Definitions and Purpose

Life insurance and accidental death and dismemberment (AD&D) insurance are both important financial products that can provide peace of mind and financial protection to you and your loved ones.

Life insurance is designed to provide a financial benefit to your beneficiaries in the event of your death. The death benefit can be used to cover funeral expenses, outstanding debts, or other financial obligations. Life insurance can also be used to provide an ongoing income stream for your beneficiaries.

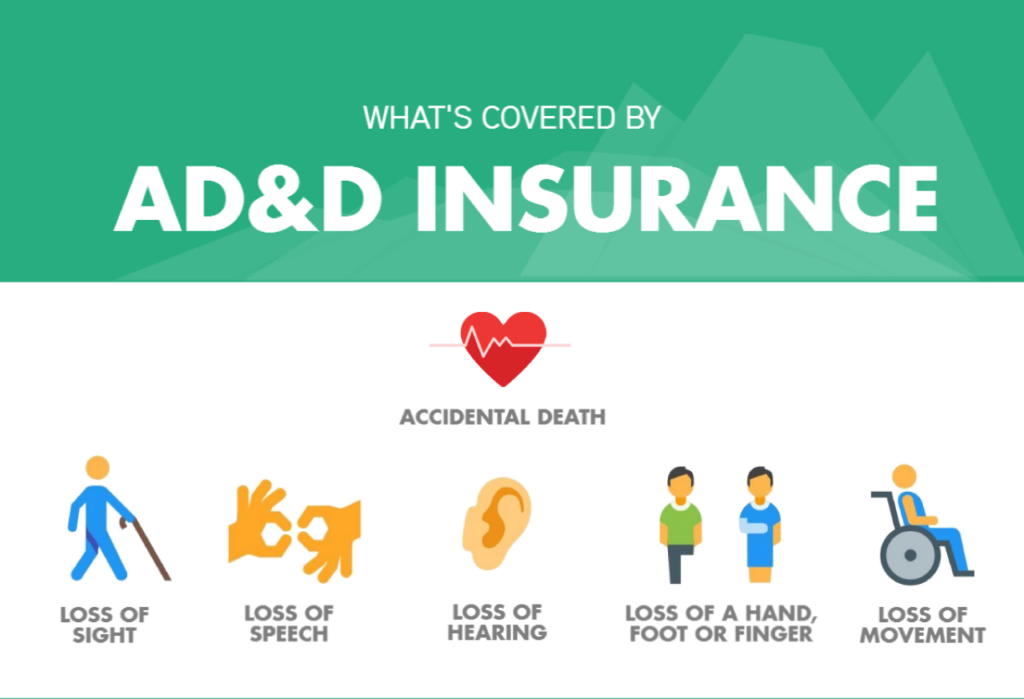

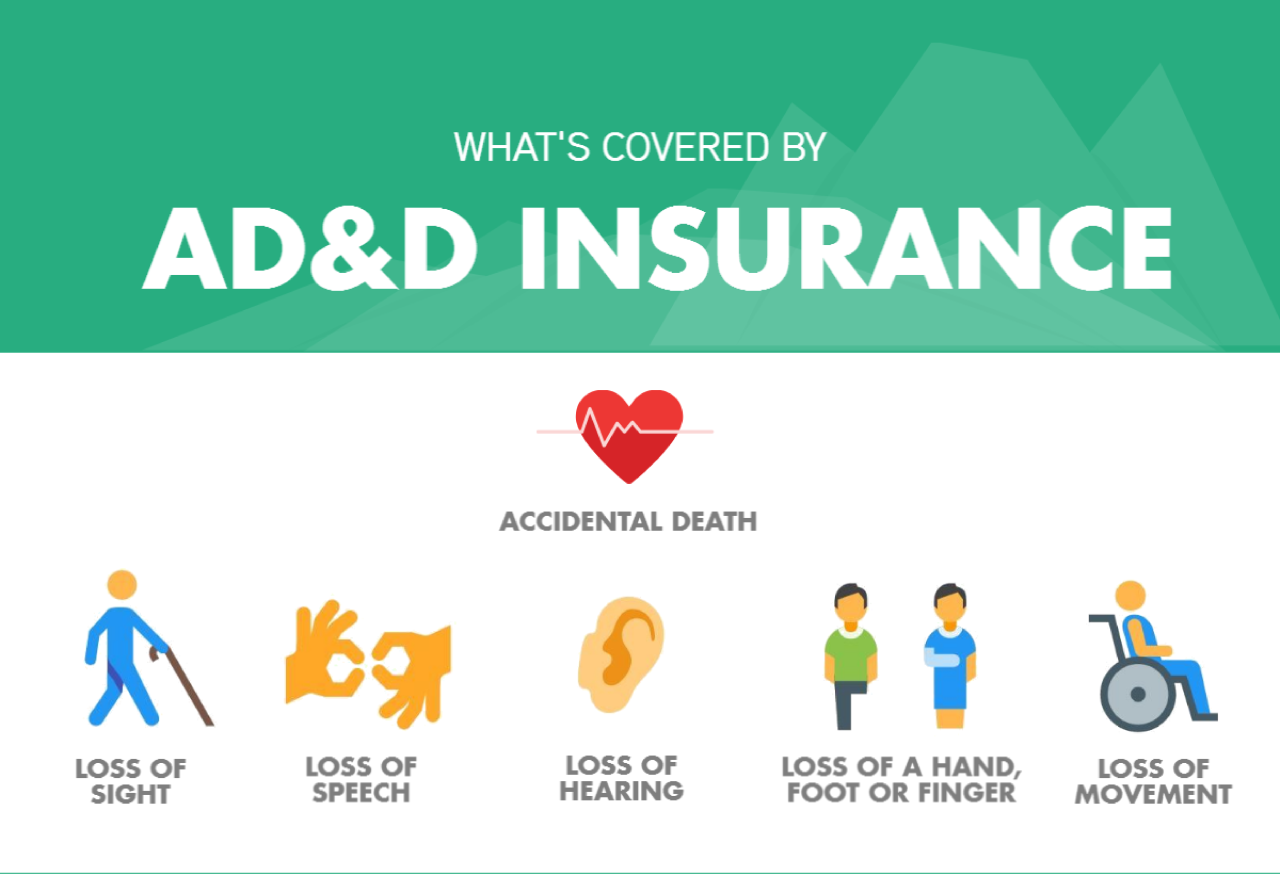

AD&D insurance is designed to provide a financial benefit to you or your beneficiaries in the event of your accidental death or dismemberment. The benefit can be used to cover medical expenses, lost wages, or other financial obligations. AD&D insurance can also be used to provide an ongoing income stream for you or your beneficiaries.

Key Differences

- Life insurance provides a financial benefit in the event of your death, while AD&D insurance provides a financial benefit in the event of your accidental death or dismemberment.

- Life insurance is typically a more comprehensive form of coverage than AD&D insurance.

- Life insurance is typically more expensive than AD&D insurance.

Coverage

Life insurance and AD&D insurance provide different types of coverage, offering protection against specific events.

Life insurance provides coverage in case of death, regardless of the cause. It ensures that beneficiaries receive a financial benefit to cover expenses and maintain their standard of living in the absence of the policyholder’s income.

Types of Events Covered by Life Insurance

- Natural death due to illness or old age

