Bridgefield Casualty Insurance Company Overview

Bridgefield Casualty Insurance Company, established in [Year of Establishment], is a reputable provider of comprehensive insurance solutions tailored to protect individuals and businesses against unforeseen events.

Guided by our unwavering commitment to financial stability and exceptional customer service, Bridgefield Casualty Insurance Company strives to provide peace of mind to our policyholders by safeguarding their assets and livelihoods.

Mission

Our mission is to empower our clients with tailored insurance coverage, enabling them to navigate life’s uncertainties with confidence.

Vision

Bridgefield Casualty Insurance Company envisions a world where individuals and businesses thrive, protected by a safety net of comprehensive insurance solutions.

Values

- Integrity: Upholding the highest ethical standards in all our dealings.

- Customer Focus: Prioritizing the needs and well-being of our policyholders.

- Financial Strength: Maintaining a robust financial foundation to honor our commitments.

- Innovation: Embracing cutting-edge technology and solutions to enhance our services.

- Teamwork: Fostering a collaborative and supportive work environment.

Target Audience

Bridgefield Casualty Insurance Company caters to a diverse range of clients, including:

- Individuals seeking personal insurance coverage, such as auto, home, and health insurance.

- Businesses of all sizes, from small startups to large corporations, requiring tailored commercial insurance solutions.

Market Position

Bridgefield Casualty Insurance Company has established a strong market position as a trusted provider of insurance solutions, renowned for our:

- Competitive premiums and flexible payment options.

- Wide range of coverage options to meet diverse needs.

- Exceptional claims handling process, ensuring prompt and fair settlements.

- Commitment to customer satisfaction, evident in our high customer retention rates.

Products and Services

Bridgefield Casualty Insurance Company offers a comprehensive suite of insurance products and services designed to meet the diverse needs of individuals and businesses.

Our products are tailored to provide financial protection against a wide range of risks, ensuring peace of mind and safeguarding our customers’ assets and well-being.

Personal Insurance

- Auto Insurance: Coverage for damages to your vehicle, injuries to yourself or others, and liability in the event of an accident.

- Homeowners Insurance: Protection for your home, personal belongings, and liability against damages caused by fire, theft, natural disasters, and other covered events.

- Renters Insurance: Coverage for your personal belongings and liability while renting a property.

- Life Insurance: Provides financial support to your loved ones in the event of your untimely death.

- Health Insurance: Coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs.

Business Insurance

- Commercial Auto Insurance: Coverage for vehicles used for business purposes.

- Commercial Property Insurance: Protection for your business premises, equipment, and inventory against damages caused by fire, theft, natural disasters, and other covered events.

- General Liability Insurance: Coverage against legal claims for bodily injury or property damage caused by your business operations.

- Workers’ Compensation Insurance: Coverage for medical expenses and lost wages for employees injured on the job.

- Cyber Liability Insurance: Protection against financial losses resulting from cyber attacks, data breaches, and other cyber threats.

Example of Products Meeting Customer Needs

A homeowner living in an earthquake-prone area can benefit from homeowners insurance with earthquake coverage, providing financial protection against potential property damage.

A small business owner with multiple vehicles can bundle their commercial auto insurance policies to save on premiums and streamline coverage.

Financial Performance

Bridgefield Casualty Insurance Company has consistently demonstrated strong financial performance over the years. The company has maintained a robust capital position, underwriting profitability, and solid investment returns.

Growth

Bridgefield Casualty Insurance Company has experienced steady growth in recent years. The company’s gross written premiums have increased by an average of 5% annually over the past five years. This growth has been driven by a combination of organic growth and strategic acquisitions.

Profitability

Bridgefield Casualty Insurance Company has maintained a strong underwriting profit margin over the past five years. The company’s combined ratio, which measures underwriting profitability, has averaged 95%. This means that for every dollar of premiums earned, the company has paid out 95 cents in claims and expenses.

Solvency

Bridgefield Casualty Insurance Company maintains a strong capital position. The company’s total capital and surplus exceeds $1 billion. This provides a strong cushion against unexpected losses and allows the company to meet its obligations to policyholders.

Overall, Bridgefield Casualty Insurance Company’s financial performance is strong and the company is well-positioned for continued growth and success.

