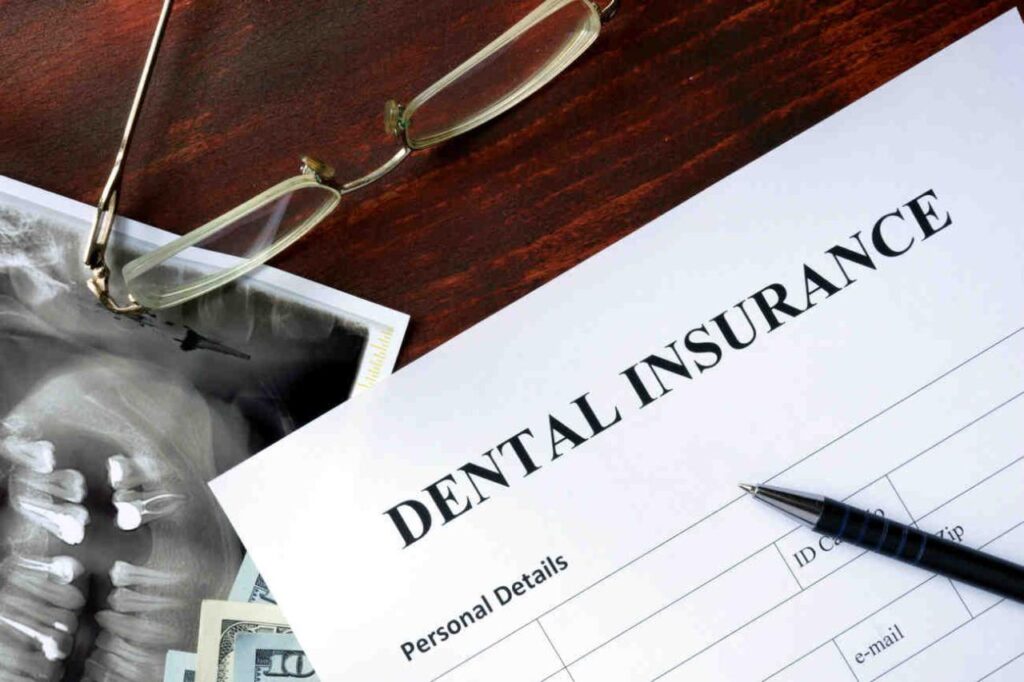

Dental Insurance Coverage for Root Canals

Root canals are a common dental procedure used to treat severely decayed or infected teeth. Dental insurance plans typically provide coverage for root canals, but the extent of coverage can vary.

In general, dental insurance plans cover a percentage of the cost of a root canal. The percentage varies depending on the plan, but most plans cover between 50% and 80% of the cost. Some plans may also have an annual maximum for root canal coverage, which means that the plan will only cover a certain amount of money for root canals in a given year.

Exclusions and Restrictions

There are some exclusions and restrictions that may apply to root canal coverage. For example, some plans may not cover root canals on teeth that have been previously treated. Other plans may not cover root canals that are performed by a specialist, such as an endodontist.

Factors Influencing Coverage

The coverage of root canals by dental insurance is not always straightforward and can vary depending on several factors. Understanding these factors can help you determine the extent of coverage you may have and avoid unexpected expenses.

The primary factors that can influence coverage include the type of dental insurance policy, the plan design, and individual circumstances.

Policy Type

Dental insurance policies come in two main types: indemnity plans and managed care plans.

- Indemnity plans: These plans allow you to choose any dentist and typically reimburse you for a percentage of the covered expenses, up to the policy limits. They may offer more flexibility but can also have higher premiums.

- Managed care plans: These plans restrict you to a network of dentists and often require you to obtain referrals for certain procedures, including root canals. They typically have lower premiums but may limit your choice of providers.

Plan Design

The plan design also plays a role in coverage. Some plans have annual maximums, which limit the total amount of coverage you can receive in a year. Others may have waiting periods, which require you to wait a certain amount of time before coverage for certain procedures, such as root canals, begins.

Individual Circumstances

Your individual circumstances can also affect coverage. For example, if you have a history of dental problems or have undergone previous root canals, your coverage may be limited or excluded.

Types of Root Canal Coverage

Dental insurance plans offer varying levels of coverage for root canals. Understanding these differences is crucial for making informed decisions about your dental care.

Basic Coverage

Basic coverage typically includes a fixed dollar amount or percentage towards the cost of a root canal. This coverage may be sufficient for individuals with minimal dental needs.

Enhanced Coverage

Enhanced coverage offers more comprehensive protection. It may cover a higher percentage of the root canal cost or include additional benefits like coverage for multiple root canals per year. This coverage is suitable for individuals with higher dental risks or those who anticipate needing more extensive root canal treatments.

Example Coverage Options

– Delta Dental PPO: Basic coverage with a fixed dollar amount towards root canals.

– Cigna Dental HMO: Enhanced coverage with 80% coverage for root canals, up to a maximum of two per year.

– MetLife Dental Indemnity: Flexible coverage that allows you to choose the amount of coverage you need for root canals.

Pre-Approval and Authorization

Before undergoing a root canal treatment, it is crucial to obtain pre-approval or authorization from your dental insurance provider. This process ensures that the treatment is covered under your plan and helps prevent any unexpected out-of-pocket expenses.

To request pre-approval, you typically need to provide your insurance provider with specific information, such as your dental history, the reason for the root canal, and the estimated cost of the procedure. Your provider will then review your request and determine whether the treatment is covered.

Tips for Obtaining Pre-Approval

- Contact your insurance provider as early as possible to initiate the pre-approval process.

- Provide clear and accurate information about your dental condition and the proposed treatment.

- Be prepared to submit documentation, such as X-rays or a treatment plan, to support your request.

- Follow up with your insurance provider regularly to check on the status of your pre-approval request.

- If your request is denied, you can appeal the decision by providing additional information or documentation.

Coverage for Follow-Up Procedures

Dental insurance plans may provide coverage for follow-up procedures related to root canals. These procedures are typically necessary to restore the functionality and aesthetics of the treated tooth.

Types of Follow-Up Procedures Covered

The types of follow-up procedures covered by dental insurance can vary depending on the plan. However, some common procedures that may be covered include:

- Crowns: These are artificial caps that are placed over the treated tooth to protect it and restore its shape and function.

- Fillings: These are used to fill in any remaining cavities or defects in the tooth after the root canal.

- Post and Core: In some cases, a post and core may be necessary to provide additional support for a severely damaged tooth before a crown can be placed.

Limitations and Restrictions

Coverage for follow-up procedures may be subject to certain limitations and restrictions. For example, some plans may only cover a certain number of follow-up procedures per year or may require pre-approval for certain types of procedures. Additionally, the coverage amount may vary depending on the type of procedure and the specific plan.

Out-of-Network Coverage

Dental insurance plans may also offer coverage for root canals performed by out-of-network dentists. Out-of-network coverage typically differs from in-network coverage in terms of the level of reimbursement and the process for obtaining coverage.

To find out-of-network providers who accept dental insurance, you can:

- Check your insurance provider’s website or call their customer service line.

- Contact your local dental society or dental association.

- Ask friends or family members for recommendations.