- Accidental death, including death from accidents such as car crashes, falls, or drowning

AD&D insurance, on the other hand, provides coverage specifically for accidental death or dismemberment.

Types of Events Covered by AD&D Insurance

- Accidental death due to accidents such as car crashes, falls, or drowning

- Dismemberment, including the loss of limbs, sight, or hearing due to an accident

In summary, life insurance provides broader coverage for death from any cause, while AD&D insurance focuses on accidental death and dismemberment.

Benefits

Life insurance and AD&D insurance both provide financial benefits to beneficiaries in the event of the insured’s death or dismemberment. However, there are key differences in the coverage and benefits provided by each type of insurance.

Life Insurance

Life insurance provides a death benefit to beneficiaries upon the insured’s death, regardless of the cause of death. The death benefit can be used to cover expenses such as funeral costs, outstanding debts, or lost income. Life insurance policies can be either term life insurance or whole life insurance. Term life insurance provides coverage for a specific period of time, while whole life insurance provides coverage for the insured’s entire life.

AD&D Insurance

AD&D insurance provides a death benefit or dismemberment benefit to beneficiaries in the event of the insured’s accidental death or dismemberment. The death benefit is typically equal to the amount of the policy’s coverage, while the dismemberment benefit is typically a percentage of the death benefit. AD&D insurance policies can be either individual policies or group policies. Individual policies provide coverage for a single person, while group policies provide coverage for a group of people, such as employees of a company.