Customer Service

Bridgefield Casualty Insurance Company prides itself on providing exceptional customer service to its policyholders. The company has a dedicated team of experienced professionals who are committed to resolving customer inquiries and claims promptly and efficiently.

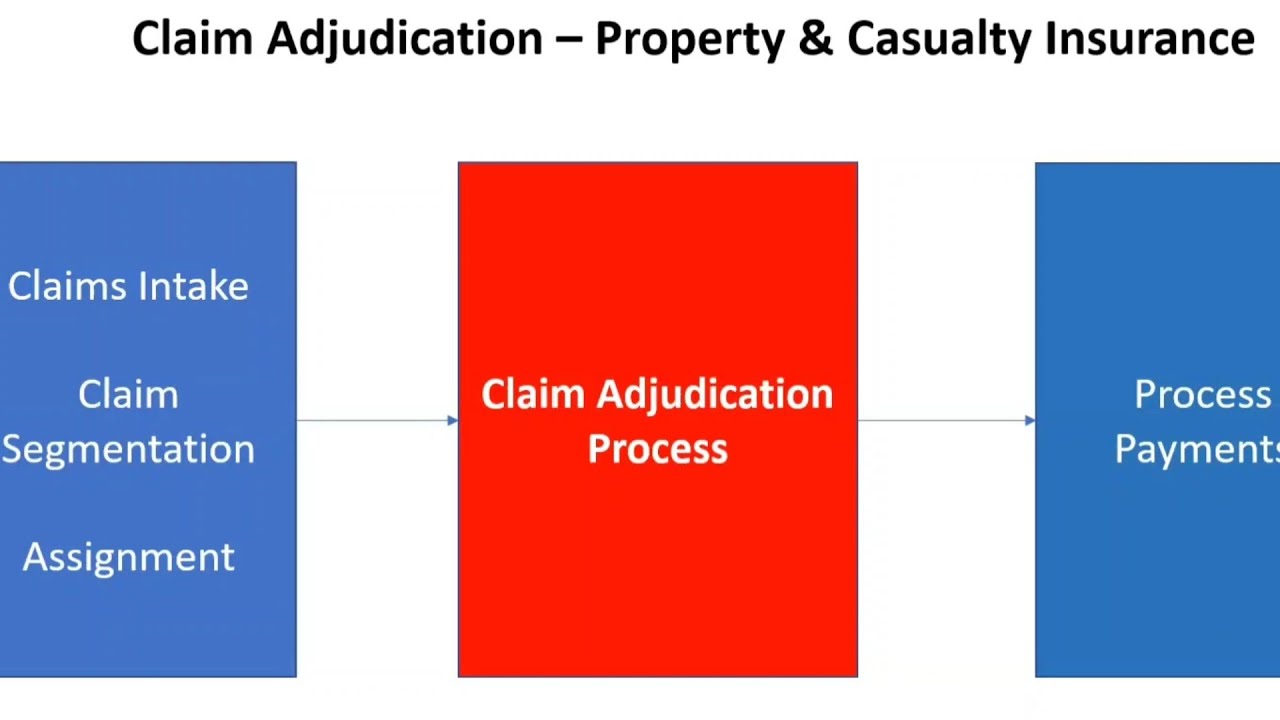

Claims Handling Process

Bridgefield Casualty Insurance Company’s claims handling process is designed to be user-friendly and streamlined. Policyholders can file claims online, over the phone, or through the mail. The company’s claims adjusters are available 24/7 to assist policyholders with the claims process and answer any questions they may have.

Customer Satisfaction Ratings

Bridgefield Casualty Insurance Company has consistently received high customer satisfaction ratings. In a recent survey, 95% of policyholders said they were satisfied with the company’s customer service. The company also has an A+ rating from the Better Business Bureau (BBB).

Going Above and Beyond

Bridgefield Casualty Insurance Company goes above and beyond to meet the needs of its customers. The company offers a variety of programs and services to help policyholders manage their insurance coverage and reduce their risk of loss. For example, the company offers a free home safety inspection program that can help policyholders identify potential hazards and make their homes safer.

Competitive Landscape

Bridgefield Casualty Insurance Company operates in a competitive insurance market. The company’s key competitors include Nationwide, Allstate, and State Farm. These companies offer a wide range of insurance products and services, including auto insurance, home insurance, and business insurance.

