Dental Insurance Plan Types

Dental insurance plans in New Hampshire vary in coverage and cost. Understanding the different types of plans available can help you choose the one that best meets your needs.

Preferred Provider Organization (PPO) Plans

PPO plans offer a network of dentists who have agreed to provide services at a discounted rate. You can choose any dentist within the network, but you will pay more if you see a dentist outside the network.

Advantages:

- Lower premiums than indemnity plans

- Wide network of dentists

- No referrals needed to see specialists

Disadvantages:

- Higher out-of-network costs

- May have annual maximums

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans are similar to PPO plans, but they have a more limited network of dentists. You must choose a primary care dentist within the network, and you will need a referral to see a specialist.

Advantages:

- Lower premiums than PPO plans

- No deductibles or annual maximums

Disadvantages:

- Limited network of dentists

- Need referrals to see specialists

Indemnity Plans

Indemnity plans allow you to see any dentist you want. You will be reimbursed for a percentage of the cost of your dental care, up to a maximum amount.

Advantages:

- Freedom to choose any dentist

- No network restrictions

Disadvantages:

- Higher premiums than PPO and DHMO plans

- May have annual maximums

- Out-of-pocket costs can be high

Dental Insurance Plan Coverage

Dental insurance plans in New Hampshire typically cover a range of dental services, including preventive care, basic treatments, and major procedures. However, the specific coverage and limitations vary depending on the plan you choose.

Preventive care, such as regular checkups, cleanings, and fluoride treatments, is typically covered at 100% by most plans. Basic treatments, such as fillings, root canals, and crowns, are usually covered at a percentage of the cost, typically between 50% and 80%. Major procedures, such as bridges, dentures, and implants, are often covered at a lower percentage, around 50% or less.

Exclusions and Limitations

Dental insurance plans may have certain exclusions and limitations that restrict coverage for specific procedures or conditions. For example, some plans may not cover cosmetic procedures, such as teeth whitening or veneers. Additionally, certain pre-existing conditions may not be covered, and there may be waiting periods before coverage for certain procedures begins.

Examples of Coverage

- Preventive care: 100% coverage for regular checkups, cleanings, and fluoride treatments

- Basic treatments: 50-80% coverage for fillings, root canals, and crowns

- Major procedures: 50% or less coverage for bridges, dentures, and implants

- Exclusions: Cosmetic procedures, pre-existing conditions, and certain procedures with waiting periods

Dental Insurance Plan Costs

Dental insurance plan costs in New Hampshire vary depending on several factors, including the type of plan, the coverage level, and the insurance provider.

Factors Affecting Dental Insurance Plan Costs

* Type of plan: Dental insurance plans can be either indemnity plans or preferred provider organization (PPO) plans. Indemnity plans allow you to see any dentist you want, while PPO plans offer a network of dentists who have agreed to provide services at a discounted rate. PPO plans are typically less expensive than indemnity plans.

* Coverage level: The coverage level of a dental insurance plan refers to the percentage of covered dental expenses that the plan will pay. Plans with higher coverage levels will typically have higher premiums.

* Insurance provider: Different insurance providers offer different rates for dental insurance plans. It is important to compare rates from multiple providers before choosing a plan.

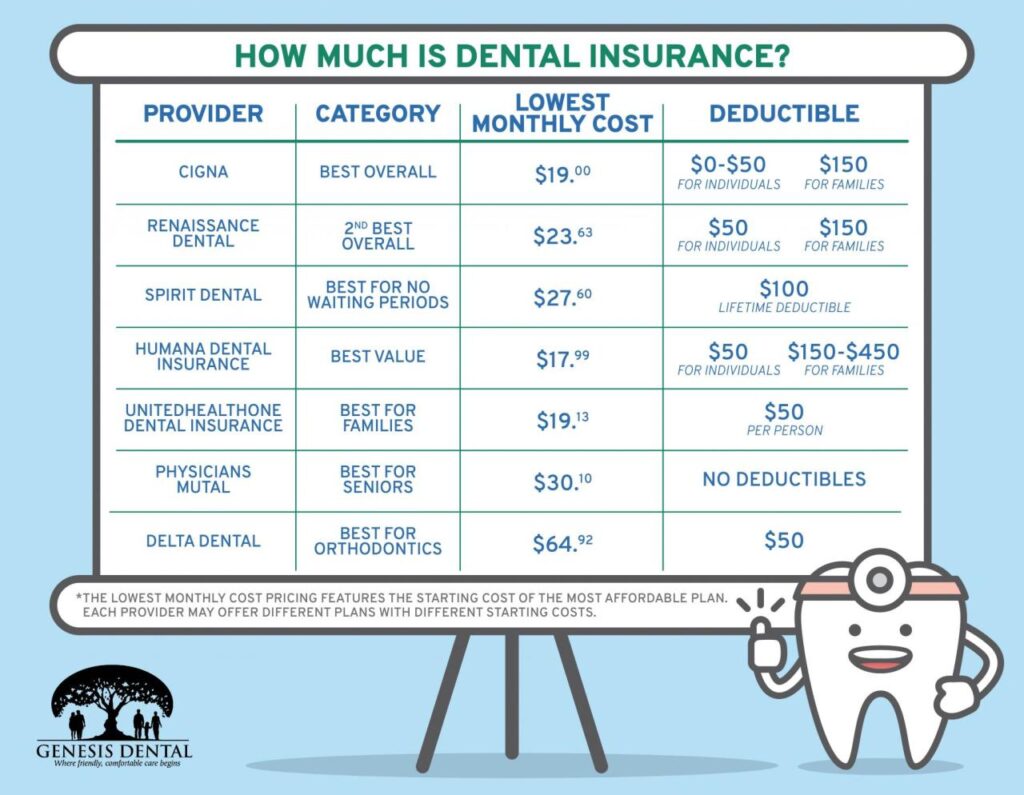

Average Cost of Dental Insurance Plans in New Hampshire

The average cost of a dental insurance plan in New Hampshire is between $30 and $60 per month. However, the cost can vary depending on the factors discussed above.

