Water Damage Insurance Claim Process

Experiencing water damage in your home can be stressful. Here’s a step-by-step guide to help you navigate the insurance claim process:

Contact Your Insurance Company

As soon as possible after the damage occurs, contact your insurance company. They will assign an adjuster to handle your claim.

Document the Damage

Take photos or videos of the damaged areas, including close-ups of the source of the water and any personal belongings affected.

File a Claim

Submit a formal claim to your insurance company, providing details of the incident, the extent of the damage, and your contact information.

Provide Supporting Documents

Gather and submit the following documents to support your claim:

- Proof of ownership or lease agreement

- Estimates for repairs or replacement

- Receipts for any expenses related to the damage (e.g., temporary housing, cleanup)

- Inventory of damaged personal belongings

Meet with the Adjuster

The adjuster will visit your property to assess the damage and determine the amount of coverage you are entitled to.

Negotiate the Settlement

Once the adjuster has assessed the damage, they will present you with a settlement offer. You may negotiate the amount of the settlement if you believe it is inadequate.

Receive Payment

Once the settlement is agreed upon, your insurance company will issue payment for the covered damages.

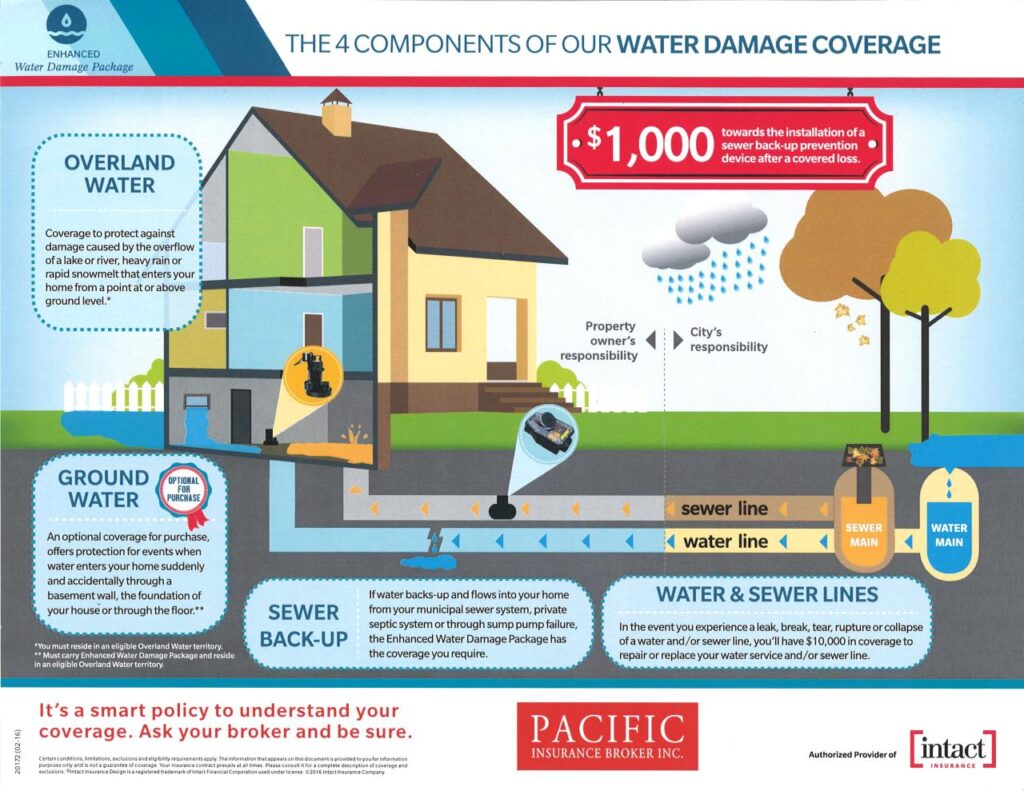

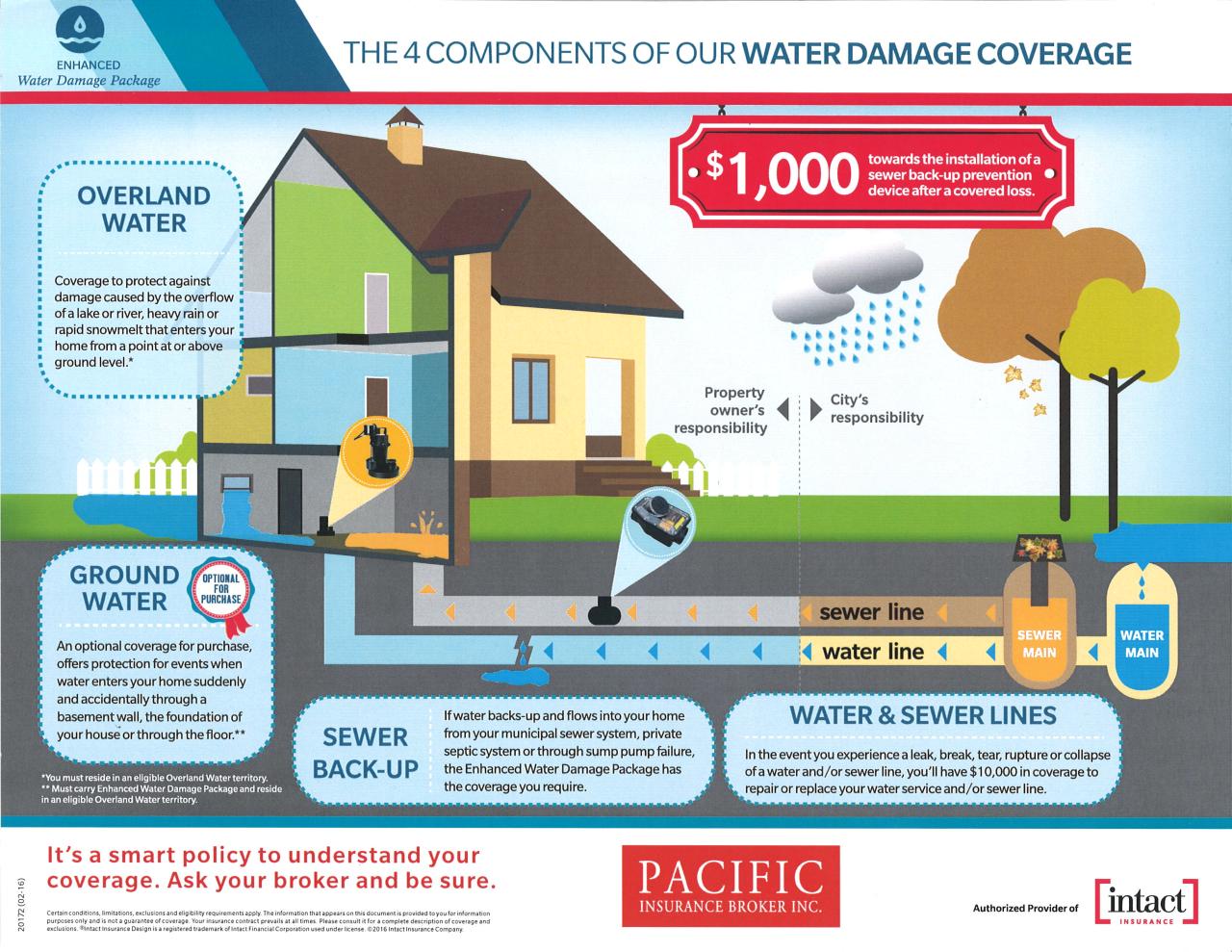

Types of Water Damage Covered by Insurance

Most homeowners insurance policies cover various types of water damage, providing financial protection against the costs of repairs and replacements. However, it’s important to understand the specific types of water damage that are covered and any exclusions or limitations that may apply.

Generally, insurance policies cover water damage caused by:

- Burst pipes

- Leaking appliances (such as dishwashers, washing machines, or water heaters)

- Overflowing toilets or sinks

- Torrential rainfall

