Blank Certificate of Insurance Definition

A blank certificate of insurance is a document that verifies the existence of insurance coverage without specifying the details of the policy. It is typically used when a party requires proof of insurance but does not need the specific details of the policy.

A blank certificate of insurance can be required in various situations, such as:

– When renting an apartment or house

– When applying for a business license

– When obtaining a loan

– When entering into a contract

A blank certificate of insurance typically includes the following information:

– The name of the insured

– The name of the insurance company

– The policy number

– The effective dates of the policy

– The type of coverage provided

– The amount of coverage provided

Types of Blank Certificates of Insurance

Blank certificates of insurance vary in their coverage and limitations, catering to different insurance needs. Here are the primary types:

ACORD Certificate of Insurance

The ACORD (Association for Cooperative Operations Research and Development) Certificate of Insurance is a standardized form widely used in the United States. It provides basic coverage information, including the policyholder’s name, the insurer’s name, the policy number, the coverage period, and the limits of liability.

Insurance Services Office (ISO) Certificate of Insurance

The ISO Certificate of Insurance is another standardized form that is commonly used in the United States. It offers a more comprehensive level of coverage information than the ACORD Certificate, including details on the types of coverage, deductibles, and exclusions.

Customizable Certificate of Insurance

Customizable Certificates of Insurance allow policyholders to tailor the certificate to their specific needs. They can include additional information, such as the project name, the contract number, and specific endorsements or riders.

Industry-Specific Certificates of Insurance

Some industries have developed their own specific types of Certificates of Insurance that address the unique risks associated with those industries. For example, the construction industry uses the AIA (American Institute of Architects) Certificate of Insurance, while the healthcare industry uses the HIPPA (Health Insurance Portability and Accountability Act) Certificate of Insurance.

Additional Insured Certificates of Insurance

Additional Insured Certificates of Insurance are issued to entities that are not the policyholder but are covered under the policy. This type of certificate is often used when a contractor or subcontractor needs to be added to the policy of the project owner or general contractor.

Obtaining a Blank Certificate of Insurance

Obtaining a blank certificate of insurance is a straightforward process. It involves reaching out to your insurance provider and requesting a blank certificate.

To complete the certificate, you will need to provide the following information:

- Your company’s name and address

- The name of the certificate holder

- The policy number

- The coverage limits

- The policy period

Once you have provided the necessary information, your insurance provider will issue a blank certificate of insurance. The turnaround time for issuing a blank certificate of insurance varies depending on the insurance provider, but it typically takes a few days.

Using a Blank Certificate of Insurance

To use a blank certificate of insurance, you will need to fill it out with the necessary information. This includes the name of the insured, the policy number, the coverage period, and the limits of liability. It is important to be accurate and complete when filling out the certificate, as any errors or omissions could void the coverage. Providing false or misleading information on the certificate could also result in legal penalties.

Completing the Certificate

When completing the certificate, be sure to include the following information:

- The name of the insured (the person or entity being insured)

- The policy number

- The coverage period (the dates during which the policy is in effect)

- The limits of liability (the maximum amount the insurer will pay for a covered loss)

You may also need to include additional information, such as the type of insurance coverage, the deductible, and the exclusions. Once you have completed the certificate, you should sign and date it.

Importance of Accuracy and Completeness

It is important to be accurate and complete when filling out a blank certificate of insurance. Any errors or omissions could void the coverage. For example, if you list the wrong policy number, the insurer may not be able to verify your coverage and could deny your claim. Similarly, if you list the wrong coverage period, you may not be covered for losses that occur outside of that period.

Consequences of Providing False or Misleading Information

Providing false or misleading information on a blank certificate of insurance could have serious consequences. The insurer could void the coverage, which means you would not be covered for any losses. You could also be subject to legal penalties, such as fines or imprisonment.