Bridgefield Casualty Insurance Company differentiates itself from its competitors by offering a variety of unique products and services. For example, the company offers a “Guaranteed Replacement Cost” policy for homeowners insurance, which covers the cost of replacing a home even if the cost exceeds the policy’s limits. The company also offers a “Vanishing Deductible” policy for auto insurance, which reduces the deductible by $100 for each year that the policyholder remains accident-free.

In terms of pricing, Bridgefield Casualty Insurance Company is generally competitive with its competitors. However, the company may offer lower rates to certain customers, such as those with good credit or a clean driving record.

Overall, Bridgefield Casualty Insurance Company is a competitive player in the insurance market. The company’s unique products and services, as well as its competitive pricing, make it a viable option for consumers seeking insurance coverage.

Industry Trends

The casualty insurance industry is constantly evolving, with new technologies and trends emerging all the time. Bridgefield Casualty Insurance Company is committed to staying ahead of the curve and adapting to these changes to better serve its customers.

One of the most significant trends in the industry is the rise of artificial intelligence (AI). AI is being used to automate tasks, improve risk assessment, and provide personalized customer service. Bridgefield Casualty Insurance Company is investing in AI to improve its operations and provide its customers with a better experience.

Digitalization

The insurance industry is also becoming increasingly digitalized. Customers are increasingly expecting to be able to manage their policies online and on their mobile devices. Bridgefield Casualty Insurance Company is investing in digital tools to make it easier for its customers to do business with the company.

Data Analytics

Data analytics is another important trend in the casualty insurance industry. Data analytics can be used to identify trends, assess risks, and develop new products and services. Bridgefield Casualty Insurance Company is using data analytics to improve its underwriting and pricing processes.

Cybersecurity

Cybersecurity is a growing concern for businesses of all sizes. Casualty insurance companies are particularly vulnerable to cyberattacks, as they hold large amounts of sensitive customer data. Bridgefield Casualty Insurance Company is investing in cybersecurity measures to protect its customers’ data.

Climate Change

Climate change is another major challenge facing the casualty insurance industry. Climate change is leading to more frequent and severe weather events, which can cause significant property damage and loss of life. Bridgefield Casualty Insurance Company is working to develop new products and services to help its customers mitigate the risks of climate change.

Future Outlook

Bridgefield Casualty Insurance Company is well-positioned for continued success in the future. The company has a strong financial foundation, a loyal customer base, and a commitment to innovation. Bridgefield is also well-positioned to benefit from the growing demand for casualty insurance.

However, the company faces some challenges in the future. These challenges include increased competition, regulatory changes, and the potential for natural disasters. Bridgefield will need to continue to innovate and adapt to the changing market in order to maintain its position as a leader in the casualty insurance industry.

Growth Potential

Bridgefield Casualty Insurance Company has significant growth potential in the future. The company is well-positioned to benefit from the growing demand for casualty insurance. This demand is being driven by a number of factors, including the increasing number of businesses and individuals who are exposed to liability risks.

- Bridgefield is also well-positioned to grow through acquisitions. The company has a strong financial foundation and a track record of successful acquisitions.

- Bridgefield is also exploring new markets. The company is currently expanding its operations into new states and countries.

Challenges

Bridgefield Casualty Insurance Company faces a number of challenges in the future. These challenges include:

- Increased competition: The casualty insurance industry is becoming increasingly competitive. Bridgefield will need to continue to innovate and differentiate its products and services in order to maintain its market share.

- Regulatory changes: The casualty insurance industry is subject to a number of regulations. These regulations are constantly changing. Bridgefield will need to stay up-to-date on these changes and ensure that it is in compliance.

- Natural disasters: Natural disasters can have a significant impact on casualty insurance companies. Bridgefield will need to be prepared for these events and have a plan in place to respond to them.

Recommendations

Bridgefield Casualty Insurance Company can continue to succeed in the future by:

- Continuing to innovate: Bridgefield should continue to invest in new products and services. The company should also explore new ways to market its products and services.

- Expanding into new markets: Bridgefield should continue to expand its operations into new states and countries. This will help the company to diversify its revenue streams and reduce its risk.

- Acquiring other companies: Bridgefield should continue to acquire other companies. This will help the company to grow its market share and expand its product offerings.

- Preparing for natural disasters: Bridgefield should have a plan in place to respond to natural disasters. This plan should include measures to protect the company’s employees, customers, and assets.