- Natural disasters (such as floods or hurricanes)

Exclusions and Limitations

While most insurance policies provide coverage for water damage, there are some common exclusions and limitations to be aware of:

- Flood damage: Most homeowners insurance policies do not cover flood damage. Flood insurance is typically purchased separately through the National Flood Insurance Program (NFIP).

- Negligence: If water damage is caused by the homeowner’s negligence or lack of maintenance, it may not be covered by insurance. For example, if a pipe bursts due to lack of insulation in cold weather, the damage may not be covered.

- Maintenance issues: Water damage caused by poor maintenance, such as clogged gutters or leaking roofs, may not be covered by insurance.

- Acts of war or terrorism: Water damage caused by acts of war or terrorism is typically not covered by homeowners insurance.

Evidence to Support a Water Damage Claim

When filing a water damage insurance claim, it is crucial to provide evidence to support your claim. This evidence helps the insurance company assess the extent of the damage and determine the amount of coverage you are entitled to.

The types of evidence you can use to support your claim include:

Photos and Videos

Take detailed photos and videos of the damaged area. Make sure to capture the extent of the damage, including any water stains, mold, or structural damage. Take photos from different angles and distances to provide a comprehensive view of the damage.

When taking photos, be sure to include:

- Close-up shots of the damaged areas

- Photos of the water source, if known

- Photos of any damaged belongings

- Photos of any temporary repairs you have made

When taking videos, be sure to:

- Pan slowly around the damaged area

- Zoom in on specific areas of damage

- Narrate what you are seeing

Mitigation of Water Damage

Mitigating water damage is crucial to minimize the extent of the claim. Prompt action can prevent further damage and reduce the cost of repairs.

