on a budget or who only need temporary coverage.

Another benefit of extended term life insurance is its flexibility. Policyholders can choose the length of the initial term and the amount of coverage they need. This allows them to customize the policy to fit their specific needs and budget.

However, there are also some disadvantages to extended term life insurance. One is that the coverage amount does not increase over time. This means that if the policyholder lives longer than the initial term, they will not have any coverage unless they renew the policy. Another disadvantage is that the premiums can increase when the policy is renewed.

Overall, extended term life insurance is a good option for people who need temporary coverage and who are on a budget. It is important to understand the features and benefits of this type of insurance before making a decision.

Advantages and Disadvantages of Extended Term Life Insurance

Extended term life insurance offers unique advantages and disadvantages. Understanding these aspects helps in making informed decisions about choosing this insurance type.

Advantages of Extended Term Life Insurance

- Low Premiums: Extended term life insurance typically has lower premiums compared to permanent life insurance policies, making it a more affordable option for those seeking temporary coverage.

- Flexibility: The extended term feature provides the flexibility to extend the policy’s term coverage beyond the initial period, ensuring continued protection if needed.

- Simplicity: Extended term life insurance policies are relatively simple to understand and manage, focusing solely on providing term coverage without additional investment or cash value components.

Disadvantages of Extended Term Life Insurance

- Limited Coverage Duration: Extended term life insurance provides coverage only for a specific period, unlike permanent life insurance that offers lifelong protection.

- Premium Increases: As the policyholder ages, the premiums for extended term life insurance tend to increase significantly, potentially becoming unaffordable in later years.

- No Cash Value: Extended term life insurance policies do not accumulate cash value, unlike whole life insurance, which can provide additional financial benefits beyond the death benefit.

Comparing the advantages and disadvantages helps determine if extended term life insurance aligns with individual needs and financial goals. For those seeking temporary and affordable coverage, extended term life insurance can be a viable option. However, if long-term protection or cash value accumulation is a priority, permanent life insurance may be a more suitable choice.

Eligibility and Application Process

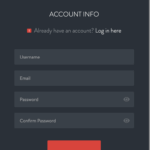

Extended term life insurance is generally available to individuals between the ages of 18 and 80 who are considered to be in good health.

The application process typically involves completing an application form, providing medical information, and undergoing a medical exam. The medical exam may include a physical examination, blood tests, and urine tests. The insurance company will use this information to assess your health and determine your risk of dying during the policy term.

Tips for Increasing Your Chances of Approval

- Be honest and accurate on your application.

- Provide complete medical information.

- Be prepared to undergo a medical exam.

- Consider getting a life insurance policy through a broker who can help you find the best policy for your needs.

Premiums and Coverage Options

The cost of extended term life insurance premiums is influenced by several factors, including the insured individual’s age, health, and the amount of coverage desired. Premiums generally increase with age and decline with better health. Coverage options vary widely, with different death benefit amounts and term lengths available to meet individual needs.

Death benefit amounts typically range from $100,000 to $1 million or more, depending on the policy. Term lengths can be as short as 10 years or as long as 30 years. Some policies also offer riders that provide additional coverage, such as accidental death benefits or waiver of premium benefits.

Premium Calculations

The following are examples of premium calculations based on different scenarios:

- A healthy 30-year-old male non-smoker who purchases a $250,000 death benefit policy with a 20-year term might pay an annual premium of around $300.

- A 50-year-old male smoker with a history of heart disease who purchases a $500,000 death benefit policy with a 10-year term might pay an annual premium of around $1,200.

- A 65-year-old female in excellent health who purchases a $100,000 death benefit policy with a 5-year term might pay an annual premium of around $200.

Riders and Endorsements

Extended term life insurance policies can be enhanced with riders and endorsements, which are optional add-ons that provide additional coverage or benefits.

These riders and endorsements can customize the policy to meet specific needs and provide peace of mind.

Common Riders and Endorsements

- Accidental Death Benefit Rider: Provides additional coverage in case of accidental death.

- Waiver of Premium Rider: Waives future premium payments if the policyholder becomes disabled.

- Guaranteed Insurability Rider: Allows the policyholder to increase coverage without additional medical underwriting.

- Spouse’s Insurance Rider: Provides coverage for the policyholder’s spouse.

- Children’s Insurance Rider: Provides coverage for the policyholder’s children.

Benefits of Riders and Endorsements

Riders and endorsements offer several benefits, including:

- Enhanced coverage: Riders and endorsements can provide additional coverage for specific events or circumstances.

- Peace of mind: Knowing that loved ones are financially protected in various scenarios can provide peace of mind.

- Flexibility: Riders and endorsements allow policyholders to customize their coverage to meet their specific needs.

Example of Enhanced Coverage

For example, the accidental death benefit rider provides additional coverage in case of accidental death. This can be beneficial for individuals with dangerous occupations or who engage in high-risk activities.

Tax Implications

Extended term life insurance premiums are generally not tax-deductible. However, the death benefits are generally tax-free. This can be a significant advantage, especially for large death benefits.

Tax-Free Death Benefits

The death benefit from an extended term life insurance policy is generally not subject to federal income tax. This is because life insurance proceeds are considered a form of inheritance, which is not taxable. However, there are some exceptions to this rule. For example, if the death benefit is paid to a trust that is not a qualified trust, the death benefit may be subject to income tax.

Minimizing Tax Liability

There are a few things you can do to minimize your tax liability on extended term life insurance. One is to make sure that the death benefit is paid to a qualified trust. Another is to make sure that the policy is owned by an irrevocable trust. This will help to ensure that the death benefit is not included in your estate for estate tax purposes.

Case Studies and Examples

Extended term life insurance offers flexibility and adaptability in meeting various financial needs. Here are some case studies and examples that showcase how it has been effectively utilized:

Case Study 1: Affordable Temporary Coverage

- John, a young professional, needed temporary life insurance coverage for the next 10 years to protect his family during a career transition.

- Extended term life insurance provided affordable coverage with a level premium for the specified period, ensuring financial security for his dependents.

Case Study 2: Supplementing Retirement Income

- Mary, a retiree, wished to supplement her retirement income with a life insurance policy that would provide a death benefit to her beneficiaries.

- Extended term life insurance offered a low-cost option to enhance her retirement savings, ensuring a financial cushion for her loved ones.

Case Study 3: Covering Unforeseen Expenses

- David, a business owner, needed coverage to cover potential expenses associated with a lawsuit against his company.

- Extended term life insurance provided a flexible and affordable way to mitigate financial risks and protect his business from unforeseen liabilities.