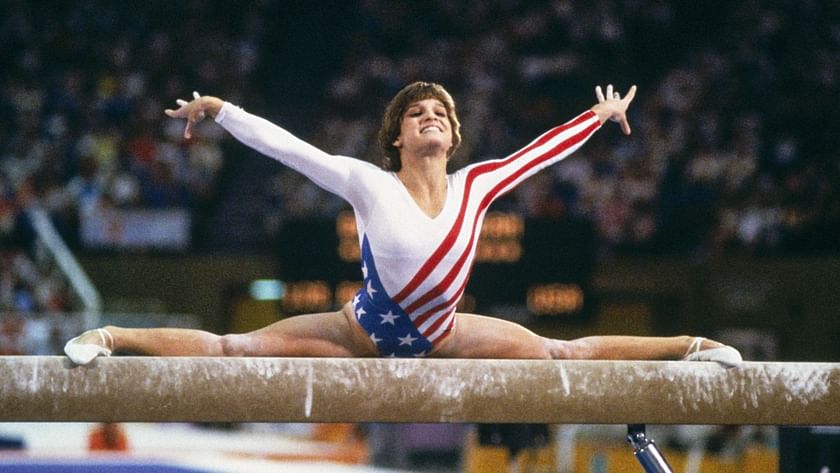

Mary Lou Retton’s Financial Situation

Mary Lou Retton is a retired American gymnast and Olympic gold medalist. She is currently estimated to have a net worth of around $8 million. Her primary source of income comes from her work as a motivational speaker and commentator, as well as endorsements and sponsorships.

Despite her financial success, it is possible that Mary Lou Retton does not have health insurance. This could be due to a number of reasons, including:

Eligibility for Public Health Insurance

Mary Lou Retton may not be eligible for public health insurance programs such as Medicaid or Medicare. These programs typically have income and asset limits, and Mary Lou Retton’s net worth may exceed these limits.

High Cost of Private Health Insurance

Mary Lou Retton may also find that private health insurance is too expensive. The cost of health insurance premiums can vary depending on a number of factors, including age, health status, and location. Mary Lou Retton’s age and health status may make her a higher-risk individual, which could lead to higher premiums.

Lack of Employer-Sponsored Health Insurance

Mary Lou Retton is self-employed, which means she does not have access to employer-sponsored health insurance. This is a common problem for many Americans, as more and more people are working in non-traditional employment arrangements.

Health Insurance Options and Eligibility

The United States offers a range of health insurance options, catering to diverse needs and circumstances. These options include government-sponsored programs like Medicare and Medicaid, as well as private insurance plans.

Eligibility for these programs varies depending on factors such as age, income, and health status. Let’s explore the eligibility criteria for each program and assess Mary Lou Retton’s potential eligibility.

Medicare

- Medicare is a federal health insurance program primarily for individuals aged 65 or older, or those with certain disabilities.

- Mary Lou Retton, currently 54 years old, does not meet the age requirement for Medicare eligibility.

Medicaid

- Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families.

- Eligibility for Medicaid is based on income and assets, and varies by state.

- Without specific information on Mary Lou Retton’s income and assets, it’s difficult to determine her eligibility for Medicaid.

Private Insurance

- Private health insurance plans are offered by insurance companies and can be purchased by individuals or through an employer.

- Eligibility for private insurance is generally not based on age or income, but on factors such as health history and pre-existing conditions.

- Mary Lou Retton could potentially qualify for private health insurance through her own means or through a family member’s plan.

Barriers to Health Insurance Access

Mary Lou Retton, despite her accomplishments and financial success, may face challenges in obtaining health insurance coverage. Pre-existing conditions, high premiums, and lack of access to affordable plans are potential barriers she could encounter.

Pre-existing conditions refer to medical conditions that an individual had before enrolling in a health insurance plan. These conditions can make it difficult to obtain coverage, as insurance companies may consider them high-risk and charge higher premiums or even deny coverage altogether.

High Premiums

Health insurance premiums can be a significant financial burden, especially for those with limited income. Mary Lou Retton, despite her financial success, may still find it challenging to afford high premiums, particularly if she has pre-existing conditions that require specialized care.

Lack of Access to Affordable Plans

In some cases, individuals may not have access to affordable health insurance plans. This can be due to factors such as geographic location, income level, or lack of employer-sponsored coverage. Mary Lou Retton, if she is not currently employed or does not have access to an employer-sponsored plan, may face challenges in finding an affordable plan that meets her needs.

These barriers can have a significant impact on Mary Lou Retton’s ability to secure health insurance coverage. Without adequate coverage, she may face financial hardship if she requires medical care, and her health and well-being could be compromised.

Consequences of Lacking Health Insurance

The consequences of not having health insurance can be severe. Individuals without health insurance face the full financial burden of medical expenses, which can be substantial. The lack of health insurance can also affect overall health and well-being, as individuals may delay or avoid seeking necessary medical care due to cost concerns.

Financial Burden

Medical expenses are a major source of financial stress for many Americans. According to a study by the Kaiser Family Foundation, the average annual cost of health insurance premiums for a family of four in 2020 was $21,342. For those without health insurance, the cost of medical care can be even higher. A single hospital stay can cost tens of thousands of dollars, and even routine medical care can be expensive.

Impact on Health and Well-being

The lack of health insurance can have a negative impact on health and well-being. Individuals without health insurance are less likely to have a regular doctor or receive preventive care, such as screenings and check-ups. They are also more likely to delay or avoid seeking medical care for illnesses and injuries, which can lead to more serious health problems.

Access to Healthcare Services

The lack of health insurance can also affect access to healthcare services. Individuals without health insurance may have difficulty finding doctors who accept uninsured patients. They may also have to wait longer for appointments and may not be able to get the same level of care as those with health insurance.

Potential Solutions and Recommendations

Addressing Mary Lou Retton’s lack of health insurance requires exploring various solutions. Government assistance programs, non-profit organizations, and crowdfunding initiatives can provide potential pathways to secure health coverage.

Government assistance programs such as Medicaid or Medicare may offer options for low-income individuals or those with specific health conditions. These programs provide subsidized or free health insurance, covering essential medical services.

Non-Profit Organizations

Non-profit organizations dedicated to healthcare advocacy and assistance can provide support to individuals struggling to obtain health insurance. They offer enrollment assistance, financial aid, and access to affordable healthcare plans.

Crowdfunding Initiatives

Crowdfunding platforms can facilitate fundraising efforts to cover health insurance premiums. Individuals can create campaigns to seek financial support from the community, enabling them to access necessary medical care.

Improving Access to Health Insurance

To improve access to health insurance for individuals in similar situations, comprehensive policy changes are crucial. Expanding eligibility criteria for government assistance programs, increasing subsidies for low-income individuals, and implementing universal healthcare initiatives can ensure that all citizens have access to affordable and comprehensive health coverage.