Tips for Mitigating Water Damage:

Stop the Source of the Leak

- Locate the source of the leak and stop it if possible.

- Turn off water valves, tighten loose pipes, or repair broken appliances.

Dry Out Affected Areas

- Remove standing water using a wet/dry vacuum or towels.

- Open windows and doors to ventilate the area.

- Use fans or dehumidifiers to accelerate drying.

- Remove wet carpets and padding to prevent mold growth.

Other Mitigation Measures

- Document the damage with photos and videos.

- Contact your insurance company promptly to report the claim.

- Avoid using damaged electrical appliances or equipment.

- Discard any food or beverages that may have come into contact with contaminated water.

Working with Insurance Adjusters

Insurance adjusters play a crucial role in the water damage claim process. They are responsible for assessing the damage, determining the cause of the damage, and calculating the amount of the claim. It is important to communicate effectively with insurance adjusters and provide them with all the necessary information.

Here are some tips for working with insurance adjusters:

Be Prepared

- Gather all of the documentation related to your claim, such as your insurance policy, proof of ownership, and photographs of the damage.

- Be prepared to answer questions about the damage, such as when it occurred, what caused it, and what steps you have taken to mitigate the damage.

Be Cooperative

- Allow the insurance adjuster to inspect the damage and ask questions.

- Provide the insurance adjuster with all of the requested documentation.

- Be patient and understanding, as the claims process can take time.

Be Honest

- Do not exaggerate the damage or make false claims.

- Be truthful about the cause of the damage and the steps you have taken to mitigate the damage.

Be Persistent

- If you are not satisfied with the insurance adjuster’s assessment of the damage, do not hesitate to contact them again.

- Be persistent in following up on your claim and getting the compensation you deserve.

Negotiating a Settlement

Negotiating a water damage insurance claim settlement is a crucial step in the claims process. It involves discussions between you and the insurance adjuster to reach a mutually acceptable agreement on the amount of compensation you’ll receive for your damages.

To ensure a fair and equitable settlement, it’s essential to approach the negotiation process strategically. Here are some key strategies to consider:

Understanding Your Policy Coverage

Thoroughly review your insurance policy to understand the specific coverage and limits applicable to water damage claims. This will provide a clear understanding of your rights and the scope of compensation you can expect.

Document Your Damages

Gather comprehensive documentation of the water damage, including photographs, videos, and receipts for repair or replacement costs. These documents will serve as evidence to support your claim and justify your settlement request.

Estimate Repair Costs

Obtain estimates from qualified contractors or repair professionals to assess the cost of repairing or replacing the damaged property. These estimates will help you determine a reasonable settlement amount.

Be Prepared to Negotiate

Understand that negotiation is a give-and-take process. Be prepared to compromise on certain aspects of your claim while remaining firm on your core demands. Remember, the goal is to reach a settlement that both parties can accept.

Consider Legal Advice

If you’re facing difficulties in negotiating a fair settlement, consider seeking legal advice from an attorney specializing in insurance law. They can provide guidance and represent your interests throughout the process.

Avoiding Common Pitfalls

Filing a water damage insurance claim can be a complex process. Avoid common mistakes that can jeopardize your claim and ensure a successful outcome.

Protect your rights by understanding the following pitfalls and taking appropriate measures to mitigate them.

Not Reporting the Claim Promptly

- Delaying reporting can lead to denied claims due to policy time limits or suspicion of fraud.

- Report the damage to your insurance company as soon as possible, preferably within 24 hours.

Failing to Document the Damage

- Lack of documentation can make it difficult to prove the extent of the damage and support your claim.

- Take detailed photos and videos of the damaged areas, including close-ups and wide shots.

- Create an inventory of damaged items, noting their condition and estimated value.

Not Hiring a Qualified Contractor

- Choosing an unqualified contractor can result in improper repairs or inflated costs.

- Hire a licensed and insured contractor who specializes in water damage restoration.

- Get multiple quotes and compare their estimates before making a decision.

Overstating the Damage

- Exaggerating the damage can lead to insurance fraud charges and policy cancellation.

- Be honest and accurate in your claim documentation, only reporting the actual extent of the damage.

Not Mitigating the Damage

- Failure to mitigate the damage can increase the severity of the loss and impact your claim settlement.

- Take reasonable steps to prevent further damage, such as removing water, drying out the area, and covering broken windows.

Accepting the First Offer

- Insurance companies may offer a low settlement amount initially to minimize their payout.

- Negotiate with the adjuster to ensure you receive a fair settlement that covers all your losses.

- Consider hiring a public adjuster to represent your interests.

Not Understanding Your Policy

- Lack of knowledge about your insurance policy can lead to coverage gaps and denied claims.

- Review your policy carefully before filing a claim to understand your coverage and limitations.

- Contact your insurance agent if you have any questions or concerns.