Comparing the Costs of Different Plans

When comparing the costs of different dental insurance plans, it is important to consider the following factors:

* Monthly premium: The monthly premium is the amount you will pay each month for your dental insurance plan.

* Deductible: The deductible is the amount you must pay out-of-pocket before your insurance coverage begins.

* Coinsurance: Coinsurance is the percentage of covered dental expenses that you will be responsible for paying after you meet your deductible.

* Annual maximum: The annual maximum is the maximum amount that your insurance plan will pay for covered dental expenses in a year.

By comparing these factors, you can choose a dental insurance plan that meets your needs and budget.

Dental Insurance Plan Providers

The dental insurance landscape in New Hampshire is dominated by a few major providers. Each provider offers a range of plans with varying coverage and costs. It’s important to compare the plans and providers carefully to find the best option for your needs.

Delta Dental of New Hampshire

Delta Dental of New Hampshire is the largest dental insurance provider in the state. They offer a wide range of plans, from basic to comprehensive, and have a large network of dentists.

Advantages:

– Largest network of dentists in New Hampshire

– Wide range of plans to choose from

– Excellent customer service

Disadvantages:

– Premiums can be higher than other providers

– May not cover all procedures

MetLife

MetLife is another major dental insurance provider in New Hampshire. They offer a variety of plans, including PPO and DHMO plans.

Advantages:

– Lower premiums than Delta Dental

– Good network of dentists

– Offers a variety of plans to choose from

Disadvantages:

– Network may not be as large as Delta Dental’s

– May not cover all procedures

Cigna

Cigna is a national dental insurance provider that offers plans in New Hampshire. They offer a variety of plans, including PPO and DHMO plans.

Advantages:

– National provider with a large network of dentists

– Offers a variety of plans to choose from

– Good customer service

Disadvantages:

– Premiums may be higher than other providers

– May not cover all procedures

Contact Information

Delta Dental of New Hampshire: 1-800-446-4466

MetLife: 1-800-638-5433

Cigna: 1-800-996-6806

Choosing a Dental Insurance Plan

Selecting the right dental insurance plan in New Hampshire can help you maintain a healthy smile and avoid costly dental expenses. Here are some factors to consider when choosing a plan:

- Coverage: Determine the types of dental services you need covered, such as preventive care, basic restorative procedures, and major dental work.

- Premiums: Consider the monthly or annual premiums you can afford to pay. Premiums vary depending on the plan’s coverage and deductible.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choose a deductible that fits your budget.

- Copays: Copayments are fixed amounts you pay for specific services, such as a copay for a dental checkup. Compare copays for different plans.

- Out-of-pocket maximums: This is the maximum amount you pay for covered services in a year. Choose a plan with an out-of-pocket maximum that aligns with your financial situation.

- Provider network: Check if the plan’s provider network includes dentists in your area. Having access to in-network dentists can save you money on services.

Tips for Finding the Best Plan

To find the best dental insurance plan for your needs:

- Compare quotes: Get quotes from multiple insurance companies to compare coverage, premiums, and deductibles.

- Read the plan details: Carefully review the plan’s terms and conditions to understand what is covered and what is not.

- Ask for recommendations: Seek advice from your dentist or friends and family about their experiences with different dental insurance plans.

- Consider your budget: Choose a plan that fits your financial situation and provides the coverage you need.

Importance of Reading the Plan Details

It’s crucial to read the plan details thoroughly before enrolling. Pay attention to the following:

- Exclusions: Check for any services that are not covered by the plan.

- Waiting periods: Some plans have waiting periods before certain services are covered.

- Annual limits: Some plans have annual limits on the amount of coverage you can receive.

By carefully considering these factors and following these tips, you can choose a dental insurance plan that meets your needs and helps you maintain a healthy smile.

Using a Dental Insurance Plan

Using a dental insurance plan in New Hampshire is a straightforward process. Here’s a guide to help you understand how it works:

Filing Claims

When you receive dental services covered by your plan, the dentist will typically file the claim on your behalf. They will submit the claim form, along with any necessary documentation, to your insurance provider.

Getting Reimbursed

Once your claim is processed, your insurance provider will determine the amount of coverage you’re eligible for. They will then send you a reimbursement check or directly deposit the funds into your account.

Tips for Maximizing Benefits

– Choose the right plan: Select a plan that meets your specific dental needs and budget.

– Use your plan regularly: Regular dental checkups and cleanings can help prevent costly procedures in the future.

– Understand your coverage: Familiarize yourself with your plan’s coverage limits, exclusions, and co-pays.

– Keep records: Maintain a record of your dental visits and treatments for easy reference when filing claims.

– Ask questions: Don’t hesitate to contact your insurance provider or dentist if you have any questions about your coverage or treatment options.

Dental Insurance Plan Resources

If you need more information about dental insurance plans in New Hampshire, there are several resources available to you. The New Hampshire Insurance Department regulates dental insurance in the state and can provide you with information about your rights and responsibilities under your plan.

You can also contact consumer advocacy groups for assistance with dental insurance issues. These groups can provide you with information about your rights and help you file a complaint if you have a problem with your dental insurance company.

Government Websites

Consumer Advocacy Groups

Dental Insurance Providers

If you have questions or concerns about your dental insurance plan, you can contact the New Hampshire Insurance Department at 603-271-2261 or by email at insurance@nh.gov.