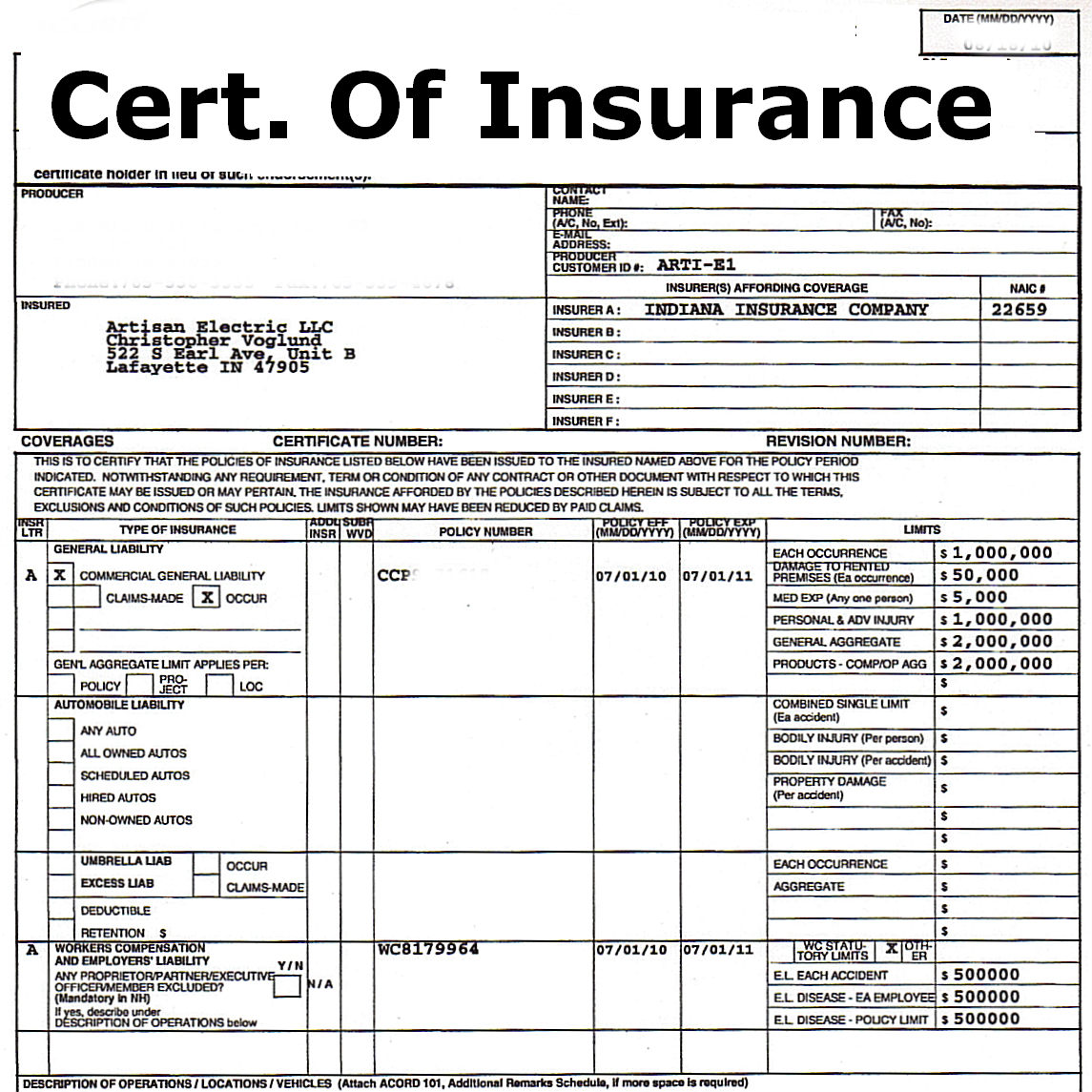

Sample Blank Certificate of Insurance

A blank certificate of insurance is a form that provides proof of insurance coverage. It is typically used when a business or individual needs to provide proof of insurance to a third party, such as a landlord, contractor, or client.

To complete a blank certificate of insurance, you will need to provide the following information:

– Your name and address

– The name and address of the insured

– The policy number

– The policy period

– The coverage limits

– Any additional endorsements or riders

Once you have completed the form, you should sign and date it. You can then provide it to the third party who requested it.

Here is a sample blank certificate of insurance in HTML table format:

| Field | Description |

|—|—|

| Name of Insured | The name of the person or business that is insured. |

| Address of Insured | The address of the person or business that is insured. |

| Policy Number | The number of the insurance policy. |

| Policy Period | The period of time that the policy is in effect. |

| Coverage Limits | The maximum amount that the insurance company will pay for each type of coverage. |

| Additional Endorsements or Riders | Any additional coverage that has been added to the policy. |

| Signature | The signature of the person who is completing the form. |

| Date | The date that the form is completed. |

Common Mistakes to Avoid

When using blank certificates of insurance, several common mistakes can lead to misunderstandings, coverage gaps, or even legal liabilities. Understanding these mistakes and taking steps to avoid them is crucial for ensuring adequate insurance protection.

One common mistake is failing to review the certificate thoroughly. This can result in overlooking important details, such as coverage limits, policy exclusions, or named insureds. It is essential to carefully review the certificate to ensure that it accurately reflects the agreed-upon coverage.

Another mistake is not understanding the difference between a certificate of insurance and an insurance policy. A certificate is only a summary of coverage and does not replace the actual policy. It is important to obtain a copy of the insurance policy to fully understand the terms and conditions of the coverage.

Additionally, it is crucial to ensure that the certificate is up-to-date and reflects the current coverage. Outdated certificates may not accurately represent the current policy status, leading to coverage gaps or misunderstandings.

To avoid these mistakes, it is advisable to work closely with an insurance agent or broker to obtain a blank certificate of insurance that accurately reflects the intended coverage. By carefully reviewing the certificate, understanding its limitations, and keeping it up-to-date, individuals and businesses can minimize the risks associated with using blank certificates of insurance.