Comparison of Benefits

The following table compares the benefits provided by life insurance and AD&D insurance:

| Benefit | Life Insurance | AD&D Insurance |

|---|---|---|

| Death benefit | Yes | Yes |

| Dismemberment benefit | No | Yes |

| Coverage period | Term life insurance: Specific period of time Whole life insurance: Insured’s entire life |

Individual policies: Specific period of time Group policies: Typically renewable |

Costs

The cost of life insurance and AD&D insurance can vary depending on several factors. These factors include age, health, occupation, and the amount of coverage desired.

Factors Affecting the Cost of Life Insurance

- Age: The younger you are when you purchase life insurance, the lower your premiums will be.

- Health: If you are in good health, you will likely pay lower premiums than someone with a history of health problems.

- Occupation: If you have a dangerous occupation, you may pay higher premiums than someone with a less risky job.

- Amount of coverage: The more coverage you purchase, the higher your premiums will be.

Factors Affecting the Cost of AD&D Insurance

- Age: The younger you are when you purchase AD&D insurance, the lower your premiums will be.

- Occupation: If you have a dangerous occupation, you may pay higher premiums than someone with a less risky job.

- Amount of coverage: The more coverage you purchase, the higher your premiums will be.

Comparison of Costs

In general, AD&D insurance is less expensive than life insurance. This is because AD&D insurance only covers death or dismemberment due to an accident, while life insurance covers death from any cause.

Who Needs Life Insurance and AD&D Insurance?

Determining whether you need life insurance or AD&D insurance depends on your individual circumstances and financial responsibilities.

Who Needs Life Insurance?

Life insurance provides financial protection for your loved ones in the event of your untimely death. It is generally recommended for individuals with:

- Dependents, such as a spouse, children, or elderly parents

- Significant financial obligations, such as a mortgage or car loan

- A desire to leave a legacy or provide for future expenses, such as education or funeral costs

Who Needs AD&D Insurance?

AD&D insurance provides financial compensation for accidental death or dismemberment. It is often purchased by individuals in high-risk occupations or those who engage in dangerous hobbies. It can be particularly beneficial for:

- Construction workers, firefighters, and law enforcement officers

- Athletes, stunt performers, and extreme sports enthusiasts

- Individuals who travel frequently or live in areas with high crime rates

Factors to Consider

When deciding between life insurance and AD&D insurance, consider the following factors:

- Your financial situation and responsibilities

- Your occupation and lifestyle

- The cost and coverage options available

It is recommended to consult with a financial advisor or insurance agent to determine the most appropriate coverage for your specific needs.

How to Purchase Life Insurance and AD&D Insurance

Purchasing life insurance and AD&D insurance involves similar processes but with some key differences. Here’s a step-by-step guide for each:

Purchasing Life Insurance

1. Determine Your Needs: Assess your income, expenses, dependents, and financial obligations to determine the amount of coverage you need.

2. Shop Around: Compare policies from different insurers, considering factors like coverage amount, premiums, and riders.

3. Apply for Coverage: Complete an application form and provide medical information. The insurer may request a medical exam.

4. Underwriting: The insurer assesses your health and lifestyle to determine your risk level and set your premium.

5. Policy Issuance: Once approved, the insurer issues a policy outlining the coverage details, including the death benefit and premiums.

Purchasing AD&D Insurance

1. Determine Your Needs: Consider your occupation, hobbies, and lifestyle to assess your risk of accidental death or dismemberment.

2. Shop Around: Compare policies from different insurers, considering factors like coverage amount, premiums, and exclusions.

3. Apply for Coverage: Complete an application form and provide information about your occupation and activities.

4. Underwriting: The insurer assesses your risk based on your occupation, lifestyle, and medical history.

5. Policy Issuance: Once approved, the insurer issues a policy outlining the coverage details, including the benefit amount and premiums.

Comparison of Processes

The processes for purchasing life insurance and AD&D insurance are generally similar, involving steps like determining your needs, shopping around, and applying for coverage. However, there are some key differences:

* Medical Exam: Life insurance policies typically require a medical exam, while AD&D policies often do not.

* Underwriting: Life insurance underwriting considers a wider range of health factors than AD&D underwriting.

* Coverage: Life insurance provides a death benefit, while AD&D insurance provides benefits for accidental death or dismemberment.